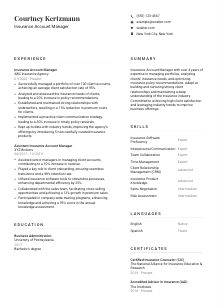

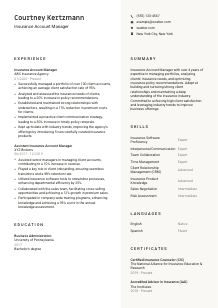

Insurance Account Manager CV Example

Balancing policies, but your CV doesn't feel covered? Navigate this Insurance Account Manager CV example, fashioned with Wozber free CV builder. Learn how to detail your account management acumen to align with job specifics, ensuring your career trajectory is as secure as the policies you oversee!

How to write an Insurance Account Manager CV?

Hello, aspiring Insurance Account Manager! Preparing your CV for your dream job isn't just about listing your previous jobs; it's about strategically aligning your experiences, skills, and qualifications with the specific needs of your prospective employer. With the help of Wozber's free CV builder and this comprehensive guide, let's craft a CV that not only passes the ATS (Applicant Tracking System) checks with flying colors using an ATS-compliant CV but also captures the essence of what makes you the perfect candidate for this role.

Ready to get started? Your journey to landing that Insurance Account Manager position begins now!

Personal Details

The Personal Details section is the cornerstone of your CV. It's your chance to make a great first impression and ensure your application lands in the right hands with all the essential information readily available. Let's tailor this section specifically for your Insurance Account Manager application.

1. Clearly State Your Name

Your name is your headline. Ensure it's bold and the first thing a hiring manager sees. This is not just about aesthetics; it's about making your CV memorable.

2. Position Title Precision

Immediately below your name, tailor your title to match the job you're applying for. For example, "Insurance Account Manager," instantly signals to hiring managers that your career aligns perfectly with the job opening.

3. Contact Info Must-haves

- Phone Number: Your lifeline for direct communication. Ensure it's current and typo-free.

- Professional Email Address: First impressions count, even in your email address. Keep it professional and straightforward.

4. Location, Location, Location

"Must be located in New York City, New York." This requirement from the job description can't be overlooked. Mentioning your locality reaffirms to the employer your availability and readiness for the position.

5. Online Presence

Including a LinkedIn profile or a professional website can significantly bolster your first impression. It's an opportunity to showcase your professional image and credentials beyond the limitations of a CV.

Takeaway

Consider the Personal Details section as your professional handshake. It's short, impactful, and sets the stage for the rest of your CV. Make sure it says, "I'm the Insurance Account Manager you're looking for."

Experience

The Experience section is where you shine, demonstrating how your past roles have prepared you for this opportunity. It's not just about what you did, but how those roles contribute to your qualifications as an Insurance Account Manager. Follow these steps to showcase achievements aligning with the job description.

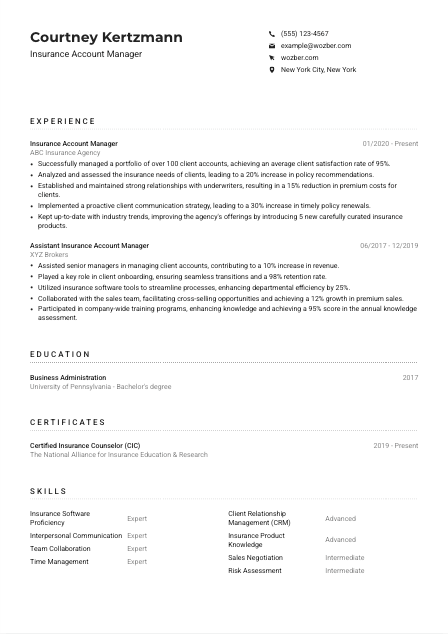

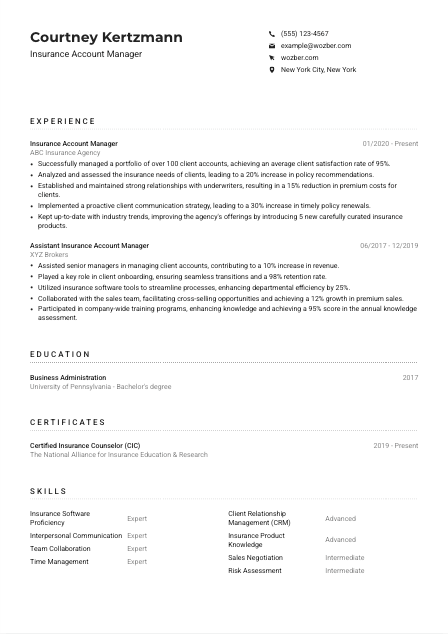

- Successfully managed a portfolio of over 100 client accounts, achieving an average client satisfaction rate of 95%.

- Analyzed and assessed the insurance needs of clients, leading to a 20% increase in policy recommendations.

- Established and maintained strong relationships with underwriters, resulting in a 15% reduction in premium costs for clients.

- Implemented a proactive client communication strategy, leading to a 30% increase in timely policy renewals.

- Kept up‑to‑date with industry trends, improving the agency's offerings by introducing 5 new carefully curated insurance products.

- Assisted senior managers in managing client accounts, contributing to a 10% increase in revenue.

- Played a key role in client onboarding, ensuring seamless transitions and a 98% retention rate.

- Utilized insurance software tools to streamline processes, enhancing departmental efficiency by 25%.

- Collaborated with the sales team, facilitating cross‑selling opportunities and achieving a 12% growth in premium sales.

- Participated in company‑wide training programs, enhancing knowledge and achieving a 95% score in the annual knowledge assessment.

1. Decode the Job Description

Start by underlining key responsibilities and required experience in the job description, such as "Manage an assigned portfolio, ensuring client satisfaction." These are your CV keywords and guideposts.

2. Strategic Formatting

List your experience in reverse-chronological order. Begin with your most recent role, clearly outlining your position, the company name, and the dates of employment. This is essential for passing through an ATS with ease using an ATS-friendly CV format.

3. Highlighting Achievements

Turn your duties into accomplishments. For example, "Successfully managed a portfolio of over 100 client accounts" speaks volumes more than simply stating your responsibilities. Detail how you exceeded targets, solved problems, and added value.

4. Quantify Your Impact

Numbers tell a compelling story. By quantifying your achievements, such as improving client retention by 30%, you provide concrete evidence of your capabilities and direct results.

5. Relevancy is Key

Align your experience with the job requirements. Exclude unrelated roles or responsibilities that don't add value to your candidacy as an Insurance Account Manager. This focus will help your CV pass ATS checks more efficiently with the help of ATS optimisation tools like Wozber's ATS CV scanner.

Takeaway

Think of the Experience section as the narrative of your professional journey. Each role you list is a chapter demonstrating your growth, achievements, and readiness for the next step in your career as an Insurance Account Manager.

Education

In the sector of insurance management, your educational background lays the groundwork for your expertise and knowledge. Properly illustrating this in your CV can offer a significant advantage, especially when it aligns with the specific qualifications sought by employers.

1. Match the Job Requirements

Starting with a clear identification of what the job asks for is crucial. If the job requires a "Bachelor's degree in Business, Finance, or a related field," make sure your degree is prominent on your CV.

2. Simplified Structure

Keep your education section clear and straightforward. Mention your degree, the institution where you earned it, and your graduation year. This simplicity aids in ATS scans by making the information easily digestible to the system.

3. Degree Relevance

Specificity matters. Highlight your degree that aligns with the job's requirements. If you have more than one relevant degree, list them in order of significance to the role of Insurance Account Manager.

4. Additional Coursework

Including courses or certifications relevant to insurance, finance, or business management can set you apart, especially if they are directly related to the job or industry trends.

5. Honorable Mentions

Any academic honors, relevant extracurricular activities, or clubs that showcase your leadership skills or industry-related interests can be a value-add, demonstrating your dedication and proactive engagement in your professional development.

Takeaway

Your educational section should act like a solid foundation that your experience and skills are built upon. It quietly reassures hiring managers of your fitting academic background for the role of Insurance Account Manager.

Certificates

In the world of insurance account management, certifications can be your golden ticket to proving your specialized knowledge and commitment to continuous learning. Here's how to optimise this section to elevate your candidacy.

1. Job Description Alignment

Identify certifications mentioned in the job description as a plus, such as ‘Certified Insurance Counselor (CIC)' or ‘Accredited Advisor in Insurance (AAI).' These should be prominently listed to catch the hiring manager's attention.

2. Prioritize Pertinence

It's better to list a few highly relevant certifications than many loosely related ones. This ensures your CV doesn't get bogged down with unnecessary information and remains targeted toward the Insurance Account Manager role.

3. Date Details

Validity matters in certifications. Make sure to include the dates of your certifications to show that your knowledge is current and up-to-date. This can be crucial for roles requiring ongoing education.

4. Never Stop Learning

Highlight any recent certification or ongoing training. This demonstrates your dedication to staying ahead in your field, an appealing trait for any candidate. Use tools like Wozber to ensure your CV remains ATS-optimised even as you update your certifications.

Takeaway

View certifications as both achievements and promises of your commitment to excellence in the insurance field. Each certification you list is a testament to your dedication and a signal that you're more than ready for the Insurance Account Manager role.

Skills

Your skills section is a quick reference for hiring managers to assess if you have the toolkit to succeed in the role. For an Insurance Account Manager, striking the right balance between industry-specific skills and essential soft skills is key. Let's tailor this section to bridge your capabilities with the job's requirements.

1. Unpacking the Job Ad

Sift through the job posting with a fine-tooth comb to identify both implied and explicitly stated skills. For instance, "proficiency with insurance software" and "excellent interpersonal and communication skills," should be directly mirrored in your skills list.

2. Balancing Act

Strike a balance between hard and soft skills, showcasing your comprehensive capabilities. Hard skills prove your technical know-how, while soft skills illustrate how you apply this knowledge in working environments.

3. Less Is More

Focus on quality over quantity. Listing too many skills can dilute your CV's impact. Instead, highlight the skills that directly address the job's needs and your standout capabilities.

Takeaway

Approach your skills section as a curated showcase of your professional arsenal. Highlight the skills that align most closely with the Insurance Account Manager role, indicating you're not just a suitable candidate, but the ideal choice.

Languages

In today's interconnected world, the ability to communicate across cultures can be a significant asset, particularly in a diverse city like New York. For an Insurance Account Manager role, emphasizing your linguistic skills can bolster your CV's attractiveness. Let's make the most of your multilingual abilities.

1. Analyzing the Job Requirement

The job posting emphasizes, "Must be fluent in English." Clearly, this is non-negotiable. Position your language proficiency at the forefront, starting with English and then listing any additional languages.

2. Language Proficiency

Honestly assess and represent your language skills. Are you fluent, or do you have conversational skills? This honesty ensures expectations are set correctly and can also open discussions about how your languages can serve the role.

3. Additional Languages

Even if not specifically required, other language skills can be a bonus, showcasing your ability to communicate with a broader range of clients. It speaks to your adaptability and global mindset.

4. Candid Proficiency Levels

Be transparent about your language proficiency using terms like ‘native,' ‘fluent,' ‘intermediate,' and ‘basic.' This clarity will help hiring managers gauge where you might fit in a diverse team or client base.

5. Understanding the Business Context

In a city as cosmopolitan as New York, the ability to engage with clients in their native language can be a noticeable advantage. It's about more than just speaking the language; it's about building relationships.

Takeaway

Languages are more than just words; they are keys to unlocking new opportunities. Highlighting your language skills, especially in a diverse and bustling market like New York, showcases your potential to connect and cater to a wide client base as an Insurance Account Manager.

Summary

The summary section is your CV's hook, enticing hiring managers to dive deeper into your professional narrative. For an Insurance Account Manager position, it's crucial that your summary encapsulates your core competencies and achievements, setting the tone for the rest of your application.

1. Grasping the Role's Core

Start by digesting the job description carefully, identifying the core skills and experiences required. Your summary should reflect your understanding and capability to fulfill these needs.

2. Crafting a Strong Opening

Begin with a powerful statement about your professional identity, focusing on your specialized skills in insurance account management, and your proven track record of success in the field.

3. Addressing Key Competencies

Mention your adeptness at managing client portfolios, your analytical skills in assessing insurance needs, and your ability to negotiate favorable terms with underwriters. These competencies directly respond to the job description's requirements.

4. Conciseness is Key

Keep your summary brief yet impactful. Aim for 3-5 lines that highlight your most compelling qualities and experiences, alluding to the detailed achievements listed in the subsequent sections of your CV.

Takeaway

Consider the summary section your professional introduction, the highlight reel of your career. It's your chance to assert why you're not just a great candidate, but the perfect fit for the Insurance Account Manager role. Let it usher in the story of your professional journey with confidence and clarity.

Crafting Your Path to Success

Congratulations on taking the first step towards securing your dream job as an Insurance Account Manager. With each section of your CV thoughtfully curated, you're not just submitting an application; you're showcasing a cohesive, comprehensive overview of what makes you an unparalleled candidate. Use Wozber's free CV builder, including its ATS-friendly CV templates and ATS CV scanner, to ensure your CV not only aligns with the job description but is optimised for ATS compliance. Your next career milestone is within reach.

Channel your expertise, confidence, and this guide to propel you forward. The insurance world awaits your unique contributions. Go forth and make your mark!

- Bachelor's degree in Business, Finance, or a related field.

- Minimum of 3 years of experience in insurance account management or related positions.

- Strong knowledge of insurance products and services, as well as proficiency with insurance software.

- Excellent interpersonal and communication skills to effectively liaise with clients and internal teams.

- Possession of relevant insurance certifications, such as Certified Insurance Counselor (CIC) or Accredited Advisor in Insurance (AAI), is a plus.

- Must be fluent in English.

- Must be located in New York City, New York.

- Manage an assigned portfolio of client accounts, ensuring client satisfaction and retention.

- Analyze client's insurance needs, present policy options, and recommend appropriate coverage.

- Maintain regular communication with clients, addressing any inquiries or concerns.

- Collaborate with underwriters and insurance carriers to negotiate and secure the best terms and conditions for clients.

- Stay updated on industry trends, regulatory changes, and new insurance products to provide informed advice to clients.