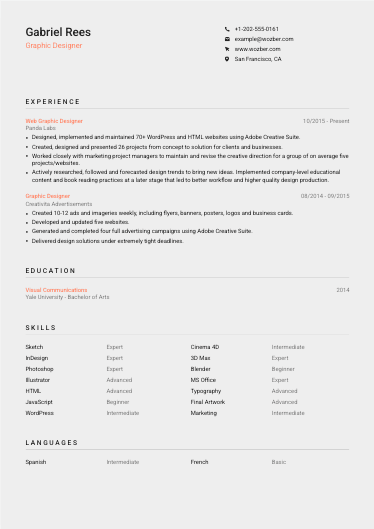

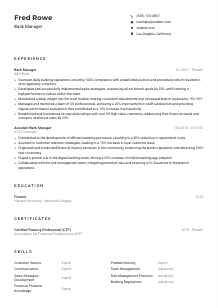

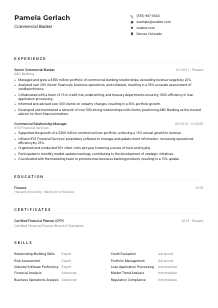

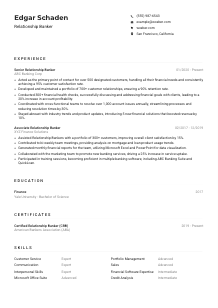

Banker Resume Example

Balancing ledgers, but your resume doesn't add up? Take a look at this Banker resume example, designed with Wozber free resume builder. See just how effortlessly you can align your fiscal finesse with job demands, and deposit your banking career into a growth account!

How to write a Banker resume?

Embarking on your journey as a Banker in the bustling world of finance requires a resume that's not just good, but exceptional—one that reflects your expertise in navigating complex financial landscapes with precision and confidence. Leveraging Wozber's free resume builder, this guide will navigate you through the detailed art of writing a resume tailored specifically for a Banker position. With insights on ATS-compliant resume crafting, including utilizing ATS-friendly resume templates and optimizing with an ATS resume scanner, you're about to transform your resume into a compelling narrative that banks on your success!

Personal Details

In the banking sector, first impressions count, and your resume's Personal Details section is precisely that. Here, you're not just providing contact information; you're signaling your readiness and fit for the role. Let's perfect this section to catch the eye of any banking recruiter.

1. Command Attention with Your Name

Your name should command attention—make it prominent. Use a clear font that's professional yet distinct. As a Banker, ensuring your personal brand stands out from the get-go is crucial in a competitive job market.

2. Match the Job Title

You're gunning for a Banker position, so make that known immediately. Placing "Banker" just below your name aligns you with the role at first sight. Those two seconds where the hiring manager identifies your application with their need are invaluable.

3. Essential Contact Information

A professional email address and your most reliable contact number are non-negotiable. Ensure there's no room for errors; double-check your details. Residing in "New York City, New York", as stated, ticks a geographical preference box for this particular role, streamlining your path into the interview room.

4. Opt for a Professional Profile Link

Include a link to your LinkedIn profile or a personal website that showcases your expertise and projects. Given the importance of digital presence in today's networking landscape, this step is particularly relevant for a Banker, drawing a holistic picture of your professional demeanor and accomplishments.

5. Keep It To The Point

Steer clear of personal details that aren't required—age, marital status, or photo. Let your professionalism and qualifications speak for you. In the banking world, discretion and privacy are valued; your resume should echo this ethos.

Takeaway

Consider the Personal Details section as your initial handshake with the hiring manager—firm, professional, and inviting further conversation about your potential role within their team. It's your first step in the realm of professional success. Make it as impactful as possible.

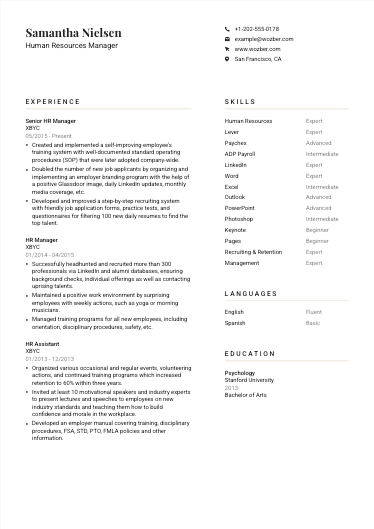

Experience

In the realm of banking, your experience speaks volumes. It's your proof of capability and adaptability within intricate financial systems. Translating this experience effectively on your resume requires strategic thought. Here's how to mirror the needs of the Banker job and present your achievements in the best light.

- Managed and oversaw over 500 client accounts, consistently ensuring their financial needs were met and exceeded.

- Analyzed financial profiles of over 700 clients annually to offer suitable banking products, leading to a 25% increase in account openings.

- Ensured 100% compliance with bank policies, procedures, and regulatory requirements by conducting monthly audits.

- Developed and strengthened relationships with over 350 existing clients, resulting in a 20% increase in account referrals.

- Collaborated with internal teams to streamline banking operations, reducing process times by 15%.

- Successfully managed a portfolio of 300 clients, providing personalized financial advice and solutions.

- Introduced a new client onboarding system, enhancing user experience and reducing onboarding time by 30%.

- Played a key role in training 20+ new associates on banking software, improving overall team productivity by 20%.

- Participated in cross‑departmental initiatives, leading to a 15% increase in product cross‑sell.

- Assisted senior bankers in complex financial analyses, contributing to a 10% growth in premium account sign‑ups.

1. Dissect the Job Requirements

The job entails managing client accounts and analyzing financial data among other responsibilities. Break down these needs and reflect on how your past roles have prepared you for these tasks. It's about drawing parallels between your experience and the job's demands.

2. Structuring Your Professional Journey

List your roles chronologically, prioritizing the most recent and relevant. For instance, your role as "Senior Banker" where you managed over 500 client accounts directly resonates with the primary responsibilities of the Banker position you're eyeing.

3. Articulate Your Achievements

Quantify your accomplishments to lend them weight. Did you boost account openings by 25%? Specify that. Banking is numbers-driven; your resume should echo that reality, demonstrating your impact in tangible terms.

4. Numbers Tell the Tale

Whenever possible, quantify your contributions. Metrics like a '15% reduction in process times' or '20% increase in account referrals' are golden, painting a clear picture of your efficiency and effectiveness.

5. Relevance is Key

While it's great to have diverse experiences, focus on banking and financial services roles that directly speak to the requirements listed. Showcase your journey through the lens of the banking sector's needs and expectations.

Takeaway

Think of the Experience section as the meat of your banking saga, where each bullet point contributes to building a compelling case for your candidacy. Keep it relevant, quantified, and directly correlated to the job at hand. You're painting a picture of an invaluable addition to their banking team.

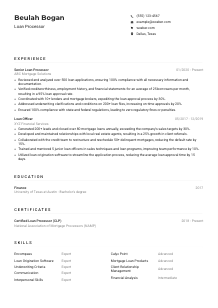

Education

The banking sector places significant emphasis on formal education and continuous learning. Your resume's Education section is more than just a list of degrees; it's a testament to your foundational understanding of finance and business. Let's finesse this section to reflect your readiness for the Banker role.

1. Identifying Key Educational Needs

Start with the cornerstone—a Bachelor's degree in Finance or a related field. Ensure your degree aligns with this prerequisite. This baseline qualification acts as your passport into the world of banking.

2. Structure with Clarity

Present your educational background in a clear, concise manner. Degree type, field of study, then institution, followed by the graduation year. For example, presenting your "Bachelor's degree in Finance from a prestigious university" directly aligns with the job's educational requirements.

3. Detail the Degree

If your degree specifically aligns with the job—like a Bachelor's in Finance—highlight it. This immediately showcases your educational compatibility with the role and reinforces your expertise in the field.

4. Relevant Courses or Achievements

While the broader degree may cover essentials, highlighting specific courses or milestones (such as a thesis relevant to banking) can add depth to your educational narrative, especially if these elements align closely with the skills or knowledge the job requires.

5. Continuous Learning and Accolades

Banking is an ever-evolving sector. If you've pursued additional certifications, workshops, or were part of relevant clubs or societies, mention those. It demonstrates your commitment to staying at the forefront of industry knowledge and trends.

Takeaway

Your Education section lays down a solid foundation for your understanding and capability in finance. Tailor it to not only meet but exceed the role's requirements, showcasing you as not just a candidate, but an asset to the banking world.

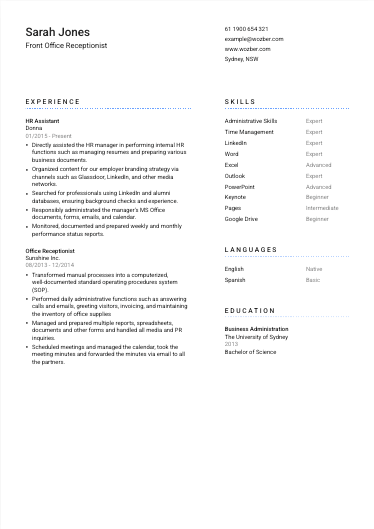

Certificates

Banking, with its rigorous standards and continuous innovations, values certified professionals who invest in their skills. Your Certificates section is an opportunity to demonstrate your dedication and expertise in specific banking competences. Let's ensure your certificates cast you in the best possible light for the Banker role.

1. Correlate with Job Specifications

The job description mentions a preference for certifications such as Certified Personal Banker (CPB) or Certified Retail Banker (CRB). If you possess these, they deserve a prime spot on your resume, directly linking you to the job's desired credentials.

2. Prioritize Relevant Certifications

While listing every certificate might be tempting, focus on those most relevant to banking. This not only saves space but ensures the hiring manager sees immediately that you've invested in skills directly applicable to the Banker role.

3. Date and Detail

For certifications, especially those with expiry dates or recent achievements, including the acquisition date or valid-through period can denote your current competency level, offering a snapshot of your up-to-date expertise.

4. Stay Ahead of the Curve

Banking is dynamic, requiring professionals to continually update their knowledge and skills. Highlight recent certificates or ongoing training endeavors, suggesting your proactive stance in staying relevant in the field.

Takeaway

Certificates are the badges of honor in the banking world, attesting to your skills and dedication. Carefully curated and strategically placed, they underscore your readiness to elevate your role as a Banker, blending both knowledge and innovation.

Skills

In banking, your skillset is your most powerful asset. It's a blend of technical savvy, analytical acuity, and interpersonal finesse. Optimizing your Skills section to match the Banker job requirements is crucial. With the right approach, you can make this section a compelling highlight of your resume.

1. Decipher the Job Listing

Deep dive into the job description and identify both the stated and inferred skills required. Skills like "analytical skills," "interpersonal skills," and proficiency in "banking software" are explicitly mentioned and should be prominently listed on your resume.

2. Highlight Your Match

Directly align your skills with those mentioned in the job listing. If you're an expert in "Microsoft Office Suite" or possess "advanced proficiency in banking software," make it known. This instantly signals to the hiring manager that you're a fit.

3. Organize for Impact

While it's tempting to list every skill you possess, prioritize those most relevant to the banking sector and the specific role you're applying to. This curated approach ensures your resume remains clutter-free and focused, amplifying your suitability for the position.

Takeaway

Your skills are a testament to your readiness for the Banker role. By strategically aligning your skillset with the job requirements, you demonstrate not just compatibility, but excellence. Remember, in banking, every skill is a lever for success. Position them wisely on your resume, and watch opportunities unfold.

Languages

The banking industry operates on a global stage, where communication across borders can be a significant advantage. Your proficiency in languages can therefore be a unique selling point, especially in roles that require liaising with international clients. Let's tailor your Languages section to reflect your global acumen.

1. Assess Job Language Requirements

For the Banker position, "English language fluency" is explicitly required. Highlighting your native or fluent English proficiency is paramount, directly addressing a crucial job requirement.

2. Prioritize Key Languages

Beyond the essential, listing other languages you're proficient in showcases your potential to communicate with a broader client base. While the job might prioritize English, additional languages can set you apart in a globalized sector.

3. Honest Proficiency Levels

Clearly state your level of proficiency—whether native, fluent, intermediate, or basic. This honesty ensures expectations are set accurately, and you can confidently engage in conversations at your stated level of proficiency.

4. Value in Versatility

Even if additional languages aren't a strict job requirement, they undeniably add value, suggesting your ability to navigate multicultural environments with ease—a plus in the dynamic, global world of banking.

5. The Role's Global Scope

Consider the broader implications of your linguistic skills in the context of the role. In banking, where cross-border transactions and international client interactions are common, your language skills can greatly enhance your appeal as a global finance navigator.

Takeaway

In banking, every language you speak fluently is an asset, bridging gaps and building connections. Flaunt your linguistic capabilities proudly on your resume, embracing your role as a facilitator of global financial dialogues. Let languages be your passport to opportunities in the world of banking.

Summary

A compelling Summary section sits atop your resume, offering a snapshot of your professional identity. For a Banker, it's the chance to encapsulate your expertise, experience, and readiness for the role. Here's how to draft a summary that captures and holds attention, compelling hiring managers to delve deeper into your resume.

1. Grasp the Job's Core

Before drafting your summary, reflect deeply on the job description. Understand the essence of the Banker role you're targeting—the need for analytical prowess, client management skills, and a strong financial acumen.

2. Opening with Impact

Begin with a powerful introduction that positions you squarely in the banking sector, with phrases like, "Banker with over 7 years of experience." This establishes your domain expertise immediately.

3. Reflect the Requirements

Incorporate key skills and achievements that directly respond to the job's requirements. Phrases like "analyzing financial data" and "ensuring seamless banking operations" mirror the responsibilities outlined in the job description, fostering an immediate connection.

4. Concise and Powerful

Keep your summary brief yet impactful. In just a few lines, illuminate your qualifications, demonstrating why you're not just a candidate, but the candidate for the Banker position. Efficiency in communication is a prized skill in banking; let your summary reflect that prowess.

Takeaway

Consider your Summary the prelude to your professional narrative, drawing the hiring manager into your story. Craft it with intention, aligning it meticulously with the Banker role you aspire to. Capture their interest, make your case succinctly, and pave the way for the rest of your resume to shine.

Launching Your Banker Journey

With these tailored guidelines, you're equipped to craft a Banker resume that not only meets the mark but elevates your application to the top of the pile. Utilize Wozber's free resume builder, including its ATS-friendly resume templates and ATS resume scanner, to ensure your resume's design and content are optimized. As you fine-tune each section, remember, your resume is your narrative in the competitive world of banking—it has the power to open doors and forge paths to new professional heights.

Ready to make your mark? Create your resume today and step confidently into your future in finance.

- Bachelor's degree in Finance, Business Administration, or related field.

- Minimum of 3 years of experience in banking or a related financial sector.

- Proficiency in using banking software and Microsoft Office Suite.

- Strong analytical, interpersonal, and communication skills.

- Certification in Certified Personal Banker (CPB) or Certified Retail Banker (CRB) is a plus.

- English language fluency is a key requirement.

- Must be located in New York City, New York.

- Manage and oversee client accounts, ensuring their financial needs are met.

- Analyze financial data to offer suitable banking products, services, or solutions to clients.

- Ensure compliance with all bank policies, procedures, and regulatory requirements.

- Develop and maintain strong relationships with existing clients while seeking out potential new clients.

- Collaborate with internal departments to ensure seamless banking operations for clients.