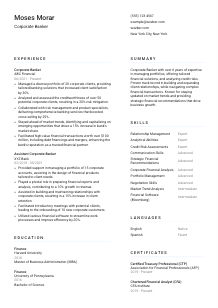

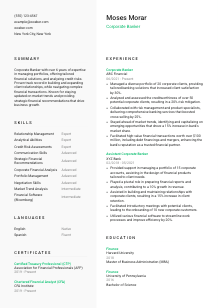

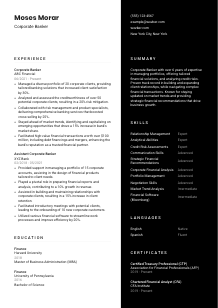

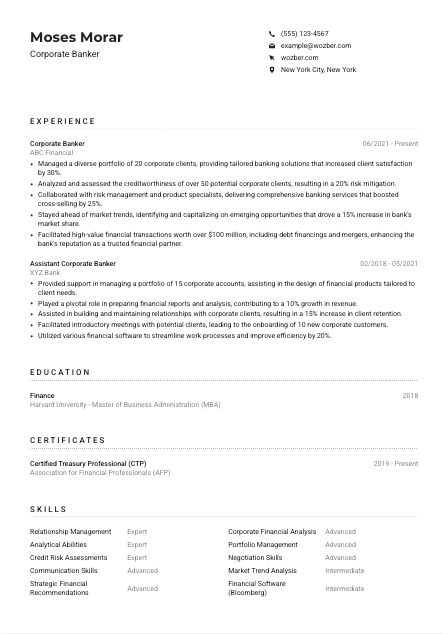

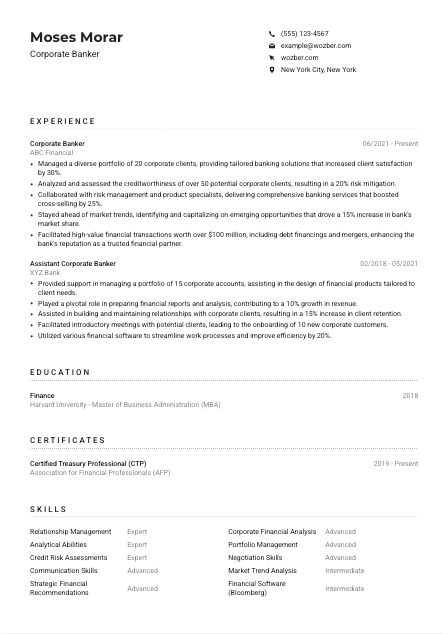

Corporate Banker Resume Example

Juggling stocks and bonds, but your resume seems interest-rate flat? Dive into this Corporate Banker resume example, mapped out with Wozber free resume builder. Learn how to align your financial prowess with job demands, propelling your career to growth and dividends!

How to write a Corporate Banker Resume?

Embarking on the path to becoming a Corporate Banker in the bustling financial district? Your resume is not just a document; it's the key to unlocking your dream job. This journey, paved with precision and strategy, leads to crafting a resume that doesn't just speak to your skills but echoes your perfect alignment with the role of a Corporate Banker.

With the help of Wozber's free resume builder and expert guidance on ATS optimization, you're about to create a resume that stands tall in the competitive finance landscape. Get ready to align your financial acumen with your career aspirations!

Personal Details

In the world of banking, first impressions are critical. The personal section of your resume is more than just basic information; it's your first handshake with the hiring manager. Here's how to ensure this section is as polished as the marble floors of Wall Street.

1. Brand Yourself

Start with your name, prominently displayed. Think of it as your professional banner, welcoming the viewer into your world of expertise.

2. Align Your Title

Just beneath your name, tailor your title to the job you're seeking. For instance, "Corporate Banker" directly mirrors the role advertised and subtly reinforces your suitability.

3. Detailed Contact Info

Include a phone number and a professional email address. Your meticulous attention to detail begins here; ensure there's not a digit or letter out of place.

4. Location Matters

Being located in New York City, as specified, is a logistical plus. Directly mentioning this matches a specific requirement, making you a more convenient candidate.

5. Professional Links

If you have a LinkedIn profile or a personal website showcasing your professional achievements, adding it here can provide a deeper insight into your professional narrative.

Takeaway

Consider the Personal Details section as the gateway to your professional journey. Ensure it reflects the highest standards of accuracy and professionalism, setting the stage for the compelling story that unfolds in your resume. With these steps, you're not just presenting yourself; you're inviting the hiring manager into your professional world. Let's make that introduction count.

Experience

In corporate banking, your track record of managing client portfolios, financial transactions, and risk assessments speaks volumes. Let's delve into tailoring this crucial section to showcase your expertise and alignment with the Corporate Banker role.

- Managed a diverse portfolio of 20 corporate clients, providing tailored banking solutions that increased client satisfaction by 30%.

- Analyzed and assessed the creditworthiness of over 50 potential corporate clients, resulting in a 20% risk mitigation.

- Collaborated with risk management and product specialists, delivering comprehensive banking services that boosted cross‑selling by 25%.

- Stayed ahead of market trends, identifying and capitalizing on emerging opportunities that drove a 15% increase in bank's market share.

- Facilitated high‑value financial transactions worth over $100 million, including debt financings and mergers, enhancing the bank's reputation as a trusted financial partner.

- Provided support in managing a portfolio of 15 corporate accounts, assisting in the design of financial products tailored to client needs.

- Played a pivotal role in preparing financial reports and analysis, contributing to a 10% growth in revenue.

- Assisted in building and maintaining relationships with corporate clients, resulting in a 15% increase in client retention.

- Facilitated introductory meetings with potential clients, leading to the onboarding of 10 new corporate customers.

- Utilized various financial software to streamline work processes and improve efficiency by 20%.

1. Deconstruct the Job Description

Highlight key experiences the job demands, like managing corporate clients' portfolios or facilitating high-value financial transactions. Your goal is to reflect these points with your accomplishments.

2. Present Your Professional Journey

Structure your experience in reverse chronological order. Begin with your most recent position, ensuring each entry includes your job title, the company, and your tenure there.

3. Tailor Your Achievements

For each position held, detail how your contributions have directly impacted your place of employment. Use concrete examples, like "Managed a diverse portfolio of 20 corporate clients, increasing client satisfaction by 30%." This not only mirrors the job at hand but does so with measurable success.

4. Quantify Success

Numbers speak louder than words in the world of finance. Where applicable, quantify your achievements to provide a tangible representation of your impact and capabilities.

5. Relevance is Key

Stick to experiences that tie back directly to the Corporate Banker role. Although being the office ping-pong champion may be a great conversation starter, unless it's directly relevant to banking or client relationships, it's best to leave it off.

Takeaway

Think of the Experience section as the proof of your professional prowess. Each achievement you list is a testament to your suitability for the role of Corporate Banker. This is your chance to show the hiring manager not only that you are capable but that you are the candidate they've been searching for. Tailor wisely, quantify your contributions, and prepare to shine.

Education

In the domain of corporate banking, your educational background is the bedrock upon which your skills and expertise are built. Here's how to sculpt this section to highlight how your educational journey aligns with the Corporate Banker role.

1. Identify Key Educational Requirements

The job calls for a Bachelor's degree in fields like Finance or Economics. Ensure your highest relevant degree is listed first, aligning directly with these requirements.

2. Simplify the Layout

Present your educational achievements clearly. Start with your degree, followed by your field of study, the institution's name, and your graduation year.

3. Match the Job Description

Your Master of Business Administration (MBA) in Finance and Bachelor of Science in Finance directly match the job's requirements. Highlighting these shows you have the precise educational foundation the role demands.

4. Present Relevant Courses

While your degree speaks volumes, noting relevant coursework can add depth to your qualifications, especially for early-career professionals.

5. Showcase Other Achievements

Graduating with honors, participating in finance-related clubs, or completing significant projects can further demonstrate your dedication and capability in your field.

Takeaway

Your Education section is a cornerstone of your resume, providing a snapshot of your academic dedication and the knowledge base you bring to the table as a Corporate Banker. It's not just about where you studied, but how those experiences have equipped you for the challenges and responsibilities of the corporate banking world. Highlight your educational achievements with pride, and let them serve as a testament to your readiness for this role.

Certificates

In the fast-evolving field of corporate banking, staying ahead with relevant certifications can give you a noticeable edge. Let's encapsulate how to integrate this section seamlessly into your resume, showcasing your commitment to professional growth.

1. Clarify Relevant Certifications

The job description hints at an advantage for candidates with certifications like CTP or CFA. If you hold these, make sure they're prominently listed.

2. Prioritize Pertinence

Quality trumps quantity. List only those certifications that align closely with the Corporate Banker role, ensuring they're seen as assets rather than just accolades.

3. Date Your Achievements

For each certification, note the date of attainment or expiration, especially if it's a recently acquired skill or knowledge area. This indicates your ongoing commitment to staying current.

4. Remain Proactive

The financial sector never rests, and neither should your pursuit of excellence. Continuously seek out new certifications and learning opportunities that bolster your expertise and align with your career path.

Takeaway

Certificates in your resume are like badges of honor; they attest to your dedication and expertise in specific areas within corporate banking. They tell the hiring manager that you're not only qualified but also engaged in continuous professional development. Highlight your certifications with pride – they could very well be the tipping point in landing your dream role.

Skills

The Skills section of your resume is where you get to showcase the tools in your professional toolkit. For a Corporate Banker, this means highlighting the hard and soft skills that are directly relevant to the demands of the role. Let's align your skillset with the job requirements.

1. Extract from the Job Description

Peruse the job posting and note both the stated and implied skills required. Skills like "Analytical Abilities" and "Relationship Management" are directly applicable to the role of a Corporate Banker.

2. Match and List

Identify the skills from the job description that you possess, and ensure they're prominently featured in your resume. This creates a direct correlation between what you offer and what the job requires.

3. Organize and Prioritize

Keep this section tidy by focusing on the skills most pertinent to the job at hand. This isn't the place for a comprehensive list but rather a curated selection that showcases your alignment with the role.

Takeaway

The Skills section is your opportunity to highlight your proficiency and readiness for the Corporate Banker role. It's where the nuances of your professional capabilities come to light, offering a condensed glimpse into why you're the right fit. Prioritize relevance and clarity, ensuring each skill you list is a beacon calling out to the hiring manager. Stay focused, stay relevant, and let your skills do the talking.

Languages

In today's interconnected financial markets, the ability to communicate across borders can greatly enhance your appeal as a Corporate Banker. Here's how to effectively incorporate your linguistic skills into your resume, adding yet another layer of desirability to your candidacy.

1. Job Requirement Alignment

The job explicitly requires "effective English communication abilities." If English is your native language, note it upfront. For additional languages, consider the potential global interactions of the role and list accordingly.

2. Prioritize and Proficiency

Start with the languages most relevant to the job, and use clear descriptors for your level of proficiency. This avoids any ambiguity and allows the hiring manager to understand your capabilities fully.

3. Broaden Your Appeal

While the job may not explicitly require additional languages, being multilingual is a significant asset in corporate banking, where understanding diverse clients can be a game-changer.

4. Honesty is the Best Policy

Be truthful about your language proficiency levels. Overestimating your abilities can lead to awkward situations, especially if the role requires client interaction in those languages.

5. Global Role Consideration

For positions requiring or benefiting from a global perspective, your language skills can set you apart. Demonstrating your ability to navigate multicultural environments can be a strong asset.

Takeaway

The Languages section of your resume is not just about listing the languages you speak; it's about showcasing your ability to connect and communicate in a global market. For a Corporate Banker, this can be a standout feature of your resume, indicating your readiness to engage with clients and markets across the globe. List your languages with confidence, highlighting the depth of your global perspective.

Summary

The summary section is your opening statement, a succinct encapsulation of your professional identity. For a Corporate Banker, this means a blend of analytical prowess, financial acuity, and client relationship skills. Here's how to distill your essence into a potent summary.

1. Digest the Job Description

Understand the core requirements of the Corporate Banker role. This foundational step ensures your summary aligns perfectly with what the job demands.

2. Introduce Yourself

Begin with a clear statement about who you are professionally, highlighting your overall experience in the banking field.

3. Spotlight Your Expertise

Mention specific skills and achievements that directly address the job's requirements. Quantify these where possible to add weight and credibility.

4. Brevity is Key

Keep your summary concise yet impactful. Aim for 3-5 lines that grab attention, succinctly showcasing your alignment with the position and your unique selling points.

Takeaway

The Summary section is your chance to make a compelling first impression. It should echo the job's requirements while highlighting your distinctiveness as a candidate. This is where your journey in crafting a tailored, ATS-optimized resume using Wozber's free resume builder and ATS-friendly resume templates begins. Ensure your summary is polished, poised, and reflective of both your career aspirations and the specific demands of the Corporate Banker role. Let your professional narrative captivate and convince from the get-go.

Embarking on Your Corporate Banker Journey

With these tailored insights and Wozber's comprehensive suite of tools at your disposal, you're now ready to craft a resume that not only meets but surpasses the expectations of hiring managers in the corporate banking sector. Your resume is more than a document; it's a strategic tool that showcases your unique professional story, optimized perfectly for ATS systems and honed to highlight your fit for the Corporate Banker role. Utilize Wozber's free resume builder, including its ATS-friendly resume templates and ATS resume scanner, to ensure you're presenting the strongest, most aligned version of yourself.

The path to your next great opportunity is clear – it's time to take those confident steps forward.

- Bachelor's degree in Finance, Economics, Business Administration, or a related field.

- Minimum of 5 years' experience in corporate banking, relationship management, or a similar field.

- Demonstrated ability to analyze complex financial data, perform credit risk assessments, and provide strategic financial recommendations.

- Strong interpersonal and communication skills, with the ability to build and maintain relationships with corporate clients.

- Relevant certifications such as Certified Treasury Professional (CTP) or Chartered Financial Analyst (CFA) are a plus.

- Must possess effective English communication abilities.

- Must be located in New York City, New York.

- Manage a portfolio of corporate clients, understanding their financial needs, and providing tailored banking solutions.

- Analyze and assess the creditworthiness of potential and existing corporate clients to mitigate risk and ensure regulatory compliance.

- Collaborate with various internal departments, such as risk management and product specialists, to deliver comprehensive banking services to clients.

- Stay updated on market trends, regulatory changes, and emerging opportunities to maintain a competitive edge in the corporate banking sector.

- Facilitate and negotiate various financial transactions, including debt and equity financing, mergers, and acquisitions.