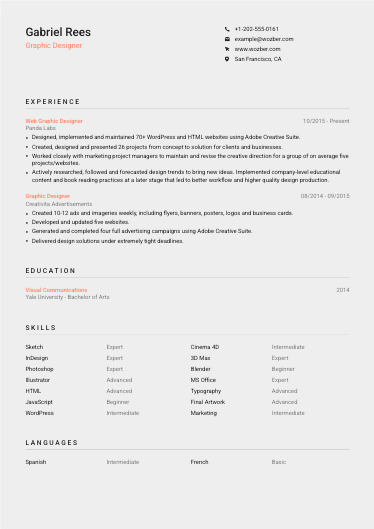

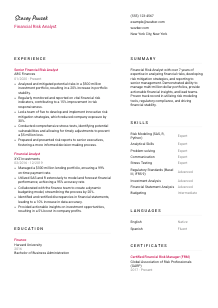

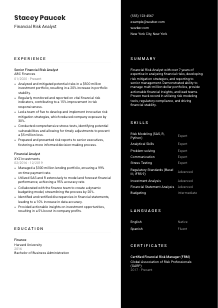

Financial Risk Analyst CV Example

Navigating investment risks, but your CV seems uncertain? Delve into this Financial Risk Analyst CV example, charted with Wozber free CV builder. Grasp how to depict your risk assessment expertise to sync with job requirements, setting your career trajectory to a blue-chip status!

How to write a Financial Risk Analyst CV?

Hello, aspiring Financial Risk Analyst! In a playing field as complex and competitive as financial risk analysis, your CV isn't just a summary of your experience - it's your ticket to the big leagues. With the knowledgeable support of Wozber's free CV builder, this guide will navigate you through the intricacies of aligning your CV with the precise requirements of your dream role, emphasizing the importance of an ATS-compliant CV - your golden key to getting noticed.

Let's turn the tide in your favor and carve out a CV that not only speaks volumes about your expertise but also passes the rigorous screening of Applicant Tracking Systems (ATS). Ready to elevate your career profile?

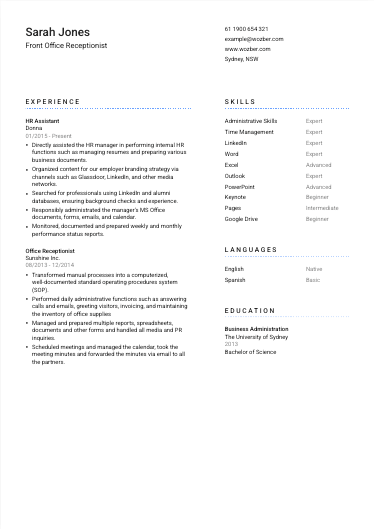

Personal Details

Personal Details is the handshake of your CV. Here, precision and alignment with the role you're aiming for are crucial. We will tailor this section precisely for a Financial Risk Analyst position, ensuring that your personal brand resonates right from the start.

1. Spotlight Your Name

Think of your name as the title of your professional story. Make sure it's prominently placed using a clear, professional font. Opt for a size that's slightly larger to ensure it catches the eye. Remember, your name is the anchor of your personal brand.

2. Position and Alignment

Directly beneath your name, align your profession with the job title. For instance, inserting "Financial Risk Analyst" clearly states your expertise and draws a direct line between your aspirations and the job at hand.

3. Essential Contact Information

Your contact information is your bridge to potential employers. Ensure your phone number is current, and your email address is professional - a combination of your first and last name usually works best. In today's digital age, including a LinkedIn profile or personal portfolio site, if applicable, can provide a deeper dive into your professional story.

4. Localize Your Application

Since the job specifies a New York City location, mention "New York City, New York" prominently. This small detail signals to employers that you're in the vicinity or willing to relocate, eliminating any doubts about logistical complexities.

5. Online Presence

A LinkedIn profile or a personal website can significantly enhance your CV by providing a fuller picture of your professional journey. Ensure these are up-to-date and reflect a professional image. Use them to showcase your career achievements and aspirations, acting as a compelling prologue to your skills and experiences.

Takeaway

Crafting your Personal Details with care sets the tone for your entire CV. Each detail contributes to a strong first impression, aligning with the Financial Risk Analyst role. Now's the time to ensure your professional narrative begins on a note of precision and professionalism.

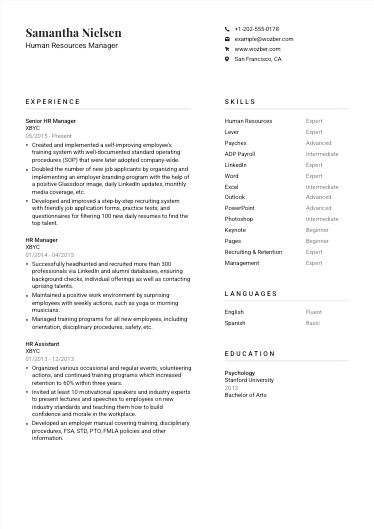

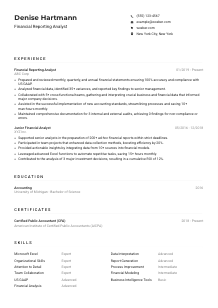

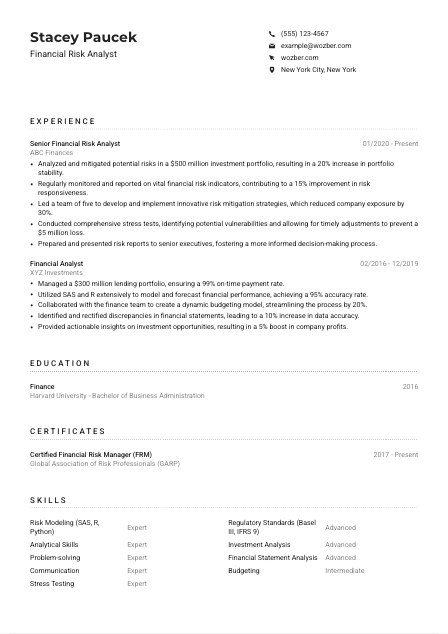

Experience

The Experience section is where you validate your candidacy with concrete examples of your expertise. Here's how to tailor this crucial part of your CV to showcase that not only are you a perfect match for the Financial Risk Analyst position but also a standout candidate.

- Analyzed and mitigated potential risks in a $500 million investment portfolio, resulting in a 20% increase in portfolio stability.

- Regularly monitored and reported on vital financial risk indicators, contributing to a 15% improvement in risk responsiveness.

- Led a team of five to develop and implement innovative risk mitigation strategies, which reduced company exposure by 30%.

- Conducted comprehensive stress tests, identifying potential vulnerabilities and allowing for timely adjustments to prevent a $5 million loss.

- Prepared and presented risk reports to senior executives, fostering a more informed decision‑making process.

- Managed a $300 million lending portfolio, ensuring a 99% on‑time payment rate.

- Utilized SAS and R extensively to model and forecast financial performance, achieving a 95% accuracy rate.

- Collaborated with the finance team to create a dynamic budgeting model, streamlining the process by 20%.

- Identified and rectified discrepancies in financial statements, leading to a 10% increase in data accuracy.

- Provided actionable insights on investment opportunities, resulting in a 5% boost in company profits.

1. Dissect the Job Description

Begin with a deep dive into the job description, highlighting keywords and phrases, especially those related to responsibilities and required skills. For a Financial Risk Analyst role, pay special attention to phrases like 'risk modeling tools,' 'regulatory standards,' and 'financial statement analysis.'

2. Arrange Your Professional Story

Organize your previous jobs in reverse chronological order, focusing on roles that align directly with the requirements of a Financial Risk Analyst. For each position, list your job title, the company's name, and your period of employment, creating a clear timeline of your career progression.

3. Showcase Relevant Achievements

Translate your responsibilities into achievements. Use action verbs to begin each accomplishment, demonstrating not just your responsibilities but how you excelled in those roles. For example, 'Analyzed and mitigated potential risks in a $500 million investment portfolio, achieving a 20% increase in stability.'

4. Quantify Successes

Numbers speak louder than words. Quantify your achievements wherever possible to provide a tangible measure of your contributions, like 'Reduced company exposure by 30% through innovative risk mitigation strategies.' This offers a direct glimpse into the impact you can bring to the role.

5. Relevance is Key

Every bullet point should be a testament to your qualifications for the Financial Risk Analyst role. Irrelevant experiences can dilute the effectiveness of your CV. Focus on experiences that resonate with the job description to paint a compelling picture of your suitability.

Takeaway

The Experience section is your narrative spotlight. Tailor it with precision, ensuring each word adds value and relevance to your application as a Financial Risk Analyst. Let your career story not just tell but show your qualification and readiness for the role.

Education

While seemingly straightforward, the Education section is more than a list of degrees; it's an affirmation of your foundational knowledge relevant to the Financial Risk Analyst role. Let's ensure it's shaped to highlight your most pertinent academic achievements.

1. Identify Educational Prerequisites

Scrutinize the job description for specific educational requirements. In this case, a 'Bachelor's degree in Finance, Accounting, Economics, or a related field' is specified. Ensure your highest relevant degree is listed prominently.

2. Structure with Clarity

A simple, legible format is key. List your degree, the field of study, the institution's name, and your graduation date. This ensures that at a glance, recruiters can confirm your educational qualifications match the job's requirements.

3. Highlight Pertinent Details

For your degree title, choose the wording that best matches the job listing. If your degree is directly in line with the role, such as a Bachelor of Business Administration in Finance, make sure this is clear and emphasized.

4. Include Relevant Extras

Should you have any additional academic credentials or have taken specific courses relevant to the Financial Risk Analyst position, include these. Such details can add depth, showing your dedication and continuous learning in the field.

5. Other Educational Achievements

For more junior roles or if your education is exceptionally relevant, including honors or significant projects could be beneficial. However, for seasoned professionals, focusing on degrees and specific relevant certifications or courses is more pertinent.

Takeaway

The Education section solidifies your intellectual foundation for the Financial Risk Analyst role. Ensure it's precise, relevant, and reflective of the job requirements. It's not just about listing your degrees; it's about showcasing your readiness from an educational standpoint.

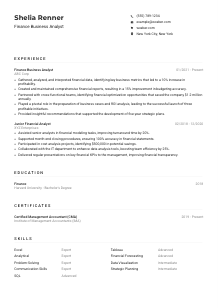

Certificates

Certificates are your arsenal of specialized skills and knowledge, showcasing your commitment to continuous learning and professional growth. Let's align your certificates with what's sought after for a Financial Risk Analyst position.

1. Align with Job Specifications

Examine the job listing for any preferred certifications. The 'Certified Financial Risk Manager (FRM)' designation stands out for our example. Highlighting this certification, if you have it, directly aligns with a preferred qualification.

2. Quality Over Quantity

It's tempting to list every certificate you've ever earned. However, relevance is key. Focus on those certificates specifically related to financial risk analysis, as they speak directly to your job-specific expertise and dedication to the field.

3. Date Transparency

Providing acquisition or validity dates can be essential, especially for certifications that require renewal. This detail offers employers insight into your current knowledge level and your commitment to staying updated in your field.

4. Stay Proactively Informed

The financial sector is ever-evolving, and so should your knowledge base. Continuously seek out certifications that can enhance your career, keeping aligned with the latest industry standards and regulations. This proactive approach to learning demonstrates your dedication to excellence.

Takeaway

Your certifications highlight your specialized expertise and ongoing commitment to professional development. For a Financial Risk Analyst, selecting and presenting these certifications strategically can significantly influence your CV's impact, positioning you as a lifelong learner and leader in the field.

Skills

The Skills section of your CV is like a quick-reference guide to your professional toolkit. Here's how to optimise this section to highlight your qualifications for the Financial Risk Analyst position, ensuring you're showcasing the hard and soft skills that matter most.

1. Extract From the Job Listing

Carefully review the job description to identify both explicitly stated and implicitly required skills. For a Financial Risk Analyst, skills like 'risk modeling tools (SAS, R, Python)' and 'analytical abilities' are often crucial.

2. Curate Your Skill Set

Select skills from your arsenal that directly address the job requirements. Ensure a balanced mix of hard skills, such as 'regulatory standards knowledge (Basel III, IFRS 9)', and soft skills like 'excellent communication and problem-solving abilities.'

3. Organize and Prioritize

Structuring your skills section for clarity and impact is essential. Prioritize skills that are most relevant to the role of a Financial Risk Analyst at the top. This strategic organisation ensures the hiring manager sees your most applicable skills first.

Takeaway

Your skills section provides a powerful snapshot of your professional capabilities. By carefully curating and prioritizing the skills that align with the Financial Risk Analyst role, you can effectively communicate your readiness and differentiate yourself as the ideal candidate.

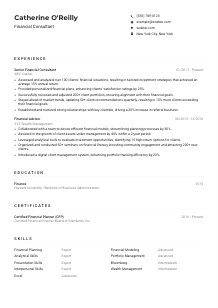

Languages

In our interconnected global economy, linguistic abilities can be a unique selling point. Particularly for a Financial Risk Analyst, being able to communicate across borders can be a substantial asset. Let's explore how to effectively present your language skills.

1. Assess Job Language Requirements

Initially, determine if the job posting specifies a need for certain language proficiencies. For the Financial Risk Analyst role, 'High level of fluency in English required' is a clear directive, so make English proficiency prominent in this section.

2. Prioritize Key Languages

Start with the languages most important for the role, stating your proficiency levels clearly. For example, listing 'English: Native' directly meets a critical requirement for the Financial Risk Analyst position.

3. List Additional Languages

Even if additional languages aren't specified in the job description, they can still add value to your application by showcasing your adaptability and global perspective. Just make sure to honestly assess your proficiency levels.

4. Honest Self-assessment

Clearly delineate your language proficiency using terms like 'Native,' 'Fluent,' 'Intermediate,' and 'Basic.' This clarity helps employers understand exactly what level of communication they can expect from you in each language.

5. Connect to the Role's Scope

Consider how your linguistic skills can enhance your candidacy for the Financial Risk Analyst position. For roles with an emphasis on international markets or diverse stakeholder groups, having multiple languages can be a distinct advantage.

Takeaway

Your linguistic skills reflect your capacity to navigate diverse environments and communicate effectively - key traits for a successful Financial Risk Analyst. Highlight your language proficiencies, particularly those critical to the role, to underscore your global competency and adaptability.

Summary

Your CV's Summary section is its leading paragraph, setting the stage for everything that follows. Let's ensure it encapsulates your experience, skills, and professional ethos as a Financial Risk Analyst, compellingly and concisely.

1. Reflect on the Role

Begin by assimilating the essence of the job description. What key attributes is the employer looking for in a Financial Risk Analyst? This understanding will serve as a foundation for crafting your summary.

2. Start with a Strong Introduction

Introduce yourself with a statement that highlights your professional identity and years of experience. For instance, 'Financial Risk Analyst with over 7 years of expertise in analyzing financial risks and developing mitigation strategies…'

3. Emphasize Your Match

Incorporate a few of your most relevant skills and achievements that directly address the job requirements. Tie these back to the responsibilities and prerequisites stated in the job listing to demonstrate how you're a perfect fit.

4. Conciseness is Key

While tempting to include every accomplishment, the summary should be a high-impact, succinct overview of your professional persona. Aim for 3-5 impactful lines that invite the reader to dive deeper into your CV.

Takeaway

Your Summary is the hook that captures the interest of hiring managers. By painting a picture of a highly competent and experienced Financial Risk Analyst, you set a confident tone for the rest of your CV, compelling employers to consider you seriously for the role.

Launching Your Financial Risk Analyst Journey

Congratulations on taking a definitive step towards crafting a standout Financial Risk Analyst CV. Through the guidance provided, you now have the tools to create a CV that not only meets but exceeds employer expectations. Remember, your CV is a dynamic document; continually refine it as you gather more experience and skills. With the ATS-friendly CV template and ATS optimisation tools offered by Wozber, you're well on your way to securing your next role.

The financial landscape awaits your expertise. Dive into Wozber's free CV builder, unleash your potential, and step into the role you're meant to fill.

- Bachelor's degree in Finance, Accounting, Economics, or a related field.

- A minimum of 3 years of experience in financial risk analysis, credit risk assessment, or a similar quantitative role.

- Strong proficiency in risk modeling tools, such as SAS, R, or Python.

- In-depth knowledge of regulatory standards, including Basel III and IFRS 9.

- Excellent analytical, problem-solving, and communication skills.

- Certified Financial Risk Manager (FRM) designation preferred.

- High level of fluency in English required.

- Must be located in New York City, NY.

- Analyze and assess potential risks in investment and lending portfolios.

- Monitor and report on key financial risk indicators on a regular basis.

- Collaborate with cross-functional teams to develop risk mitigation strategies and policies.

- Conduct stress tests and scenario analyses to evaluate the impact of potential economic downturns.

- Prepare and present risk reports to senior management and internal stakeholders.