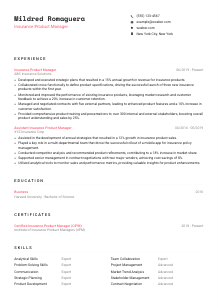

Insurance Product Manager CV Example

Padding policies, but your CV doesn't click for coverage? Navigate to this Insurance Product Manager CV example, outlined with Wozber free CV builder. Discover how to align your product-shaping prowess with job specifications, ensuring your career trajectory remains as secure as the premiums you oversee!

How to write an Insurance Product Manager CV?

Hello, aspiring Insurance Product Manager! The insurance sector's battlefield is both challenging and rewarding, requiring not just experience and knowledge but a CV that speaks volumes about your capabilities. Fear not, with Wozber's free CV builder at your side, you're about to embark on a journey to create a CV that's not just a collection of your professional milestones but a beacon drawing the right opportunities your way.

Personal Details

The Personal Details section of your CV is the first handshake with your potential employer. Let's ensure it introduces you not just as any candidate, but THE candidate for the Insurance Product Manager position.

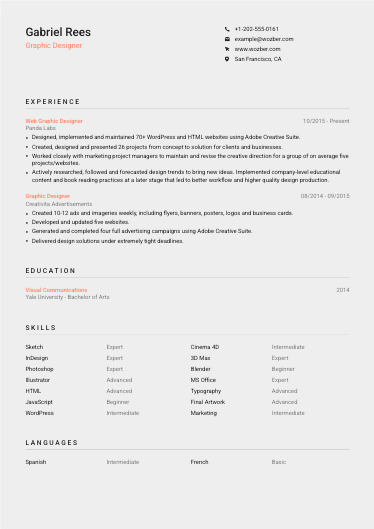

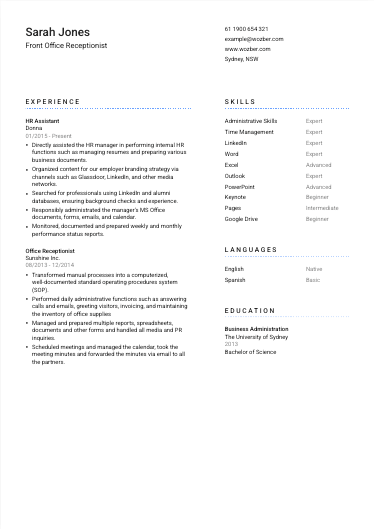

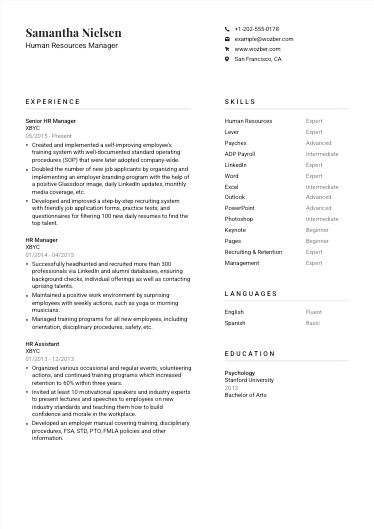

1. The Power of Your Name

Your name is the marque of your professional brand. Highlight it with a font that's professional yet noticeable. This isn't just a small detail; think of it as the title to your professional story.

2. Position Precision

Right under your name, mirror the job title - Insurance Product Manager. This alignment not only shows your determination but subtly aligns your CV in the radar of ATS (Applicant Tracking Systems) optimisation.

3. Crucial Contact Details

List your phone number and professional email address (a simple firstname.lastname formula works wonders) clearly. These are the bridges to your next opportunity, ensuring they're typo-free is a must.

4. Location Alignment

"Must be located in New York City, New York." Since the job emphasizes this, echoing it in your CV assures the hiring manager you're exactly where you need to be, cutting through any relocation concerns immediately.

5. Digital Presence

Should you have a LinkedIn profile that's polished and mirrors your CV, including it can provide a comprehensive view of your professional landscape. Just like a detailed map, it guides potential employers through your career journey.

Takeaway

Ensuring your Personal Details section is not only professional but ATS-compliant and perfectly aligned with the job emphasis, sets the stepping stone for a solid first impression. Consider this section your professional headline, making it both accurate and intriguing.

Experience

This is where your CV shines brightest. Drawing the line from past achievements to future potential, the Experience section for an Insurance Product Manager must reflect not just what you've done, but how ready you are to take on this new role.

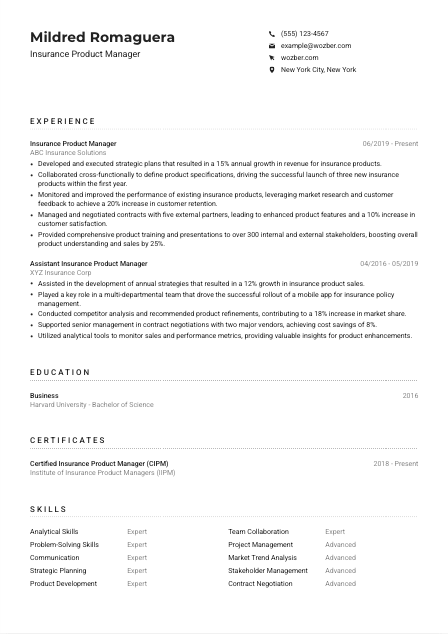

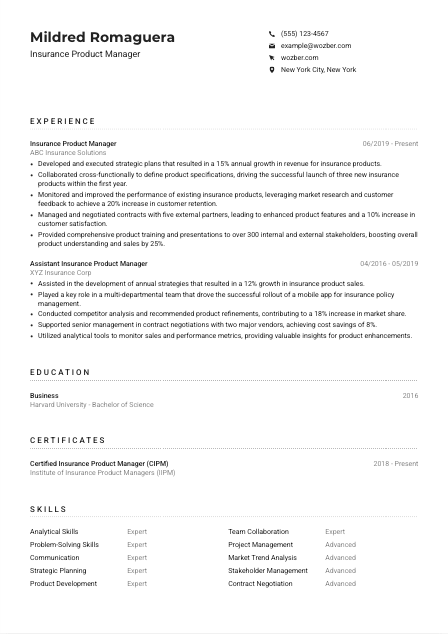

- Developed and executed strategic plans that resulted in a 15% annual growth in revenue for insurance products.

- Collaborated cross‑functionally to define product specifications, driving the successful launch of three new insurance products within the first year.

- Monitored and improved the performance of existing insurance products, leveraging market research and customer feedback to achieve a 20% increase in customer retention.

- Managed and negotiated contracts with five external partners, leading to enhanced product features and a 10% increase in customer satisfaction.

- Provided comprehensive product training and presentations to over 300 internal and external stakeholders, boosting overall product understanding and sales by 25%.

- Assisted in the development of annual strategies that resulted in a 12% growth in insurance product sales.

- Played a key role in a multi‑departmental team that drove the successful rollout of a mobile app for insurance policy management.

- Conducted competitor analysis and recommended product refinements, contributing to a 18% increase in market share.

- Supported senior management in contract negotiations with two major vendors, achieving cost savings of 8%.

- Utilized analytical tools to monitor sales and performance metrics, providing valuable insights for product enhancements.

1. Matching Job Requirements

Begin by dissecting the job description. For instance, if it requires "experience in product management within the insurance industry," prioritize roles and responsibilities that speak directly to this.

2. Role & Company Structure

Present your roles chronologically, starting with the most recent. Your job title, employer, and dates of employment are your CV's backbone, providing a clear timeline of your growth.

3. Achievement-Focused Bullet Points

"Developed strategic plans leading to a 15% annual growth" – this bullet point grabs attention by not only stating what you did but showcasing the impact of your actions, a critical tactic for emphasizing your contribution.

4. Quantifying Success

Whenever possible, equip your achievements with figures. Whether it's revenue growth or customer retention rates, numbers offer a concrete measure of your success, making your application stand out.

5. Relevance Over Quantity

Stick to experiences that echo the role's demands. The unwritten rule here is quality over quantity. Every line should make the case for why you're the ideal candidate for the Insurance Product Manager position.

Takeaway

Craft each entry in your Experience section to communicate your capability and readiness for the Insurance Product Manager role. Remember, it's not just about what you've done; it's about illustrating your potential to add value.

Education

While not the flashiest section, Education provides a crucial foundation for your understanding of the business and insurance sector. Let's sculpt your Education section to reflect the bedrock of your expertise.

1. Degree Detailing

The job description asks for a "Bachelor's degree in Business, Marketing, or a related field." If your degree aligns, it's critical to list it verbatim, confirming you meet this fundamental requirement.

2. Structuring for Clarity

Stick to a simple format that displays your field of study, degree, the institution attended, and graduation date. This clear-cut structure ensures your educational qualifications are easy to scan.

3. Degree Relevance

For the Insurance Product Manager role, emphasizing your Bachelor of Science in Business directly connects your academic journey with your career path, making a solid case for your foundational knowledge.

4. Relevant Courses and Honors

If your coursework or academic accolades directly relate to insurance or product management, mention them. This can add depth, showing a long-standing interest and dedication to your field.

5. Continued Education and Clubs

Leadership roles in relevant clubs or additional certificates (even if completed online) demonstrate a proactive approach to learning and leadership, qualities that resonate well with the role you're applying for.

Takeaway

Aligning your educational background with the job's requirements does more than check a box; it paints a picture of a well-prepared candidate, ready to leverage their foundational knowledge in a practical, impact-focused role.

Certificates

In the world of insurance, staying ahead of market trends and regulations is key. Let's ensure your Certificates section showcases your commitment to continuous learning and expertise in the field.

1. Selecting Relevant Certifications

Though the job description may not specify required certifications, aligning your listed certifications with the nature of the job is crucial. For example, a Certified Insurance Product Manager (CIPM) certification underscores your specialized knowledge.

2. Quality over Quantity

Only include certificates that fortify your candidacy. A cluttered list can dilute the perceived value of your most pertinent qualifications. Think of your certifications as the highlights of your professional skill set.

3. Date Details

Including the acquisition or validity dates of your certifications helps hiring managers assess the currency of your knowledge, an important factor in a rapidly evolving field like insurance.

4. Continuous Learning

Emphasize recent certifications or ongoing education efforts to portray an image of a candidate who values growth and is always in tune with the latest industry developments.

Takeaway

Thoughtfully curated certifications signal to potential employers your dedication and proficiency in your field. Make sure they shine by selecting those most aligned with the role and the future path you envision in the insurance industry.

Skills

Your skills section is a compact display of your professional toolkit. For an Insurance Product Manager, highlighting a balance between analytical acumen and project management prowess is key. Let's navigate the skill terrain to maximize your CV's impact.

1. Skill Extraction

Analyzing the job description, we identify core skills such as "Project Management," "Analytical Skills," and "Strategic Planning." These should not only be listed but serve as keywords for ATS optimisation.

2. Tailoring Your Toolkit

Don't just list your skills - match them with the requirements. For instance, if "Contract Negotiation" is a highlighted part of the role, ensuring it's prominently featured in your skills section is a no-brainer.

3. Precision and Priority

While it's tempting to include every skill under the sun, prioritize those that offer direct value to the Insurance Product Manager role. This not just aids in ATS optimisation but streamlines the focus towards your most relevant capabilities.

Takeaway

Your Skills section is the succinct summary of 'Why you?' for the role. Ensuring it speaks directly to the requirements, and the value you bring, enhances your narrative, making you an unmissable candidate for an Insurance Product Manager position.

Languages

In the diverse landscape of the insurance industry, being multilingual can be a notable advantage. Your ability to communicate across cultures can be a unique selling point—let's make sure it's rightly highlighted in your CV.

1. Language Requirements

While "Advanced English language skills" are a must as per the job description, being fluent in more than one language can set you apart, especially in multicultural markets. It shows you're prepared for client interactions across different regions.

2. Categorizing Proficiency

List your language skills starting with English, noting your proficiency level as "Native" or "Fluent." This immediately ticks off a crucial requirement. Then, list any additional languages in order of proficiency.

3. Adding Value with Additional Languages

Even if secondary languages are not explicitly needed, they can underscore your ability to interact with a broader array of stakeholders or clients. It's a soft skill that highlights adaptability and cultural sensitivity.

4. Honesty is Key

Be truthful about your level of proficiency. Overstating your language skills can lead to awkward situations, while underestimating them may sell you short. Accurate self-assessment is vital.

5. The Bigger Picture

Languages are more than communication tools; they're a testament to your willingness to bridge gaps and connect. This eagerness to reach beyond barriers can be a significant advantage in the world of insurance product management.

Takeaway

Embrace your multilingual skills as part of your professional identity. They're not just lines on a CV but signals of your ability to thrive in and contribute to a globalized business environment. Highlight them with pride.

Summary

Your summary is the concise narrative of your professional persona. For an Insurance Product Manager, it's an opportunity to illustrate your strategic mindset fused with a hands-on approach to product growth and innovation. Let's craft a summary that tells your story.

1. The Role Essence

9 years of expertise in driving strategic growth and product development within the insurance industry, reflecting the requirements.

2. Open with Zeal

Begin with a punchy, engaging introduction that encapsulates your career in a nutshell. 'Insurance Product Manager with over 9 years of expertise' not only establishes your experience level but directly aligns with the job title.

3. Spotlight on Key Achievements

Select achievements that echo the job's responsibilities, like 'leading to a 15% annual growth in revenue for insurance products.' This quantifiable success addresses 'develop and implement strategic plans,' aligning your history with future expectations.

4. Brevity is Brilliance

Keep your summary succinct yet powerful. In 3-5 lines, present a snapshot that captures your essence as a candidate. This is your chance to intrigue and promise value, setting the tone for the detailed narrative to follow.

Takeaway

Let your summary be the persuasive opener that earns a deeper look. Tailoring it to reflect key job criteria while encapsulating your unique professional journey presents a compelling case for why you're the best candidate.

Launching Your Insurance Product Manager Journey

Now that you have navigated through crafting an Insurance Product Manager CV with the aid of Wozber's free CV builder, including ATS-compliant CV features, you're set to embark on your job search journey with confidence. Remember, your CV is the gateway to opportunities - a document that speaks volumes before you've even uttered a word. Refine, adapt, and let it showcase the very best of what you bring to the insurance industry. The right opportunity awaits, and you're more than equipped to seize it.

- Bachelor's degree in Business, Marketing, or a related field.

- Minimum of 5 years of experience in product management within the insurance industry.

- In-depth knowledge of insurance products, market trends, and regulatory requirements.

- Strong analytical, project management, and problem-solving skills.

- Excellent interpersonal, communication, and presentation abilities.

- Advanced English language skills needed.

- Must be located in New York City, New York.

- Develop and implement strategic plans to ensure the growth and profitability of insurance products.

- Collaborate with cross-functional teams to define product specifications and drive product development projects.

- Monitor product performance, conduct market research, and gather customer feedback to recommend product refinements and new product launches.

- Manage and negotiate contracts with external partners or vendors for new product features or enhancements.

- Provide product training, presentations, and sales support to internal and external stakeholders.