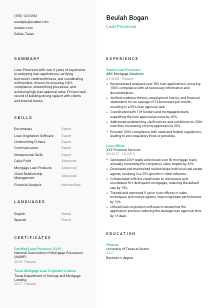

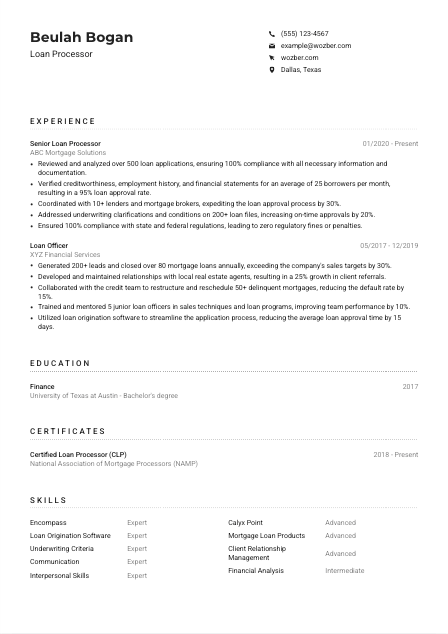

Loan Processor CV Example

Navigating loan files, but your CV feels like it's stuck in the underwriting queue? Delve into this Loan Processor CV example, shaped with Wozber free CV builder. Grasp how you can present your credit acuity and paperwork prowess to align perfectly with job requisites, advancing your career as smoothly as a loan approval!

How to write a Loan Processor CV?

Embarking on the journey to secure a Loan Processor position? You're in the right place! Crafting a CV that stands out in the world of finance isn't just about listing your achievements; it's about storytelling, precision, and a dash of strategy. Using Wozber, a free CV builder designed for ATS optimisation, we'll guide you through making a CV that not only meets the job description but elevates your application.

Ready to take on the challenge? Follow this expert guide to tailor your CV into a narrative that speaks volumes to hiring managers.

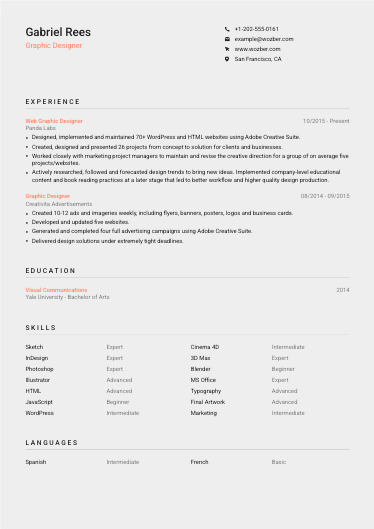

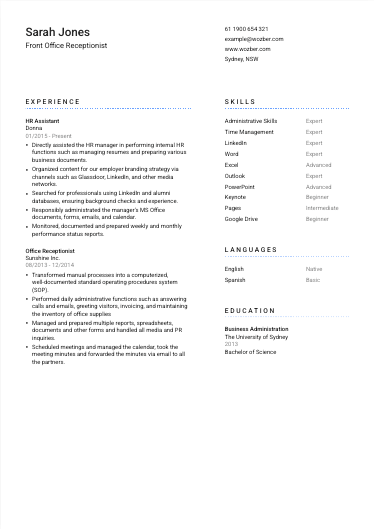

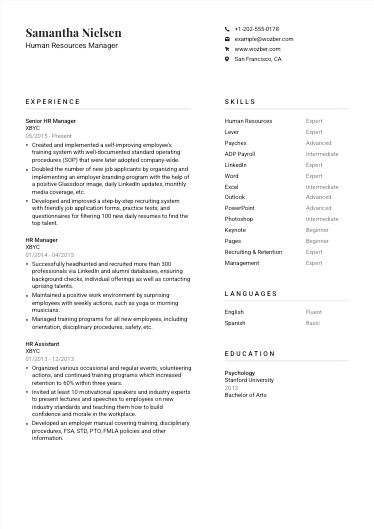

Personal Details

The gateway to a stand-out Loan Processor CV begins with a personal touch. This section is your first impression, and when tailored correctly, it makes a world of difference.

1. Name: Your Professional Banner

Start with your name, your professional headline. It's not just a label; it's the headline of your career story. Opt for a font that's professional and size it just a tad larger than the rest of your text to ensure it catches the eye.

2. Job Title Compatibility

Reflect the job title "Loan Processor" right below your name to forge an instant connection. This aligns your professional identity with the employer's needs, setting a tailored tone from the get-go.

3. Essential Contact Info

Include only the most necessary contact information: your phone number and a professional email. A simple, yet professional format like firstname.lastname@email.com projects a polished image.

4. Location Matters

Mentioning "Dallas, Texas" highlights your alignment with one of the specific requirements. This simple step can put you ahead by assuring the employer of your availability and feasibility for the position.

5. Professional Online Presence

A LinkedIn profile or a professional website can be a powerful tool. Ensure it's updated and reflective of your CV. This digital footprint can provide a deeper insight into your professional journey.

Takeaway

This introduction is not just a formality; it's the first chapter of your professional narrative. Make every word count and ensure it resonates with the Loan Processor role you're yearning to secure. With Wozber's free CV builder, you can effortlessly ensure your personal details are both ATS-compliant and tailored to perfection.

Experience

The experience section is where you let your professional achievements do the talking. It's crucial to frame your history not just accurately but compellingly, especially for a Loan Processor position.

- Reviewed and analyzed over 500 loan applications, ensuring 100% compliance with all necessary information and documentation.

- Verified creditworthiness, employment history, and financial statements for an average of 25 borrowers per month, resulting in a 95% loan approval rate.

- Coordinated with 10+ lenders and mortgage brokers, expediting the loan approval process by 30%.

- Addressed underwriting clarifications and conditions on 200+ loan files, increasing on‑time approvals by 20%.

- Ensured 100% compliance with state and federal regulations, leading to zero regulatory fines or penalties.

- Generated 200+ leads and closed over 80 mortgage loans annually, exceeding the company's sales targets by 30%.

- Developed and maintained relationships with local real estate agents, resulting in a 25% growth in client referrals.

- Collaborated with the credit team to restructure and reschedule 50+ delinquent mortgages, reducing the default rate by 15%.

- Trained and mentored 5 junior loan officers in sales techniques and loan programs, improving team performance by 10%.

- Utilized loan origination software to streamline the application process, reducing the average loan approval time by 15 days.

1. Dissecting the Job Requirements

Carefully analyze the job description. Identify key phrases like "underwriting criteria" and "loan origination software proficiency." These will be your guideposts for highlighting relevant experiences.

2. Structuring Your Professional Journey

Present your roles in reverse chronological order, emphasizing your capabilities with ATS-friendly CV formats provided by Wozber. Always start with your latest role, making your upward trajectory evident.

3. Crafting Achievement-focused Statements

Each role you list should include accomplishments that mirror the job's responsibilities, such as handling loan applications or coordinating with mortgage brokers. Deploy percentage increases or any quantifiable metrics to bring your contributions to life.

4. Tailoring Your Impact

Tie your achievements directly to key responsibilities listed in the job description. Managed 500+ loan applications? Highlight it. Your aim is to make the hiring manager see you in the role already.

5. Relevance is King

Stick strictly to experiences that align with the Loan Processor role. It's tempting to list all accomplishments, but focus and precision in matching the job description take precedence.

Takeaway

The experience section is your professional showcase. Use it to demonstrate how your past has perfectly prepped you for your future as a Loan Processor. As you align your CV with Wozber's ATS-friendly CV template, you ensure each accomplishment speaks directly to what hiring managers are looking for.

Education

Tailoring your education section for a Loan Processor position takes more than listing degrees. It's about shaping your academic background to meet the role's requirements seamlessly.

1. Identify the Degree Requisite

The job asks for a "Bachelor's degree in Finance, Business, or a related field." Ensure your degree matches this requirement exactly or emphasizes its relevance to the position.

2. Clear and Ordered

Structure this section for clarity: Degree, Field of Study, Institution, Graduation Date. Utilize Wozber's ATS-friendly CV format to present this information orderly.

3. Degree Synergy

Your Bachelor's degree in Finance directly meets the educational criteria. No need for flamboyancy here; the alignment speaks volumes.

4. Course Relevance (Optional)

In some cases, detailing relevant courses can give you an edge. For seasoned professionals like a Loan Processor, however, your degree and relevant certifications take precedence.

5. Academic Achievements (Optional)

If your academic journey boasts honors or significant projects that demonstrate your prowess in finance or related fields, mention them. Yet, remember the focus is your fit for the Loan Processor role, so keep it relevant.

Takeaway

Your education section quietly affirms your foundation for the Loan Processor position. With Wozber, you can ensure it's not only compliant with ATS systems but also perfectly aligned with the job you're aspiring to.

Certificates

In the world of Loan Processing, certifications can set you apart by illustrating your commitment to excellence and continuous learning.

1. Align with Job Necessities

Although the job listing may not specify required certifications, leveraging relevant ones such as the "Certified Loan Processor" shows initiative and specialization—a definite plus.

2. Selectivity is Key

Prioritize certifications that directly enhance your candidacy for the Loan Processor role. This ensures that hiring managers immediately see your commitment to the field.

3. Validity Matters

For certifications with expiration dates, including the acquired or expiration date is crucial. It shows you're up-to-date in your profession.

4. Continuous Learning

The finance industry evolves; so should you. Keep updating and adding certifications, especially those pertinent to loan processing, underwriting, and compliance regulations.

Takeaway

Your certifications mirror your journey toward mastery in the Loan Processing field. Highlight them with confidence, knowing they bolster your narrative as a dedicated professional. The ATS optimisation feature of Wozber ensures they're also seen and valued by the ATS.

Skills

A well-defined skill set tailored to the Loan Processor position can distinctly elevate your CV. Here's how you can curate yours to stand out:

1. Extracting Crucial Skills

Review the job description to pinpoint skills like "proficiency with loan origination software" and "strong knowledge of underwriting criteria." These are your keywords for ATS optimisation.

2. Mapping Your Skill Set

Reflect on your professional journey and match your skills to those highlighted in the job description. This alignment shows you're not just qualified but a perfect fit.

3. Order and Precision

Prioritize your skills based on the job's needs, beginning with those most relevant to Loan Processing. Use Wozber's ATS-friendly CV format to ensure they're presented cleanly and attractively.

Takeaway

Your skills section is the quick snapshot of your capability. Leveraging Wozber to perfectly align it with the Loan Processor's requirements ensures that hiring managers—and ATS systems—immediately recognize your suitability for the role.

Languages

While proficiency in English is a must for a Loan Processor, showcasing additional language skills can illustrate your ability to navigate a diverse client base.

1. Understanding Language Needs

"Must demonstrate proficiency in English." If you meet this requirement, place it prominently in your languages section. It's a non-negotiable, so make it clear you're up to par.

2. Prioritize Essential Languages

If the job specifies English, list it first. Then, follow with other languages you're fluent in, like Spanish, which is beneficial in diverse markets like Dallas, Texas.

3. Catalog Other Linguistic Skills

Even if not explicitly required, additional languages can be a significant asset, demonstrating versatility and the ability to engage with a broader client base.

4. Honesty in Proficiency

Use clear descriptors—Native, Fluent, Intermediate, Basic—to indicate your language capabilities. This honesty adds integrity to your CV.

5. Considering the Job's Scope

If your Loan Processor role involves global clients, your multilingual abilities can be a compelling selling point, portraying you as a bridge in international transactions.

Takeaway

Languages are not just about communication; they're about connection. Showcasing your linguistic skills can subtly signal to employers your ability to interact with a diverse clientele. With Wozber's help, your CV will not only be ATS-optimised but also culturally attuned.

Summary

A compelling summary weaves together your skills, experience, and aspirations. It sets the stage for your CV by providing a glimpse into your professional persona.

1. Capturing the Job's Essence

Start by absorbing the job description. Understand the Loan Processor role's core requirements and how your career journey aligns with these needs.

2. Crafting an Opening Pitch

Begin with a powerful statement that positions you as an experienced Loan Processor. This is your chance to make an immediate impact, showing why you're the right fit.

3. Key Skills and Achievements

Highlight a few pivotal skills and notable achievements that directly respond to the job's demands. This bit should resonate with the responsibilities and qualifications listed, demonstrating your preparedness for the role.

4. Precision and Brevity

Keep this section tight and impactful. Aim for 3-5 sentences that compellingly summarize your professional identity and aspirations as a Loan Processor.

Takeaway

Your summary isn't just an introduction; it's your personal elevator pitch. It encapsulates why you're not just a candidate but the candidate for the Loan Processor position. With every word chosen for impact, let this section highlight your distinct suitability for the role, assured of ATS compliance with Wozber's tools.

Embarking on Your Loan Processing Journey

With this detailed guide, you're now equipped to craft a Loan Processor CV that doesn't just meet the job description but exceeds expectations. Your CV is a reflection of your professional narrative, polished and precise. Through strategic tailoring and ATS optimisation with Wozber, you ensure that your journey towards a successful Loan Processor career is well underway.

Remember, it's not just about matching keywords; it's about presenting a cohesive and compelling career story. Start building your standout CV today and step confidently into your future.

- Bachelor's degree in Finance, Business, or a related field.

- Minimum of 2 years of experience in loan processing or a similar role.

- Strong knowledge of mortgage loan products, underwriting criteria, and documentation requirements.

- Proficiency with loan origination software such as Encompass or Calyx Point.

- Excellent communication and interpersonal skills to build rapport with clients and internal teams.

- Must demonstrate proficiency in English.

- Must be located in Dallas, Texas.

- Review and analyze loan applications to ensure all necessary information and documentation are provided.

- Verify borrower's creditworthiness, employment history, and financial statements.

- Submit complete loan files for underwriting approval, addressing any clarifications or conditions requested.

- Coordinate with lenders, mortgage brokers, and other internal departments to expedite the loan approval process.

- Ensure compliance with all state and federal regulations, including the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA).