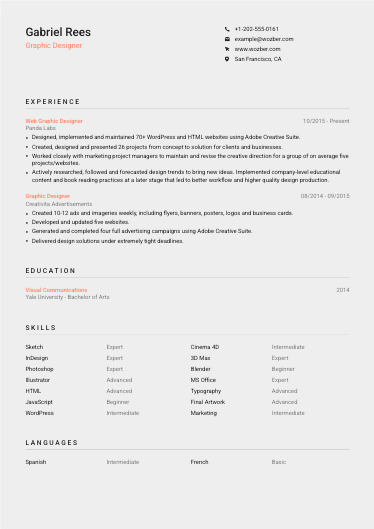

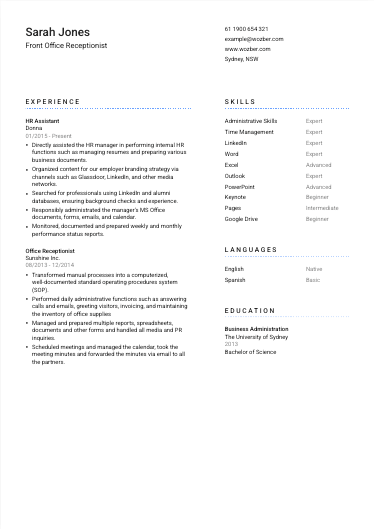

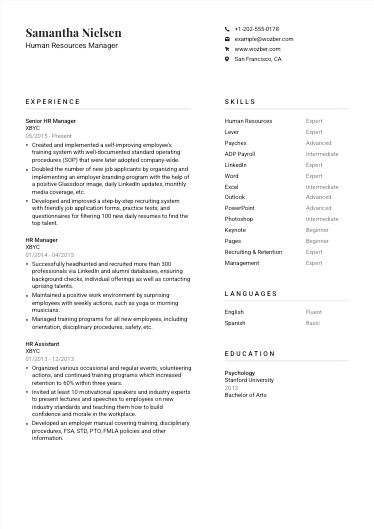

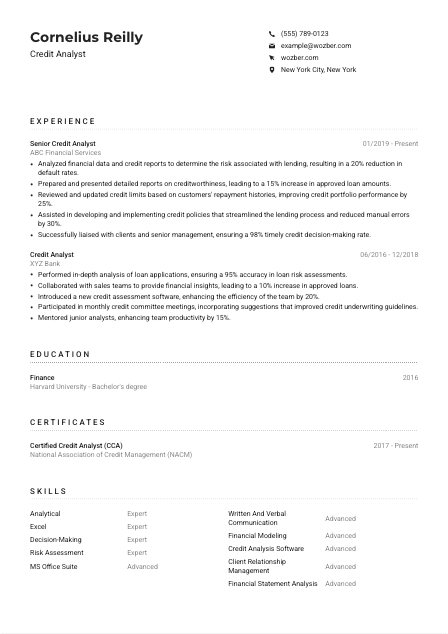

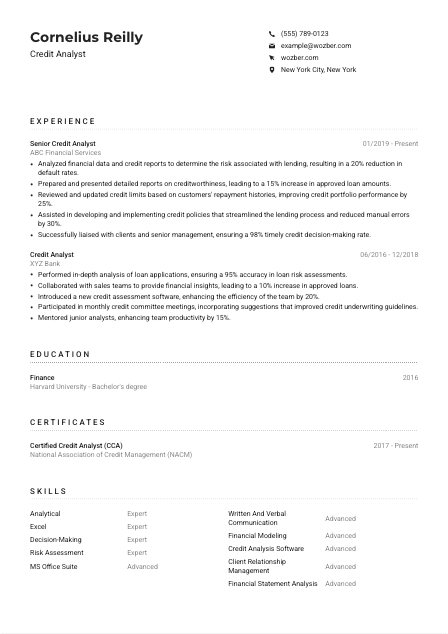

Credit Analyst CV Example

Crunching credit but your CV's maxed out? Dive into this Credit Analyst CV example, tailored using Wozber free CV builder. Discover how you can detail your financial insights to meet the job's lending criteria, paving your way to a career in the green zone of finance!

How to write a Credit Analyst CV?

Greetings, aspiring Credit Analyst! In the fiercely competitive world of finance, your CV is not just a summary of your work history - it's a powerful tool to showcase your expertise and analytical prowess, specifically tailored to the role you're eyeing. With our guidance, powered by the Wozber free CV builder, we'll navigate through the intricacies of creating an ATS-compliant CV that not only meets but exceeds job requirements.

Ready to secure your position in the finance sector? Let's forge your CV into a beacon for hiring managers!

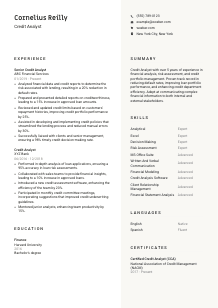

Personal Details

The 'Personal Details' section is your opening gambit. It's where you make your first impression count, ensuring it's aligned with the expectations for a Credit Analyst. Here's how to master this section, making your CV irresistibly appealing to employers.

1. Name and Job Title

Start strong with your name in a clear font, setting the stage. Directly below, tailor the job title 'Credit Analyst' as it appears in the job description. This explicit alignment suggests that your CV is custom-made for the position.

2. Contact Essentials

Include your phone number and a professional email address in a "firstname.lastname@email.com" format. Double-checking for typos is vital - your attention to detail here reflects your precision, crucial for a Credit Analyst.

3. Local Advantage

By stating 'New York City, New York' in line with the job's location requirement, you're already ticking a critical box, reassuring employers of your readiness and suitability from a logistical standpoint.

4. Professional Online Presence

Linking a current LinkedIn profile or a professional website gives a comprehensive glimpse into your career, emphasizing your proficiency with the digital tools and networking essential for today's analysts.

5. Privacy Matters

Keep personal matters personal. Omitting age, gender, or marital status not only maintains your privacy but also ensures the focus remains on your skills and achievements.

Takeaway

This section is more than just your contact info; it's the launchpad of your professional narrative. By hitting all the right notes upfront, you open the door to a favorable first impression. Sharpen it up, and watch your CV work wonders.

Experience

The Experience section is the backbone of your CV, a testament to your contributions and successes in the world of finance. Mapping your journey with precision and relevance to the Credit Analyst role is crucial. Let's break down how to articulate your career saga, making every word count towards your dream job.

- Analyzed financial data and credit reports to determine the risk associated with lending, resulting in a 20% reduction in default rates.

- Prepared and presented detailed reports on creditworthiness, leading to a 15% increase in approved loan amounts.

- Reviewed and updated credit limits based on customers' repayment histories, improving credit portfolio performance by 25%.

- Assisted in developing and implementing credit policies that streamlined the lending process and reduced manual errors by 30%.

- Successfully liaised with clients and senior management, ensuring a 98% timely credit decision‑making rate.

- Performed in‑depth analysis of loan applications, ensuring a 95% accuracy in loan risk assessments.

- Collaborated with sales teams to provide financial insights, leading to a 10% increase in approved loans.

- Introduced a new credit assessment software, enhancing the efficiency of the team by 20%.

- Participated in monthly credit committee meetings, incorporating suggestions that improved credit underwriting guidelines.

- Mentored junior analysts, enhancing team productivity by 15%.

1. Dissect the Description

Begin by closely examining the job posting, drawing parallels between your past roles and the listed responsibilities. For instance, 'Analyzed financial data and credit reports to determine the risk' directly mirrors the job's key requirements.

2. Chronological Clarity

List your positions beginning with the most recent. Use clear headings for each job title, company name, and dates of employment, ensuring easy navigation for hiring managers.

3. Achievements Over Duties

Focus on what you've accomplished rather than what you were tasked with. For instance, 'resulting in a 20% reduction in default rates' quantifies your impact, making your contributions tangible and relatable.

4. Fact-based Success

Numbers speak louder than words. Whenever possible, quantify your achievements, like 'leading to a 15% increase in approved loan amounts,' to validate your efficacy and detail your proficiency in financial analysis.

5. Relevance is Key

Tailor your CV to reflect only the most relevant experiences. Even if you're proud of certain achievements, if they don't align with the Credit Analyst role, it's better to leave them out. Stay focused on what will make you stand out for this specific position.

Takeaway

Crafting your experience with focus and precision transforms your CV into a compelling story of your financial acumen. Emphasize your analytic capabilities and how they've driven success. This section doesn't just chronicle your career; it's your proof of excellence.

Education

While the Education section might seem straightforward, it's crucial to align it with the expectations for a Credit Analyst role. Let's navigate through sculpting this section to reinforce your suitability and dedication to the field of finance.

1. Degree Specification

Echo the job's educational prerequisites by listing your 'Bachelor's degree in Finance, Accounting, or a related field.' Matching the job description's requirements word-for-word reinforces your qualification for the role.

2. Simple Structure

Maintain clear, concise details of your educational background, including the degree obtained, the institution's name, and your graduation year. Excess information might dilute the impact of your qualifications.

3. Degree Relevance

Make sure the degree title precisely mirrors what is sought in the job posting. In the case of needing a 'Bachelor's degree in Finance,' listing this exact qualification shows direct compliance with role requirements.

4. Related Coursework

For roles like Credit Analyst, where specific expertise is valuable, mentioning relevant courses can reinforce your educational background. However, restrain from overloading this section. Stick to courses directly related to financial analysis and risk assessment.

5. Additional Achievements

Should you have any honors or extracurricular activities that highlight skills pertinent to the Credit Analyst role, include them. This could be membership in finance clubs or participation in financial analysis competitions, showcasing your enthusiasm for the field.

Takeaway

Leveraging your education section to exhibit your relevant academic foundation is crucial. A well-crafted education segment underscores your preparedness for the challenges of a Credit Analyst role, showcasing a strong base of financial knowledge.

Certificates

In the competitive field of credit analysis, certifications can highlight your dedication to continuous improvement and specialization. Here's how to strategically present your certifications to align with a Credit Analyst's role requirements.

1. Job Description Alignment

Referencing the job posting, note the preferred qualifications. The mention of 'Certified Credit Analyst (CCA)' directly matches one of your certifications, immediately demonstrating your commitment to the profession.

2. Selective Listing

Prioritize listing certificates that showcase your aptitude and dedication to credit analysis. This targeted approach helps in illustrating your preparedness and specialization for the role over a scattergun listing of every certificate you've earned.

3. Date Precision

Mentioning the acquisition or validity dates of your certifications, such as the 'Certified Credit Analyst (CCA)' designation, provides insights into your current knowledge and commitment to staying updated in the field.

4. Pursue Ongoing Development

Finance and credit analysis are ever-evolving fields. Showing an ongoing commitment to learning through recent and relevant certifications can set you apart. This dedication resonates well with employers looking for proactive and self-motivated candidates.

Takeaway

Your certifications are not merely credentials; they're proof of your zeal for excellence and continuous learning. Highlighting the right certificates on your CV emphasizes your suitability and readiness for the Credit Analyst role, marking you as a valuable asset.

Skills

The Skills section is your opportunity to showcase your professional toolkit. For a Credit Analyst, certain skills are non-negotiable. Here's how to highlight your competencies, ensuring they resonate with the role you're aspiring to.

1. Analyze the Posting

Start by comprehensively reviewing the job description. Skills such as 'Strong analytical and financial modeling skills' and 'Proficiency with MS Office Suite' are directly asked for and must be prominently featured on your CV.

2. Tailoring Your Toolkit

Your CV should list skills that mirror the job's requirements. This includes both hard skills like 'Financial Modeling' and soft skills such as 'Excellent written and verbal communication.' This mix portrays you as a well-rounded candidate.

3. Organisation is Key

Avoid clutter. Organize your skills in a manner that makes them easy to read and digest. Highlight your top skills that directly align with the job's requirements, ensuring they catch the eye of the hiring manager.

Takeaway

Carefully curated and presented skills are a testament to your capability and readiness for the Credit Analyst role. Think of this section as your professional highlight reel, emphasizing your most relevant and impressive competencies. Shine bright and stand out.

Languages

In the global world of finance, being multilingual can set you apart. While the job description might prioritize English proficiency, additional languages could give you an unexpected edge. Let's detail how to effectively present your language skills on your CV.

1. Job Language Requirement

Firstly, confirm if the job specifies language skills, such as 'Command of the English language is essential.' Demonstrating your proficiency in English as a 'Native' speaker addresses this requirement explicitly.

2. Prioritize Pertinent Languages

While English is a must-have for this role, showcasing your fluency in additional languages, like Spanish, illustrates your ability to navigate a multicultural work environment, adding a valuable dimension to your CV.

3. Honesty in Proficiency

Being transparent about your language levels is crucial. Use clear descriptors like 'Native' or 'Fluent' to convey your language competencies accurately, ensuring no misinterpretations.

4. Gauge The Role's Scope

While this job primarily demands proficiency in English, having additional languages can be beneficial, especially if the role evolves to include or interact with international markets. It shows preparedness and adaptability.

5. The Global Perspective

Even if not immediately relevant, listing additional languages showcases your versatility and openness to global perspectives, traits that are increasingly valuable in the interconnected world of finance.

Takeaway

Your language skills are more than just a section on your CV; they are a showcase of your ability to thrive in a global market. Highlight them with pride and precision, and watch as they open doors to diverse opportunities in the finance sector.

Summary

A compelling Summary at the top of your CV is like a firm handshake; it sets the tone and invites further exploration. Here's how to distill your essence into a few powerful sentences, perfectly tailored to the Credit Analyst role.

1. Capturing the Job's Heart

Begin by internalizing the job requirements. Your summary should reflect a clear understanding of what the role entails, emphasizing your alignment with its demands.

2. Who You Are

Introduce yourself as a finance professional with a specific focus, such as your 5 years of experience in financial analysis and risk assessment. This quick snapshot starts your narrative on a high note.

3. Your Proven Track Record

Briefly delve into how your skills have made a tangible impact, citing a '20% reduction in default rates' or a '15% increase in approved loan amounts' as clear, quantifiable evidence of your credit analysis skills.

4. Brevity is Your Friend

Craft a tease, not a tell-all. Your Summary should be a beacon, highlighting your qualifications and enticing the reader to dive deeper into your CV. Aim for 3-5 punchy lines that showcase your proficiency and potential.

Takeaway

Think of your Summary as your CV's headline - compelling, concise, and conveying your career narrative at a glance. It's your first opportunity to communicate your value proposition, making it clear why you're the perfect candidate for the role. Make every word count.

Launching Your Credit Analyst Journey

Congratulations on completing this deep dive into crafting an impactful, ATS-optimised Credit Analyst CV. With these tailored strategies and the power of Wozber's ATS-friendly CV template and free CV builder at your disposal, you're now well-equipped to create a CV that not only passes through ATS scanners with flying colors but also captures the attention of hiring managers. Your CV is your story waiting to be told. Let Wozber's free ATS CV scanner ensure it's ATS-optimised.

Embrace your expertise, and let your CV be the key to unlocking your next career move. The finance world awaits your insights and analysis. It's your turn to shine!

- Bachelor's degree in Finance, Accounting, or a related field.

- Minimum of 3 years of experience in credit analysis or a similar financial role.

- Strong analytical and financial modeling skills.

- Proficiency with credit analysis software and MS Office Suite, particularly Excel.

- Excellent written and verbal communication skills.

- Certified Credit Analyst (CCA) or Chartered Financial Analyst (CFA) designation preferred.

- Command of the English language is essential.

- Applicant must be located in New York City, New York.

- Analyze financial data and credit reports to determine the risk involved in lending to individuals or businesses.

- Prepare detailed reports outlining creditworthiness and lending recommendations.

- Review and update credit limits based on customers' repayment histories and credit conditions.

- Assist in the development and implementation of credit policies and procedures.

- Liaise with clients, sales teams, and senior management to ensure timely credit decision-making and risk mitigation.