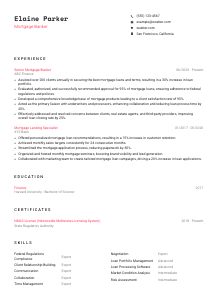

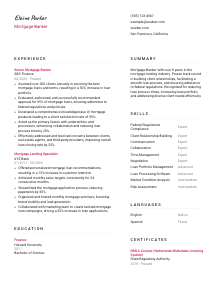

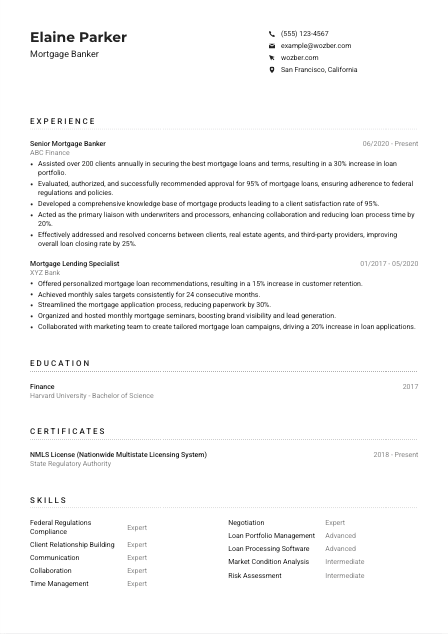

Mortgage Banker CV Example

Crafting home loans, but your CV is feeling underwater? Dive into this Mortgage Banker CV example, structured with Wozber free CV builder. Understand how you can seamlessly align your lending expertise with job specifics, making your career just as solid as the foundations you finance!

How to write a Mortgage Banker CV?

Welcome, future Mortgage Banker dynamo! In the realm of finance, your CV isn't just a document; it's a ticket to your dream job. With the pressure of making that perfect impression, the path to crafting a CV fit for a Mortgage Banker role may seem daunting. Fortunately, the Wozber free CV builder is here to guide your journey.

This step-by-step guide steers you through tailoring your CV with finesse, ensuring it aligns with your target job's nuances. Ready to craft a CV that not only ticks all the boxes but also stands out? Let's dive in!

Personal Details

Your personal details are your CV's handshake. Let's ensure this section shines with professionalism and aligns flawlessly with your Mortgage Banker aspirations.

1. Your Name: The Brand

Think of your name as the title of your professional story. Highlight it in a clear font, maybe a touch larger than the rest, and let it be the anchor of your CV. It's not just a name; it's the promise of your potential.

2. Job Title Alignment

Right below your name, echoing the job title "Mortgage Banker" positions you perfectly from the get-go. It's a subtle yet powerful way to say, 'I am exactly who you're looking for.'

3. Essential Contact Digits

Include your phone number and a professional email. Imagine this: 'example.firstname.lastname@email.com' – It's clean, straightforward, and screams professionalism. Always double-check these for typos. A call or an email missed due to a simple mistake? Let's not go there.

4. Location Matters

Mentioning "San Francisco, California" not only ticks a requirement box, it whispers to the employer, 'Relocation? No need. I'm already where I need to be.' It's a detail, sure, but one that could set you apart.

5. The Professional Profile Link

In our digital age, a LinkedIn profile can be a powerful ally, offering a deeper dive into your professional landscape. Make it available and ensure it reflects the strengths and experiences highlighted in your CV.

Takeaway

Consider the Personal Details section as your opening gambit, setting a professional and targeted tone. It's these initial nuances that can make your CV resonate from the first glance. Keep it concise, clear and aligned with your Mortgage Banker aspirations. Your CV is now ready to introduce you properly.

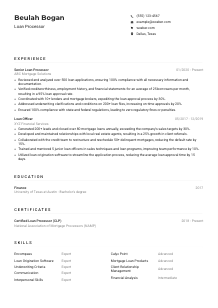

Experience

The Experience section is where you shine. It's about weaving your professional saga in a way that underscores your readiness and fitness for the Mortgage Banker role.

- Assisted over 200 clients annually in securing the best mortgage loans and terms, resulting in a 30% increase in loan portfolio.

- Evaluated, authorized, and successfully recommended approval for 95% of mortgage loans, ensuring adherence to federal regulations and policies.

- Developed a comprehensive knowledge base of mortgage products leading to a client satisfaction rate of 95%.

- Acted as the primary liaison with underwriters and processors, enhancing collaboration and reducing loan process time by 20%.

- Effectively addressed and resolved concerns between clients, real estate agents, and third‑party providers, improving overall loan closing rate by 25%.

- Offered personalized mortgage loan recommendations, resulting in a 15% increase in customer retention.

- Achieved monthly sales targets consistently for 24 consecutive months.

- Streamlined the mortgage application process, reducing paperwork by 30%.

- Organized and hosted monthly mortgage seminars, boosting brand visibility and lead generation.

- Collaborated with marketing team to create tailored mortgage loan campaigns, driving a 20% increase in loan applications.

1. Job Requirement Mapping

First, break down the job requirements. For a Mortgage Banker, understanding federal regulations, managing client relationships, and having a strong grasp of the mortgage process are key highlights. Reflect on how your past roles parallel these demands.

2. Your Professional Narrative

List your roles in reverse-chronological order. Begin with your most recent position, where you've hopefully had the chance to hone skills directly relevant to mortgage banking, such as "assisted over 200 clients annually in securing the best mortgage loans," directly echoing the job demands.

3. Accomplishments That Speak Volumes

Quantify your achievements. Did you increase a loan portfolio by 30%? Reduce loan process times by 20%? These numbers tell a compelling story of your impact and effectiveness, making it easier for recruiters to understand your potential contribution.

4. Aim for Relevance

Trim the fat. Focus on experiences that map directly to a Mortgage Banker's role. This focused approach ensures the hiring manager sees only the most relevant and impressive facets of your professional journey.

5. Narrate Your Professional Evolution

Demonstrate your growth within the industry. Showcase how each position built upon the last, culminating in an optimal blend of skills, experiences, and accomplishments that paint you as the perfect candidate for the role.

Takeaway

The Experience section is your professional portfolio. It's your opportunity to demonstrate that you're not just qualified but uniquely suited for the Mortgage Banker position. Tailor it with precision, infuse it with your achievements, and let your career journey resonate with prospective employers.

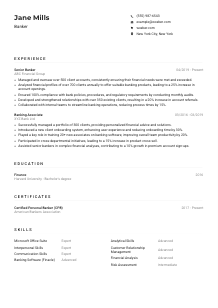

Education

The education section isn't just a formality; it's a pillar of your CV. Here's how to tailor this section to underline your suitability for the Mortgage Banker position.

1. Identifying Key Requirements

The job calls for a 'Bachelor's degree in Finance, Business, or a related field.' If your degree aligns, make it prominent. Your education is a direct link to your readiness for this role.

2. Clear and Ordered Presentation

Maintain a clean structure: Your degree, your field of study, and where you studied. For instance, 'Bachelor of Science in Finance,' positions you perfectly in the recruiter's eyes: educated, specialized, and prepared.

3. Highlight Degree Relevance

Make your degree speak to the role. A 'Bachelor of Science in Finance from Harvard University,' isn't just impressive; it's directly relevant and sets a strong educational backdrop for your Mortgage Banker ambitions.

4. Relevant Courses and Achievements

Did you excel in courses specific to mortgage banking? Or perhaps led a finance-related campus organisation? These details offer color to your educational narrative, spotlighting your drive and relevance.

5. Other Academic Honors

Grades matter, but so do honors and awards. They're evidence of your dedication and ability to excel, traits that are invaluable in the precise and demanding world of mortgage banking.

Takeaway

Your education section is a testament to your foundational knowledge and proof of your qualifications for the Mortgage Banker role. Craft it to showcase not just where you've studied, but how your academic journey has prepared you for the specifics of the job.

Certificates

In the world of mortgage banking, certain certifications can catapult your CV from great to exceptional. Here's how to utilize your certificate section for maximal impact.

1. Pinpointing Key Requirements

The job description underscored the need for an 'Active NMLS License.' If you have it, it's not just a certification; it's a golden ticket. Place it front and center to immediately meet one of the pivotal requirements.

2. Highlight What's Relevant

Focus on certifications that echo the job's demands. In a sea of qualifications, the ones that matter are those that speak directly to the core requirements of a Mortgage Banker.

3. Dates: The Timeline of Your Expertise

For certifications like the NMLS License, the date of acquisition showcases your continued relevance in the field. It's a small detail that carries weight, hinting at your updated knowledge and dedication.

4. Never Stop Learning

The financial landscape is ever-evolving. Regularly updating your certifications and pursuing new ones signal your commitment to staying at the forefront of the industry. It's a testament to your desire to grow and adapt.

Takeaway

Your certificates paint a picture of a candidate who goes above and beyond, who invests in their skills and stays ahead of industry standards. Tailor this section to meet the job's requirements and let it underscore your commitment and specialized knowledge.

Skills

The Skills section is your chance to quickly convey your mastery relevant to the Mortgage Banker role. Let's align it with the skills expressly sought in the job description.

1. Decoding the Job Post

Begin by dissecting the job posting. Looking for skills like 'Federal Regulations Compliance' and 'Client Relationship Building'? These aren't just desired skills; they're the essence of your role as a Mortgage Banker.

2. Matching Skills

Once you've identified the key skills sought, weave them into your CV. Are you an 'Expert' in 'Federal Regulations Compliance'? Say so. This direct mirroring makes it abundantly clear you're not just qualified; you're the perfect fit.

3. Order and Precision

While it might be tempting to list every skill under the sun, restraint and relevance win the day. Prioritize the skills that strongly align with the Mortgage Banker position, ensuring each one serves a clear purpose.

Takeaway

The skills section is more than a list; it's a strategically curated portfolio showcasing your readiness for the role. Approach it as an opportunity to highlight why you're not just a great candidate, but the ideal Mortgage Banker for the job.

Languages

In a global economy, language skills can significantly broaden your professional reach. Here's how to finesse the Languages section for the Mortgage Banker niche.

1. Language Requirements

First, let's address the job's call for 'Strong English language proficiency.' This isn't a mere requirement; it's your daily bread in mortgage banking. Position English at the top and clearly state your proficiency level.

2. Additional Linguistic Assets

If you speak other languages, include them. While not explicitly required, additional languages reflect your ability to navigate diverse client demographics, a valuable asset in personalized mortgage solutions.

3. Clarity in Proficiency

Be explicit about your language skills. Whether it's 'Native,' 'Fluent,' or 'Intermediate,' clear descriptors help paint a vivid picture of your linguistic capabilities.

4. Each Language is a Door

While English reigns supreme in this role, every additional language you list could be the key to unlocking new client relationships and opportunities. View them as facets of your professional appeal.

5. The Bigger Picture

For roles with a broader scope or in cosmopolitan areas like San Francisco, linguistic diversity isn't just an asset; it's essential. It signifies your agility in a multifaceted marketplace.

Takeaway

Language skills can transform your CV from local to global, making you an appealing candidate for roles that value diversity and outreach. Flaunt your language prowess; let it echo your capability to engage with a broad client base effectively.

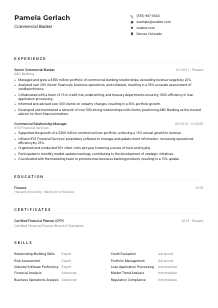

Summary

Your summary is your moment to shine, to encapsulate your fit for the Mortgage Banker role succinctly yet impactfully. Here's how to craft a summary that compels.

1. The Job Essence

Immerse yourself in the job requirements. A Mortgage Banker isn't just about loans; it's about guiding clients through one of their most significant financial decisions with expertise and care.

2. An Inviting Introduction

Initiate with a strong statement that encapsulates your professional stance and your years in the industry. 'A Mortgage Banker with over 6 years in the mortgage lending industry,' sets the stage beautifully.

3. Your Professional Highlights

Illuminate key aspects of your career that resonate with the job description—enhancing client relationships, expertise in federal regulations, and proficiency in managing a diverse loan portfolio are prime examples.

4. Conciseness is Key

Remember, your summary is the appetizer, not the meal. Aim for 3-5 impactful lines that invite the hiring manager to delve deeper into the compelling narrative of your CV.

Takeaway

Think of the summary as your professional headline, a snippet that distills your essence to captivate and intrigue. Tailored correctly, it makes a persuasive case for why you are the ideal candidate for the Mortgage Banker position. Make it unignorable; make it yours.

Launching Your Mortgage Banker Journey

Congratulations! With each section refined and tailored, your CV is now a beacon for Mortgage Banker opportunities. By leveraging the ATS-friendly CV template and ATS optimisation tools with Wozber, you've created a document that's not only beautiful but powerful. It's time to step forward with confidence and let your CV open doors to your next big opportunity in mortgage banking. The industry awaits; your move.

- Bachelor's degree in Finance, Business, or a related field.

- Minimum of 3 years of experience in mortgage lending or underwriting.

- Strong knowledge of federal regulations pertaining to mortgage banking and lending.

- Excellent communication and interpersonal skills for building and maintaining client relationships.

- Active NMLS (Nationwide Multistate Licensing System) license.

- Strong English language proficiency required.

- Must be located in or willing to relocate to San Francisco, CA.

- Assist clients in securing the best mortgage loans and terms to fit their financial goals.

- Evaluate, authorize, or recommend approval of mortgage loans, while adhering to internal and external regulations.

- Maintain a deep understanding of current market conditions and mortgage products to provide the best solutions to clients.

- Collaborate with underwriters and loan processors to facilitate a smooth loan process from application to closing.

- Act as a liaison between clients, real estate agents, and third-party service providers, addressing any concerns or potential obstacles in the loan process.