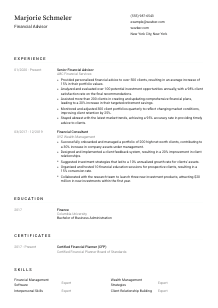

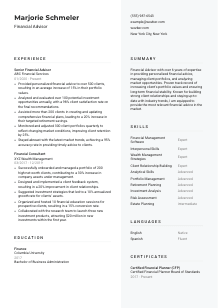

Financial Advisor CV Example

Navigating portfolios, but your CV seems underdiversified? Explore this Financial Advisor CV example, balanced out using Wozber free CV builder. Uncover how to showcase your investment insights to meet job needs, propelling your career growth to market-beating levels!

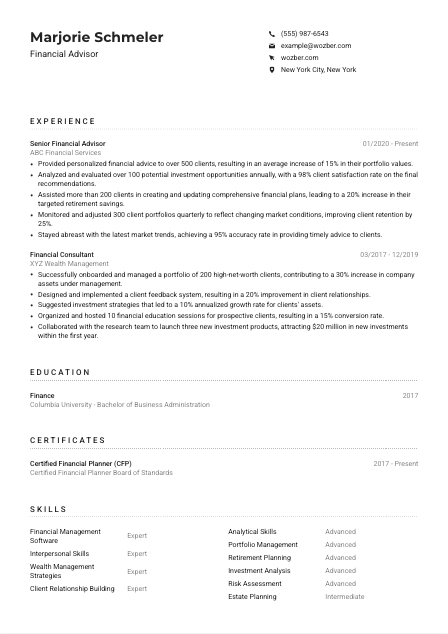

How to write a Financial Advisor CV?

Hello, aspiring Financial Advisor! In the dynamic landscape of finance, standing out in a sea of competitors requires more than just skill—it requires a CV that speaks volumes of your prowess and dedication. Using Wozber free CV builder, this guide is your blueprint for assembling a CV that not only resonates with the nuances of the Financial Advisor role but also navigates the intricacies of Applicant Tracking Systems (ATS). Let's embark on this journey to forge your CV into the key that unlocks your next career milestone.

Personal Details

The 'Personal Details' section is where your personal brand begins. It requires precision and an alignment with the Financial Advisor role that goes beyond the basics to make a compelling first impression.

1. Name: Your Professional Introduction

Your name is the beacon that guides the hiring manager through your CV. Ensure it's prominently placed and the font size slightly larger than the rest of your document. Consider this the headline of your professional story.

2. Title: Speak Their Language

Position your targeted job title - "Financial Advisor" directly beneath your name. It's like affirming, "Yes, I belong here." This alignment bridges your profile with the role, making it evident that your aspirations and the job description are in sync.

3. Contact Information: Stay Accessible

Provide a professional email and phone number, ensuring they're both typo-free. A pro tip: your email should be a variation of firstname.lastname@email.com to maintain professionalism. And since the job mandates being located in New York City, emphasizing your local address closes any geographical gaps right off the bat.

4. Online Presence: Showcase Your Professionalism

Include a LinkedIn profile or personal website, if applicable. In the digital age, an online presence can significantly augment your CV, offering a deeper dive into your professional journey. Ensure it mirrors the information on your CV for consistency.

5. Cultural Fit: State Your Locale

"Must be located in New York City, New York." By highlighting your adherence to this requirement upfront, you nullify any potential concerns regarding relocation. It subtly reassures the hiring manager that you're immediately available and logistically compatible with the job's location demands.

Takeaway

Your Personal Details section is not just the starting line; it's the spotlight. Through strategic details and alignment, you transform it into an impactful introduction that paves the way for the narrative of your professional excellence. With Wozber, you're steering this narrative with precision and insight.

Experience

The Experience section is where you transform your past roles into compelling stories of success, tailored precisely for the Financial Advisor role. It's about painting a picture of your journey that not only meets but surpasses expectations.

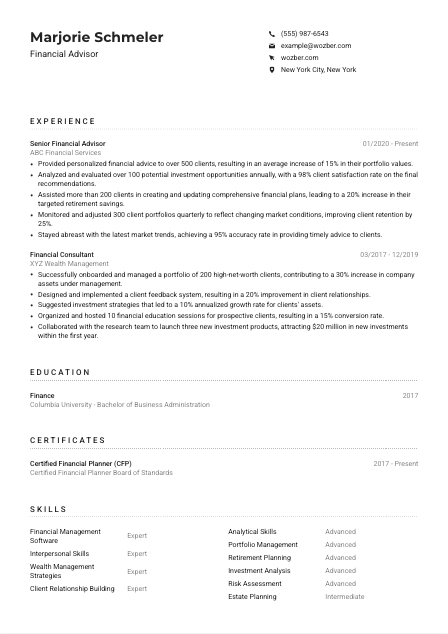

- Provided personalized financial advice to over 500 clients, resulting in an average increase of 15% in their portfolio values.

- Analyzed and evaluated over 100 potential investment opportunities annually, with a 98% client satisfaction rate on the final recommendations.

- Assisted more than 200 clients in creating and updating comprehensive financial plans, leading to a 20% increase in their targeted retirement savings.

- Monitored and adjusted 300 client portfolios quarterly to reflect changing market conditions, improving client retention by 25%.

- Stayed abreast with the latest market trends, achieving a 95% accuracy rate in providing timely advice to clients.

- Successfully onboarded and managed a portfolio of 200 high‑net‑worth clients, contributing to a 30% increase in company assets under management.

- Designed and implemented a client feedback system, resulting in a 20% improvement in client relationships.

- Suggested investment strategies that led to a 10% annualized growth rate for clients' assets.

- Organized and hosted 10 financial education sessions for prospective clients, resulting in a 15% conversion rate.

- Collaborated with the research team to launch three new investment products, attracting $20 million in new investments within the first year.

1. Analyze the Role

Dissect the job description to highlight experiences directly aligned with responsibilities such as providing personalized financial advice, analyzing investment opportunities, and staying updated with market trends. This way, every bullet point is a direct answer to the job's needs.

2. Structure and Precision

List your roles in reverse chronological order, emphasizing not just what you did but how well you did it. For instance, "Provided personalized financial advice to over 500 clients, resulting in an average increase of 15% in their portfolio values." This quantified achievement directly correlates with the expected responsibilities.

3. Speak Their Language

Express your accomplishments in terms that resonate with the Financial Advisor role. Use keywords from the job description and mirror their language. This not only caters to the human eye but ensures your CV speaks the same language as the ATS, otimizing your chances for success.

4. The Power of Numbers

Quantify your achievements wherever possible. Numbers provide tangible evidence of your impact, making your accomplishments more compelling. Whether it's portfolio growth, client retention improvement, or assets managed, these metrics serve as benchmarks of your success.

5. Relevance Above All

While versatility is valuable, relevance is key. Prioritize experiences that mirror the Financial Advisor's role. This laser focus ensures every line of your CV adds weight to your candidacy, convincingly advocating for your fit for the position.

Takeaway

The Experience section is your arena to showcase how you've navigated the complexities of financial advising, impacting clients and companies alike. It's about demonstrating your proficiency and passion, turning your professional journey into a compelling case for why you're the ideal candidate. With each bullet point, you're not just recounting your past; you're mapping out your future successes.

Education

In financial advising, your educational background establishes your foundational knowledge. Crafting this section to reflect the job's educational prerequisites not only demonstrates compliance but underscores your compatibility with the role.

1. The Degree Essentials

"Bachelor's degree in Finance, Accounting, Business, or a related field." Directly list your degree, ensuring it matches the job's educational requirements. This establishes your academic grounding in the fields crucial for success as a Financial Advisor.

2. Clear and Structured

Maintain clarity in presenting your education. A straightforward format listing your degree, the institution, and graduation year avoids any confusion. Brevity here ensures attention is drawn to the most relevant details.

3. Degree Specificity

If the role calls for a specific educational background, highlight that. For the Financial Advisor position, showcasing a "Bachelor of Business Administration in Finance" directly ties your academic journey to the job's core requirements.

4. Coursework and Achievements

For roles demanding particular expertise, mentioning relevant coursework or academic achievements might bolster your candidacy. While the Financial Advisor role might not necessitate this, it's a valuable tool in early career stages or highly specialized positions.

5. Align With Career Level

Assess the level of detail required based on the role's seniority. For a seasoned Financial Advisor, the focus might be more on professional experience. For newcomers, emphasizing educational achievements can fill in experience gaps, showcasing potential.

Takeaway

Your educational background isn't just a checklist item; it's the bedrock of your financial acumen. By aligning it with the role's requirements, you're signaling not just compliance but a depth of knowledge and commitment to your field. It's about showcasing a foundation robust enough to build a successful career upon.

Certificates

Certificates are your arsenal for standing out, underscoring your commitment to ongoing learning and excellence in the Financial Advisor domain. Let's navigate curating this section to highlight certifications that resonate most with your target role.

1. Identify Key Certifications

"Must possess relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA)." Align your certifications list with those explicitly preferred or required by the job, spotlighting your specialized knowledge and dedication.

2. Quality Over Quantity

Focus on certifications that directly contribute to your role as a Financial Advisor. This targeted approach ensures the hiring manager immediately sees the most relevant qualifications, streamlining the connection between your specializations and the job's demands.

3. Date Details

Include acquisition or validity dates for your certifications, especially when they're recent or particularly relevant to the role's current demands. This not only showcases your up-to-dateness but also your proactive approach to professional growth.

4. Continual Learning

The finance field is ever-evolving, and staying abreast with certifications reflects your commitment to excellence. This section is not just a testament to your current qualifications but a signal of your dedication to continuous improvement and relevancy in your profession.

Takeaway

Your certifications tell a story of ambition, expertise, and an unyielding commitment to your development as a Financial Advisor. They are badges of honor, each underscoring your suitability and readiness for the challenges of the role. Showcase them with pride, and let them speak volumes of your journey towards professional excellence.

Skills

In the realm of financial advising, your skills are what set you apart. This section is about strategically aligning your skills with the needs of the role, demonstrating your capability to not only meet but exceed expectations.

1. Unpacking the Job Requirements

Extract from the job description the core skills needed for the role—both explicit and implicit. This requires a keen eye to discern not just the hard skills like proficiency in financial management software but also soft skills like exceptional interpersonal prowess.

2. Curating Your Skill Set

Choose skills that directly match those listed in the job description, ensuring a mix of technical and soft skills. Highlight your expertise in critical areas including wealth management strategies and client relationship building, mirroring the key requisites of the role.

3. Organized and Precise

Avoid clutter. An overcrowded skills section can dilute the impact of your key attributes. Stick to a selection that demonstrates your comprehensive capabilities as a Financial Advisor, ensuring each skill listed serves a purpose and reinforces your candidacy.

Takeaway

This curated showcase of your skills is a declaration of your readiness and fit for the Financial Advisor role. It's not just about listing your abilities; it's about communicating the depth of your expertise and your potential for impact. Let each skill reflect your uniqueness, making it impossible for the hiring manager to overlook your CV.

Languages

In today's global economic environment, language skills can significantly enhance your appeal as a Financial Advisor. This section delves into leveraging your linguistic capabilities to showcase versatility and a global mindset.

1. Reviewing Language Requisites

Start by ascertaining if the job emphasizes any specific language skills. For a Financial Advisor, articulating well in English is a fundamental requirement, but additional languages could underscore your value, especially in roles with international clientele.

2. Prioritizing Essential Languages

If English is a must, list it prominently, reflecting your fluency and comfort with the language. This addresses a primary requirement, reassuring employers of your ability to communicate effectively with clients and colleagues.

3. Showcasing Multilingual Skills

Including other languages you're fluent in can set you apart, especially if the role involves international markets. This demonstrates not just linguistic proficiency but cultural sensitivity and versatility, traits highly valued in the financial industry.

4. Honesty in Proficiency

Clearly indicate your level of proficiency in each language. From "Native" to "Basic," offer a realistic assessment of your abilities. This transparency builds trust and highlights your linguistic capabilities without overpromising.

5. Global Finance Perspective

For roles that span borders or engage with a diverse clientele, your language skills are a testament to your ability to navigate complex global interactions. They reflect not just your communication skills but an understanding of global market dynamics.

Takeaway

Your fluency in languages paints a picture of a Financial Advisor poised for the global stage. These skills enhance your CV, translating to broader opportunities and the potential to connect with a diverse range of clients. In the world of finance, every language you speak is another door you can open, both for yourself and for those you advise.

Summary

A well-crafted summary is the bow that ties your CV together, offering a concise snapshot of your qualifications and why you're the perfect fit for the Financial Advisor position. Here's how to distill your narrative into a compelling prelude.

1. Embrace the Job's Core

Begin by internalizing the essence of the Financial Advisor role. Understand its demands and how your experiences align with them. This insight will be the guide in crafting a summary that resonates with the core responsibilities and expectations.

2. Open with Precision

Introduce yourself as a seasoned professional, anchoring your summary in the reality of your experiences. For example, "Financial Advisor with over 6 years of expertise..." instantly frames you as a seasoned expert in the field.

3. Address Key Attributes

Selectively highlight your skills and achievements that align with the job's requirements like your success in "managing client portfolios" and "analyzing market opportunities." This targeted approach ensures you're presenting yourself as an ideal candidate from the get-go.

4. Conciseness Is King

Aim for a potent blend of brevity and impact. Your summary should invite the hiring manager to delve deeper into your CV, intrigued by your professional outline. Keep it tight, relevant, and compelling, setting the tone for the detailed narrative that follows.

Takeaway

Your summary isn't just an introduction; it's your personal pitch, concisely conveying your qualifications and readiness for the Financial Advisor role. It's the first handshake, the first impression that sets the stage for the detail and depth that your CV holds. Craft it with care, and let it echo the caliber of your professional journey.

Launching Your Financial Advisor Journey

Congratulations, you've now navigated the complexities of crafting a CV tailored for the Financial Advisor role. With Wozber's free CV builder, including the use of ATS-friendly CV templates and ATS CV scanner, you're armed to create a document that not only meets the criteria but truly stands out. Your CV is the distillation of your professional essence, ready to open doors to new opportunities. Turn the page, embrace your potential, and let your career in financial advising soar.

- Bachelor's degree in Finance, Accounting, Business, or a related field.

- Minimum of 3 years of experience in financial planning, wealth management, or a similar role.

- Must possess relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Exceptional interpersonal skills with demonstrated ability to build and maintain client relationships.

- Strong analytical skills with proficiency in financial management software.

- Must be able to articulate well in English.

- Must be located in New York City, New York.

- Provide clients with personalized financial advice and investment strategies to meet their financial goals.

- Analyze, evaluate, and present potential investment opportunities to clients, tailored to their specific needs and risk tolerance.

- Assist clients in creating, reviewing, and updating financial plans, encompassing areas such as retirement, education, estate planning, and insurance options.

- Monitor, review, and adjust client portfolios as needed, ensuring alignment with changing market conditions and client objectives.

- Stay updated with current market trends, compliance regulations, and best practices in the financial industry to provide the most relevant advice to clients.