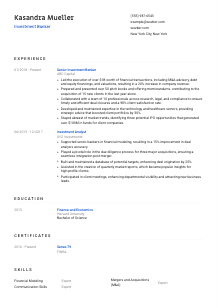

Investment Banker CV Example

Crunching numbers, but your CV isn't adding up? Dive into this Investment Banker CV example, crafted with Wozber free CV builder. See how you can strategically position your financial finesse to match job prerequisites, and prepare to make lucrative career deals in no time!

How to write an Investment Banker CV?

Hello, aspiring Investment Banker! If you're eyeing a game-changer move in the high-stakes world of finance, your CV is not just a document; it's a golden ticket to the front lines of Wall Street. With Wozber's free CV builder, this guide will navigate you through crafting an ATS-compliant CV that makes you the top pick for any investment banking lineup. Let's sculpt your CV into a deal-closing masterpiece that lands you the coveted Investment Banker position!

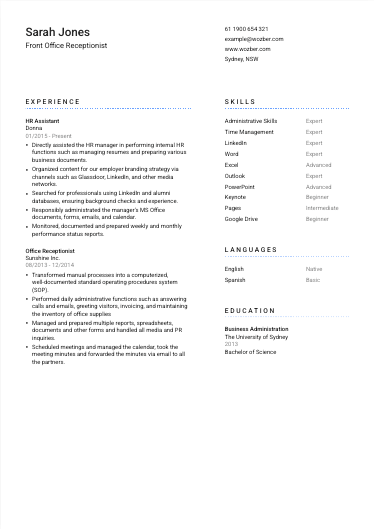

Personal Details

The Personal Details section is your opening bid. Let's ensure it commands attention, aligning perfectly with the Investment Banker role's prestige.

1. Your Name is Your Banner

Think of your name as the bold headline of your career story. It should pop off the page, ready to convince every hiring manager that they're about to read about the next big thing in investment banking.

2. Position Yourself

"Investment Banker" directly below your name acts like a beacon, signaling to hiring managers that you're exactly what they've been searching for. It's about planting the idea early and reinforcing your suitability for the role.

3. Connect the Dots

A phone number without errors and a sleek, professional email format, such as firstname.lastname@email.com, are essentials. They're like the well-maintained contacts list that keeps an investment banker always in the loop.

4. Location is Key

Mentioning "New York City, New York" not only satisfies one of the job requirements but signals to the employer that you're in the heart of the financial universe, ready to hit the ground running with no relocation delays.

5. Online Presence

A LinkedIn profile or personal finance blog can serve as an extension of your CV, offering deeper insights into your professional persona. Ensure it's updated and echoes the prowess of your CV.

Takeaway

Consider these steps as crafting your opening statement in the deal-making process of your career. Each detail should be meticulously chosen and aligned to the investment banking field, setting an elite and professional tone right from the start.

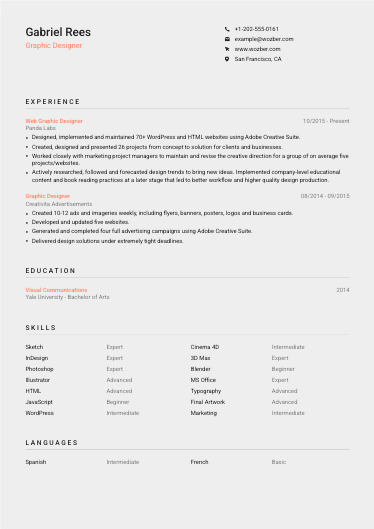

Experience

The Experience section is where your track record of financial triumphs shines. Let's delve into aligning your career highlights with the Investment Banker role, embodying the essence of success.

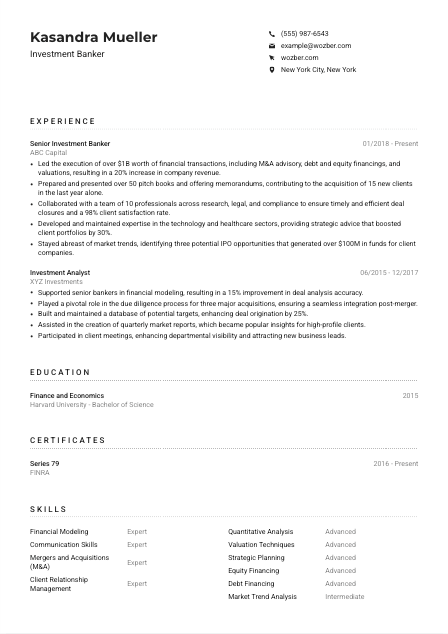

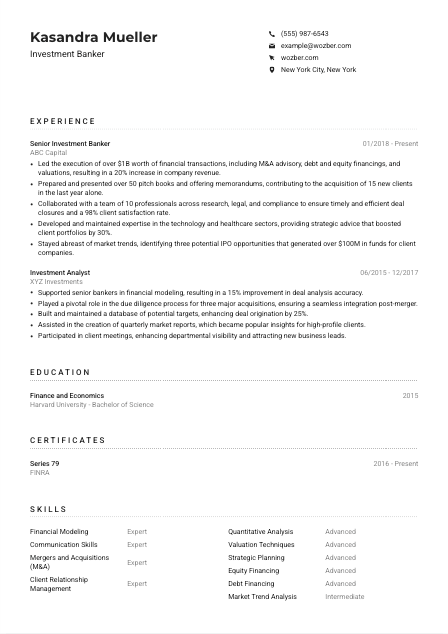

- Led the execution of over $1B worth of financial transactions, including M&A advisory, debt and equity financings, and valuations, resulting in a 20% increase in company revenue.

- Prepared and presented over 50 pitch books and offering memorandums, contributing to the acquisition of 15 new clients in the last year alone.

- Collaborated with a team of 10 professionals across research, legal, and compliance to ensure timely and efficient deal closures and a 98% client satisfaction rate.

- Developed and maintained expertise in the technology and healthcare sectors, providing strategic advice that boosted client portfolios by 30%.

- Stayed abreast of market trends, identifying three potential IPO opportunities that generated over $100M in funds for client companies.

- Supported senior bankers in financial modeling, resulting in a 15% improvement in deal analysis accuracy.

- Played a pivotal role in the due diligence process for three major acquisitions, ensuring a seamless integration post‑merger.

- Built and maintained a database of potential targets, enhancing deal origination by 25%.

- Assisted in the creation of quarterly market reports, which became popular insights for high‑profile clients.

- Participated in client meetings, enhancing departmental visibility and attracting new business leads.

1. Dissect Job Demands

Read between the lines of the job description. For example, "Led the execution of over $1B worth of financial transactions" directly mirrors the requirement to lead financial transactions, making it clear you've got the hands-on experience they need.

2. The Power of Structure

Listing each relevant position in reverse-chronological order allows your most impactful roles and accomplishments to take the spotlight first, setting the stage for a narrative of success.

3. Tailor Your Triumphs

Accomplishment statements should be your crowning jewels. For instance, detailing your role in increasing company revenue by 20% or identifying IPO opportunities showcases not just your skills, but your tangible impact on growth and success.

4. Quantify Your Wins

In investment banking, numbers speak louder than words. Quantifying achievements, like a 30% boost in client portfolios or spearheading $100M IPOs, provides concrete evidence of your financial acumen.

5. Relevant Experience Only

Your CV should be as streamlined and impactful as a well-negotiated deal. Exclude unrelated roles and keep the focus on experiences that highlight your investment banking prowess.

Takeaway

This section is your portfolio, showcasing your strategic investments in various roles that have compounded into a wealth of experience. Tailor it with precision to reflect not just what you've done, but how you're poised for even greater achievements.

Education

In the realm of investment banking, your academic credentials set the stage for your expertise. Let's sculpt your Education section to highlight the foundational knowledge that powers your finance prowess.

1. Degree on Display

If a "Bachelor's degree in Finance, Economics, or a related field" is what they seek, then that's exactly what you'll showcase. List your relevant degree upfront; it's the academic bedrock upon which your career is built.

2. Simple Structure

Adopt a straightforward format: Degree, Field of study, University, and Graduation date. It's like presenting a clear, concise investment prospectus to stakeholders.

3. Match the Role

A Bachelor of Science in Finance and Economics, perfectly tailored to the job description, affirms you have the specialized knowledge base the role demands.

4. Course Relevance

While your degree speaks volumes, highlighting specific courses (if they're especially relevant) can add depth to your educational narrative.

5. Other Academic Laurels

Accolades, honors, or societies related to your field are like bonus dividends; they enrich your profile but ensure they complement the level of role you're applying for.

Takeaway

Your education is both a testament to your dedication and a launchpad for your career ambitions. Shape it as a reflection of not only what you know, but also your perpetual drive to learn and excel.

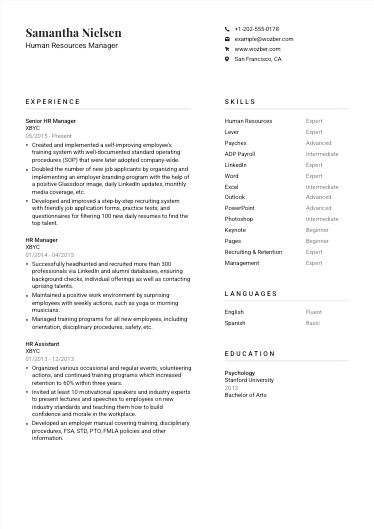

Certificates

In a field that values precision and continuous improvement, certain certifications can amplify your appeal. Let's craft your Certificates section to serve as a hallmark of your dedication and expertise.

1. Draw from the Job Description

While the job might not explicitly require certifications, they're an opportunity to add value. Leverage certifications like Series 79 and Series 63 that echo the preferred qualifications of the role.

2. Quality over Quantity

Prioritize relevance. Listing FINRA Series 79 and Series 63 certifications presents you as perfectly synced with the preferred qualifications. It's not about how many certificates you have, but how well they complement the role.

3. Clear Validity

Be precise about the dates of acquisition and, if applicable, expiration. This transparency assures hiring managers of your current qualifications and readiness.

4. Stay Proactive

Investment banking is an evolving field. Strive to keep your certifications updated and continue seeking out opportunities for professional growth.

Takeaway

Let each certification you list be a testament to your investment in your career and your commitment to excellence. They're more than accolades; they're a clear indication of your readiness and relevance for the role you aspire to.

Skills

An Investment Banker's skill set is like their trading strategy: it has to be well-researched, diversified, and decisively applied. Let's ensure your Skills section is optimised to display your market readiness.

1. Decipher the Listing

From financial modeling to client relationship management, dissect the job listing to understand not just the requested skills, but also the underlying qualities they reflect.

2. Prioritize Pertinence

Align your skill set with those mentioned in the job description. Skills like "Financial Modeling" and "Client Relationship Management" resonate with the core of the Investment Banker role, directly showcasing your suitability.

3. Organized Presentation

List skills in order of relevance and proficiency. A methodical arrangement aids in easy readability, much like how a well-structured portfolio appeals to potential investors.

Takeaway

Your skills are integral to your professional identity. Curate them carefully, ensuring each one you list is a testament to your capability and readiness for the high-stakes world of investment banking.

Languages

In the international arena of investment banking, linguistic prowess is akin to a global currency. Let's ensure your Languages section showcases your capacity to navigate diverse markets.

1. Job-Specific Prerequisites

"Must be adept at English language communication"—this requirement is your cue to illustrate not just your proficiency, but your fluency and ease with complex financial language.

2. Emphasize Necessities

Prioritize the languages the job description highlights. In this case, English is your main currency, but mentioning additional languages could distinguish you in the global market.

3. Showcase Additional Linguistic Assets

List any other languages you're fluent in as bonus qualifications. They could be the tie-breaker in a pool of similarly qualified candidates.

4. Accurate Self-Assessment

Be honest about your proficiency levels. Whether you're "Native" in English or "Fluent" in French, clarity about your language capabilities sets clear expectations.

5. Role Relevance

Consider how each language you speak could potentially enrich your capability to serve in the role, particularly in a cosmopolitan hub like New York or an assignment that requires international engagement.

Takeaway

Languages are more than just communication tools; they're bridges to new opportunities. Highlight your linguistic skills as vital components of your global investment strategy, ready to connect with stakeholders worldwide.

Summary

This is your moment to consolidate your identity as an Investment Banker. A well-crafted summary acts like a sleek, enticing prospectus that convinces stakeholders to invest in you.

1. Digest the Role

Analyze the job's core demands. Reflect on how your experiences and skills not only meet but surpass these requirements.

2. Start with a Bang

Kickstart with a statement that encapsulates your identity as an Investment Banker. This is your headline grabber, akin to the executive summary of an annual report.

3. Highlight Relevant Expertise

Lace your summary with strategic keywords from the job description, like "M&A advisory" and "financial transactions," painting a vivid picture of your fit for the role.

4. Be Brief but Mighty

In a few punchy lines, distill the essence of your professional journey. It's about compelling the hiring manager to dive deeper into the story of your career.

Takeaway

Think of your summary as the thesis of your professional narrative, each word weighted for impact. Craft it to intrigue, engage, and invite the hiring manager into the world of your unparalleled expertise and potential.

Launching Your Investment Banking Odyssey

Well done on navigating through these tailored steps! With these strategies, you're ready to craft an ATS-friendly CV that lands not just interviews but offers. Use Wozber's free CV builder, including ATS-friendly CV templates and the ATS CV scanner, to ensure your CV not only meets but exceeds the requirements. Your investment banking journey is ripe with opportunities. It's time to close the deal on your dream job. The market awaits your expertise. Go forth and conquer!

- Bachelor's degree in Finance, Economics, or a related field.

- Minimum of 5 years of investment banking, M&A advisory, or corporate finance experience.

- Proficiency in financial modeling, quantitative analysis, and valuation techniques.

- Strong interpersonal and communication skills with the ability to build rapport and maintain client relationships.

- Series 79 and Series 63 licenses are preferred.

- Must be adept at English language communication.

- Must be located in New York City, New York.

- Lead the execution of various financial transactions including M&A advisory, debt and equity financings, and valuations.

- Prepare and present pitch books, offering memorandums, and other related investment materials to clients.

- Collaborate with internal departments such as research, legal, and compliance to ensure smooth deal flow.

- Develop and maintain industry and company-specific expertise to provide strategic advice to clients.

- Stay updated on market trends, regulatory changes, and competitive landscape to ensure client satisfaction and business growth.