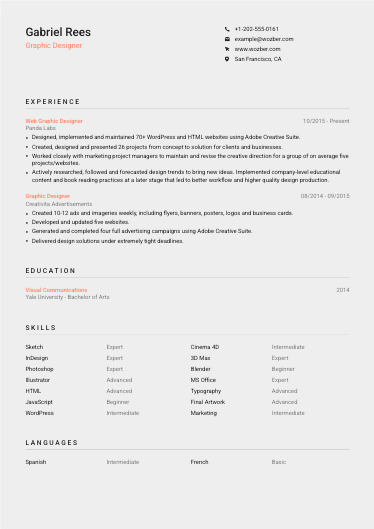

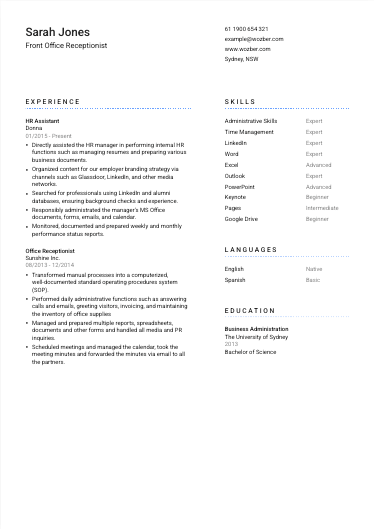

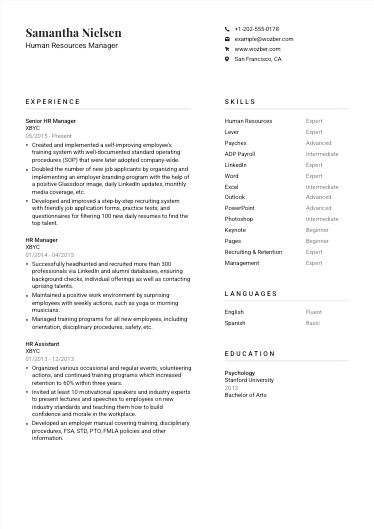

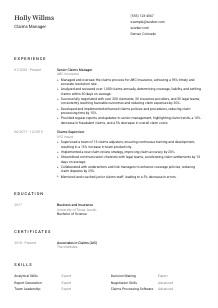

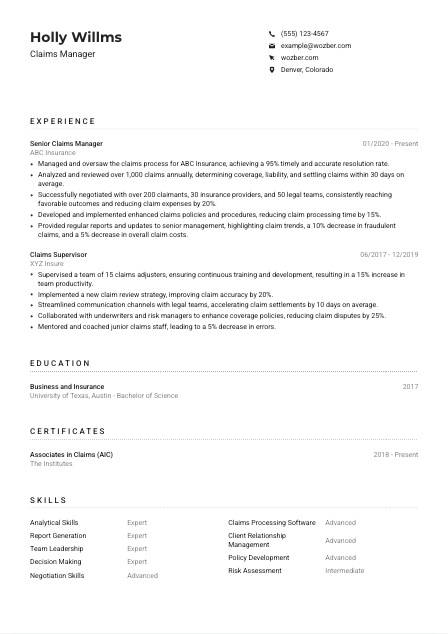

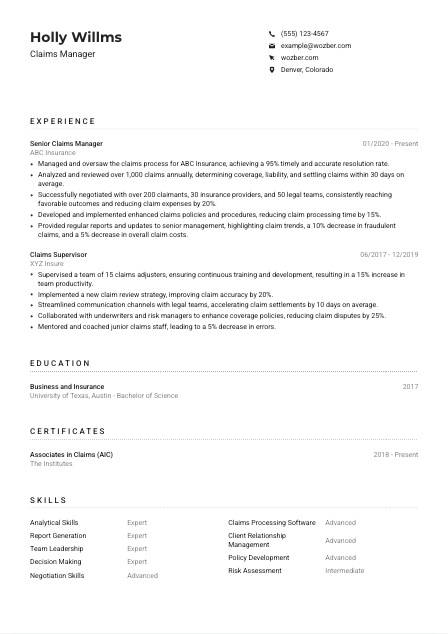

Claims Manager CV Example

Processing insurance claims, but your CV feels like a denied appeal? Navigate this Claims Manager CV example, coded with Wozber free CV builder. Learn how to align your claims expertise with the job criteria, ensuring your career track record is as smooth as a settlement!

How to write a Claims Manager CV?

Stepping into the Claims Manager role requires not just expertise in managing insurance claims but also an aptitude for negotiation, analytics, and policy development. Your CV is the cornerstone of your job application and crafting it with precision is paramount. Here's a guide, enriched with insights and best practices, to create a CV that resonates deeply with the demands of a Claims Manager position. With the help of Wozber's free CV builder, ATS-friendly CV template, and ATS CV scanner, let's navigate through this process together and position you as the ideal candidate.

Personal Details

The journey to an impactful Claims Manager CV begins with the Personal Details section. Here's how to ensure this section is not just informative but perfectly aligned with the job requirements.

1. Name and Brand

Your name is more than an identifier; it's the title of your professional story. Make it prominent, allowing it to stand as a strong personal brand. A touch of larger typography can set it apart effectively.

2. Job Title Relevance

Echoing the job title 'Claims Manager' just below your name bridges the gap between you and your desired role instantly. It signals to hiring managers that your application is targeted and not a one-size-fits-all CV.

3. Essential Contact Information

Accuracy is key in your contact information. A mobile number without typos and a professional email format (firstname.lastname@email.com) ensures you're reachable. Remember, clarity and accessibility in your contact details pave the way for smooth communication.

4. Location Match

By mentioning "Denver, Colorado" directly in your CV, you align with a crucial job requirement, eliminating any doubts about relocation logistics from the get-go.

5. Digital Presence

In today's digital era, a LinkedIn profile or a personal website can serve as a dynamic extension of your CV. Ensure it's updated and mirrors your CV to maintain consistency across your professional brand.

Takeaway

Think of the Personal Details section as your opening pitch. It's succinct yet informative, designed to align with the Claims Manager role you're aiming for. Keep it professional, precise, and tailored. First impressions count, and this is where you make yours.

Experience

The heart of your CV lies in the Experience section. It's here that you showcase not only your journey but also how closely it aligns with the Claims Manager position.

- Managed and oversaw the claims process for ABC Insurance, achieving a 95% timely and accurate resolution rate.

- Analyzed and reviewed over 1,000 claims annually, determining coverage, liability, and settling claims within 30 days on average.

- Successfully negotiated with over 200 claimants, 30 insurance providers, and 50 legal teams, consistently reaching favorable outcomes and reducing claim expenses by 20%.

- Developed and implemented enhanced claims policies and procedures, reducing claim processing time by 15%.

- Provided regular reports and updates to senior management, highlighting claim trends, a 10% decrease in fraudulent claims, and a 5% decrease in overall claim costs.

- Supervised a team of 15 claims adjusters, ensuring continuous training and development, resulting in a 15% increase in team productivity.

- Implemented a new claim review strategy, improving claim accuracy by 20%.

- Streamlined communication channels with legal teams, accelerating claim settlements by 10 days on average.

- Collaborated with underwriters and risk managers to enhance coverage policies, reducing claim disputes by 25%.

- Mentored and coached junior claims staff, leading to a 5% decrease in errors.

1. Dissect the Job Requirements

Understanding the job description is critical. Identify key phrases like 'manage and oversee the claims process' or 'negotiate with claimants' and reflect on how your past roles align with these responsibilities.

2. Highlighting Roles and Achievements

Structure this section chronologically, with emphasis on roles that resonate with the Claims Manager's duties. For each role, articulate how your work directly impacted the claims process, policy development, or stakeholder negotiation.

3. Quantifying Success

Numbers talk. Quantify your achievements, such as 'Managed a portfolio worth $X million' or 'Reduced claim processing time by X%.' This provides tangible evidence of your expertise and effectivity.

4. Relevance is Key

Tailor your experiences to highlight the skills most pertinent to a Claims Manager. Focus on showcasing your proficiency in claims management, policy analysis, and stakeholder negotiations.

5. Continuous Improvement

Showcase growth by highlighting how you've expanded your competencies over time, adopting new strategies, technologies, or achieving certifications that underline your dedication to excellence in claims management.

Takeaway

Your experience section is a testament to your journey and fit for the role at hand. Each point you make should aim to demonstrate your adeptness in claims management. Remember, being specific and quantifiable strengthens your case significantly. Let your achievements advocate for your candidacy.

Education

The foundation of your professional journey, the Education section, when tailored appropriately, accentuates your suitability for the Claims Manager role.

1. Meeting the Educational Bar

Right off the bat, ensure your education aligns with the specified requirement of a 'Bachelor's degree in Business, Insurance, or a related field'. This immediately positions you as meeting the basic educational prerequisites.

2. Structure and Clarity

Keep this section straightforward: list your degree, the field of study, the institution, and your graduation year. This clear structure makes it easy for hiring managers to verify your educational credentials against their requirements.

3. Degree Relevance

In cases where your degree directly matches the job requirement, make it prominent. This establishes a direct link between your educational foundation and the demands of the Claims Manager position.

4. Additional Credentials

While the core focus is your degree, don't shy away from listing relevant courses, honors, or activities that underscore your interest and competency in insurance and claims management.

5. Continuous Learning

The field of insurance is ever-evolving. Indicate any ongoing education or plans to pursue further qualifications. This demonstrates a commitment to staying current and growing your expertise.

Takeaway

Your Education section forms the bedrock of your professional qualifications. Highlighting your relevant degree and any additional credentials showcases your preparedness and ambition. Make it unambiguous that your academic journey aligns beautifully with the role of a Claims Manager.

Certificates

In the world of claims management, certifications can significantly bolster your CV by showcasing your specialized knowledge and commitment to your profession.

1. Targeted Certifications

Focus on certifications mentioned in the job description, such as AIC or CPCU. Listing these shows you meet or exceed specific requirements and are deeply invested in your professional development.

2. Quality Over Quantity

It's tempting to list every certificate you've earned. However, prioritize those most relevant to the Claims Manager role, ensuring they highlight your key competencies and readiness for the position.

3. Currency and Clarity

Ensure that listed certifications are current, and if applicable, include the acquisition date. This reflects your commitment to maintaining and expanding your expertise.

4. Continuous Enhancement

Always be on the lookout for additional certifications that could strengthen your CV. A commitment to continual professional development is highly attractive to employers.

Takeaway

Your certifications are a powerful testament to your dedication to excellence in the claims management field. They provide an additional layer of credibility and display a relentless pursuit of professional growth. Prioritize relevance and currency, making it clear you're not just equipped but enthusiastic about the challenges of the Claims Manager role.

Skills

The Skills section distills your professional capabilities into a potent mix of aptitudes that are crucial for a successful Claims Manager. Here's how to hammer this in.

1. Pinpointing Job-Related Skills

Begin by identifying the specific skills mentioned in the job description - 'analytical and negotiation skills', 'knowledge of insurance policies', etc. Matching these directly shows your CV is tailor-made for the position.

2. Curating Your List

Once you've identified the most relevant skills, organize them in your CV with the most impactful ones leading. This not only captures the attention of the hiring manager but also showcases your best attributes up front.

3. Proof in Practice

It's one thing to list skills, it's another to show how you've applied them. Whenever possible, provide context in the Experience or Summary sections, demonstrating how your skills have positively impacted your work.

Takeaway

Your Skills section should paint a picture of you as the ideal Claims Manager: analytically sharp, a keen negotiator, and a sigma at policy and coverage intricacies. Tailor this section to reflect the job description, transforming it into a beacon that signals to hiring managers your readiness and aptitude for the role.

Languages

In a diverse and global industry like insurance, your linguistic skills can set you apart. Here's how to leverage your languages to enhance your Claims Manager CV.

1. Essential Language Requirements

Start with the basics. For a Claims Manager role, demonstrating 'the ability to effectively communicate in English' as listed in the job requirement is pivotal. Ensure English is prominently listed with the highest level of proficiency.

2. Adding Linguistic Diversity

Beyond the essentials, listing additional languages can broaden your appeal, especially for companies with a diverse clientele or those operating internationally. Position them as an asset that enhances your capability to manage claims across a broader demographic.

3. Accurate Level Depiction

Honesty in depicting your language proficiency levels maintains credibility. Use clear descriptors like 'Native', 'Fluent', or 'Intermediate' to outline your comfort and capability with each language.

4. Understanding Role Scope

Consider the scope of your role. If the Claims Manager position involves oversea claims or dealing with international policyholders, your multilingual abilities could be a significant advantage. Use your judgment to highlight languages that align with these aspects of the job.

5. The Power of Language in Negotiation

Negotiation is a key skill for a Claims Manager. If you're fluent in multiple languages, it could provide an upper hand in negotiations, enabling smoother interactions with claimants or partners. Highlighting this skill can underscore your versatility and effectiveness in the role.

Takeaway

While the mastery of languages may seem ancillary, it is indeed a powerful asset in the Claims Manager toolkit. Each language you speak opens doors to more nuanced and effective communication across borders and cultures. Flaunt your linguistic skills, especially if they offer you an edge in negotiations or stakeholder interactions. Here's to you, the globe-trotting Claims Manager!

Summary

The Summary section is your CV's handshake. It communicates your professional narrative at a glance, making a compelling case for why you're the perfect fit for the Claims Manager position.

1. Capturing the Job's Essence

Start by internalizing the job description. Acknowledge the core responsibilities and qualifications desired, and reflect on how your experience and skills answer these needs.

2. A Strong Opening

Begin your summary with a powerful statement that encapsulates your professional identity and core competencies. 'Experienced Claims Manager adept at navigating complex claims and negotiations to drive resolutions and reduce costs' sets a commanding tone.

3. Cementing Your Fit

Weave in your key skills and achievements that respond directly to the job criteria. Highlight experiences that showcase your ability to manage claims efficiently, negotiate effectively, and contribute strategically to policy development.

4. Precision and Impact

Keep your summary concise yet impactful. Aim for 3-5 lines that capture your professional essence, tailor-fit to the Claims Manager role. Each word should serve the purpose of positioning you as the ideal candidate.

Takeaway

Your Summary is the first glimpse into your professional world. Make it count by highlighting your strengths and aligning closely with the Claims Manager role. It's your moment to shine; package your experiences and skills into a compelling narrative that leaves hiring managers keen to learn more. Your journey as a Claims Manager is about to ascend to its next chapter.

Launching Your Claims Manager Journey

Congratulations, you're now equipped with actionable insights on crafting a Claims Manager CV that's not just aligned with job requirements but shines among the competition. Remember, every section of your CV is an opportunity to reflect your uniqueness and suitability for the role. Utilize Wozber's free CV builder, ATS-friendly CV templates, and ATS CV scanner to ensure your application is not only seen but also leaves a lasting impression. Your story is compelling; let your CV narrate it compellingly.

Embark on your Claims Manager career path with confidence. The next great opportunity is just a CV away.

- Bachelor's degree in Business, Insurance, or a related field.

- Minimum of 5 years experience in claims management or related insurance role.

- Strong knowledge of insurance policies, coverage, and industry standards.

- Excellent analytical and negotiation skills with the ability to make sound judgments.

- Possession of or the ability to obtain relevant insurance industry certifications (e.g., AIC, CPCU).

- Ability to effectively communicate in English is a prerequisite.

- Must be located in or willing to relocate to Denver, Colorado.

- Manage and oversee the claims process ensuring timely and accurate resolution.

- Analyze and review claims to determine coverage, liability, and settlement value.

- Negotiate with claimants, insurance providers, and legal teams to reach favorable outcomes.

- Develop, implement, and ensure compliance with company claims policies and procedures.

- Provide regular reports and updates on claim's status, trends, and financial impact to senior management.