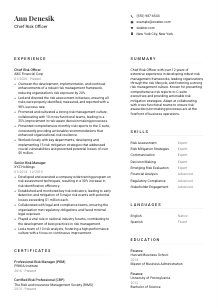

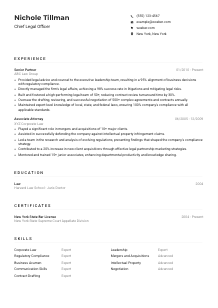

Chief Risk Officer Resume Example

Shielding organizations from uncertainty, but your resume feels like a gambit? Browse through this Chief Risk Officer resume example, fortified with Wozber free resume builder. Grasp how to articulate your risk-slaying strategies to align with firms seeking guardians of stability!

How to write a Chief Risk Officer Resume?

Hello, aspiring Chief Risk Officer! If you're poised to guard an organization against its myriad risks with your unique skills, your resume isn't just a document; it's your arsenal. In the realm of high stakes and strategic defenses, let's leverage the Wozber free resume builder to craft a resume that showcases your prowess in navigating the treacherous waters of risk management. This guide is your blueprint to a resume that doesn't just pass the ATS test but speaks directly to the heart of what hiring managers seek in a Chief Risk Officer.

Ready to command the attention your expertise deserves? Let's begin this journey to secure your place at the executive table.

Personal Details

In the meticulous world of risk management, your personal details are the first line of defense—the beacon that guides hiring managers to your expertise. Here's how to fine-tune this section for the Chief Risk Officer role, ensuring it aligns perfectly with the expectations.

1. Brand Yourself

Your name is more than a label—it's the brand that carries your professional legacy. Ensure it's prominently displayed, using a font that's both professional and readable. Consider this the title of your story, inviting readers into the world of a risk management maestro.

2. Emphasize Your Aspired Role

Directly beneath your name, align yourself with your goal by stating 'Chief Risk Officer'. This explicit declaration primes the ATS and signals to the hiring manager that you're purpose-built for the role, aligning with the "Chief Risk Officer" title in our resume example.

3. Essential Contact Avenues

In the digital age of networking, your phone number and email are your open channels. Use a professional email format, typically firstname.lastname@email.com, to reinforce your professionalism. Verify these details meticulously—miscommunication here is an unwelcomed risk.

4. Reinforce Your Locale

For a position anchored in New York City, mentioning your location as such taps into the local advantage, directly meeting one of the job's logistical preferences. This detail subtly assures the employer of your immediate availability and integration ease.

5. Digital Professional Footprint

In an era where digital presence is scrutinized, including a LinkedIn profile or a professional website can offer depth to your candidacy, allowing the hiring team to delve deeper into your career achievements and network strength.

Takeaway

Consider the Personal Details section the threshold of your professional narrative. Craft it with precision and professionalism, ensuring every piece of information serves as a testament to your alignment with the Chief Risk Officer role. It's the handshake before you walk through the door, setting the stage for the powerful narrative that follows.

Experience

In the arena of risk management, your experience chronicles battles won and lessons learned. Let's sculpt your experience section into a testament of your strategic foresight and leadership in navigating the risk landscape.

- Overseen the development, implementation, and continual enhancements of a robust risk management framework, reducing organization's risk exposure by 20%.

- Led and directed the risk assessment initiatives, ensuring all risks were properly identified, measured, and reported with a 98% success rate.

- Promoted and cultivated a strong risk management culture, collaborating with 10 cross‑functional teams, leading to a 25% improvement in risk‑aware decision‑making processes.

- Presented comprehensive monthly risk reports to the C‑suite, consistently providing actionable recommendations that enhanced organizational risk resilience.

- Worked closely with key departments, developing and implementing 15 risk mitigation strategies that addressed crucial vulnerabilities and prevented potential losses of over $5 million.

- Developed and executed a company‑wide training program on risk assessment techniques, resulting in a 30% increase in risk identification efficiency.

- Established and monitored key risk indicators, leading to early detection and mitigation of 5 major risk events with potential losses exceeding $1 million each.

- Collaborated with legal and compliance teams, ensuring the organization met regulatory obligations and faced minimal legal exposure.

- Played a vital role in national industry forums, contributing to the development of best practices in risk management.

- Led a team of 10 risk analysts, fostering a high‑performance culture with a focus on continuous improvement.

1. Dissect the Requirements

Begin with a strategic mindset: dissect the job description like an imminent risk profile. Identify key phrases like 'robust risk management framework' or 'risk-aware decision-making processes'. These are the battles you've led, and it's time to showcase them.

2. Chronicle Your Leadership

Detail your journey in reverse chronological order, highlighting roles pertinent to risk management. For each position—be it as a previous Chief Risk Officer or a Senior Risk Manager—emphasize leadership and strategic influence, just as shown in the resume example.

3. Quantify Your Strategies

Narrate your legacy with numbers; they speak volumes. Whether it's reducing risk exposure by 20% or averting potential losses of over $5 million, quantifying achievements creates tangible testimonies of your capabilities.

4. Match and Mirror

Align your experience with specific job requirements. Show how you've 'led risk assessment initiatives' or 'promoted risk-aware decision-making processes'. This mirroring strategy not only satisfies the ATS but resonates with the hiring manager's checklist.

5. Relevance is Key

Filter through your illustrious career for the gems that align with being a Chief Risk Officer. Extraneous details dilute your message; focus on experiences that showcase your prowess in strategic risk management and decision-making.

Takeaway

The Experience section is your arena to demonstrate your command in the field of risk management. Every role, every achievement, is evidence of your ability to navigate, mitigate, and capitalize on risk, turning potential threats into strategic opportunities. Showcase this with precision, and your resume will not just pass the ATS test—it will capture the attention and respect of your future employer.

Education

At the core of a Chief Risk Officer's expertise lies a foundation of rigorous learning and academia. Let's illustrate how your educational background prepares you for the strategic orchestration of risk management.

1. Highlight Required Education

Anchor your resume with the necessary educational credentials. As per our example, showcasing a 'Bachelor of Science in Finance' directly aligns with the educational prerequisites for a Chief Risk Officer, providing a solid academic foundation.

2. Frame Your Academic Journey

Organize this section with clarity, laying out your degrees, the institutions from which you graduated, and the years of graduation. This crisp, uncluttered structure allows for easy navigation and instant acknowledgment of your academic qualifications.

3. Accentuate Relevant Advanced Degrees

Given the preference for an advanced degree indicated in the job description, spotlighting your 'Master of Business Administration in Finance' positions you as a candidate of esteemed academic standing and specialized knowledge.

4. Relevant Courses and Specializations

Though our Chief Risk Officer example doesn't necessitate this step due to extensive experience, early-career professionals should not hesitate to illuminate relevant coursework or specializations that underscore their readiness and enthusiasm for risk management roles.

5. Celebrate Educational Milestones

If your educational journey includes honors, significant projects, or affiliations with professional organizations, tactfully weave these into your narrative. While senior roles might lean more on practical achievements, these details enrich your academic portrait.

Takeaway

Your education section is more than a checklist; it's a testament to your preparedness and dedication to the field of risk management. Craft it thoughtfully to reflect the depth of your knowledge and your journey of continuous learning. This foundation not only meets the prerequisites but sets the stage for your professional accomplishments.

Certificates

In the ever-evolving landscape of risk management, certificates are your badges of honor—proof of your relentless pursuit of excellence and knowledge. Here's how to illuminate your commitment through your certifications.

1. Target Certificate Relevance

Pinpoint certifications that echo the job's demands. For instance, being a 'Certified Risk Professional (CRP)' or a 'Professional Risk Manager (PRM)' not only meets but exceeds the expectations set forth in the job description, showcasing your commitment to the profession.

2. Showcase Your Arsenal

List your most relevant certifications prominently. Quality trumps quantity, ensuring that the hiring manager's first glance catches the most impactful endorsements of your skills and dedication to staying at the forefront of risk management practices.

3. Date Your Achievements

Timelines matter. Indicating the validity or acquisition dates of your certifications, as seen with CRP and PRM, reinforces the currency of your knowledge and expertise in the eyes of the hiring manager and the ATS alike.

4. Commit to Continuous Improvement

Risk Management is dynamic, and so should be your learning curve. Regularly update your certification portfolio and pursue new knowledge, demonstrating your unwavering commitment to excellence and innovation in the field.

Takeaway

Your certificates are a powerful testament to your expertise and dedication to the field of risk management. These badges of honor not only satisfy the technical requisites but underscore your commitment to continuous learning and adaptation. Enlist these achievements to construct a compelling narrative of your professional journey.

Skills

In the world of risk management, your skills are your strategic assets. Here's how to strategically display your professional toolkit to convey you're not just equipped for the role of Chief Risk Officer but primed to excel.

1. Align with the Job's Heartbeat

Dive deep into the job description, 'decoding' both explicit and implicit skill requirements. Whether it's risk assessment expertise or a knack for 'Emerging Risk Evaluation', make sure your skill set resonates with the core needs of the role.

2. Strategically Showcase Your Assets

Prioritize skills that directly answer the job's call. Mirror the language of the job description to strengthen your resume's ATS-compliance and ensure a hiring manager's nod of approval for skills like 'Risk Mitigation Strategies' and 'Stakeholder Engagement', as seen in the resume example.

3. Order and Elegance

While it's tempting to list all your competencies, clarity wins battles. Focus on curating a list of skills that showcases your pedigree in risk management, ensuring each one is a clear signal of your suitability and readiness for the Chief Risk Officer role.

Takeaway

Your skill section is the tactical display of your professional arsenal. Construct it with care, affirming your proficiency and readiness for the challenges of a Chief Risk Officer. Let your skills do more than fill space—they should engage, convince, and reassure hiring managers of your exceptional fit for the role.

Languages

In a global risk landscape, your linguistic prowess can amplify your strategic footprint. Let's navigate crafting a languages section that accents your worldly savvy and connectivity.

1. Prioritize Job-Specific Languages

For the Chief Risk Officer role, command over 'English' is paramount. Ensuring your proficiency is clearly marked as ‘Native' or ‘Fluent' aligns with the job's essentials and sets a professional standard.

2. Highlight Additional Linguistic Strengths

Beyond the mandatory, additional languages showcase your capacity for global communication. 'Spanish: Fluent', as listed, casts you as a versatile communicator, prepared for the international scope of risk management.

3. Authentic Representation

Accuracy in profiling your language proficiency avoids miscommunications. Honest representation of your linguistic capabilities ensures that you're seen as a credible and reliable potential leader.

4. Understand the Scope

While our example focuses on roles within a specific geographical context, for positions with global interface, emphasizing your multilingualism can significantly bolster your candidacy, showcasing readiness for broader, cross-cultural challenges.

5. Leverage Languages as Assets

Each language you speak fluently is a bridge to new markets and cultures. Represent your linguistic abilities as strategic assets for the organization, signaling your capacity to lead and communicate effectively in a diverse, global landscape.

Takeaway

Languages in your resume aren't just about communication—they're about connection. A Chief Risk Officer with a global linguistic reach is a formidable contender, ready to navigate the multifaceted dynamics of global risk management. Flaunt your linguistic capabilities with confidence and let them underscore your global operational readiness.

Summary

In the opening act of your professional narrative, your summary sets the stage. Let's craft a compelling introduction that immediately captivates and convinces hiring managers of your unparalleled fit for the Chief Risk Officer role.

1. Grasp the Role's Essence

Immerse yourself in the job description. Your summary should echo the role's core demands, establishing you as a 'Chief Risk Officer with over 12 years of extensive experience in developing robust risk management frameworks', mirroring the expertise sought.

2. Compelling Introduction

Begin with a statement that encapsulates your professional identity and mission. Highlight your leadership in 'fostering a strong risk management culture' and your strategic acumen in 'navigating organizations through the risk lifecycle'.

3. Exhibit Your Arsenal

Detail your key skills and most impactful achievements. Phrases like 'known for presenting comprehensive risk reports' and 'providing actionable risk mitigation strategies' directly reflect the responsibilities and qualifications outlined in the job description.

4. Precision and Punch

Craft a summary that's both succinct and striking. Use it to assert your unique value proposition, trimming any fluff, ensuring every word earns its place on your resume. This is your elevator pitch; make every second count.

Takeaway

Your summary is more than an introduction; it's your strategic pitch. It showcases your journey, highlights your expertise, and aligns your narrative with the Chief Risk Officer role's unique demands. Craft it with intent, and let it serve as the compelling opener to your professional story, urging hiring managers to read on.

Launching Your Chief Risk Officer Journey

Congratulations! With these insights and the Wozber free resume builder at your disposal, you're well on your way to crafting a resume that not only meets the ATS criteria but speaks volumes to hiring managers. Remember, your resume is more than a document—it's a declaration of your candidacy and readiness for the Chief Risk Officer role. Use it to strategically position yourself, leveraging Wozber's ATS-friendly resume templates and ATS resume scanner for optimization.

Now, step forth with confidence and let your resume be the key that unlocks new opportunities in the high-stakes world of risk management. Your next big role awaits!

- Bachelor's degree in Finance, Risk Management, or a related field.

- Advanced degree preferred.

- A minimum of 10 years of experience in risk management, with at least 5 years in a senior leadership role.

- Strong expertise in risk assessment, mitigation strategies, and handling complex risk situations.

- Excellent communication and presentation skills, with the ability to convey complex risk concepts to non-technical stakeholders.

- Relevant certifications such as Certified Risk Professional (CRP) or Professional Risk Manager (PRM) are preferred.

- Proficient in English communication.

- Must be located in New York City, New York.

- Oversee the development and implementation of a robust risk management framework, policies, and procedures across the organization.

- Lead risk assessment initiatives, ensuring risks are properly identified, measured, monitored, and reported.

- Collaborate with cross-functional teams to promote risk-aware decision-making processes and foster a strong risk management culture.

- Present risk reports to the C-suite, provide recommendations, and work with departments to develop risk mitigation strategies.

- Stay updated with industry trends, best practices, and regulatory requirements to ensure the organization remains ahead of emerging risks.