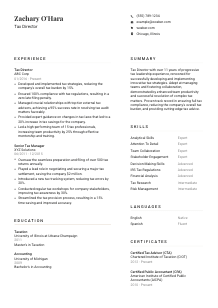

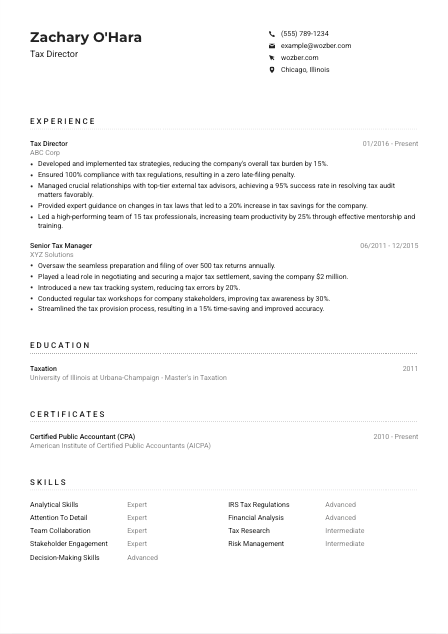

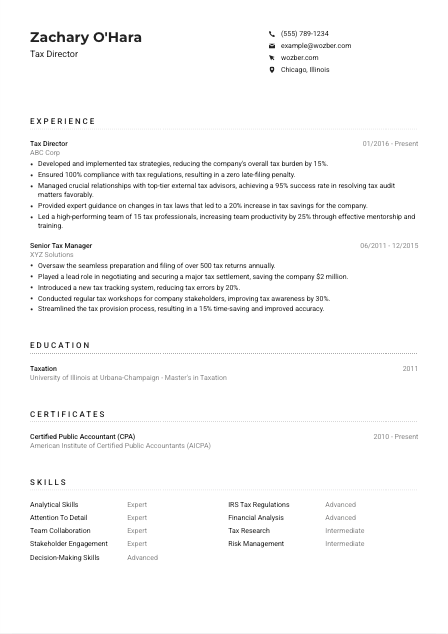

Tax Director CV Example

Navigating intricate tax codes, but your CV feels like an audit in progress? Delve into this Tax Director CV example, charted with Wozber free CV builder. See how effortlessly you can align your fiscal fluency to sync with job standards, turning your career trajectory into a tax return that's always filed on time!

How to write a Tax Director CV?

Greetings, future Tax Director! You're about to navigate the complex labyrinth of tax laws and regulations, but first, let's tackle that CV. In the niche world of tax, where every deduction and credit counts, your CV needs to be equally precise and strategic.

With Wozber's free CV builder, we'll guide you through crafting a CV that not only meets the requirements of your dream job but is also optimised for those pesky Applicant Tracking Systems (ATS). Let's embark on this journey together, turning your career history into a compelling, ATS-compliant narrative that secures your spot as a Tax Director.

Personal Details

Begin with the basics, but tailor them with precision. Even the simplest details can spark an interest or build a connection. Ready to set the professional tone from the get-go? Let's dive into the art of personalizing your contact details for the Tax Director role.

1. Personal Branding

Your name isn't just a label, it's your brand. Present it boldly at the top of your CV. Choose a clear, professional font that says, "I mean business." A slightly larger font size for your name sets it apart from the rest of your CV, laying the groundwork for your professional presentation.

2. Positioning Yourself

Immediately below your name, include your target job title, "Tax Director." This strategic placement not only clarifies your professional goal but also aligns your application with the role, providing an ATS and hiring manager with immediate relevance.

3. Essential Contact Information

In the realm of Tax Director applicants, let your contact details tell a story of professionalism and accessibility. A phone number without typos and a professional email format—first.last@example.com—offer direct channels for potential employers to engage with your profile.

4. Geographic Compatibility

"Located in Chicago, Illinois," signals to your prospective employer your geographic compatibility and readiness. For a position that specifies a location, showing your alignment or willingness to relocate is key. It simplifies the hiring decision process by eliminating any geographical uncertainties.

5. Online Presence

An up-to-date LinkedIn profile linked in your CV acts as a dynamic extension of your professional story. Ensure your LinkedIn reflects the same level of detail and professionalism as your CV to create a cohesive narrative. A personal website, if relevant and polished, can further distinguish your candidacy.

Takeaway

Every element of your contact information is an opportunity to establish your professionalism and alignment with the Tax Director role. This section, though brief, is potent. It marks the beginning of your narrative. Make every word count, and ensure it's ATS-friendly to move smoothly past the digital gatekeepers.

Experience

The experience section is where your professional journey comes to life. Here, your past roles orchestrate a story of growth, achievement, and relevance to the Tax Director position. Let's refine this narrative with details that resonate with hiring managers and satisfy ATS algorithms.

- Developed and implemented tax strategies, reducing the company's overall tax burden by 15%.

- Ensured 100% compliance with tax regulations, resulting in a zero late‑filing penalty.

- Managed crucial relationships with top‑tier external tax advisors, achieving a 95% success rate in resolving tax audit matters favorably.

- Provided expert guidance on changes in tax laws that led to a 20% increase in tax savings for the company.

- Led a high‑performing team of 15 tax professionals, increasing team productivity by 25% through effective mentorship and training.

- Oversaw the seamless preparation and filing of over 500 tax returns annually.

- Played a lead role in negotiating and securing a major tax settlement, saving the company $2 million.

- Introduced a new tax tracking system, reducing tax errors by 20%.

- Conducted regular tax workshops for company stakeholders, improving tax awareness by 30%.

- Streamlined the tax provision process, resulting in a 15% time‑saving and improved accuracy.

1. Job Alignment

First, sieve through the job description, identifying keywords and responsibilities matching your background. Phrases like "implemented tax strategies" or "ensured compliance with tax regulations" directly mirror the job's requirements, making your CV a mirror reflection of the employer's needs.

2. Chronological Structure

List your experience starting with your most recent position. Use a clear, ATS-friendly CV format. This approach not only highlights your current capabilities but also shows a career trajectory that aligns with the ambition of becoming a Tax Director.

3. Achievement-Focused Statements

Instead of merely listing duties, showcase your achievements. Use active language and quantify your impact wherever possible. Phrases like "Reduced the company's overall tax burden by 15%" illustrate not just your responsibilities but your effectiveness and strategic impact.

4. Quantification of Success

Numbers speak louder than words. Quantifying your achievements, be it through percentages or financial figures, offers tangible evidence of your contributions and prowess. It's a compelling way to demonstrate your ability to deliver results, a crucial trait for a Tax Director.

5. Relevance Above All

In the pursuit to impress, maintain focus on what's truly relevant to the Tax Director role. Tailor your bullets to reflect skills and achievements that directly correlate with the responsibilities and qualifications outlined in the job description.

Takeaway

Crafting an experience section that resonates with hiring managers requires strategic choices. By aligning with the job description, structuring information chronologically, quantifying achievements, and ensuring relevance, you present yourself as the ideal Tax Director candidate. Let Wozber's free CV builder guide you in shaping this critical section with its ATS CV scanner for an optimised, impactful presentation.

Education

For a Tax Director, formal education is not just about obtaining degrees—it's evidence of your foundational knowledge and commitment to the field. Let's sculpt your education section to reflect your academic credentials in a way that resonates with the role's requirements.

1. Degree Relevance

Start by listing your highest level of relevant academic achievement. A "Master's in Taxation" or a "Bachelor's in Accounting," as specified in our CV example, directly addresses the educational requirements. This not only showcases your fit but also underlines your specialized knowledge.

2. Organized Presentation

Adopt a straightforward, ATS-friendly layout: degree, field of study, institution, and graduation year. Clarity and ease of readability ensure that the ATS and hiring managers can easily find and understand your academic qualifications.

3. Tailoring Degree Details

For roles like the Tax Director, specificity matters. Listing degrees that perfectly match the job description underscores your direct alignment with the role's demands. It's about drawing a straight line from your academic endeavors to your career objectives.

4. Course Highlights

Although not always necessary for seasoned professionals, highlighting specific courses can be beneficial, particularly if they directly relate to the job's requirements or signal advanced expertise in a relevant area of tax law.

5. Additional Academic Honors

Accentuate any academic distinctions or relevant extracurricular activities that add depth to your profile. While these might take a backseat to direct experience for senior roles, they enrich your story, suggesting a longstanding dedication to excellence.

Takeaway

An effectively tailored education section does more than list degrees; it aligns your academic journey with your career trajectory as a Tax Director. Use it to reinforce your qualifications and underscore your commitment to the role. Remember, every detail contributes to your narrative of suitability and preparedness for leadership in the tax domain.

Certificates

In the ever-evolving field of tax, certifications are not just accolades; they are a testament to your expertise and dedication to staying at the forefront of the profession. Here's how to emphasize these critical credentials in your CV.

1. Certification Alignment

Identify certifications mentioned in the job description, such as the "Certified Public Accountant (CPA)" or "Certified Tax Advisor (CTA)" designations. These are non-negotiable credentials that directly affirm your qualification for the Tax Director position.

2. Highlight Pertinent Certifications

Listing certifications that resonate with the job requirements not only clears preliminary ATS checks but also signals to hiring managers your preemptive alignment with the role's demands. Prioritize these certificates in your CV to ensure they're spotted quickly.

3. Transparency with Dates

Validity matters. Include the date you obtained the certification, and if applicable, its expiration date. This level of detail adds credibility to your application and ensures transparency regarding the currency of your qualifications.

4. Commitment to Continuous Learning

Tax laws change; so should your expertise. Highlight recent or advanced certifications to showcase your dedication to continuous professional development. It illustrates not just competence but an ongoing commitment to staying ahead in the field.

Takeaway

Your certifications are powerful endorsements of your expertise and commitment to the tax field. Present them prominently and precisely, using them to bolster your candidacy for the Tax Director role. They're affirmations of your readiness to lead, manage, and strategize at the highest levels.

Skills

Your skills section is like the toolbox you bring to the Tax Director role—each skill is a tool, precisely chosen for its relevance and utility. Let's ensure this toolbox is not just full, but optimally organized and tailored to the task at hand.

1. Skills Inventory

Start by cataloging the skills you've honed over your career, particularly those that align with the job description. Skills like "analytical skills" and "attention to detail" directly speak to core competencies of a Tax Director.

2. Focus on Relevance

Prioritize skills that match those listed in the job description or highlight expertise crucial to the role. This ensures that your CV passes ATS scans and captures the hiring manager's attention by demonstrating a strong fit for the position.

3. Skill Presentation

Keep your skills list organized and free of fluff. A concise list that directly ties to the role's demands is more impactful than an exhaustive catalog. Each listed skill should be a brick in the foundation of your argument for why you're the ideal Tax Director.

Takeaway

An effectively curated skills section is your chance to quickly signal your fit and readiness for the Tax Director role. Make it count by carefully selecting skills that resonate with the job's requirements and your professional identity. Let Wozber's free CV builder help you align and refine this crucial section for maximum ATS and managerial impact.

Languages

In a global economy, your linguistic prowess can be a significant asset, especially in roles that may involve cross-border transactions or multinational teams. While not always central to the Tax Director role, your language skills can differentiate and add depth to your application.

1. Job Specification Scan

Check if the job posting specifies any language requirements. For a Tax Director, advanced English is a given, but additional languages could present an advantage, especially in firms with a global footprint.

2. Essential Languages

List English at the top, along with any other languages that the job might value. Your proficiency level—whether native, fluent, or conversational—gives a quick snapshot of your communication capabilities, potentially setting you apart from monolingual candidates.

3. Language Proficiency

Be honest and precise about your language capabilities. Misrepresenting your proficiency can lead to awkward situations, particularly if the role unexpectedly requires the use of a listed language.

4. Additional Languages

Even if not specifically mentioned in the job description, other languages can be valuable. They demonstrate cultural awareness and adaptability—traits that are beneficial for leadership roles in an increasingly connected world.

5. Understanding Role Scope

Consider how each language you speak might benefit the specific demands of being a Tax Director. Whether it's liaising with international clients or navigating foreign tax codes, your linguistic skills can underscore your versatility and global mindset.

Takeaway

While not the linchpin of your Tax Director application, your language skills can subtly enhance your appeal, suggesting a broader set of soft skills and worldliness. Consider this section an opportunity to add color and diversity to your CV, potentially tipping the scales in a competitive job market.

Summary

Your summary is the crowning statement of your CV, condensing your professional identity into a few impactful sentences. For a Tax Director role, it's your opportunity to encapsulate your strategic tax expertise and leadership prowess. Let's craft a summary that leaves no doubt about your fit and readiness for the role.

1. Role Comprehension

To write a compelling summary, you first need to deeply understand the Tax Director role. Reflect on keywords from the job description—like "tax strategies," "compliance," and "team leadership"—and how your experience intersects with these areas.

2. Opening Pitch

Begin with a punchy statement that positions you squarely in the tax field, summarizing your years of experience and areas of special expertise. An opening like, "Tax Director with over 11 years of progressive tax leadership experience," immediately sets a solid professional baseline.

3. Key Achievements and Skills

Highlight a blend of your most relevant achievements and skills. Focus on those that directly address the job's requirements, such as your success in developing tax strategies or leading high-performing teams. This is your chance to shine in brief.

4. Brevity and Impact

Keep your summary tight and powerful. Aim for a maximum of five lines that capture your essence as a Tax Director candidate. Each word should contribute to an impression of capability, experience, and strategic insight.

Takeaway

A well-crafted summary has the power to set the tone for your entire application, encapsulating your experience, skills, and readiness for the Tax Director role. It's your first impression, your pitch, and your promise. Make it compelling, make it authentic, and above all, make it resonate with your prospective employer's needs. And with Wozber's free CV builder, crafting such a tailored, impactful summary has never been easier.

Launching Your Tax Director Journey

Congratulations on completing this comprehensive guide to tailoring your CV for a Tax Director position! Armed with insights on personalizing each section and otimizing for ATS, you're now prepared to articulate your professional story compellingly. Remember, your CV is not just a document; it's a strategic tool in your career arsenal. Fine-tune it, infuse it with your unique strengths, and let it pave the way to your next significant role.

The stage is set for your expertise to shine. Go forth with confidence, and let your CV open doors to new and fulfilling opportunities in tax leadership!

- Bachelor's degree in Accounting, Finance, or a related field.

- Master's in Taxation preferred.

- Certified Public Accountant (CPA) license or Certified Tax Advisor (CTA) designation.

- Minimum of 10 years of progressive tax experience, with at least 5 years in a leadership role.

- In-depth knowledge of tax regulations at the federal, state, and local levels.

- Strong analytical, research, and decision-making skills, with attention to detail.

- Advanced English language skills needed.

- Must be located in Chicago, Illinois.

- Develop and implement tax strategies to minimize the company's overall tax burden.

- Ensure compliance with tax regulations, timely filing of tax returns, and accurate tax provisions.

- Manage relationships with external tax advisors and authorities during tax audits.

- Stay updated on changes in tax laws and provide accurate tax advice to internal stakeholders.

- Lead, mentor, and manage a team of tax professionals, fostering their professional growth and team collaboration.