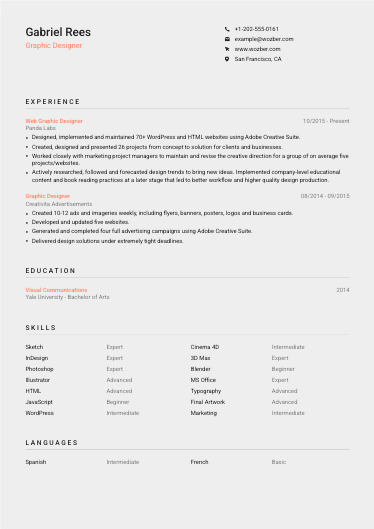

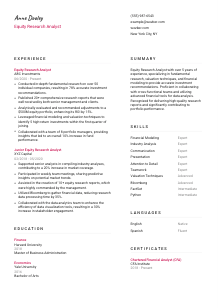

Equity Research Analyst CV Example

Predicting market trends, but your CV seems traded on? Analyze this Equity Research Analyst CV example, molded with Wozber free CV builder. See how you can reflect your financial insights with job requirements, building a career portfolio with growth potential as solid as blue-chip stocks!

How to write an Equity Research Analyst CV?

Stepping into the shoes of an Equity Research Analyst? Let's navigate the intricate dance of aligning your CV with the meticulous demands of this sought-after role. We'll delve into each section of your CV, transforming it from a mere document to a compelling narrative. By otimizing for ATS and utilizing a free CV builder, you're about to make your mark in a field where precision meets foresight.

Ready to fine-tune your CV into a portfolio that boasts not just growth but a robust investment in your future? Let's dive in.

Personal Details

First impressions matter. In the world of Equity Research Analysts, where analysis and accuracy are kings, your Personal Details section must reflect professionalism and alignment with the job's locale and requirements. Here's how to craft this section to resonate with your desired role.

1. Brand with Your Name

Your name is not just an identifier; it's the headline of your professional story. Ensure it's prominently placed, using a clear, ATS-friendly font. This front-and-center approach is like the bold title on an analytical report, inviting recruiters to delve deeper.

2. Job Title Precision

"Equity Research Analyst" - allowing this title to trail just below your name instantly connects your professional identity with the job at hand. It's like a stock ticker flashing your trading strategy; it quickly informs hiring managers of your targeted role.

3. Essential Contact Info

Your phone number and professional email (think firstname.lastname@email.com) are like your contact coordinates in the vast job market. Double-check for accuracy; a missed digit could mean a missed opportunity.

4. A Nod to New York

The job demands a New York City base. By stating "New York City, NY" in your CV, you align with one of the pivotal requirements, offering assurance of your availability and eliminating any relocation uncertainties. It's like marking your position on a financial map, signaling you're right where you need to be.

5. Web Presence

A LinkedIn profile or personal website can act as your digital portfolio. Ensure it's polished and mirrors your CV, offering a deeper insight into your professional journey. Think of it as the supplementary notes to your main analysis, providing additional data points for employers.

Takeaway

Tailoring your Personal Details isn't just about sharing your contact info; it's about strategically positioning yourself for the Equity Research Analyst role. Like a well-crafted executive summary, it clear-cut presents you as the ideal candidate from the get-go.

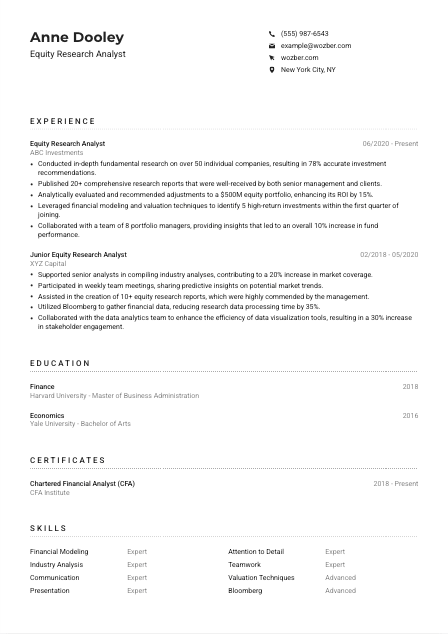

Experience

For Equity Research Analysts, the Experience section is your battleground to showcase your analytical prowess and market acumen. Let's dissect how to make your past roles do the heavy lifting, proving you're the investment the company needs.

- Conducted in‑depth fundamental research on over 50 individual companies, resulting in 78% accurate investment recommendations.

- Published 20+ comprehensive research reports that were well‑received by both senior management and clients.

- Analytically evaluated and recommended adjustments to a $500M equity portfolio, enhancing its ROI by 15%.

- Leveraged financial modeling and valuation techniques to identify 5 high‑return investments within the first quarter of joining.

- Collaborated with a team of 8 portfolio managers, providing insights that led to an overall 10% increase in fund performance.

- Supported senior analysts in compiling industry analyses, contributing to a 20% increase in market coverage.

- Participated in weekly team meetings, sharing predictive insights on potential market trends.

- Assisted in the creation of 10+ equity research reports, which were highly commended by the management.

- Utilized Bloomberg to gather financial data, reducing research data processing time by 35%.

- Collaborated with the data analytics team to enhance the efficiency of data visualization tools, resulting in a 30% increase in stakeholder engagement.

1. Requirement Reconnaissance

Begin by dissecting the job requirements. "Analyzing financial statements" or "Publishing research reports" are not just tasks; they are your achievements waiting to be highlighted. Make a list; this will be your CV's blueprint.

2. Positioning Past Roles

Structure your experience in reverse chronological order, ensuring your latest (and most relevant) stint is the first thing recruiters see. It's like presenting a financial timeline, where your most recent analysis holds the most weight.

3. Crafting Achievement Bullets

For each role, forge bullet points that resonate directly with the job's demands. Mention how you "Conducted in-depth fundamental research" or "Published 20+ research reports." These aren't just actions; they're evidence of your capability and impact.

4. Numbers Speak Louder

Quantifying achievements (e.g., "resulting in 78% accurate investment recommendations") adds scale and tangibility to your successes. It's akin to financial metrics; they provide clear, measurable proof of performance.

5. Relevance is Key

Like filtering data for analysis, keep your experience relevant. Side projects or unrelated roles can clutter your narrative, distracting from your core expertise. Ensure each point is a strategic investment towards showcasing your fit for the role.

Takeaway

Crafting the Experience section is about more than listing roles; it's about narrating your journey through strategically highlighted achievements that align with the Equity Research Analyst position. Each bullet point is a data point, proving your market value.

Education

The Education section substantiates your analytical foundation, especially vital for an Equity Research Analyst. Here's how to ensure your academic background aligns perfectly with the job requirements, showcasing your preparedness for the role.

1. Requirement Mapping

Identify the educational credentials the job requires. For Equity Research Analysts, a "Bachelor's degree in Finance, Accounting, Economics, or a related field" isn't just a requirement; it's the academic lineage that supports your expertise.

2. Layout Essentials

Keep this section succinct yet informative. Display your degree, field of study, institution, and graduation year. It's like financial reporting - clear, comprehensive, and concise information wins.

3. Degree Alignment

If your degree directly aligns with the job's educational requirements, spotlight it. Your "Master of Business Administration in Finance" isn't just a degree; it's a testament to your advanced understanding of the market's rhythms and trends.

4. Coursework & Projects

For roles as specialized as Equity Research Analyst, highlighting relevant coursework or projects can be beneficial early in your career. It shows a proactive approach to acquiring specific skills and knowledge, almost like specific stock analysis techniques that bolster your trading strategies.

5. Additional Accolades

Graduating with honors or leadership roles within relevant organisations can further enrich this section. These details, while not directly job-specific, paint a picture of a well-rounded candidate with a robust foundation in finance.

Takeaway

The Education section is your proof of expertise. Just as you wouldn't invest without analyzing financial statements, employers seek candidates with a solid educational foundation. Ensure your Education section underscores your readiness for the complex analysis and insight the role demands.

Certificates

In the evolving market of equity research, Certificates can act as badges of continuous improvement and specialization. This segment shows how to spotlight certificates that underscore your expertise and dedication to staying at the cutting edge.

1. Job Requirement Reflection

First off, immerse yourself in the job's requirements. Although our Equity Research Analyst position did not specify certifications, being a Chartered Financial Analyst (CFA) or having similar credentials showcases your dedication and expertise in the field.

2. Relevant Certification Highlighting

Select certificates that are laser-focused on the role's requirements - in this case, anything enhancing your analytical, valuation, and financial modeling prowess. Each certificate you list should be a testament to your capability and commitment.

3. Dating Your Credentials

Including the acquisition or validity dates of your certifications establishes their current relevance, similar to how a time-stamped report confirms the timeliness of your analysis.

4. Continuous Learning

Staying updated signifies not only your commitment to your profession but also your adaptability to evolving market conditions. It's an indication that you're always looking to enhance your portfolio of skills, much like an analyst seeking to diversify investment strategies.

Takeaway

Certificates are like specialized tools in your analytical toolkit, each one enhancing your ability to dissect the market's complexities. Display them prominently, ensuring they resonate with the Equity Research Analyst's multifaceted role, enriching your CV's overall narrative.

Skills

The Skills section of your CV is a concise showcase of your professional toolkit. As an Equity Research Analyst, balancing hard and soft skills is paramount. Here's how to strategically list skills that speak directly to the job's demands.

1. Dissect the Job Posting

Begin by drawing out both explicit and implicit skills from the job description. For an Equity Research Analyst, this means not just "Financial Modeling" but also "Excellent communication"—the two pillars of conveying complex analyses.

2. Skills Alignment

Choose skills that mirror the job description to your own. If "Industry Analysis" and "Valuation Techniques" are mentioned, these are not just skills; they're the keywords your CV needs to highlight, signaling a perfect match to ATS and hiring managers alike.

3. Organized Presentation

Just like a well-structured report, your skills section should be neatly organized. Prioritize them based on their relevance to the role, ensuring the critical skills stand out at first glance.

Takeaway

The Skills section is where your professional capabilities are highlighted in summary. Tailor this section so meticulously that hiring managers can't help but see you as the perfect fit for the Equity Research Analyst position. Remember, every skill you list is a key that unlocks a part of the role.

Languages

In the world of Equity Research, the ability to communicate across cultures can be a distinct advantage. This section guides on aligning language skills with job requirements, enhancing your profile's appeal to global firms.

1. Requirement Review

Begin by checking if the job specifies language skills. For our Equity Research Analyst role, strong English communication is a must, making your proficiency in English the top highlight.

2. Primary Language Highlight

State your proficiency level in English prominently. If you're a native speaker or fluent, make it known. This isn't just a skill; it's a key tool in your kit, enabling you to dissect and present complex reports effectively.

3. Additional Languages

If you speak other languages, list them. This can reveal your ability to navigate multi-cultural environments and expand your research's reach. Think of each language as a market you can analyze with ease.

4. Proficiency Clarification

Use clear terms to indicate your level of proficiency. From 'Native' down to 'Basic', this clarity is akin to a stock's performance rating, giving a clear indication of your capacity in each language.

5. Role's Global Scope

If the role has a global focus, your multi-lingual skills become significantly more valuable, illustrating your ability to engage with international markets. Reflect on the broader applicability of your language skills, much like considering the global impact on local markets.

Takeaway

Your multilingual abilities are not just competencies; they're competitive advantages in the global market of Equity Research. Present them proudly, letting them underscore your capability to operate beyond linguistic barriers, adding another dimension to your analytical skill set.

Summary

The Summary section is your CV's opening statement, offering a sneak peek into your expertise and achievements. Here's how to distill your professional essence into a compelling summary, tailored for the Equity Research Analyst role.

1. Role Comprehension

Start by absorbing the essence of the role. Understand what makes an Equity Research Analyst invaluable – the synthesis of analytical skill, market intuition, and the ability to communicate complex ideas clearly.

2. Captivating Introduction

Open with a strong statement that encapsulates your professional identity. Mention your years of experience and key areas of expertise. Consider this the headline of your professional narrative.

3. Key Achievements & Skills

Highlight key achievements and skills that align with the job requirements, such as your accurate investment recommendations or mastery in financial modeling. It's about giving a preview of your portfolio's highlights, enticing the reader to delve deeper.

4. Conciseness is Key

Keep your summary succinct yet informative. Aim for 3-5 impactful sentences that encapsulate your value proposition. It's the executive summary for your career, providing a crisp and clear insight into your professional standing.

Takeaway

Consider the Summary section your elevator pitch. It's your opportunity to capture the hiring manager's attention and make a compelling argument for your candidacy right from the start. Tailor it with precision, imbuing it with the essence of your professional journey, mirroring the specific needs of the Equity Research Analyst position.

Launching Your Equity Research Analyst Journey

Congratulations, you've now tailored each section of your CV to spotlight your suitability for the Equity Research Analyst role. With this guide and the assistance of Wozber's free CV builder, ATS-compliant CV, and ATS-friendly CV template, your CV is not just a document – it's a ticket to your next big opportunity. The financial markets await your analytical prowess. It's time to step forward with confidence and secure your position in the world of equity research.

- Bachelor's degree in Finance, Accounting, Economics, or a related field.

- Minimum of 3 years experience in equity research, preferably in a buy-side or sell-side firm.

- Strong knowledge of financial modeling, valuation techniques, and industry analysis.

- Proficiency in using financial analysis software and tools, such as Bloomberg or FactSet.

- Excellent communication and presentation skills to convey research findings to both internal teams and clients.

- Strong skills in English language communication essential.

- Must be located in or willing to relocate to New York City, NY.

- Conduct in-depth fundamental research on individual companies or industries to provide investment recommendations.

- Analyze financial statements, industry trends, and other relevant data to evaluate the value and potential of investments.

- Regularly publish research reports and present findings to senior management or external clients.

- Collaborate with portfolio managers, traders, and other team members to provide insights and recommendations for portfolio decisions.

- Stay updated with market news and events to quickly react to changing investment opportunities or risks.