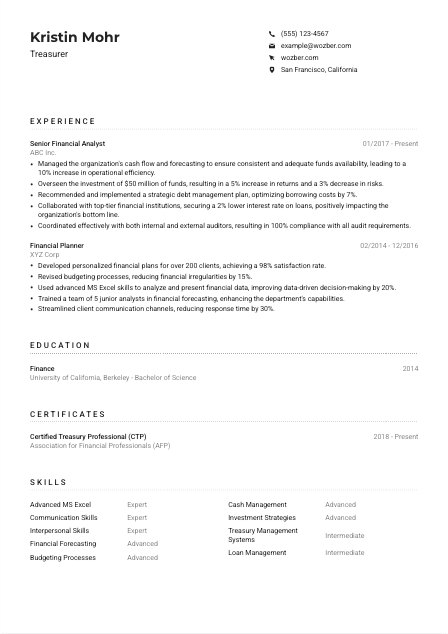

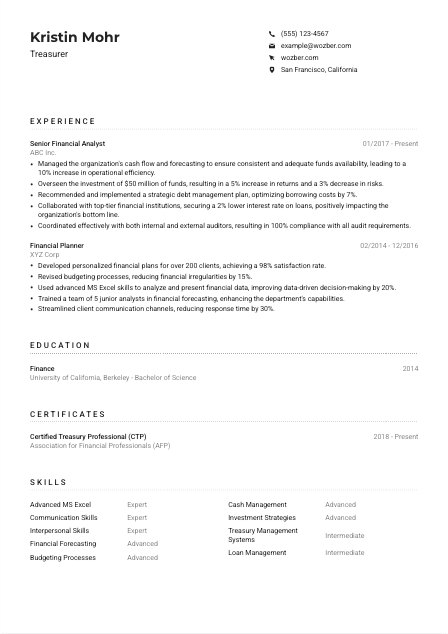

Treasurer Resume Example

Juggling finances, but your resume isn't adding up? Count on this Treasurer resume example, organized with Wozber free resume builder. See how skillfully you can balance your fiscal know-how with job requisites, directing your career to its most profitable path!

How to write a Treasurer Resume?

Stepping into the world of Treasury with its nuanced financial strategies and risk management requires more than a strong background in finance—it requires a resume that speaks volumes. Today, we're diving deep into crafting a Treasurer-specific resume that not only passes the Applicant Tracking Systems (ATS) but also showcases your unique financial expertise. With the guidance of Wozber's free resume builder, ATS-friendly resume format, and ATS resume scanner, you're about to prepare a document that sets you apart in the dynamic field of treasury.

Personal Details

This section is your handshake with potential employers. It's your chance to make a memorable first impression. Hence, it's crucial your personal details section aligns seamlessly with the Treasurer position.

1. Make Your Name Recognizable

Flash your name in bold, readable typography. Imagine your name as the title of your professional story, beckoning the reader to learn more about you, the aspiring Treasurer.

2. Align Your Professional Title

Immediately below your name, affirm your professional identity by mirroring the job title. In this case, "Treasurer." This signals to the hiring manager that you're not just applying; you're answering their call.

3. Essential Contact Details

List your most reachable contact number and use a professional email format suggested in the resume example. These details ensure a potential employer can connect with you effortlessly.

4. Location, Location, Location

Match the job's geographic requirement by listing "San Francisco, California" as your location. It's a subtle nod, showing you're already in the loop with the company's logistical preferences.

5. Professional Online Presence

Considering the digital age, including a link to your LinkedIn profile can provide further insights into your professional life. Just ensure it's polished and mirrors the achievements and skills listed on your resume.

Takeaway

Your personal details should act as the gateway to your professional narrative. Crafted thoughtfully, it lays down the foundation for a compelling treasurer-focused resume. Remember to keep it professional, precise, and tailored.

Experience

The experience section is where you illustrate your financial acumen and problem-solving skills. For a Treasurer, it's crucial to detail how you've managed organizational finances, overseen investments, and worked within budget constraints.

- Managed the organization's cash flow and forecasting to ensure consistent and adequate funds availability, leading to a 10% increase in operational efficiency.

- Overseen the investment of $50 million of funds, resulting in a 5% increase in returns and a 3% decrease in risks.

- Recommended and implemented a strategic debt management plan, optimizing borrowing costs by 7%.

- Collaborated with top‑tier financial institutions, securing a 2% lower interest rate on loans, positively impacting the organization's bottom line.

- Coordinated effectively with both internal and external auditors, resulting in 100% compliance with all audit requirements.

- Developed personalized financial plans for over 200 clients, achieving a 98% satisfaction rate.

- Revised budgeting processes, reducing financial irregularities by 15%.

- Used advanced MS Excel skills to analyze and present financial data, improving data‑driven decision‑making by 20%.

- Trained a team of 5 junior analysts in financial forecasting, enhancing the department's capabilities.

- Streamlined client communication channels, reducing response time by 30%.

1. Highlight Your Financial Leadership

Delve into each job description, especially focusing on roles akin to treasury management. It's here you tie your past roles with the requirements for a Treasurer, showcasing your deft handling of financial forecasting, cash flow management, and more.

2. The Timeline of Your Progress

Organize your roles chronologically, emphasizing recent positions or projects that highlight your expertise in treasury or finance. This backtracks your journey to becoming an adept candidate for the position.

3. Accomplishments That Speak Volumes

For each role, especially those closely tied to treasury tasks, mention accomplishments with quantifiable results. For instance, "Overseen the investment of $50 million of funds, resulting in a 5% increase in returns." This provides concrete proof of your capabilities.

4. Numbers Make a Difference

Where possible, bolster your achievements with metrics. Percentages, dollar amounts, and efficiency improvements give a tangible sense to your impact and prowess in financial management.

5. Relevance is Key

Limit this section to your most pertinent professional experiences. Ensure each point correlates directly to the role of a Treasurer, leaving out unrelated accolades however impressive they may be in other contexts.

Takeaway

Your experience section is the backbone of your resume. It's where you make a compelling case for your candidacy, aligning your financial journey with the treasurer role you're eyeing. Stay focused, insightful, and quantitative to make each point a testament to your financial stewardship.

Education

While experience often takes center stage, don't underestimate the power of a solid educational background. For a Treasurer, highlighting your degree in finance or a related field reinforces your theoretical foundation and readiness for the challenges ahead.

1. Zeroing in on Educational Requisites

Start by echoing the job's educational demands. In this Treasury role, a "Bachelor's degree in Finance, Accounting, or related field" aligns perfectly with the prerequisite—thus, it's essential to list it prominently.

2. Clarity and Structure

List your educational achievements clearly, beginning with your highest degree. Include the field of study, degree, institution, and graduation year, following the structure provided in the resume example for efficiency and clarity.

3. Degree Specificity

Ensure your degree name precisely matches what the job description seeks. If you have a Bachelor of Science in Finance, highlight that detail. It's about demonstrating an exact match with the employer's requirements.

4. Coursework that Counts

Should your role demand a specialized skill set or knowledge base, mentioning relevant courses can prove advantageous. However, in the Treasurer example provided, the broad degree encompasses the requisite financial expertise.

5. Academic Achievements

For roles seeking a depth of knowledge or special recognitions such as cum laude, don't hesitate to include these details. They underline your commitment and excellence in your field, although they might play a more subdued role at the senior-level positions.

Takeaway

The education section is a showcasing of your academic endeavors in finance and related fields, laying out a path of diligence and dedication. Make sure it reflects the level of knowledge expected of a Treasurer, finely tuning your resume to fit the role's demands.

Certificates

Certifications can serve as sparkling endorsements of your specialized knowledge and commitment to your career in finance and treasury. Here's how to illuminate your resume with these accolades.

1. Targeted Certification Listing

While no specific certifications were mentioned in the job description, it's advantageous to include industry-relevant certifications, such as the "Certified Treasury Professional (CTP)" as seen in the resume example.

2. Prioritization of Pertinence

Highlight certifications closely aligned with treasury management, financial forecasting, or strategic risk management. This directs attention to your readiness and advanced skills primed for the Treasury role.

3. Include Valid Dates

For certifications like the CTP which bear a renewal term, mentioning the validity dates conveys your up-to-date expertise in the field. It's a subtle cue of your ongoing commitment to professional development.

4. Continuous Learning

The domain of treasury is ever-evolving. Displaying a dedication to refining your skills through certifications is impressive. It showcases an adaptive mindset, keen to stay ahead in the financial sphere.

Takeaway

Certifications act as beacons of your specialized knowledge and proactive learning attitude in the financial field. Be selective, current, and proud of these achievements—they underscore your qualifications and readiness for the Treasurer role.

Skills

The Skills section functions as a compact display of your competencies. As a Treasurer, it's pivotal to not only cover the bases with the technical skills required but also to intersperse them with the soft skills that complement your role.

1. Decoding the Requirements

Begin with a meticulous scan of the job description, identifying both direct and inferred skills. Skills such as "Advanced MS Excel" and "Financial Forecasting" are crucial technical skills, while "Communication Skills" and "Interpersonal Skills" cover essential soft skills for collaboration.

2. Matching and Demonstrating

Link your skills both listed and developed in previous roles directly with the job's demands. Ensure to keep them organized and prioritized, mirroring the importance outlined in the job posting.

3. Strategic Listing

Resist the temptation to overload this section. Focus on the skills most pertinent and appealing to a prospective employer for the Treasury position. Each skill listed is a thread in the fabric of your professionalism, make each one count.

Takeaway

Your Skills section is a dynamic portfolio of your capabilities, neatly tied to the job's needs. Approach it as an opportunity to impress upon the hiring manager your readiness and exceptional match for the Treasurer role. Dedicate time to refine this section, making it a robust component of your ATS-compliant resume.

Languages

In a treasurer role that might entail global operations or dealings, language skills can present you as a versatile and adaptable candidate. Here's how to strategically position your linguistic prowess on your resume.

1. Necessity and Preference

The language requirement for our Treasurer position was straightforward—"Proficient in English is a condition of employment." However, the ability to speak additional languages like Spanish fluently showcases a global mindset and communicative versatility.

2. Prioritize Your Proficiencies

List English prominently as your native or fluent language, following with any additional languages in order of proficiency. This organization presents a clear picture to the employer of your communicative capabilities.

3. Showcase Multilingual Strength

Even if additional languages aren't a key requirement, they signify your ability to navigate diverse environments and potentially liaise with global partners, adding depth to your candidacy for the Treasurer role.

4. Proficiency Clarity

Clarify your language proficiency levels honestly. Whether you're "Fluent" or "Intermediate," these descriptors offer an accurate gauge of your ability to communicate and perform in those languages.

5. Global Roles Insight

For positions with a global perspective or offices in multiple countries, emphasizing your multilingual talents could be especially compelling. It showcases you're not just prepared for a Treasurer role; you're ready for its international dimensions.

Takeaway

Your language skills can significantly bolster your Treasurer resume, painting you as a candidate with broad communicative reach and cultural agility. Highlight these abilities with confidence, evidencing your potential to thrive in international finance environments.

Summary

Your summary is a powerful section that encapsulates your professional narrative in a few compelling lines. For a prospective Treasurer, it's your chance to distill your financial wisdom, strategic acumen, and collaboration prowess into an irresistible introduction.

1. Capturing the Essence

Start your summary by directly addressing the core requisites of the Treasurer role. An effective opener might be, 'Treasurer with over 7 years of experience in managing cash flow, investments, and financial forecasting.' It sets the stage for your expertise.

2. Your Professional Story

Briefly narrate the key milestones and skills that align with the Treasurer position. This includes managing significant investments, implementing debt strategies, and collaborating with financial institutions.

3. Impactful Achievements

Incorporate one or two quantifiable achievements to substantiate your claims of expertise and efficiency. For instance, 'leading to a 10% increase in operational efficiency' or 'securing a 2% lower interest rate on loans.'

4. Brevity and Clarity

Though brief, your summary should pack a punch. Aim for a concise, clear articulation of your qualifications and impact as a Treasury professional, enticing the hiring manager to delve deeper into your resume.

Takeaway

Think of the summary as your professional headline—short, striking, and significant. Tailoring it specifically to the Treasurer role you're aspiring for, you immediately convey your suitability and readiness. This is your moment to shine; encapsulate your professional essence with precision.

Launching Your Treasurer Journey

Armed with these insights and guided by Wozber's ATS-friendly resume template, ATS optimization tools, and free resume builder, you're now equipped to craft a resume that not only aligns with the Treasurer position but also distinguishes you in the competitive financial landscape. Your resume is the key to unlocking exciting opportunities—it's time to refine, tailor, and present your professional story in a way that resonates with hiring managers. Your journey as a Treasurer awaits; embark with confidence and anticipation!

- Bachelor's degree in Finance, Accounting, or related field.

- Minimum of 5 years of relevant experience in treasury, finance, or accounting.

- Strong knowledge of financial forecasting and budgeting processes.

- Proficiency in using treasury management systems and advanced MS Excel skills.

- Excellent interpersonal and communication skills to collaborate with cross-functional teams.

- Proficient in English is a condition of employment.

- Must be located in San Francisco, CA.

- Manage the organization's cash flow and forecasting to ensure funds availability.

- Oversee the investment of funds with an aim to maximize returns while minimizing risks.

- Recommend, implement, and monitor the organization's debt strategy.

- Collaborate with financial institutions to secure advantageous financial arrangements.

- Coordinate with internal and external auditors regarding treasury operations.