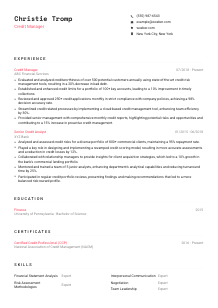

Credit Manager CV Example

Juggling credit scores, but your CV isn't making the cut? Examine this Credit Manager CV example, formulated with Wozber free CV builder. Grasp how you can tailor your fiscal finesse to align with job requisites, paving your career path as smooth as a top credit rating!

How to write a Credit Manager CV?

Hello, aspiring Credit Manager! If you're eager to elevate your career within the financial field, carving out an exceptional CV is a crucial milestone on this journey. Think of your CV as a powerful tool in your arsenal, a detailed map that leads hiring managers precisely where you want them to go - towards recognizing your unique value as a Credit Manager.

Using the insights and the tailored steps provided here, along with the advanced features of Wozber free CV builder, we'll mold your CV into an irresistible narrative that aligns perfectly with your target role. Your path to securing that Credit Manager position starts now!

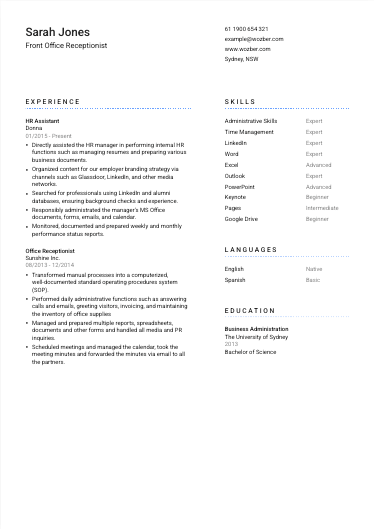

Personal Details

The Personal Details section might appear straightforward, yet it's your initial handshake with prospective employers. Here, we dive into customizing this section for the Credit Manager role, ensuring it not only meets the basics but also strikes a chord right from the start.

1. Your Professional Branding

Begin with your name, your beacon. Opt for a clear, professional font, letting it slightly overshadow everything else for that immediate emphasis. Your name is the flag under which your accomplishments will march; ensure it is seen.

2. Align Your Title

Directly below your name, feature the target job title, "Credit Manager" in this case, to immediately resonate with the hiring manager. This strategic placement acts as a mirror, reflecting the job posting and initiating a match.

3. Essential Contact Information

Only the essentials: phone number and a professional email address. With an email format akin to firstname.lastname@email.com, you cultivate an aura of professionalism from the outset. Double-check these for accuracy; a minor typo could lead to missed opportunities.

4. Location Matters

"Must be located in New York City, New York" - If you fit this bill, make it known. This immediate geographical match signals to employers that you're ready and available, removing any potential concerns about relocation.

5. LinkedIn and Professional Websites

In today's digital age, a well-curated LinkedIn profile or a personal website showcasing your accomplishments can distinguish your application. Ensure these mirror your CV for a consistent professional narrative.

Takeaway

The Personal Details section is where you set the stage with the right tone and clarity. Here, precision meets personality to kickstart your professional story. Keep it relevant, clear, and in full harmony with the Credit Manager role you're eyeing.

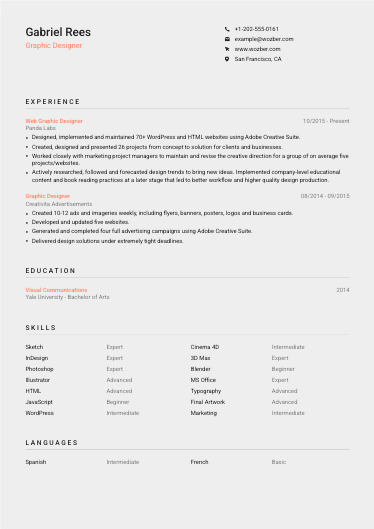

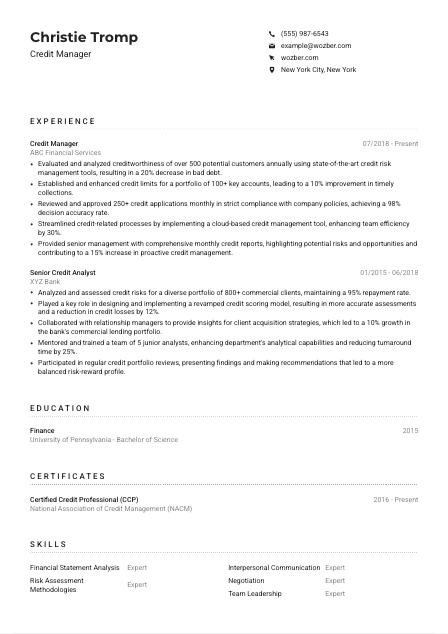

Experience

The Experience section is your arena to showcase your prowess and directly align your achievements with the targeted job role. Here's how you can sculpt your experience, emphasizing relevant accomplishments and making every word count.

- Evaluated and analyzed creditworthiness of over 500 potential customers annually using state‑of‑the‑art credit risk management tools, resulting in a 20% decrease in bad debt.

- Established and enhanced credit limits for a portfolio of 100+ key accounts, leading to a 10% improvement in timely collections.

- Reviewed and approved 250+ credit applications monthly in strict compliance with company policies, achieving a 98% decision accuracy rate.

- Streamlined credit‑related processes by implementing a cloud‑based credit management tool, enhancing team efficiency by 30%.

- Provided senior management with comprehensive monthly credit reports, highlighting potential risks and opportunities and contributing to a 15% increase in proactive credit management.

- Analyzed and assessed credit risks for a diverse portfolio of 800+ commercial clients, maintaining a 95% repayment rate.

- Played a key role in designing and implementing a revamped credit scoring model, resulting in more accurate assessments and a reduction in credit losses by 12%.

- Collaborated with relationship managers to provide insights for client acquisition strategies, which led to a 10% growth in the bank's commercial lending portfolio.

- Mentored and trained a team of 5 junior analysts, enhancing department's analytical capabilities and reducing turnaround time by 25%.

- Participated in regular credit portfolio reviews, presenting findings and making recommendations that led to a more balanced risk‑reward profile.

1. Dissect Job Requirements

Initiate your crafting process by isolating each requirement listed in the job description. Each point here is a clue on what exactly the employer values and is searching for in a candidate.

2. Historical Mapping

Chronologically lay down your career journey, highlighting roles and responsibilities that closely match those listed in the job description. Starting with your most recent role, this mapping will illustrate your evolution in the credit management field.

3. Achievement Highlights

"Evaluated and analyzed creditworthiness of over 500 potential customers annually" - Statements like this not only showcase your direct experience but also the impact you had. Make sure to align these achievements with the requirements of your prospective role.

4. Quantify Your Impact

Numbers speak volumes. Quantifying your achievements, whether in terms of percentage improvement, the volume of tasks handled, or monetary impact, provides tangible evidence of your contributions and capabilities.

5. Relevancy Reigns Supreme

Focus on what's truly relevant to a Credit Manager position. Extraneous information might cloud your key messages. Cut to the chase and delineate only the experiences that prove your suitedness for the role, making every line a statement of value.

Takeaway

The Experience section is where your professional narrative takes shape. It's a testament to your suitability and a reflection of your potential. Ensure it speaks directly to the Credit Manager role, making a compelling case for your candidacy.

Education

Your education section should serve as a solid foundation, showcasing your relevance and qualification for the Credit Manager position. It's not merely listing your degrees but aligning your academic journey with the role's prerequisites.

1. Target Educational Requirements

Your first mission is identifying the foundational requirements highlighted in the job post. For instance, "Bachelor's degree in Finance, Business Administration, or a related field" directly echoes the prerequisites for our Credit Manager position.

2. Simplify and Elevate

Maintain clarity and conciseness in presenting your educational background. The name of the degree, the institution, and the graduation date should be clearly laid out, making it easy for hiring managers to trace your academic qualifications.

3. Degree Specificity

Your degree is your academic identity. "Bachelor of Science in Finance" not only demonstrates that you meet the basic requirements but also showcases a specialization that's valuable in the credit management discipline.

4. Coursework and Extras

Though the broader degree might cover the bases, citing relevant coursework or academic projects can add depth, especially if these directly relate to credit management, financial analysis, or risk assessment.

5. Additional Academic Achievements

While higher degrees or certifications might take center stage, don't shy away from highlighting honors, extracurricular achievements, or participation in finance-related clubs or seminars that add another dimension to your candidacy.

Takeaway

Your academic accomplishments set the scene for your expertise and dedication. Manifesting your educational journey in a way that resonates with the Credit Manager role elevates your profile, making you a compelling candidate.

Certificates

In the realm of credit management, certifications can significantly bolster your CV. They not only affirm your expertise but also signal your commitment to professional growth. Here's how to effectively align and present your certifications.

1. Extract Pertinent Requirements

Begin by identifying certifications mentioned or implied in the job description. For a Credit Manager role, designations like the Certified Credit Professional (CCP) or Certified Credit Executive (CCE) can set you apart.

2. Highlight Relevant Certifications

Showcase certifications that directly align with the job's requirements. This ensures immediate attention and relays your specialized knowledge and dedication to your professional field right at the outset.

3. Clarity in Dates

For each certification, include acquisition or validity dates, especially for those with expiry. This not only provides transparency but also indicates your ongoing engagement with your professional development.

4. Continuous Learning

Value and seek new learning opportunities, particularly those pertinent to the credit management sector. This dedication to continuous learning will keep you at the forefront, showcasing an evolving expertise that remains relevant in a dynamic field.

Takeaway

Certifications can significantly raise your profile's value, offering tangible proof of your skills and dedication to the credit management discipline. Integrate these wisely to forge a stronger case for your candidacy and demonstrate an unwavering commitment to professional excellence.

Skills

Your skills section is a concise display of the tools in your professional toolkit. This segment allows you to match your specific skills with the job's requirements, emphasizing your perfect fit for the Credit Manager role.

1. Decode and Match

Carefully analyze the job posting to discern both the stated and implied skills required. Directly match these to your own skill set, ensuring you cover both hard skills like 'Financial Statement Analysis' and soft skills such as 'Negotiation'.

2. Prioritize Pertinence

While you might have a broad array of skills, prioritize those most relevant to the role of a Credit Manager. This ensures that your CV speaks directly to the needs of the hiring manager, making your application more compelling.

3. Neatly Organized

Avoid overwhelming the reader with an exhaustive list. Instead, neatly organize your skills, balancing between hard and soft skills to present a comprehensive picture of your capabilities.

Takeaway

The skills section is your chance to succinctly present yourself as the ideal candidate for the Credit Manager position. Select and showcase your skills strategically to affirm your ability to not only meet but exceed the role's demands.

Languages

In the modern, globally interconnected business world, your command over languages can be a substantial asset. Let's delve into effectively aligning your language skills with the job prerequisites and showcase your global communication prowess.

1. Scrutinize the Job Description

Start by identifying if there are any specific language requirements or preferences. The ability to communicate effectively in English is a cornerstone for a Credit Manager role, especially when the job specifies 'Proficiency in both oral and written English required'.

2. Main Language First

If the job description highlights a particular language need, ensure this is at the top of your languages section, with an accurate self-assessment of your proficiency level.

3. Additional Languages

Even if not explicitly required, listing other languages you're proficient in can accentuate your CV. This broadens your appeal, showcasing an ability to communicate across diverse cultural landscapes.

4. Honest Self-Assessment

Be honest and clear about your level of proficiency for each language listed. Whether you're 'Native', 'Fluent', 'Intermediate', or 'Basic', accurate representation ensures your capabilities are transparent and trustworthy.

5. Consider the Role's Scope

For roles that interface with international markets or diverse client bases, like a Credit Manager might, showcasing multilingual capabilities can significantly tilt the scale in your favor.

Takeaway

Your proficiency in languages can be a strong testament to your ability to navigate a global marketplace. Position this skill thoughtfully, aligning it with the role's requirements and potential international scope to illuminate your candidacy.

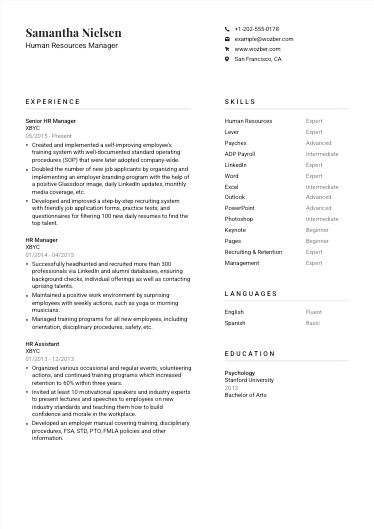

Summary

The summary section serves as your CV's elevator pitch. Here, we guide you on distilling your qualifications, skills, and unique value into a compelling narrative that aligns seamlessly with the Credit Manager role.

1. Capture the Role's Essence

Start with a deep understanding of the job requirements. Your summary should mirror the employer's needs, positioning you as the solution to their search.

2. Introduction with Impact

Begin with a strong statement about your professional identity and experience. "Credit Manager with over 9 years of expertise" sets a professional tone right from the start, immediately engaging the reader.

3. Directly Address Requirements

Weave in your relevant skills and accomplishments that directly respond to the job's needs. Highlighting your adeptness at using "advanced credit scoring tools and methodologies" directly showcases your suitability for the position.

4. Conciseness is Key

The summary is your headline; make it punchy and to the point. Deliver an enticing snapshot of your career that makes hiring managers eager to dive deeper into your CV.

Takeaway

A well-crafted summary makes you memorable, anchoring your application in the minds of hiring managers. It's your chance to assert your fit for the Credit Manager role, highlighting your unique blend of skills and experiences.

Launching Your Credit Manager Journey

Congratulations on mastering the art of CV crafting for the Credit Manager role! Each segment of your CV is a chapter in your professional story, designed to captivate and convince hiring managers of your standout suitability for the position. Embrace this journey with confidence, knowing you have the tools, including Wozber's free CV builder and ATS CV scanner, to create an ATS-optimised CV. Let your CV be the bridge to your next big opportunity.

Dive into the world of credit management with your best foot forward. Your future awaits!

- Bachelor's degree in Finance, Business Administration, or a related field.

- Minimum of 5 years of experience in credit analysis, risk assessment, or a similar role.

- Proficiency in using credit scoring tools, financial statement analysis, and risk assessment methodologies.

- Strong interpersonal, communication, and negotiation skills.

- Certified Credit Professional (CCP) or Certified Credit Executive (CCE) designation preferred.

- Proficiency in both oral and written English required.

- Must be located in New York City, New York.

- Evaluate and analyze the creditworthiness of potential customers using internal and external credit risk management tools.

- Establish and monitor credit limits, terms of payment, and collection procedures.

- Review and approve credit applications, credit lines, and credit terms in compliance with company policies.

- Coordinate with sales teams and external partners to address credit-related queries or issues.

- Provide monthly, quarterly, and annual credit reports to senior management, highlighting potential risks and opportunities.