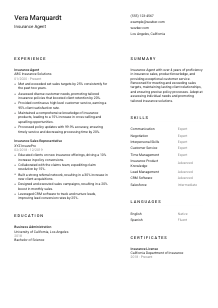

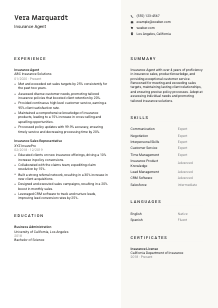

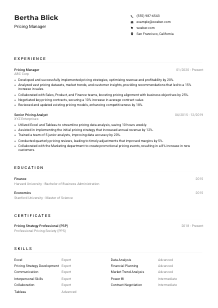

Insurance Agent CV Example

Securing policies, but your CV feels uninsured? Anchor it with this Insurance Agent CV example, structured using Wozber free CV builder. Learn how to align your coverage expertise with job specifications, ensuring your career path is as well-protected as the policies you sell!

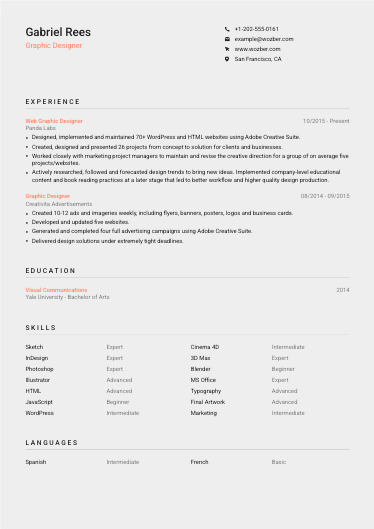

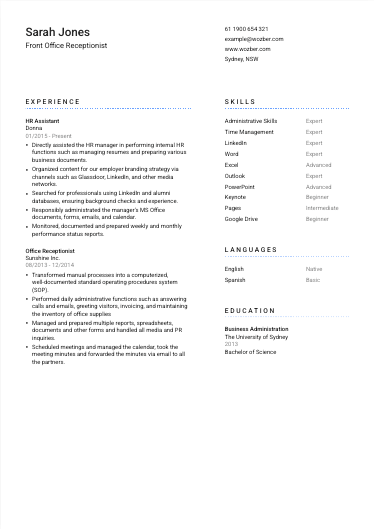

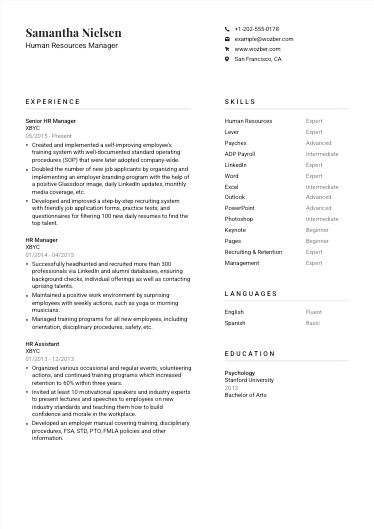

How to write an Insurance Agent CV?

Hello there, future standout Insurance Agent! In the dynamic world of insurance, making your mark requires more than just enthusiasm; it involves a well-crafted CV that speaks volumes, a CV that sets you apart from the crowd. Leveraging the power of Wozber, a free CV builder designed for ATS optimisation, this guide will navigate you through crafting that perfect CV. Let's sculpt your professional story into one that not only aligns flawlessly with your desired Insurance Agent role but also passes the rigorous checks of Applicant Tracking Systems (ATS).

Ready to unlock the secrets to a job-winning CV? Dive right in!

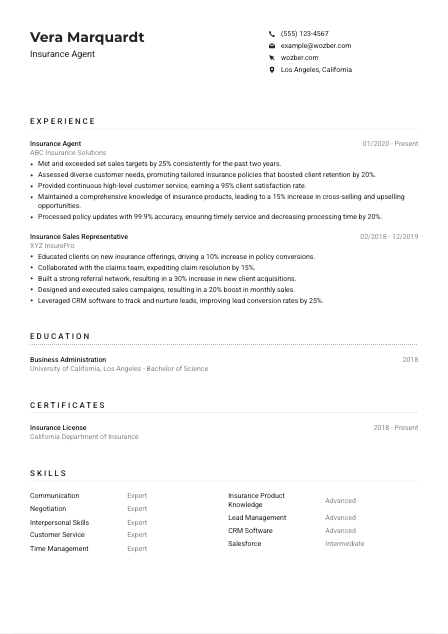

Personal Details

The Personal Details section might seem straightforward, yet it's your introductory handshake in the written form. Getting this right for the Insurance Agent position is critical, as you want to mirror the professionalism and precision the role demands.

1. Your Name, Your Brand

Think of your name as the brand logo on your CV. Use a clear, professional font, making it a tad larger to ensure it captures attention. Remember, your name is the centerpiece here.

2. Align with Your Role

Directly below your name, position your targeted job title – "Insurance Agent" in this case. This strategic positioning instantly aligns your personal brand with the role at hand, setting a clear intent from the get-go.

3. Essential Contact Details

Ensure your phone number and a professional email address (think firstname.lastname@email.com) are accurate and clearly stated. These are your direct lines, make sure they're open and typo-free.

4. Location, Location, Location

The job calls for you to be located in Los Angeles, California. Highlighting your Los Angeles address up front matches you geographically to the job's prerequisites, showing that you're in the zone – literally.

5. Professional URLs

If you have a LinkedIn profile or a personal website that showcases your professional allure, include it. Just be sure it reflects your CV and is tailored towards your prowess as an Insurance Agent.

Takeaway

This section of your CV is more than just about basic details; it's about setting the professional tone. Tailor it with precision to ensure you're broadcasting the right signals for your target role. Think of it as laying down the welcome mat, making sure it's aptly placed for your entrance into the realm of Insurance Agents.

Experience

The Experience section is where your professional narrative shines, especially for an Insurance Agent position. It's about showcasing not just where you've been, but how you've excelled and left a mark in those roles.

- Met and exceeded set sales targets by 25% consistently for the past two years.

- Assessed diverse customer needs, promoting tailored insurance policies that boosted client retention by 20%.

- Provided continuous high‑level customer service, earning a 95% client satisfaction rate.

- Maintained a comprehensive knowledge of insurance products, leading to a 15% increase in cross‑selling and upselling opportunities.

- Processed policy updates with 99.9% accuracy, ensuring timely service and decreasing processing time by 20%.

- Educated clients on new insurance offerings, driving a 10% increase in policy conversions.

- Collaborated with the claims team, expediting claim resolution by 15%.

- Built a strong referral network, resulting in a 30% increase in new client acquisitions.

- Designed and executed sales campaigns, resulting in a 20% boost in monthly sales.

- Leveraged CRM software to track and nurture leads, improving lead conversion rates by 25%.

1. Dissect the Job Description

Start by breaking down the provided job description. Notice how it emphasizes 'meeting or exceeding sales quotas' and 'providing continuous, excellent customer service'? These are your golden keywords and your accomplishments should echo them.

2. Structure It Right

Organize your roles chronologically, placing the most recent at the top. For each, clearly list your job title, the company, and your tenure there. This clear structure allows hiring managers to easily navigate your professional journey.

3. Your Achievements – Your Story

Detail your accomplishments in a way that mirrors the job requirements. Use bullet points for clarity, starting each with a strong action verb. For instance, "Met and exceeded sales targets by 25%", directly showcases your prowess, a perfect echo to the job's demand.

4. Quantify, Quantify, Quantify

Numbers draw the eye and provide concrete evidence of your accomplishments. Whether it's sales targets exceeded, retention rates boosted, or claims processed, quantifying your achievements makes your contribution palpable.

5. Relevance is Key

Tailor your listed experiences to be as relevant to the Insurance Agent role as possible. Irrelevant accolades, however impressive, can distract from the alignment between your skills and the job requirements.

Takeaway

Your experience section is your professional highlight reel. Make every achievement count, align it with what the job seeks, and don't be shy to quantify your success. This is where you build your case as the ideal candidate, make it compelling.

Education

In the insurance industry, your education sets the foundation of your expertise. Here's how to polish the Education section of your CV for the Insurance Agent role, ensuring it aligns with the job's academic requirements.

1. Meeting the Educational Requirements

The job description asks for a 'Bachelor's degree in Business, Finance, or a related field.' Ensure that your degree matches these specifications if you have it. It's your first checkmark on the hiring manager's list.

2. Clean and Clear Formatting

Your education section should be a breeze to read. List the degree obtained, the field of study, the institution's name, and your graduation year. This straightforward format respects the hiring manager's time and keeps their focus.

3. Highlight the Degree That Fits

For the Insurance Agent role, you've listed 'Bachelor of Science in Business Administration'. This precise aligning answers the job's call for a related degree, setting you a step ahead.

4. Mention Relevant Courses - Strategically

If you're fresh out of college or have taken courses directly applicable to the insurance industry or sales strategies, list them. This shows initiative and a keen interest in your professional development.

5. Other Noteworthy Achievements

Graduated with honors? Part of a business club? While not always necessary for experienced professionals, such details can bolster the CV of new graduates or those early in their careers, showing dedication and involvement.

Takeaway

Your education is not just a degree; it's proof of your foundational knowledge and readiness to excel in the Insurance Agent role. Ensure it's presented clearly, aligns with what the job demands, and offers a peek into your commitment to the field.

Certificates

In the insurance industry, staying updated with certifications can give you an edge. Here's how to weave your certificates into your CV, ensuring they underscore your commitment and expertise as an Insurance Agent.

1. Identify What's Important

Revisit the job post. It requires a valid state insurance license. This certificate is non-negotiable, so it must be prominently listed with clarity on your CV.

2. Quality Over Quantity

List the certificates that resonate most with the Insurance Agent role. For example, your state insurance license is a must-have. This selective approach ensures your CV is targeted and relevant.

3. Dating Your Certifications

Where applicable, include the date of issuance and, if applicable, expiration. This demonstrates current compliance and ongoing professional diligence. For example, 'Insurance License, California Department of Insurance, 2018 - Present' shows you're up to date.

4. Continuous Learning

The insurance world is ever-evolving, and staying abreast with certifications not only demonstrates your commitment but also your enthusiasm to grow. Make it a point to pursue ongoing educational opportunities.

Takeaway

Certificates in your CV are like badges of honor, showcasing your dedication and compliance with industry standards. Strategically select and present those that fortify your position as the ideal candidate for the Insurance Agent role.

Skills

Your Skills section is a concise showcase of your professional arsenal. Tailoring this to your Insurance Agent position means highlighting the unique skill set that makes you the perfect fit.

1. Dig Into the Job Requirements

The job calls for 'excellent communication, negotiation, and interpersonal skills'. Pinpoint these skills from your professional toolkit and prepare to present them front and center.

2. Highlight Pertinent Skills

Focus on listing skills that are most relevant to the job at hand. Include 'Communication', 'Negotiation', and 'Interpersonal Skills' at the top, and back them up with examples of your proficiency in your experience section.

3. Organized Presentation

Keep your skills list neat and prioritize those that directly impact your effectiveness as an Insurance Agent. This targeted presentation showcases your suitability and preparedness for the role.

Takeaway

The skills you list on your CV are a testament to your fit for the Insurance Agent role. Be deliberate in your selection, ensuring each skill you highlight directly correlates to the demands of the position. Show them you're not just capable, but exceptionally so.

Languages

In the diverse landscape of Los Angeles, the ability to communicate in multiple languages can set you apart as an Insurance Agent. Here's how to strategically feature your linguistic abilities on your CV.

1. Core Language Requirement

Since the job explicitly requires 'English language proficiency', listing English as a native or fluent language is non-negotiable. This direct match addresses a key requirement straight off the bat.

2. Additional Languages

If you are proficient in other languages, like Spanish, listing them could be beneficial, especially in a culturally rich city like Los Angeles. It demonstrates your potential for broader client engagement.

3. Clarity in Proficiency

Be honest and clear about your language proficiency levels. Using terms like 'Native' or 'Fluent' gives the hiring manager a precise understanding of your communication capabilities.

4. Tailor to Role's Scope

Assess whether the role may benefit from multilingual abilities beyond the stated requirements. In a city as diverse as Los Angeles, additional languages can be a definite plus, enhancing client interactions and service.

5. Reflect Global Readiness

Even if not explicitly required, additional languages speak volumes about your ability to navigate and thrive in a globalized market. It showcases adaptability, a crucial attribute for any forward-thinking Insurance Agent.

Takeaway

Your prowess in languages on a CV is not just about communication; it's a bridge to understanding and engaging with a diverse clientele. Highlight your linguistic skills, especially if they enhance your capacity for the Insurance Agent role. Your voice is powerful, let it resonate in as many languages as possible.

Summary

Crafting an engaging Summary at the top of your CV is your chance to make a sparkling first impression. For an Insurance Agent role, it's about concisely showcasing why you are not just a good, but the perfect fit.

1. Grasp the Job's Core

Start by identifying the essence of what makes an exemplary Insurance Agent. Reflect on the key skills and experiences the job description highlights, and be ready to mirror these in your summary.

2. Lead with Your Professional Identity

Introduce yourself as a professional – in this case, an ‘Insurance Agent'. Mention your years of experience and briefly touch on your areas of specialization or standout achievements.

3. Address Key Requirements

Highlight a few of your most pivotal skills and experiences that align with the job's needs. For example, ‘Renowned for meeting and exceeding sales targets, maintaining lasting client relationships, and ensuring precise policy processes.'

4. Conciseness is Key

Your summary is the appetizer, not the main course. Craft a teaser that entices the hiring manager to delve deeper into your CV – keep it impactful yet succinct.

Takeaway

The Summary is your CV's headline act. It's your pitch, highlighting your journey's high points and how they align with the Insurance Agent role you're targeting. Make it resonate, make it compelling, and above all, make it reflective of your professional story and capabilities.

Launching Your Insurance Agent Journey

Congratulations on tailoring your CV with finesse and precision for the Insurance Agent role! Using the insights and templates from Wozber, your professional narrative is now fine-tuned, ATS-optimised, and ready to make a striking impact. Remember, your CV is the key to starting conversations; make it count. The insurance world is ripe with opportunities – your newly crafted CV is your passport. Dive in, the future awaits!

- Bachelor's degree in Business, Finance, or a related field.

- Minimum of 2 years of experience in insurance sales or related positions.

- Possession of a valid state insurance license.

- Proven track record of meeting or exceeding sales quotas.

- Excellent communication, negotiation, and interpersonal skills.

- English language proficiency is a must.

- Must be located in Los Angeles, California.

- Assess customer needs, explain insurance plan options, and ensure policies are tailored to individual requirements.

- Provide continuous, excellent customer service, and build long-lasting relationships with clients.

- Maintain a high level of product and industry knowledge to educate clients on new offerings or changes in the market.

- Process policy renewals, claims, and updates in a timely manner ensuring accuracy.

- Meet or exceed set sales targets and key performance indicators (KPIs) on a consistent basis.