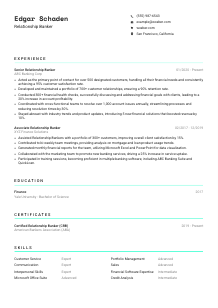

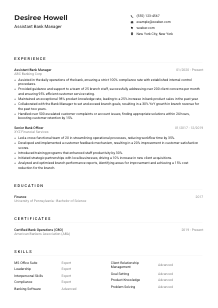

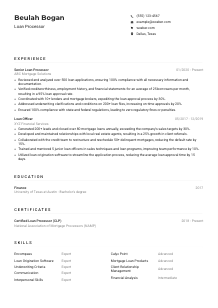

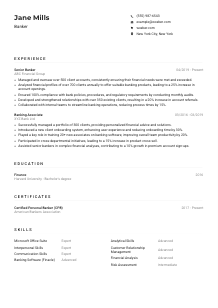

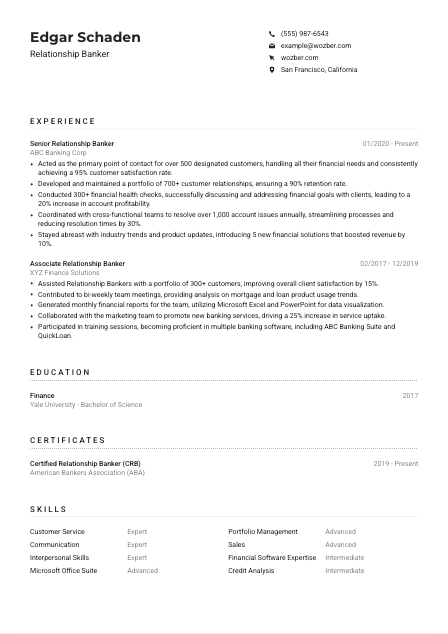

Relationship Banker Resume Example

Building connections, but your resume feels like an account in the red? Take a look at this Relationship Banker resume example, structured with Wozber free resume builder. Discover how to articulate your financial finesse with the job's deposit details, ensuring your banking pathway stays prosperous and bond-strong!

How to write a Relationship Banker Resume?

Greetings, aspiring Relationship Banker! In the bustling world of finance, your resume is more than a document; it's a testament to your banking prowess, showcasing your flair in nurturing client connections and managing financial portfolios. With the right approach and tools, such as Wozber's free resume builder, you're about to sculpt a resume that's not only a perfect fit for the Relationship Banker role but also optimized for Applicant Tracking Systems (ATS).

Ready to vault over the competition? Dive in and let's tailor your resume to highlight your banking expertise, ensuring your application shines.

Personal Details

First impressions start here. For a Relationship Banker, making the initial connection count is second nature. Let's finesse your contact section to ensure it speaks directly to potential employers.

1. Clearly Display Your Name

Think of your name as your personal brand. Ensure it's memorable and prominently placed, using a legible font size to stand out.

2. Reflect the Position Title

Place the job title 'Relationship Banker' just beneath your name to instantly align your application with the role. It subtly communicates your career focus and aspiration with clarity.

3. Contact Info Must-Haves

- Phone Number: Verify its accuracy – a simple typo could mean a missed opportunity.

- Professional Email: Opt for firstname.lastname@email.com format to maintain a professional image.

4. Location, Location, Location

Matching the specified location, "San Francisco, California", assures recruiters of your availability and removes any potential concerns about relocation.

5. Online Professional Presence

A LinkedIn profile link is a smart addition, making sure it mirrors the achievements and skills detailed on your resume.

Takeaway

Your Personal Details section is the handshake before the conversation. Craft it as meticulously as you would approach a client, ensuring every detail correctly represents your professional image. This is your first step towards making a memorable impression.

Experience

The realm where your banking prowess takes center stage. For Relationship Bankers, details on cultivating customer relationships, managing portfolios, and achieving financial targets are gold. Let's fashion an experience section that speaks volumes.

- Acted as the primary point of contact for over 500 designated customers, handling all their financial needs and consistently achieving a 95% customer satisfaction rate.

- Developed and maintained a portfolio of 700+ customer relationships, ensuring a 90% retention rate.

- Conducted 300+ financial health checks, successfully discussing and addressing financial goals with clients, leading to a 20% increase in account profitability.

- Coordinated with cross‑functional teams to resolve over 1,000 account issues annually, streamlining processes and reducing resolution times by 30%.

- Stayed abreast with industry trends and product updates, introducing 5 new financial solutions that boosted revenue by 10%.

- Assisted Relationship Bankers with a portfolio of 300+ customers, improving overall client satisfaction by 15%.

- Contributed to bi‑weekly team meetings, providing analysis on mortgage and loan product usage trends.

- Generated monthly financial reports for the team, utilizing Microsoft Excel and PowerPoint for data visualization.

- Collaborated with the marketing team to promote new banking services, driving a 25% increase in service uptake.

- Participated in training sessions, becoming proficient in multiple banking software, including ABC Banking Suite and QuickLoan.

1. Analyze the Job Requirements

Dissect the job description for vital cues. Highlight phrases like 'primary point of contact for customers' and 'portfolio management' to ensure your descriptions resonate with these pivotal tasks.

2. Outline Your Professional Journey

List roles chronologically, placing emphasis on positions most related to banking and customer service, making your current or most recent role the focal point.

3. Craft Accomplishment Statements

Challenge, Action, Result (CAR) - use this formula to detail how you've addressed financial goals, improved customer satisfaction, or streamlined operations. For instance, 'Conducted 300+ financial health checks, resulting in a 20% increase in account profitability.'

4. Include Quantifiable Achievements

Numbers offer concrete evidence of your success. Whether it's customer retention rates, the number of accounts managed, or revenue growth, make sure these figures are front and center.

5. Prioritize Relevant Experiences

Stick to detailing experiences that directly translate to the skills and duties of a Relationship Banker. Extraneous information can distract from your core qualifications.

Takeaway

This is where you convince the hiring manager you're the perfect candidate for the role. Your experience section should be a testament to your ability to excel as a Relationship Banker. Use it to demonstrate not just your eligibility, but your distinction in the field.

Education

Education lays the groundwork for your career in banking, equipping you with necessary theoretical knowledge. For a Relationship Banker, showcasing your finance or business degree is crucial. Let's ensure your education section makes the grade.

1. Identify the Required Degrees

Spotlight your "Bachelor's degree in Business, Finance, or a related field," as requested in the job description. This helps align your qualifications with the role's requirements.

2. Structure with Clarity

Keep it simple: list your degree, field of study, school name, and graduation year. Skip the GPA unless it's particularly impressive or specifically requested.

3. Specificity Wins

Fine-tuning details, like choosing 'Bachelor of Science in Finance', directly matches you to the job's educational requirements. It's all about making a direct connection between your studies and the role at hand.

4. Relevant Courses Only

If your degree is broader than the specified fields, list courses related to banking, finance, or customer service to demonstrate focused knowledge.

5. Showcase Extra Milestones

Include high-impact educational highlights like honors, relevant extracurriculars, or finance-specific certifications that add weight to your academic achievements.

Takeaway

Your education isn't just a list of schools; it's proof of your foundational knowledge in financial principles vital for a Relationship Banker. Craft this section to reflect not just your learning, but your readiness for the role.

Certificates

In the dynamic world of banking, staying updated with certifications not only boosts your knowledge but significantly enhances your resume. Let's spotlight certifications that amplify your expertise in relationship banking.

1. Filter Through the Job Description

If the job listing doesn't specify required certifications, think about what certifications can bolster your credibility for role-related tasks.

2. Choose Pertinent Certifications

"Certified Relationship Banker" by the ABA, as seen in the resume example, directly complements the relationship banker role, adding to your professional value.

3. Dates Matter

For certifications that are current or have a validity period, ensure to list when you earned them, showcasing your commitment to continuous learning and up-to-date knowledge.

4. Always Be Learning

The finance industry is ever-evolving. Regularly seek out new certifications in banking and customer relationship management to stay ahead in the game.

Takeaway

Strategically selected certifications can significantly boost your resume, showcasing your dedication to professional development. Remember, in the rapidly changing world of banking, being up-to-date is not just an advantage; it's a necessity.

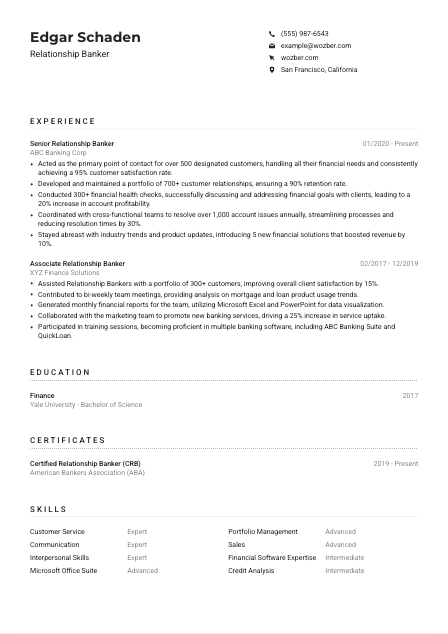

Skills

For a Relationship Banker, skills are the currency of your trade. Your ability to serve customers, manage financial portfolios, and use banking software efficiently are key. Let's craft a skills section that presents you as the gifted banker you are.

1. Extract from Job Description

Identify both stated and implied skills within the job listing. Terms like 'outstanding communication', 'knowledge of financial products', and 'proficiency with banking software' are your cues.

2. Select Skills Wisely

Align your own skills with the job's demands. Incorporate both hard skills like 'Microsoft Office Suite' and 'Financial Software Expertise', and soft skills such as 'Customer Service' and 'Interpersonal Skills' to showcase a well-rounded skillset.

3. Organization is Key

Categorize and list skills in order of relevance to the Relationship Banker position. This makes it easier for hiring managers to see your most pertinent skills at a glance.

Takeaway

A well-crafted skills section is the beacon that guides recruiters through your resume, highlighting your proficiency in both the technical and relational aspects of banking. List them with confidence, showing you're fully equipped for the role.

Languages

In a field as interpersonal as relationship banking, communication is key. The ability to converse in multiple languages can distinguish you in a multicultural banking environment. Let's articulate your linguistic skills effectively.

1. Check for Language Preferences

For the Relationship Banker role, being able to "express ideas clearly in English" is a must. Prioritize this in your resume to meet the basic requirement.

2. Prominence to Key Languages

Position English at the top of your languages section, labeling your proficiency level accurately to demonstrate your capability in professional communication.

3. Showcase Additional Languages

Even if not explicitly required, listing other languages like Spanish with your proficiency can be a tremendous asset, showcasing your ability to connect with a broader range of customers.

4. Honesty in Proficiency

Be realistic about your language levels. Overestimating can lead to uncomfortable situations, while undervaluing could sell you short. Accuracy is your ally.

5. Contextual Relevance

Especially for relationship-focused roles, additional languages imply not just the ability to communicate, but the capacity to connect on a multicultural level, enriching customer interactions.

Takeaway

Language skills are a testament to your ability to engage and connect. In banking, where trust and understanding are paramount, being multilingual can significantly uplift your professional profile. Shine a light on your linguistic skills, and open doors to diverse and enriching client relationships.

Summary

The summary section is your elevator pitch, distilled into a compact narrative that captures the essence of your professional journey. For a Relationship Banker, it's about highlighting your adeptness in customer relations and financial management. Let's distill your expertise into a powerful opener.

1. Capture the Role's Core

Begin by absorbing the heart of what makes a great Relationship Banker: exceptional customer service, expertise in financial products, and a knack for relationship building. This will be the foundation of your summary.

2. Start Strong

Open with a statement that speaks to your experience and specialization, like, 'Experienced Relationship Banker skilled in fostering client relationships and managing financial portfolios.'

3. Address Key Requirements

Mention your strategic competencies, like your knowledge of financial products or your proficiency in banking software, to directly align with the job specifications.

4. Keep it Brief

Your summary should be potent yet concise. Aim for 3 to 5 lines not just summarizing your professional past but also hinting at the value you bring to the future role.

Takeaway

The summary is more than just an introduction; it's your chance to hook the reader with your professional narrative. Tailor it to reflect not just your experience but also your enthusiasm and suitability for the Relationship Banker position. Make your first impression count.

Launching Your Relationship Banker Journey

You've now navigated through the key elements of crafting a standout resume for a Relationship Banker role. Employing Wozber's free resume builder, paired with these bespoke pointers, positions you to present a resume that is not only ATS-compliant but also compellingly tailored to your dream role. Remember, your resume is your professional story – make it resonate with your aspirations and the needs of your potential employer.

Embrace this guide, let your qualifications shine, and step confidently towards your next big opportunity. Your banking career awaits!

- Bachelor's degree in Business, Finance, or a related field.

- Minimum of 2 years of retail banking or customer service experience.

- Strong knowledge of financial products and services, including loans, mortgages, and investment options.

- Demonstrated proficiency with banking software and Microsoft Office suite.

- Outstanding communication and interpersonal skills with an emphasis on building and maintaining customer relationships.

- Must be able to express ideas clearly in English.

- Must be located in San Francisco, California.

- Act as the primary point of contact for designated customers, handling all their financial needs and providing recommendations for banking services.

- Develop and maintain a portfolio of customer relationships, focusing on customer retention and ensuring a high level of customer satisfaction.

- Conduct financial health checks, discussing financial goals with customers, and providing solutions to meet those goals.

- Coordinate with internal teams to resolve account issues, process transactions, and onboard new customers.

- Stay updated with industry trends, products, and services to provide the best advice and offerings to customers.