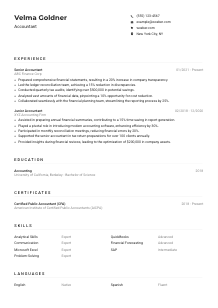

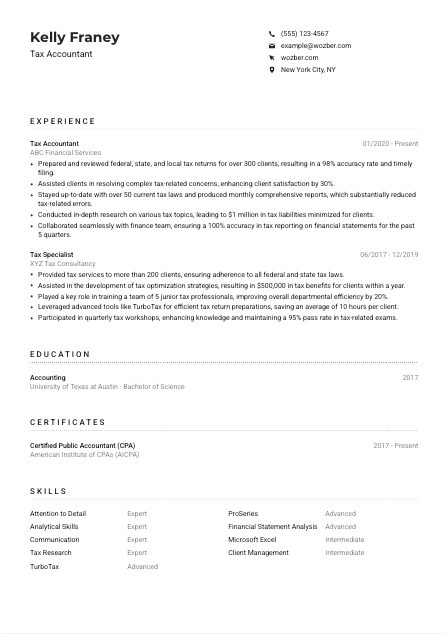

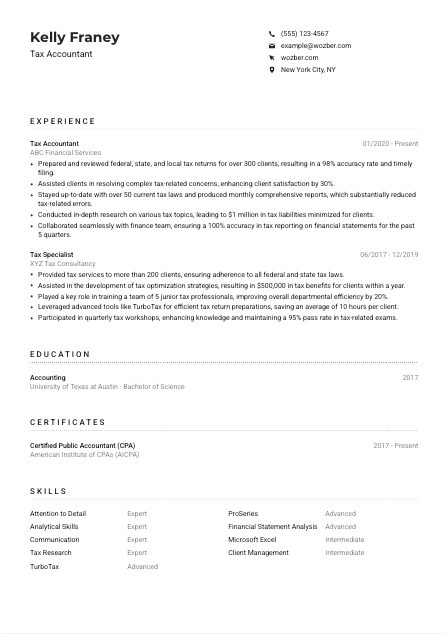

Tax Accountant CV Example

Number-crunching insights, but your CV isn't adding up? Dive into this Tax Accountant CV example, formulated with Wozber free CV builder. Discover how to detail your financial flair to fulfill job requirements, ensuring your career balance always remains in the green!

How to write a Tax Accountant CV?

Hello there, future Tax Accountant superstar! In a field where numbers speak louder than words, making your mark with a CV that resonates with your profession can seem daunting. But fret not, because you're about to learn how to craft a CV that not only meets the penchant of the industry but turns heads in the hiring process.

Using Wozber free CV builder, this guide will walk you through creating an ATS-compliant CV that mirrors the job you're aiming for. Let's put your financial flair on display and make sure that your career prospects balance out perfectly in your favor!

Personal Details

The 'Personal Details' section is often glanced over quickly by candidates, yet it represents your professional handshake. A well-crafted introduction can set the tone for your entire CV, especially for a Tax Accountant position where precision and professionalism are key.

1. Name as Your Brand

Present your name prominently, letting it serve as the marquee of your professional brand. Opt for a clear, professional font, ensuring it stands out as the beacon of your CV.

2. Job Title Alignment

Echo the job title right below your name. This alignment sends a subliminal message that you're not just a candidate but the candidate for the role. Introducing yourself as a "Tax Accountant" creates an immediate relevance to the job at hand.

3. Vital Contact Information

Ensure your contact information is impeccable: a professional email and a phone number you frequently check. Mistakes here can lead to missed opportunities, so accuracy is paramount.

4. Location, Location, Location

"New York City, NY" isn't just an address for you; it's a strategic piece of information that ticks one of the boxes in the job requirement, ensuring you're already where you need to be or you're open to relocating.

5. Professional Online Presence

In today's digital world, include your LinkedIn profile URL or a professional website to provide a deeper insight into your career achievements. Make sure it's a mirror reflection of your CV, current, and clean.

Takeaway

Remember, the 'Personal Details' section is more than just basic information; it's the formal bow that introduces your candidacy. Ensure it's polished, professional, and aligns with the Tax Accountant role you're pursuing.

Experience

For a Tax Accountant, the 'Experience' section is where you get to show off the years spent amidst tax returns, balance sheets, and federal tax laws. Getting this part right can significantly boost your chances of getting noticed.

- Prepared and reviewed federal, state, and local tax returns for over 300 clients, resulting in a 98% accuracy rate and timely filing.

- Assisted clients in resolving complex tax‑related concerns, enhancing client satisfaction by 30%.

- Stayed up‑to‑date with over 50 current tax laws and produced monthly comprehensive reports, which substantially reduced tax‑related errors.

- Conducted in‑depth research on various tax topics, leading to $1 million in tax liabilities minimized for clients.

- Collaborated seamlessly with finance team, ensuring a 100% accuracy in tax reporting on financial statements for the past 5 quarters.

- Provided tax services to more than 200 clients, ensuring adherence to all federal and state tax laws.

- Assisted in the development of tax optimisation strategies, resulting in $500,000 in tax benefits for clients within a year.

- Played a key role in training a team of 5 junior tax professionals, improving overall departmental efficiency by 20%.

- Leveraged advanced tools like TurboTax for efficient tax return preparations, saving an average of 10 hours per client.

- Participated in quarterly tax workshops, enhancing knowledge and maintaining a 95% pass rate in tax‑related exams.

1. Job Description Breakdown

Scrutinize the job requirements, focusing on key responsibilities like the preparation and review of federal, state, and local tax returns. Each point under your experience should resonate with tasks mentioned in the job description.

2. Structure and Clarity

Present your experience in reverse chronological order, emphasizing your progression and growth in the field. Start with your most recent role as a Tax Accountant and outline your path, showcasing your evolving expertise.

3. Highlighting Achievements

'Prepared and reviewed over 300 tax returns with a 98% accuracy rate' doesn't just describe your role, it showcases your capability, diligence and the impact you've had.

4. Quantify Your Impact

In a profession dominated by numbers, showing your achievements with quantifiable outcomes makes your experience tangible. Did you minimize liabilities, enhance client satisfaction, or improve efficiency? Numbers make your claims believable.

5. Relevance Over Volume

Resist the urge to list every single task you've ever undertaken. Instead, focus on those achievements that align closest with the Tax Accountant role you're applying for. This selective emphasis reinforces your suitability.

Takeaway

The 'Experience' section is your professional storyline that needs to captivate and convince. It's not just about what you've done, but how you've excelled and grown as a Tax Accountant. Take pride in your achievements and let them shine brightly on your CV.

Education

In tax accounting, your educational background lays the groundwork for your expertise. It's a direct reflection of your technical knowledge and analytical capabilities, vital components for a Tax Accountant.

1. Essential Credentials

State your education clearly, especially focusing on your Bachelor's degree in Accounting or a related field. This meets the baseline requirement for the Tax Accountant position and demonstrates your relevant foundation.

2. Structure for Success

Keep your education section clean and straightforward. Lay it out as: Degree, Field of Study, and Institution, followed by your graduation year to provide a clear timeline of your educational progression.

3. Degree Relevance

Your degree in Accounting is your ticket to the Tax Accountant realm. Make sure it's front and center, especially if it directly corresponds with the requirements of your desired position.

4. Highlighting Noteworthy Courses

If your academic journey included specialized courses relevant to tax accounting, don't hesitate to list these. While they may not be a primary focus, they add depth to your expertise.

5. Extra Mile Achievements

Honors, extracurricular activities, or clubs related to accounting or finance can demonstrate your passion and commitment to this field. Though, gauge their relevance based on the seniority of the position you're applying for.

Takeaway

Your education section is a testament to your preparedness for the Tax Accountant role. It's not just a list of institutions; it's proof of your dedication and the solid foundation upon which you've built your career.

Certificates

In Tax Accountancy, certain certifications can significantly elevate your professional standing. The CPA designation, for example, is not just preferred; it's a beacon of your expertise and commitment.

1. Align with Job Requirements

The job description hints at the gold standard: 'CPA designation preferred.' Having this certification or similar ones places you a cut above the rest by immediately ticking a significant box for potential employers.

2. Curated List of Certifications

Only include certifications that amplify your candidacy for the Tax Accountant role. Your strategic selection here demonstrates not just your qualifications, but also your understanding of the role's essence.

3. Dates Matter

If your certifications have a validity period or are notably recent achievements, include these dates. It shows that you're not just qualified but also current in your field.

4. Continuous Learning

The tax world is ever-changing. Indicating ongoing education or up-to-date certifications showcases your adaptability and dedication to staying ahead in your field.

Takeaway

Certifications in your CV are akin to professional badges of honor; they underscore your expertise and readiness for the challenges of a Tax Accountant role. Choose them wisely and keep advancing your qualifications.

Skills

For a Tax Accountant, the 'Skills' section is your arsenal. Herein lies the blend of technical knowledge, analytical acumen, and soft-skills prowess that defines your professional identity.

1. Decode and Align

Extract critical skills from the job description - "strong understanding of federal and state tax regulations," "proficiency in tax software," and "excellent communication skills." Your CV should reflect these as your core competencies.

2. Prioritize Relevance

While you may be a jack of many trades, prioritize those skills that best match the job description. Skills in tax software like TurboTax, communication prowess, and analytical skills should be at the forefront for a Tax Accountant role.

3. Organisation is Key

Categorize your skills into ‘Technical' and ‘Soft Skills' to provide a clearer picture of your capabilities. An ATS-friendly CV format helps in ensuring that these skills are easily identifiable by both ATS and human eyes.

Takeaway

Your skills are the essence of what you bring to the Tax Accountant table. Present them not just as a list, but as a curated collection that screams 'I am the candidate you're looking for.' Use them to make a compelling case for your hire.

Languages

In a city as culturally rich as New York, the ability to communicate in multiple languages can set you apart. For a Tax Accountant, this could mean the difference in serving a broader client base.

1. Essential Language Skills

Given the job requirement, your CV must highlight your fluency in English. In our diverse business landscape, this skill ensures no barriers in client communication and service delivery.

2. Additional Linguistic Assets

Other languages can be a distinctive advantage, especially for firms with a diverse clientele or international operations. If you're fluent in additional languages, this section is prime real estate on your CV.

3. Honest Proficiency Levels

Be transparent about your language proficiency levels. Misrepresentation can lead to uncomfortable situations, so it's always better to be honest about your abilities.

4. The Role's Scope

For Tax Accountants, especially those aiming for positions in cosmopolitan areas like New York, additional languages can indeed be an advantage, highlighting your potential to cater to a more diverse clientele.

5. Importance of Accuracy

Like in tax filings, accuracy in representing your language skills is crucial. Avoid overestimating your proficiency to ensure that you can deliver on the expectations your CV sets.

Takeaway

While your mastery of tax laws is paramount, your ability to communicate in multiple languages can significantly enhance your appeal as a Tax Accountant. View every language you speak as a conduit to more opportunities and richer professional interactions.

Summary

Your summary is the elevator pitch of your CV – a chance to encapsulate your proficiency and passion for the Tax Accountant role. It's where the essence of your professional self shines brightest.

1. Absorb the Job Essence

Digest the job requirements carefully. A good summary transitions seamlessly from what you are to what the role demands, setting the stage for the detailed narrative that follows.

2. Professional Snapshot

Start with a broad stroke about your profession and years of experience. 'Tax Accountant with over 6 years of proficiency' not only introduces your role but signals a seasoned candidate.

3. Mirror Key Job Aspects

Weave in skills and accomplishments that match the job description. Highlighting aspects like 'maintaining a high accuracy rate in tax reporting' directly addresses what employers are looking for.

4. Conciseness is Key

Keep your summary tight and impactful. A teaser that invites hiring managers to dive deeper into your CV, it should be precise yet powerful, setting the tone for the story you're about to unfold.

Takeaway

Consider your summary as the prologue to your professional story. Tailor it to resonate with the Tax Accountant role, layering in nuances of your experience and skills that align with the job's demands. Let it pique curiosity and draw the hiring manager deeper into your career narrative.

Launching Your Tax Accountant Journey

With these guided insights, you're well equipped to tailor a Tax Accountant CV that not only meets the mark but leaves a lasting impression. Remember, your CV is more than just a document; it's a reflection of your career story. With Wozber free CV builder, leveraging ATS-friendly CV templates and ATS CV scanner for optimisation, you're one step closer to your next big career move.

Your dedication, coupled with strategic CV crafting, opens doors. Go ahead, make your mark in the tax accounting world!

- Bachelor's degree in Accounting or related field;

- CPA designation preferred.

- Minimum of 3 years of tax accounting experience with a strong understanding of federal and state tax regulations.

- Proficiency in tax software such as TurboTax or ProSeries, as well as Microsoft Excel.

- Strong attention to detail and analytical skills.

- Excellent communication skills, both written and verbal, with the ability to explain complex tax matters to clients.

- Must have the ability to speak and understand English fluently.

- Must be located in or willing to relocate to New York City, NY.

- Prepare and review federal, state, and local tax returns for individuals, businesses, and organizations.

- Assist clients in resolving any tax-related concerns or issues.

- Stay up-to-date with current tax laws, regulations, and changes.

- Conduct research on various tax topics and provide recommendations to minimize tax liabilities or maximize tax benefits.

- Collaborate with cross-functional teams, including finance, to ensure accurate tax reporting on financial statements.