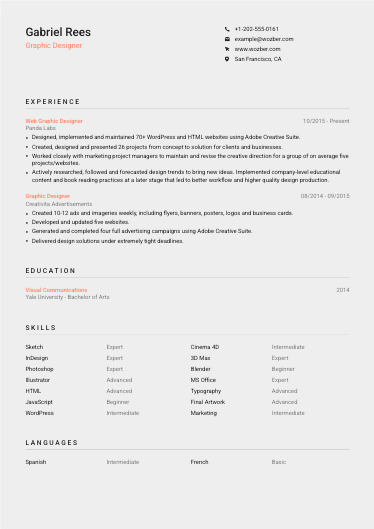

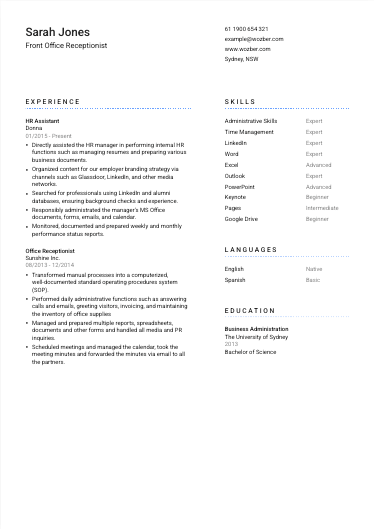

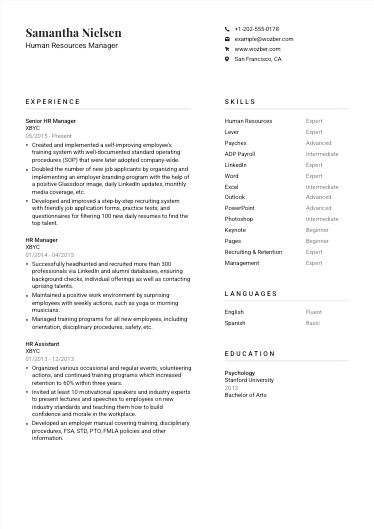

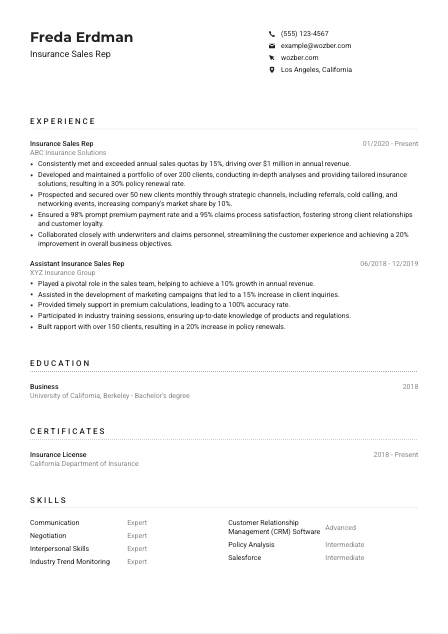

Insurance Sales Rep CV Example

Shielding clients, but your CV coverage feels incomplete? Delve into this Insurance Sales Rep CV example, crafted with Wozber free CV builder. Discover how you can synchronize your sales savvy and policy expertise to succinctly meet job requirements, ensuring your career protection is as solid as your premium offerings!

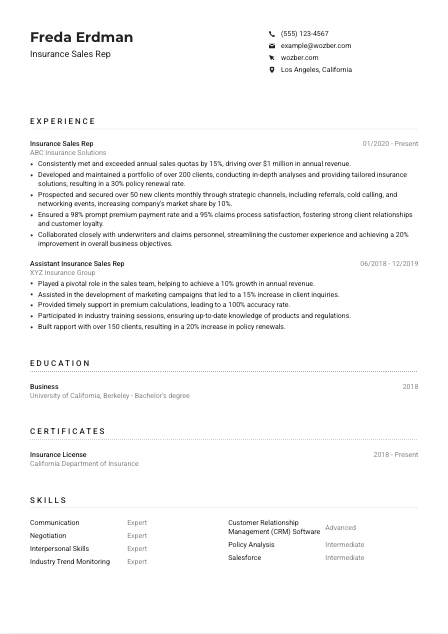

How to write an Insurance Sales Rep CV?

Hello, aspiring Insurance Sales Rep! In the fast-paced insurance industry, standing out in the job market isn't just about ambition—it's crucial for your career progression. Your CV isn't merely a document; it's the gateway to your future success, showcasing your skills, experience, and dedication. With the help of Wozber, a free CV builder optimised for Applicant Tracking Systems (ATS), you're about to learn how to construct a CV precisely tailored to the Insurance Sales Rep role you're eyeing.

Ready to transform your professional narrative into a compelling pitch that lands you the job? Let's dive in.

Personal Details

The Personal Details section is more than just information; it's your digital handshake. Tailoring this section for the Insurance Sales Rep position ensures you're instantly seen as a qualified candidate. Let's break down the art of personalizing your CV, aligning your introduction to capture the hiring manager's attention from the get-go.

1. Make Your Name Stand Out

Your name is your professional marque. Make sure it grabs attention by using a legible font and a size that commands notice. It's the first step in making your CV memorable.

2. Title Tailoring

Including the job title directly below your name immediately aligns your professional identity with the role. Think of it as wearing a badge that says 'Insurance Sales Rep', letting the hiring manager know you're a perfect fit from the start.

3. Essential Contact Info

Your contact details must be flawless. Use a professional email format like firstname.lastname@email.com, and double-check your number for accuracy. It's your direct line — ensure it's correct and professional.

4. Location Matters

"Must be located in Los Angeles, California" — this requirement can be a deal-breaker. Clearly stating "Los Angeles, California" in your CV assures the employer of your eligibility, making relocation concerns a non-issue.

5. Web Presence

Linking to a professional profile, like LinkedIn, adds depth to your application. Ensure it's synchronized with your CV, providing a consistent and comprehensive view of your professional persona.

Takeaway

The Personal Details section lays the foundation for your professional story. It's vital to tailor it precisely, ensuring it resonates with the Insurance Sales Rep role. Think of it as your business card, leading with essential details that secure a great first impression.

Experience

The Experience section is where you shine bright. It's your opportunity to demonstrate how your path aligns perfectly with the Insurance Sales Rep position. Let's navigate crafting this section to reflect your professional journey's highlights, precisely mirroring the job requirements.

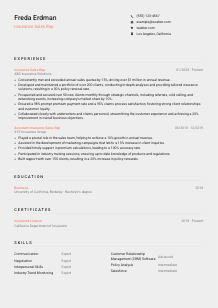

- Consistently met and exceeded annual sales quotas by 15%, driving over $1 million in annual revenue.

- Developed and maintained a portfolio of over 200 clients, conducting in‑depth analyses and providing tailored insurance solutions, resulting in a 30% policy renewal rate.

- Prospected and secured over 50 new clients monthly through strategic channels, including referrals, cold calling, and networking events, increasing company's market share by 10%.

- Ensured a 98% prompt premium payment rate and a 95% claims process satisfaction, fostering strong client relationships and customer loyalty.

- Collaborated closely with underwriters and claims personnel, streamlining the customer experience and achieving a 20% improvement in overall business objectives.

- Played a pivotal role in the sales team, helping to achieve a 10% growth in annual revenue.

- Assisted in the development of marketing campaigns that led to a 15% increase in client inquiries.

- Provided timely support in premium calculations, leading to a 100% accuracy rate.

- Participated in industry training sessions, ensuring up‑to‑date knowledge of products and regulations.

- Built rapport with over 150 clients, resulting in a 20% increase in policy renewals.

1. Dissecting the Job Spec

Start by annotating the job description. Highlight keywords and phrases related to experiences, such as "exceeding sales quotas" and "portfolio management." This nuanced approach ensures you don't miss any vital alignments.

2. Role and Company Presentation

Your professional journey should unfold in reverse-chronological order, allowing your most recent achievements to take the spotlight. Include precise titles and company names, alongside the period you were there, to provide a clear timeline.

3. Mirror Accomplishments

Tailor your accomplishments to resonate with the job's requirements. Use bullet points to detail how you "exceeded sales quotas" or "managed a portfolio of 200+ clients," directly reflecting the role's needs.

4. Quantify Your Impact

Bringing numbers into your narrative adds weight to your achievements. Quantify your results wherever possible, such as "increased market share by 10%" or "improved policy renewal rates by 30%," to offer tangible evidence of your prowess.

5. Relevance is Key

Every detail you include should serve the purpose of aligning you with the Insurance Sales Rep role. Avoid cluttering your CV with unrelated accolades. Focus on what matters most to the role at hand.

Takeaway

The Experience section is the core of your professional story. It's about presenting yourself not just as a qualified candidate, but as an indispensable asset. Think like a hiring manager and tailor your achievements to meet the firm's needs directly. Your CV is your pitch—make it compelling.

Education

While straightforward, the Education section can be more than just a list of degrees; it's another chance to align with the Insurance Sales Rep role's demands. Here's how to fine-tune your education details to underscore your suitability for the position.

1. Align with the Request

"Bachelor's degree in Business, Finance, or a related field" as per the job description should be explicitly mentioned if met. This immediate correlation showcases your foundational knowledge in the field.

2. Simplicity Shines

Maintain clarity by listing your degree, field, university, and graduation date in a straightforward manner. This ensures your educational credentials are easily digestible at a glance.

3. Degree Specificity

For the Insurance Sales Rep role, it's crucial to highlight your "Bachelor's degree in Business." This direct match with the job's necessities emphasizes your relevant academic background.

4. Relevant Courses Matter

While your degree might cover the essentials, spotlighting pertinent courses can further demonstrate your readiness for the role, especially if these courses align closely with insurance sales dynamics.

5. Educational Achievements

If your academic journey includes accolades or extracurriculars closely tied to business or finance, they're worth mentioning. However, keep this bespoke to the role's seniority and relevancy.

Takeaway

Thoughtfully presented, your education section proves not just accomplishment, but alignment with your career goals. Let your academic background be a testament to your preparedness and enthusiasm for the Insurance Sales Rep role.

Certificates

Certificates underscore your commitment to professional growth and specialized expertise. For an Insurance Sales Rep, certain certifications can set you apart. Let's explore how to showcase your certificates to highlight your continuous learning journey and its relevance to your targeted role.

1. Review Requirements

Although the job post might not specify certifications, having an "active insurance license" as highlighted in our CV example directly communicates your eligibility and dedication.

2. Choose Pertinently

List certificates that underscore your proficiency and readiness for the Insurance Sales Rep role. Prioritize those directly aligned with insurance sales, such as state-specific insurance licenses.

3. Clarity with Dates

Being transparent about the validity period of your certifications, especially your insurance license, affirms your current competency and readiness for immediate responsibilities.

4. Stay Proactive

The insurance industry evolves, and so should you. Regularly updating your qualifications and pursuing new certifications related to insurance sales demonstrates a commitment to your professional development.

Takeaway

Your certificates are a powerful testament to your dedication and expertise. They not only fulfill the explicit requirements of the Insurance Sales Rep role but also showcase your commitment to staying ahead in a competitive field.

Skills

In the competitive field of insurance sales, your skill set is what differentiates you. This section is where you list your professional capabilities that speak directly to the Insurance Sales Rep role. Here's how to strategically select and present your skills to make them shine.

1. Decode the Job Spec

Start by dissecting the job description for skills, both stated and implied. In our case, "excellent communication, negotiation, and interpersonal skills" are critical.

2. Alignment is Key

Carefully match your own skills with the job requirements. Prioritize those that demonstrate your expertise in sales, customer relationship management (CRM), and industry knowledge.

3. Selective Presentation

Avoid listing every skill you possess. Focus on those most relevant to an Insurance Sales Rep, ensuring your CV remains pointed and pertinent to the role.

Takeaway

Presenting your skills effectively lays out your professional toolkit, making a compelling argument for your candidacy. It's about showing, not just telling, that you're the best fit for the Insurance Sales Rep position.

Languages

In today's global marketplace, linguistic abilities can distinguish you as an Insurance Sales Rep. Whether engaging with diverse client portfolios or interfacing with international partners, your language skills can be a significant asset. Let's navigate through aligning your linguistic proficiencies with the job's requirements.

1. Job Requirement Check

The job description emphasizes "Strong English language proficiency required." This non-negotiable prerequisite should be clearly acknowledged in your CV.

2. Prioritize Importance

List English at the top of your language skills, categorizing yourself as either 'Native' or 'Fluent' to match the job's demands. This immediate alignment sets a positive tone.

3. Showcase Additional Languages

While English proficiency is a must, other languages can enhance your application. They reflect your ability to engage with a broader client base and adapt to various cultural contexts.

4. Honest Proficiency

Clearly mark your level of fluency for each language. This transparency ensures realistic expectations and underscores your honesty— traits valuable in any sales role.

5. Global Role Insights

For roles with international exposure, or that serve diverse communities, articulating your language skills can be tremendously beneficial. Consider this when detailing your linguistic abilities.

Takeaway

Languages are more than words; they're avenues to connect, understand, and expand prospects. Displaying your linguistic skills can open doors and highlight your readiness for the diverse demands of an Insurance Sales Rep.

Summary

Your summary is the concise brochure of your professional self, setting the tone for the narrative your CV will unfold. Here's how to craft a summary for the Insurance Sales Rep position that captivates from the first word, ensuring you make a lasting impression.

1. Capture the Job Essence

A deep understanding of the job description allows you to begin your summary with a powerful narrative. Reflect the critical aspects such as "surpassing annual sales quotas" and "providing tailored insurance solutions."

2. Introduce Yourself

Start with a punchy statement that encapsulates who you are professionally. Mention your years of experience and core expertise areas, grounding your introduction in the realities of the Insurance Sales Rep role.

3. Reflect Key Requirements

Weave in your top skills and major achievements that directly respond to the job's demands, such as your knack for "building and maintaining a robust client portfolio" and a "keen eye for industry trends."

4. Brevity is Brilliance

Keep your summary crisp and potent. With 3-5 lines, your goal is to intrigue and invite the hiring manager to delve deeper into your CV, peeling back the layers of your professional saga.

Takeaway

Think of your summary as the highlight reel of your career, paving the way for what the hiring manager can expect. It's your chance to sell yourself, aligning your professional narrative with the needs of the Insurance Sales Rep position. Let your summary ignite interest and set the stage for the detailed excellence presented in your CV.

Embarking on Your Insurance Sales Rep Journey

You've now mastered the insider strategies to craft an Insurance Sales Rep CV that not only aligns with but accentuates your fit for the role. Utilizing Wozber's free CV builder, including its ATS-friendly CV templates and ATS CV scanner, you're equipped to create a CV that speaks directly to hiring managers, dazzling them with your tailored qualifications. Your journey doesn't end here—it's just the beginning. Transform your CV into a bridge to your dreams, letting your dedication, skills, and experience shine.

The world of insurance sales awaits your talent. Embrace your future with confidence and enthusiasm!

- Bachelor's degree in Business, Finance, or a related field.

- Minimum of 2 years of experience in insurance sales or a related field.

- Proven track record of meeting or exceeding sales quotas.

- Excellent communication, negotiation, and interpersonal skills.

- Possession of an active insurance license (state-specific requirements apply).

- Strong English language proficiency required.

- Must be located in Los Angeles, California.

- Develop and maintain a portfolio of clients by conducting regular needs-based analyses and providing tailored insurance solutions.

- Prospect and secure new clients through various channels, including referrals, cold calling, and networking events.

- Ensure prompt and accurate premium payments, policy renewals, and claims processes for clients.

- Stay up-to-date with industry trends, products, and regulatory requirements to provide informed recommendations to clients.

- Collaborate with internal teams, such as underwriters and claims personnel, to deliver a seamless customer experience and achieve overall business objectives.