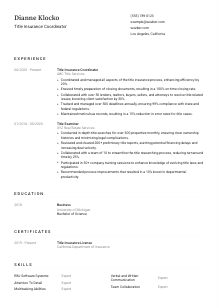

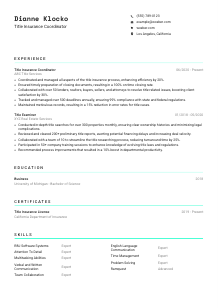

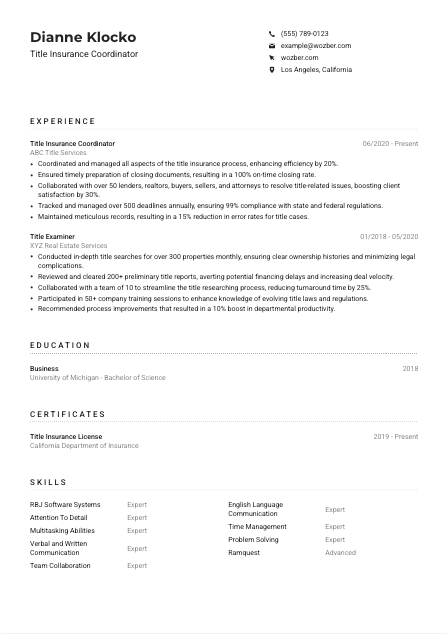

Title Insurance Coordinator Resume Example

Firming up property titles, but feeling uncertain about your resume? Settle in with this Title Insurance Coordinator resume example, arranged with Wozber free resume builder. Grasp how you can precisely underscore your due diligence and title expertise to align with job prerequisites, drafting a career journey that's as secure as a title search!

How to write a Title Insurance Coordinator Resume?

Hello there, future Title Insurance Coordinator! The world of title insurance is intricate, demanding precision, attention to detail, and excellent communication skills. Your resume is not just a piece of paper; it's the first step towards showcasing your expertise in this specialized field. With the help of Wozber's free resume builder, I'm here to guide you through crafting a resume that not only meets but exceeds job expectations.

Ready to secure your position in the title insurance industry? Let's tailor your resume to become the key to unlocking your next career opportunity!

Personal Details

The 'Personal Details' section is more than just formalities; it's your resume's handshake with potential employers. Here, we'll ensure it's a firm one, echoing the diligence required for a Title Insurance Coordinator.

1. Brand Yourself Confidently

Start off strong by placing your name prominently at the top. Use a clear font, making it slightly larger to catch attention. Remember, in the realm of title insurance, confidence begins with claiming your space.

2. Clear Job Targeting

'Title Insurance Coordinator' – seeing your target role right below your name instantly aligns your personal brand with the job at hand. This is your first chance to match the job description, ensuring a perfect fit.

3. Accessibility is Key

List a phone number and a professional email address (think firstname.lastname@email.com) that's checked regularly. Errors in this section can mean missed opportunities, so double-check and then check again.

4. Location, Location, Location

Los Angeles, California, isn't just a detail—it's a requirement for this role. Stating your location upfront meets one of the essential criteria, showing you're in the right place at the right time.

5. Online Footprint

If you have a LinkedIn profile, now's the time to clean it up and link it. In a profession where connections matter, your online professional presence can be a goldmine for opportunities.

Takeaway

Think of the 'Personal Details' as an open door, inviting the hiring manager into your professional journey. Keep it sleek, professional, and perfectly aligned with the target role, ensuring you start off on the right foot.

Experience

In the title insurance world, your experience section is where you solidify your reputation. Let's map out how your past roles have prepared you for the challenges and responsibilities of a Title Insurance Coordinator.

- Coordinated and managed all aspects of the title insurance process, enhancing efficiency by 20%.

- Ensured timely preparation of closing documents, resulting in a 100% on‑time closing rate.

- Collaborated with over 50 lenders, realtors, buyers, sellers, and attorneys to resolve title‑related issues, boosting client satisfaction by 30%.

- Tracked and managed over 500 deadlines annually, ensuring 99% compliance with state and federal regulations.

- Maintained meticulous records, resulting in a 15% reduction in error rates for title cases.

- Conducted in‑depth title searches for over 300 properties monthly, ensuring clear ownership histories and minimizing legal complications.

- Reviewed and cleared 200+ preliminary title reports, averting potential financing delays and increasing deal velocity.

- Collaborated with a team of 10 to streamline the title researching process, reducing turnaround time by 25%.

- Participated in 50+ company training sessions to enhance knowledge of evolving title laws and regulations.

- Recommended process improvements that resulted in a 10% boost in departmental productivity.

1. Dissect the Job Description

Initially, dissect the job description to ensure each responsibility and achievement matches. For example, 'Coordinated and managed all aspects of the title insurance process, enhancing efficiency by 20%' directly reflects the heart of the role.

2. Prioritize Your Roles

Structure your experience with the most recent and relevant roles first. If you've been a Title Insurance Coordinator or held a similar position, make sure it's front and center, showcasing your direct experience.

3. Reflect Your Achievements

"Ensured timely preparation of closing documents, resulting in a 100% on-time closing rate." Such achievements not only echo the job description but also quantify your impact, a crucial step in demonstrating your value.

4. Use Numbers to Your Advantage

Whenever possible, give a number to your success. 'Collaborated with over 50 lenders, realtors, buyers, sellers, and attorneys...' lets your achievements stand tall, showing the breadth of your experience and your ability to communicate effectively across the board.

5. Relevancy is King

Focus solely on relevant experiences. Each bullet point should be a beacon, guiding the hiring manager through your journey, clearly showing why you're the top candidate for this title insurance role.

Takeaway

Your experience section is your professional narrative. Craft it carefully to showcase not just your qualifications, but your dedication to the role of a Title Insurance Coordinator. Make every word count and align every achievement towards the targeted role.

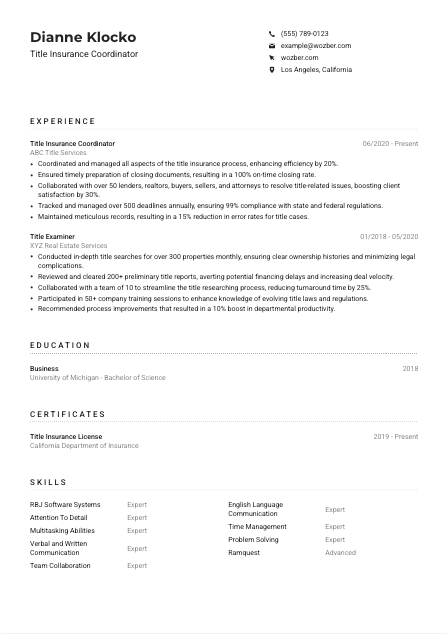

Education

For a Title Insurance Coordinator, your educational background lays the groundwork for your expertise. Let's tailor this section to underline your fitting educational achievements.

1. Identify the Must-Haves

"Bachelor's degree in Business, Finance, or a related field" directly aligns with the job's educational requirements. If your degree sings the same tune, place it front and center.

2. Structuring for Success

A clear structure is key. Degree first, then your major (if applicable), followed by the institution's name and your graduation year. This straightforward format eases the hiring manager's journey through your resume.

3. Exact Match for the Win

If your degree precisely matches the job requirements, like 'Bachelor of Science in Business', highlight it. This isn't just meeting criteria; it's showcasing your direct path toward this career.

4. Coursework and Certifications

While not always necessary, relevant coursework and certifications can bolster your claim to the role. For example, if you've completed courses in real estate law or title insurance, mention these to showcase your commitment to your specialization.

5. Additional Accolades

Any honors, awards, or extracurricular activities related to the field can add depth to your educational story, highlighting your dedication and proactive attitude towards your career in title insurance.

Takeaway

Your education is not just about the past; it's a testament to your preparedness for the future. Showcase it in a way that highlights your relevance and readiness for the challenges of a Title Insurance Coordinator role.

Certificates

In the evolving field of title insurance, staying ahead with certifications can set you apart. Let's highlight the significance of certifications in emphasizing your expertise and dedication.

1. Connect the Dots

Though our job description didn't list specific certifications, adding relevant ones, like a 'Title Insurance License', showcases your commitment and legal qualification for the role.

2. Quality Over Quantity

Only include certifications directly related to the job or the industry. This isn't about padding your resume but strategically bolstering your qualifications with relevant, impactful accolades.

3. Up-to-Date Achievements

For certificates with expiration dates, ensure they're current. If a certification is nearing its renewal date, consider updating it before sending out your resume. This shows continuous improvement and dedication.

4. Continuous Learning

The title insurance landscape is constantly changing. Staying updated with the latest certifications and training shows prospective employers that you're committed to staying at the top of your game.

Takeaway

Each certification you list is a pledge of your commitment to excellence in the title insurance industry. Carefully selected, they can make your resume shine, catching the eye of your future employer.

Skills

The 'Skills' section offers a quick glance at your capabilities. For a Title Insurance Coordinator, this is where you match the technical and soft skills to the job's demands. Let's dive in.

1. Skill Extraction

Look for both explicit and implicit skills in the job description. For instance, 'Proficiency in industry-specific software such as RBJ Software Systems or Ramquest' directly translates into listing 'RBJ Software Systems' and 'Ramquest' as skills.

2. The Perfect Match

Ensure your listed skills directly mirror the job description. Including 'Attention To Detail', 'Multitasking Abilities', and 'Verbal and Written Communication' affirms your alignment with the role's requirements.

3. Clarity and Impact

Less is often more. Focus on listing skills that make an impact and are most relevant to a Title Insurance Coordinator. This is about quality, showcasing your most pertinent capabilities to the role.

Takeaway

Approach your skill set as your professional arsenal, carefully selecting each to directly respond to the job description. Well-chosen skills speak volumes, distinguishing you as the ideal candidate.

Languages

Language skills can considerably enhance your resume. In a role that requires precision in communication, showcasing your linguistic abilities can be a unique asset. Let's explore how.

1. Requirement Resonance

From the job description, 'Strong skills in English language communication essential' indicates English proficiency is non-negotiable. Make sure to list it, showcasing your fluency.

2. Prioritize Relevant Languages

List English at the top as it's explicitly required. If you know additional languages, including them can demonstrate your ability to interact with a diverse client base or handle international documents.

3. Listing with Honesty

When stating your language proficiencies, be truthful. Whether you're 'Native', 'Fluent', 'Intermediate', or have 'Basic' skills, accurate representation ensures expectations are met.

4. A Global Perspective

Understanding additional languages in a city as diverse as Los Angeles can offer a distinct advantage. It shows you're not just ready for the role but also prepared to go the extra mile in communication.

5. The Role's Scope

Given the role's location, having multilingual abilities might not be a direct requirement but can certainly enhance your resume's appeal, demonstrating an added layer of proficiency and adaptability.

Takeaway

Fluency in multiple languages can be a testament to your ability to navigate complex scenarios and communicate with a wider audience. Highlighting language skills can subtly elevate your candidacy for the Title Insurance Coordinator position.

Summary

Your summary is the narrative gateway to your resume, offering a high-level overview of your expertise. For a Title Insurance Coordinator role, let's ensure it captivates from the get-go.

1. Capture the Job's Heart

Begin with a clear statement of your professional identity, directly linked to the Title Insurance Coordinator role. This sets a grounded expectation and shows alignment from the start.

2. Highlight Your Fit

Mention key attributes and experiences that align with the job requirements, like your 'proven expertise in coordinating and managing all aspects of the title insurance process'.

3. Be Concise, Be Impactful

Aim for a compelling yet concise summary, ideally 3-5 lines. This isn't the place for minutiae but for the highlights that make you stand out as the prime candidate for the role.

4. The Teaser

Think of your summary as the teaser for the rest of your resume. It should entice the hiring manager to delve deeper, eager to uncover the specifics of your professional journey.

Takeaway

The goal of your summary is to intrigue and assure the hiring manager that you're the key to the puzzle they're trying to solve. By succinctly capturing your essence, you make a compelling case for why you should be their next Title Insurance Coordinator.

Embarking on Your Title Insurance Coordinator Journey

Congratulations on taking this comprehensive approach to tailor your resume for the Title Insurance Coordinator position! Armed with insights and the power of Wozber's free resume builder, ATS-friendly resume templates, and ATS resume scanner, you're now ready to draft a resume that not only ticks all the boxes but showcases your unique professional narrative. Remember, your resume is the first step towards your dream job; make it count.

The door to your next great opportunity is waiting to be unlocked. Best of luck!

- Bachelor's degree in Business, Finance, or a related field.

- Minimum of 2 years of experience in the title insurance industry.

- Proficiency in industry-specific software such as RBJ Software Systems or Ramquest.

- Strong attention to detail with exceptional organizational and multitasking abilities.

- Excellent verbal and written communication skills for effective client and team collaboration.

- Strong skills in English language communication essential.

- Must be located in Los Angeles, California.

- Coordinate and manage all aspects of the title insurance process, including ordering and reviewing title commitments, and clearing any title defects.

- Ensure timely and accurate preparation of closing documents and facilitate timely closings.

- Collaborate with lenders, realtors, buyers, sellers, and attorneys to resolve any title-related issues and answer queries.

- Track and manage all deadlines, ensuring compliance with state and federal regulations.

- Maintain detailed records and documentation for all title cases and transactions.