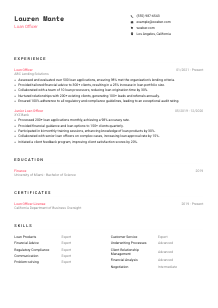

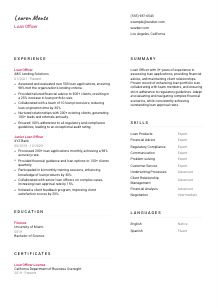

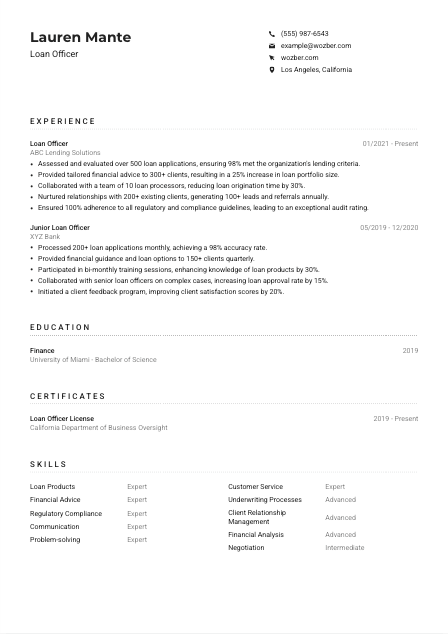

Loan Officer Resume Example

Navigating financial pathways, but your resume seems to need a loan? Dive into this Loan Officer resume example, structured with Wozber free resume builder. Learn how to present your lending expertise to align with job requirements, ensuring your career investments pay off with interest!

How to write a Loan Officer resume?

Hello, aspiring Loan Officer! You're about to embark on a journey to craft a resume that not only meets the demands of the job description but also showcases your expertise in a way that makes you impossible to overlook. With the help of Wozber's free resume builder, this guide is tailored specifically for the Loan Officer role, ensuring your resume shines in the competitive financial industry. Let's translate your skills and experiences into a resume that speaks directly to hiring managers, ensuring you stand out in the bustling job market of Los Angeles.

Personal Details

Your personal information is like the front door to your professional world. It's the first thing hiring managers see, making it vital to tailor this section specifically for the Loan Officer role. Here's how to set the right tone from the get-go.

1. Branding With Your Name

Your name should echo the professionalism you bring to the table. Opt for a clean, bold font that makes your name pop off the page, laying the groundwork for the narrative of your professional achievements.

2. Job Title Precision

Position yourself strategically by echoing the job title "Loan Officer" immediately after your name. This alignment shows you're not just looking for any job – you're here for this job.

3. Essential Contact Details

- Accessible Number: Make it easy for employers to reach you. A quick glance should reveal a typo-free, professional contact number.

- Professional Email: Employ a straightforward email format that combines professionalism with simplicity, such as firstname.lastname@domain.com.

4. Localize Your Profile

Mentioning "Los Angeles, California" not only shows you're in the heart of the market but also eliminates any relocation concerns right off the bat.

5. Digital Presence

If applicable, include a link to a professional profile or website. Verify that its content complements your resume, presenting a unified and professional online persona.

Takeaway

Think of your Personal Details as the firm handshake that introduces your professional story. By ensuring this section is meticulously tailored to the Loan Officer role, you're taking the first step towards making a memorable impression.

Experience

The Experience section is your opportunity to shine, revealing your journey through the financial world. This is where you prove you're not just a fit for the Loan Officer role but the ideal candidate. Let's dive into how to tailor this pivotal section.

- Assessed and evaluated over 500 loan applications, ensuring 98% met the organization's lending criteria.

- Provided tailored financial advice to 300+ clients, resulting in a 25% increase in loan portfolio size.

- Collaborated with a team of 10 loan processors, reducing loan origination time by 30%.

- Nurtured relationships with 200+ existing clients, generating 100+ leads and referrals annually.

- Ensured 100% adherence to all regulatory and compliance guidelines, leading to an exceptional audit rating.

- Processed 200+ loan applications monthly, achieving a 98% accuracy rate.

- Provided financial guidance and loan options to 150+ clients quarterly.

- Participated in bi‑monthly training sessions, enhancing knowledge of loan products by 30%.

- Collaborated with senior loan officers on complex cases, increasing loan approval rate by 15%.

- Initiated a client feedback program, improving client satisfaction scores by 20%.

1. Job Description Analysis

First, dissect the job description. Highlight verbs and industry terminology that resonate with your own experiences, like "assessed and evaluated loan applications" and "nurtured relationships with clients," ensuring you're speaking the same language as your potential employer.

2. Chronological Layout

Lead with your most recent position and work backwards, clearly listing your title, company name, and dates of employment. This clarity guides hiring managers through your career progression seamlessly.

3. Achievement Highlighting

Under each position, craft bullet points that speak directly to the job's responsibilities and requirements. Use active language to detail how you've assessed applications, advised clients, and led projects, quantifying your impact wherever possible.

4. Quantification of Success

When you say you've "increased loan portfolio size by 25%," you're providing concrete evidence of your capabilities. Numbers translate your efforts into tangible successes, making your achievements resonate more clearly.

5. Relevance Over Volume

Resist the urge to list every task you've ever tackled. Focus instead on the responsibilities that align with the Loan Officer role, ensuring every line reinforces your fit for the position.

Takeaway

Think like a hiring manager and ask yourself, 'What achievements here prove I'm the best candidate for the role?' Highlight your successes, tailor your responsibilities, and watch as your resume rises to the top of the pile.

Education

In the world of finance, your educational background is the bedrock of your expertise. Let's ensure your Education section aligns perfectly with the Loan Officer position, underscoring your foundational knowledge and readiness for the role.

1. Identify Requirements

Pinpoint the education level the job demands. For the Loan Officer position, a "Bachelor's degree in Finance, Business Administration, or related field" is a must-have. Make sure your degree's relevance is immediately clear.

2. Clear Structure

Maintain clarity with a straightforward listing of your degree, the field of study, the institution's name, and your graduation date. This neat presentation makes it easy for hiring managers to confirm your qualifications.

3. Degree Specifics

If you have the exact degree listed in the job description, such as a "Bachelor of Science in Finance," highlight it prominently. This direct match is a significant advantage in your favor.

4. Relevant Coursework

Adding relevant courses is a plus, especially if they directly relate to the Loan Officer role. Include courses on financial law, risk management, or any other subject that prepares you for the specific tasks you'll face.

5. Additional Credentials

If you've achieved honors, participated in finance-related clubs, or completed impactful projects, mention these too. They demonstrate your commitment and depth of interest in your field.

Takeaway

Your education is a story of commitment, learning, and growth. Highlight it in a way that shows you're not just qualified but deeply invested in your professional path. Let your educational achievements pave the way to your next career milestone.

Certificates

In the loan sector, where regulations and technologies evolve rapidly, certificates can significantly bolster your credibility. Here's how to showcase your certificates to attractively complement your Loan Officer aspirations.

1. Requirement Matching

Begin by identifying certificates explicitly mentioned in the job description. A "Valid state-specific Loan Officer License" is non-negotiable for the role. Ensuring your certification is up to date and highlighted on your resume is crucial.

2. Focused Listing

Prioritize your certifications by relevance, placing those that directly impact your loan officer capabilities front and center. This strategic ordering tells hiring managers that you've got the specific knowledge they're looking for.

3. Date Detailing

Include issuance or expiration dates for time-sensitive certifications. This transparency about your credentials' currency ensures hiring managers your knowledge is fresh and applicable.

4. Continuous Learning

The financial landscape is always changing, and so should your expertise. Mention any recent or ongoing certification courses, illustrating your initiative and dedication to staying ahead in your field.

Takeaway

Certificates are badges of your dedication to professional growth. By highlighting relevant, up-to-date certifications, you're underscoring your commitment to excellence in the Loan Officer role. Keep learning, keep growing, and let your resume reflect your journey.

Skills

Your skills section is a concise showcase of your professional capabilities. For the Loan Officer role, this means highlighting your analytical prowess, communication skills, and understanding of financial regulations. Let's tailor this section to make it compelling.

1. Analyzing Job Demands

First off, extract both the explicit and implicit skill requirements from the job description. Skills like "Strong understanding of loan products" and "Excellent communication" are non-negotiables for the position.

2. Skills Alignment

Directly align your skills with those listed in the job description. This includes both hard skills like "Financial Analysis" and soft skills such as "Problem-solving." This alignment showcases your fit for the role.

3. Prioritizing Key Skills

Resist the temptation to list every skill you possess. Prioritize those most relevant to the Loan Officer role, ensuring the list remains focused and impactful.

Takeaway

Your skills are a testament to your career journey. Tailoring this section to the Loan Officer position, you're not just listing competencies; you're illustrating why you're the perfect candidate for the role. Keep sharpening your skill set, and your determination will shine through.

Languages

In an increasingly globalized industry, your ability to communicate in multiple languages can be a significant asset. This section is your chance to highlight your linguistic skills, making your resume even more appealing to employers.

1. Aligning with Requirements

The job listing emphasizes "Fluent in English, both verbally and in writing." Ensure your proficiency level in English is clearly stated as 'Native' or 'Fluent' to meet this critical requirement.

2. Prioritizing Key Languages

List languages in order of relevance to the position, starting with those explicitly mentioned in the job posting. Subsequently, include any additional languages, as they demonstrate your capability to engage with a diverse client base.

3. Detailing Proficiency Levels

Be precise about your language proficiency, whether it's 'Native,' 'Fluent,' 'Intermediate,' or 'Basic.' This clarity lets employers gauge how you can contribute to their multicultural or international engagements.

4. Recognizing the Role's Scope

Consider the broader implications of your linguistic skills. If the Loan Officer role involves interactions with non-English speaking clients or international markets, your multilingual abilities become even more crucial.

5. Honesty in Proficiency

Remain truthful about your language skills. Overstating your abilities can lead to uncomfortable situations, while honest representation showcases integrity and self-awareness.

Takeaway

Languages are your gateway to the world, enhancing your ability to connect with clients and colleagues from diverse backgrounds. Celebrate your linguistic abilities on your resume, and watch as they open doors to new opportunities in the Loan Officer role and beyond.

Summary

Your summary is the elevator pitch of your professional narrative, distilled into a few compelling sentences. For a Loan Officer, it's your chance to highlight the unique blend of skills and experiences that make you the ideal candidate. Let's create a summary that catches the hiring manager's eye.

1. Grasping the Job's Essence

Before you start writing, take a moment to truly understand the Loan Officer role. Reflect on how your experiences align with the job's requirements and responsibilities.

2. Starting Strong

Open with a statement that captures your professional identity and experience level, such as 'Loan Officer with 3+ years of experience in assessing loan applications.' This sets a strong, confident tone for the rest of your resume.

3. Matching Key Requirements

Enumerate your skills and achievements that directly respond to the job description. Highlight aspects like 'enhancing loan portfolio size,' 'nurturing client relationships,' and 'ensuring strict adherence to regulatory guidelines.'

4. Conciseness is Key

Your summary should be a teaser, not a tell-all. Aim for a crisp, punchy paragraph that invites hiring managers to read further, enticing them with your qualifications and potential value to their team.

Takeaway

A well-crafted summary sets the stage for your resume, drawing the hiring manager into your story. By aligning it closely with the Loan Officer position, you're signaling your fit from the very beginning. This is your chance to make a lasting first impression. Let your summary speak volumes about your professionalism and drive.

Embarking on Your Loan Officer Journey

Congratulations on completing this comprehensive walkthrough! Armed with these insights and Wozber's free resume builder, including free ATS-friendly resume templates and ATS resume scanner for keyword optimization, you're all set to craft a Loan Officer resume that not only meets but exceeds expectations. Remember, each section of your resume is an opportunity to tell your story, to showcase your journey towards becoming the ideal Loan Officer. Keep refining, keep tailoring, and don't forget to review your resume with our ATS optimization tools.

The next step in your career is just around the corner. Good luck!

- Bachelor's degree in Finance, Business Administration, or related field.

- Minimum of 2 years experience in lending or banking.

- Strong understanding of loan products, underwriting processes, and regulatory guidelines.

- Excellent communication and interpersonal skills to effectively work with clients and team members.

- Valid state-specific Loan Officer License (if applicable).

- Fluent in English both verbally and in writing.

- Must be located in Los Angeles, California.

- Assess and evaluate loan applications to ensure they meet the organization's lending criteria.

- Provide financial advice and guidance to clients, offering suitable loan options and terms.

- Collaborate with loan processors and underwriters to facilitate a smooth loan origination and approval process.

- Maintain and nurture relationships with existing and prospective clients to generate leads and referrals.

- Adhere to all regulatory and compliance guidelines, ensuring the organization remains in good standing.