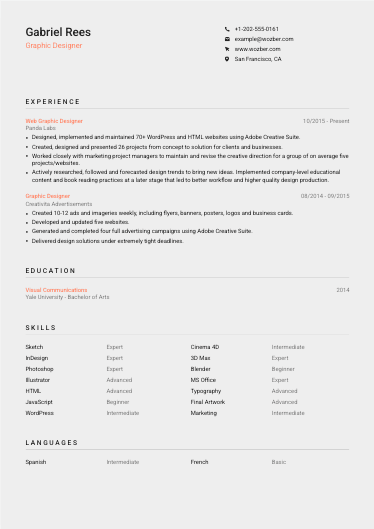

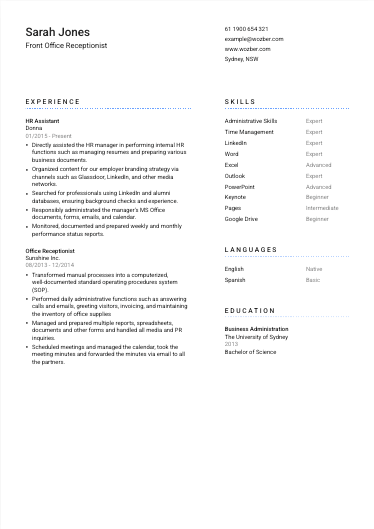

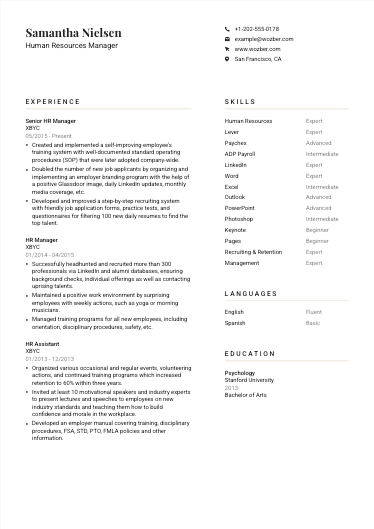

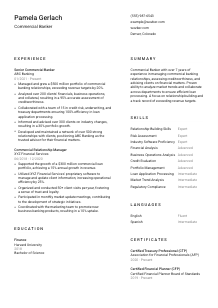

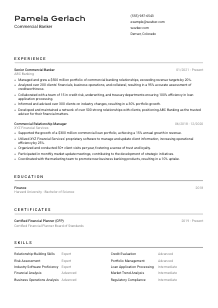

Commercial Banker Resume Example

Wealthy portfolios, but your resume feels bankrupt? Delve into this Commercial Banker resume example, furnished with Wozber free resume builder. Learn how to cash in on your finance experience to align with commercial lending requirements, ensuring your career stays robust with monetary milestones!

How to write a Commercial Banker Resume?

Aspiring to command the financial sector as a Commercial Banker? In the fast-paced world of commercial banking, where your expertise can shape businesses, your resume is your gateway. With the Wozber free resume builder, you're about to transform your resume into a targeted, compelling narrative that aligns perfectly with job descriptions, making it ATS-friendly.

Engage in this journey of fine-tuning your resume, making each section a testament to your readiness for the role. Let's equip you with the tools to ensure your resume doesn't just open doors but invites you in with a red carpet.

Personal Details

Kickstarting your resume with personal details, we aim to pitch it just right – aligning with the Commercial Banker role requirements. This initial handshake sets a professional tone, ensuring your entry details are not just a formality but a polished introduction.

1. Start Proudly with Your Name

Make your name memorable! Ensure it stands proudly, setting a commanding presence at the top of your resume. This isn't just any name; it's the brand of your professional self, potentially embossed on a future Commercial Banking desk plaque. Use a clear, bold font to make it easily identifiable.

2. Job Title: Your Professional Marquee

Directly beneath your name, align with the job by titling yourself as a "Commercial Banker". This immediate identification tunes the hiring manager into recognizing you as a fitting candidate, resonating with the "Commercial Banker" role mentioned in your targeted job description.

3. Contact Information: The Link to Your Professional World

Your contact information bridges the gap between you and your next role. Include a professional email and your most accessible contact number. Precision is key - double-check for typos! If you have a LinkedIn profile or a personal website showcasing your professional accomplishments or certificates, add these too. It's a digital era; let your online presence advocate for you.

4. Location: The Logistics of Your Availability

For a role specifying a location, such as "must be located in Denver, Colorado", aligning your resume by mentioning your Denver locale is strategic. It subtly checks off a logistic requirement and eases any concerns about relocation.

5. Personal Website: The Extended Professional You

If you have a professional portfolio or a LinkedIn profile that mirrors—and amplifies—the information on your resume, link it. Make sure it's up-to-date and reflective of your professional ethos. This extra layer can significantly amplify your candidacy, offering a fuller picture of your accomplishments.

Takeaway

This section is more than just formalities; it's the opening notes of your professional symphony, setting the rhythm for what's to come. Craft it with the care it deserves, aligning every detail with the Commercial Banker position you're eyeing. Consider each entry as laying down the welcome mat for your application.

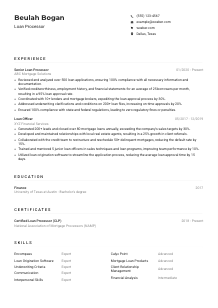

Experience

The experience section is your professional battleground, where every bullet point fights to show your suitability for the Commercial Banker role. Let's strategize how to make this section not just informative but illustrative of your banking prowess.

- Managed and grew a $500 million portfolio of commercial banking relationships, exceeding revenue targets by 20%.

- Analyzed over 200 clients' financials, business operations, and collateral, resulting in a 95% accurate assessment of creditworthiness.

- Collaborated with a team of 15 in credit risk, underwriting, and treasury departments ensuring 100% efficiency in loan application processing.

- Informed and advised over 300 clients on industry changes, resulting in a 30% portfolio growth.

- Developed and maintained a network of over 500 strong relationships with clients, positioning ABC Banking as the trusted advisor for their financial matters.

- Supported the growth of a $300 million commercial loan portfolio, achieving a 15% annual growth in revenue.

- Utilized XYZ Financial Services' proprietary software to manage and update client information, increasing operational efficiency by 25%.

- Organized and conducted 50+ client visits per year, fostering a sense of trust and loyalty.

- Participated in monthly market update meetings, contributing to the development of strategic initiatives.

- Coordinated with the marketing team to promote new business banking products, resulting in a 10% uptake.

1. Dissecting the Job Description

Your first move is to thoroughly understand the job description. For the Commercial Banker position, highlight key words such as "manage and grow a portfolio" or "analyze clients' financials". These will be the pillars upon which you construct your experience narrative.

2. Presenting Your Professional Journey

Structure your experience in reverse chronological order, so your most recent and relevant roles take precedence. For each role, include your job title, company name, and the period of your tenure. This not only lays out a clear timeline but also highlights your progression in the finance sector.

3. Accomplishments with a Purpose

For each role you list, concentrate on achievements that mirror the responsibilities in the Commercial Banker job description. Statements like "Managed and grew a $500 million portfolio, exceeding targets by 20%," directly echo the required skills and results-driven nature of the role.

4. Quantifying Success

Numbers create impact. When you can, quantify your achievements to give a tangible measure of your success. For example, mentioning the size of the portfolio you managed or the percentage by which you exceeded targets underlines your effectiveness and ambition.

5. Relevance Rules

Ensure every point in this section speaks directly to the necessities of being a Commercial Banker. Sidestep unrelated achievements, focusing only on the experiences that showcase your capability and potential in commercial banking.

Takeaway

Think of your experience section as your professional showcase, underlining your achievements, roles, and the direct value you've brought to each position. Tailor it meticulously, making sure that each point aligns with the Commercial Banker role, proving without a doubt that you're not just suitable, but the perfect candidate.

Education

In the realm of commercial banking, your educational background sets the stage for your expertise. Let's ensure this section underlines your qualification for the Commercial Banker role, showcasing your foundational knowledge and specialized study.

1. Identifying Educational Essentials

Begin with pinpointing the exact educational requirements listed in the job posting. For a Commercial Banker, a "Bachelor's degree in Finance, Business, or related field" is standard. Aligning your education accordingly positions you as a fit from the start.

2. Streamlined Structure

Present your educational achievements clearly: list your degree, the field of study, the institution, and your graduation year. For the Commercial Banker specifically, detailing your "Bachelor of Science in Finance" directly aligns with the job's educational prerequisites.

3. Degree Specificity

If the role asks for a specific degree like Finance or Business, listing your exact degree matches you directly with the requirement. For those aspiring to a Commercial Banker role, this ensures you're seen as academically prepared for the complexities of commercial banking.

4. Relevant Coursework and Honors

Though a broad degree title might suffice, detailing relevant courses or honors can set you apart. This isn't necessary for everyone, but for early-career individuals or those whose degree titles are not directly in finance, it can provide deeper insight into your qualifications.

5. Other Educational Highlights

Include any relevant memberships, extracurriculars, or academic projects if they underscore your fit for the Commercial Banker role. This is particularly effective for recent graduates or those with less experience, helping bridge the gap between education and professional application.

Takeaway

Your education is more than a list of qualifications; it's the bedrock of your professional journey. Tailoring this section to meet the specific requirements of a Commercial Banker sets a solid foundation for your resume, underlining your readiness to handle the analytical and financial rigors of the role.

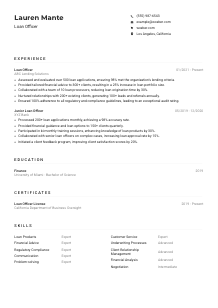

Certificates

In commercial banking, certifications can be a testament to your expertise and dedication to the field. Let's explore how to present your certifications in a manner that resonates with the Commercial Banker role, showcasing your continuous learning and specialized skills.

1. Reflecting on Job Preferences

Review the job posting for desired certifications. For a Commercial Banker, "Certified Financial Planner (CFP)" or "Certified Treasury Professional (CTP)" could be preferred. Listing these certifications if you have them places you a notch above in meeting job expectations.

2. Prioritizing Pertinent Certifications

Focus on listing certifications that are closely aligned with the role's demands. This ensures hiring managers immediately see your commitment and expertise in areas that matter most for a Commercial Banker, such as financial planning and treasury management.

3. Authenticity with Dates

For certifications with validity periods or recent achievements, include acquisition or expiration dates. This underscores not just your qualification but your initiative in staying updated in the rapidly evolving commercial banking sector.

4. Ongoing Learning

The finance realm is ever-evolving; show your dedication to professional growth by continuously updating your certifications. This proactiveness indicates to hiring managers your commitment to maintaining the highest standards of knowledge and expertise.

Takeaway

Your certifications are more than accolades; they're a reflection of your commitment to staying at the forefront of commercial banking. Highlighting these, especially when they align with the job's preferences, amplifies your application, making your resume not just compliant, but compelling.

Skills

Every Commercial Banker needs a set of hard and soft skills tailored to navigating the complexities of commercial banking. Let's dissect how you can reflect these skills in your resume, aligning with the job description while showcasing your capability to thrive in the role.

1. Unpacking the Job Description

Start by parsing the job description for explicit and implied skills required for a Commercial Banker. Skills such as "Financial Analysis", "Relationship-Building", and "Risk Assessment" are often sought after. Identifying these allows you to match them with your personal skill set.

2. Direct Alignment

List the skills you possess that are a direct match for the role. Striking a balance between hard skills like "Industry Software Proficiency" and soft skills such as "Excellent interpersonal skills" ensures you're presenting a well-rounded candidature.

3. Organized Presentation

Resist the urge to list every skill you have ever mastered. Concentrate on those that resonate most with the Commercial Banker role. This selectivity ensures your resume is focused, making it easy for hiring managers to see why you're an ideal candidate.

Takeaway

Your skills section is your professional highlight reel – an area to showcase your finest professional attributes. Curate this section with precision, ensuring it clearly articulates your ability to excel as a Commercial Banker. Let your skills narrate the story of your potential.

Languages

In the diverse world of banking, being multilingual can set you apart. Whether dealing with global markets or local communities, your language skills can be a significant boon. Let's tailor this section to shine a light on your linguistic capabilities as a Commercial Banker.

1. Job Description Cues

First, ascertain if the job posting specifies any language requirements. For our Commercial Banker role, proficiency in "Fluent English" is a must. By highlighting your fluency in English at the top, you're ticking an essential box straight away.

2. Prioritizing Key Languages

After ensuring the must-have language is prominently listed, add any additional languages you speak. This can be particularly valuable if you're aiming for a position in an area with a diverse clientele or if the bank operates internationally.

3. Honest Proficiency Levels

Be clear and honest about your proficiency levels – from "Native" to "Basic". This transparency ensures that your capabilities are accurately represented, avoiding any potential misunderstandings and positioning you as a trustworthy candidate.

4. Understanding the Role's Scope

While English fluency is non-negotiable, assessing the role's requirements can help you determine the relevance of other languages. If your Commercial Banker role has a global or multicultural facet, highlighting additional languages could significantly strengthen your application.

5. The Power of Connection

Languages are more than a means of communication; they're a bridge to understanding diverse perspectives. Even if not directly required, mentioning additional languages speaks to your ability to connect with a broader range of clients and colleagues.

Takeaway

Your capacity to communicate across languages is a potent tool in the global banking arena. Flaunt this skill with pride on your resume, signaling not just your linguistic abilities but your readiness to engage with a rich tapestry of cultures and markets.

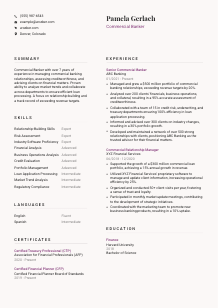

Summary

The summary is where you encapsulate your candidacy, distilling your experience, skills, and ambition into a few compelling lines. For a Commercial Banker, this is your chance to solidify your suitability and make a memorable impact.

1. Capturing the Job's Essence

Reflect on the job requirements and distill them into a core essence. Statements like 'Commercial Banker with over 7 years of experience, specialized in managing commercial banking relationships and advising on financial matters' directly speak to your alignment with the role.

2. A Strong Opening

Begin with a statement that positions you within your profession. Illustrating your trajectory and specific focus areas within the realm of commercial banking sets a clear, authoritative tone right from the start.

3. Spotlight on Key Achievements

Mention several of your most relevant skills and marquee achievements, ensuring they resonate with the Commercial Banker role. Highlighting instances where you've "exceeded revenue targets" or "managed and grew a considerable portfolio" showcases your direct impact and ambition.

4. Conciseness is Key

Though it may be tempting to cover all bases, remember this is a summary, not a cover letter. Aiming for 3-5 impactful lines ensures you grab attention without overwhelming the reader. This is your elevator pitch; make every word count.

Takeaway

Your summary isn't just an introduction; it's a powerful highlight reel distilled into a few sharp sentences. By fine-tuning this section to align strongly with the Commercial Banker role, you set a compelling tone, ensuring you're remembered long after the resume is set down.

Embarking on Your Commercial Banker Journey

Now that you've been equipped with a detailed roadmap for tailoring your Commercial Banker resume, you stand at the threshold of your next professional chapter. With Wozber free resume builder, ATS-friendly resume templates, and ATS resume scanner, you're not just prepared; you're setting new standards in resume optimization. Craft your narrative, embody the role of a Commercial Banker, and let your resume be the key that unlocks new horizons.

The path to securing your dream role is clear. Take that step with confidence and command the future you deserve.

- Bachelor's degree in Finance, Business, or a related field.

- Minimum of 5 years of experience in commercial lending or business banking.

- Strong financial analysis skills and proficiency in using industry-specific software.

- Excellent interpersonal and relationship-building skills.

- Certified Financial Planner (CFP) or Certified Treasury Professional (CTP) certification preferred.

- Fluent English is a requirement for this position.

- Must be located in Denver, Colorado.

- Manage and grow a portfolio of commercial banking relationships to drive revenue and meet individual targets.

- Analyze clients' financials, business operations, and collateral to assess creditworthiness and structure appropriate lending solutions.

- Collaborate closely with credit risk, underwriting, and treasury teams to ensure loan applications are processed efficiently and within established guidelines.

- Stay updated on market trends, regulations, and changes in the industry to offer informed advice to clients.

- Develop and maintain strong relationships with clients, being their trusted advisor in all business-related financial matters.