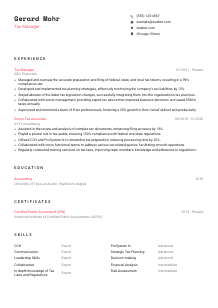

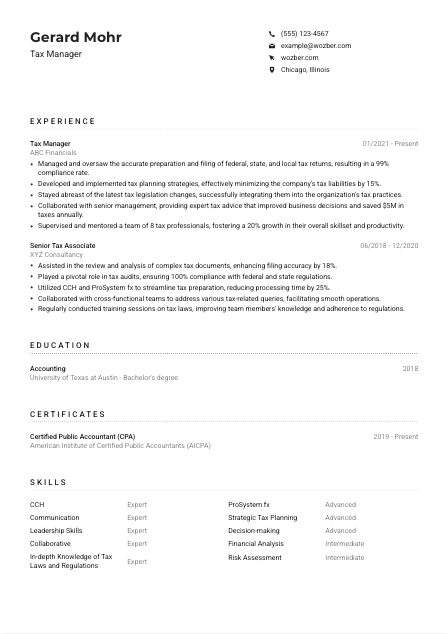

Tax Manager Resume Example

Balancing books, but your resume isn't adding up? Delve into this Tax Manager resume example, prepared with Wozber free resume builder. Discover how to strategically structure your fiscal finesse to meet job standards, positioning your tax-tackling talents at the forefront of your career spreadsheets!

How to write a Tax Manager Resume?

Hello, aspiring Tax Manager! In a finance world where precision and compliance aren't just assets but mandates, your resume stands as your personal ledger. This guide, powered by Wozber free resume builder, is your tool to craft a document that not only ticks every box for the Tax Manager position but does so with the finesse of a well-prepared tax return. Let's dive in and tailor your resume into a compelling narrative, ensuring it becomes the perfect representation of your fiscal finesse.

Personal Details

In the realm of finance and taxes, every detail counts, and your resume's Personal Details section is no exception. This section is your first handshake with the employer, setting the tone for the in-depth review to follow. It's critical to get it precisely right.

1. Name as Your Brand

Think of your name as the headline on your personal financial statement. It should be clear and unobstructed, making use of a legible font to ensure it captures attention at first glance. This is where the journey begins, and it's essential to start strong.

2. Job Title Alignment

Immediately beneath your name, include the role you're aspiring to - in this case, 'Tax Manager'. This approach not only shows your focused ambition but aligns perfectly with the job description, ensuring the hiring manager knows you're an exact match right from the start.

3. Essential Contact Info

Include your most accessible contact number and a professional email address structured as firstname.lastname@email.com. Precision and professionalism in these details reflect the same qualities in your work ethic, a must-have for anyone aiming to manage tax matters.

4. Location Specification

By specifying you're located in or willing to relocate to Chicago, Illinois, as per the job requirement, you immediately show your readiness and practical suitability for the role. This detail helps humanize your resume, providing a sense of your real-world context.

5. Digital Footprint

If applicable, include a link to a professional online profile, like LinkedIn, ensuring it's both up-to-date and reflective of your resume. In today's digital age, this acts as your professional backdrop, providing depth to your application.

Takeaway

Remember, the Personal Details section of your resume is the opening volley in the match for the Tax Manager position. Make it count by being meticulous, professional, and aligned with the job's geographic and title-specific requirements.

Experience

As a Tax Manager, your experience in navigating the complex waters of tax compliance and strategy is your most valued asset. Here's how to ensure your experience section communicates your expertise and successes in a language that speaks volumes to hiring managers.

- Managed and oversaw the accurate preparation and filing of federal, state, and local tax returns, resulting in a 99% compliance rate.

- Developed and implemented tax planning strategies, effectively minimizing the company's tax liabilities by 15%.

- Stayed abreast of the latest tax legislation changes, successfully integrating them into the organization's tax practices.

- Collaborated with senior management, providing expert tax advice that improved business decisions and saved $5M in taxes annually.

- Supervised and mentored a team of 8 tax professionals, fostering a 20% growth in their overall skillset and productivity.

- Assisted in the review and analysis of complex tax documents, enhancing filing accuracy by 18%.

- Played a pivotal role in tax audits, ensuring 100% compliance with federal and state regulations.

- Utilized CCH and ProSystem fx to streamline tax preparation, reducing processing time by 25%.

- Collaborated with cross‑functional teams to address various tax‑related queries, facilitating smooth operations.

- Regularly conducted training sessions on tax laws, improving team members' knowledge and adherence to regulations.

1. Decipher Job Expectations

First, dissect the job listing carefully, marking important skills and experiences like 'tax compliance,' 'tax planning strategies,' and 'collaborating with cross-functional teams.' Your goal is to mirror these phrases in your own job achievements.

2. Roles and Companies

Present your tax career chronology with pride, starting from the most recent. Your titles and the reputations of your past employers speak to your rise through the ranks and the trust placed in you by industry peers.

3. Successes in Tax Numbers

Quantify your achievements wherever possible. Did you save the company $5M yearly through strategic tax planning? Did you achieve a 99% compliance rate? These figures are concrete evidence of your impact and capability.

4. Relevance Is Key

Keep the focus on experiences directly related to the duties of a Tax Manager. Although being the office ping-pong champion shows your sociable side, it won't help convince employers of your tax management acumen.

5. Direct Matching with Job Listing

Give the reader what they're looking for by matching your accomplishments directly with the job requirements. Utilize phrases from the job description, such as 'implemented tax planning strategies' or 'mentored a team of tax professionals' to show you're ready to hit the ground running.

Takeaway

The experience section is your resume's profit and loss statement. It should highlight the profits (your achievements and successes) in clear, quantifiable terms. Think like a hiring manager and present your career wins in a way that demonstrates undeniable value to your potential employer.

Education

In the Tax Manager role, your academic credentials provide the bedrock of your technical knowledge. Here's how to ensure this section underscores your readiness for the responsibilities that lie ahead.

1. Key Educational Requirements

Highlight the exact degree necessary for the role - a Bachelor's degree in Accounting, Finance, or a related field, as per our example – to immediately convey your qualification for the technical aspects of the job.

2. Simple Structuring

There's an elegance in simplicity. State your degree, the institution, and the year of graduation in a clear, straightforward way. The aim is to communicate your qualifications without overwhelming the reader with unnecessary details.

3. Focus on Relevance

In this context, the relevance of your degree to the Tax Manager position cannot be overstated. It's the bedrock of your expertise in tax laws and financial strategy, directly correlating to job performance.

4. Supporting Achievements

If you've completed certification like CPA that's preferred or required for the position, this is a critical piece of information that elevates your candidacy. It shows not just compliance with educational requirements but a commitment to exceeding them.

5. Beyond the Degree

Including other achievements, like awards or honors, adds depth to your academic profile. However, strive for brevity and relevance to the Tax Manager role, ensuring everything listed serves the story of your professional journey.

Takeaway

Your education section should articulate not just where you've come from, but how prepared you are for the journey ahead. With each line, you're building the foundation of trust in your capabilities and specialized knowledge.

Certificates

Certificates are badges of honor in the tax world, showcasing your commitment to continuous learning and professional growth. Here's how to leverage your certifications to stand out in the pile.

1. Highlight Key Certifications

Identify certificates like 'Certified Public Accountant (CPA)' that are directly tied to the Tax Manager role, showing a clear commitment to your profession and exceeding baseline educational requirements.

2. Focus on What Matters

While it's tempting to list all your certifications, prioritize those most relevant to the tax management domain. This not only underscores your qualifications but also your dedication to the field.

3. Freshness and Validity

Ensure any dates listed next to certifications are current, and if they require renewal, indicate this as well. This shows you're not just qualified, but continually keeping abreast of the latest in tax law and practice.

4. Continuous Professional Development

The tax world is ever-changing, and your pursuance of up-to-date certifications reflects an adaptability and eagerness to stay at the forefront of industry developments – a crucial trait for any Tax Manager.

Takeaway

Think of your certifications as your professional toolbox – each one is a tool that's been meticulously chosen for its relevance and effectiveness in your tax management career. Showcase them wisely to build a compelling argument for your candidacy.

Skills

In the detailed world of tax management, showcasing a blend of technical proficiency and soft skills is crucial. Here's how to ensure your skills section is comprehensive, reflecting both the demands of the job and your personal expertise effectively.

1. Job Requirements as a Guide

Dig into the job description, extracting both the explicit and implicit skills required for the role. This will often include a mix of technical skills like 'proficiency in tax software' and soft skills such as 'exceptional interpersonal, communication, and leadership skills.'

2. Pertinent Skills First

Prioritize your skills list starting with those most relevant to a Tax Manager. This includes technical skills like 'CCH and ProSystem fx,' and soft skills like 'leadership' and 'strategic tax planning.' This prioritization shows you not only fit the role but are primed to excel in it.

3. Clarity and Structure

Present your skills in a clean, easily digestible format, perhaps using bullet points. This layout ensures the hiring manager can quickly see your competencies match the job requirements, increasing your chances of hitting the mark.

Takeaway

Your skill section is a testament to your toolbox – one filled with both the sharp tools of technical tax management and the softer, but no less important, skills of leadership and communication. Make it count by aligning it directly with what the job seeks.

Languages

In a globalized economy, the ability to communicate across borders is invaluable, particularly in tax management which can have multi-national implications. Let's pinpoint how to articulate your linguistic skills as potent assets.

1. Matching Job Language Requisites

Identify if the job explicitly requires certain language proficiencies. For the Tax Manager role, an effective command of English is non-negotiable, while additional languages could be a bonus, particularly in contexts involving international tax laws.

2. Prioritize and Highlight

Position your language proficiencies in order of relevance to the role. If you are multilingual and the role has an international aspect, your additional languages could significantly bolster your application.

3. Honesty in Proficiency

Language proficiency can vary widely, so be honest and precise in your self-assessment. Phrases like 'native' or 'fluent' should be used judiciously to accurately represent your ability to engage in professional tax dialogue.

4. Beyond Just Speaking

Consider the broader implications of your language skills. Your ability to navigate multi-jurisdictional tax laws can be a significant asset in roles that demand such knowledge, making you a more versatile candidate.

5. Global Perspective

In positions that interact with international regulations or teams, showcasing a range of languages - and by extension, cultural awareness - can set you apart as a candidate well-suited for the complexities of global finance.

Takeaway

Language skills in a tax management context are more than just communication tools; they're bridges to understanding broader global regulations and cultures. Your resume should highlight these abilities as key parts of your professional toolkit.

Summary

The summary section of your resume is where you distill your professional essence into a brief, powerful statement. It's your chance to encapsulate your career narrative and prime the hiring manager for the details to follow.

1. The Core of the Job

Begin by internalizing the job description, understanding deeply what the role entails. This background informs the focus of your summary, ensuring it aligns with the expectations for a Tax Manager.

2. Introduce With Impact

Start your summary with a strong statement of your profession and level of experience, such as 'Experienced Tax Manager with over 7 years in tax compliance and consulting.' This establishes authority and sets a confident tone.

3. Highlight Your Distinctions

Point to your most relevant skills, experiences, and achievements. Use this section to differentiate yourself, illustrating not just your fitness for the role but why you stand out. Mention your track record in strategic tax planning and team leadership, mirroring the job description.

4. Concision and Precision

While it's tempting to include every significant achievement here, remember that the summary is just an appetizer. Keep it concise, focusing on the points that directly reflect your suitability for the Tax Manager role.

Takeaway

Your summary is the snapshot that encourages further exploration into the depths of your resume. Make it compelling, reflective of the job requirements, and demonstrative of your unique value proposition as a Tax Manager. It's your chance to make a memorable first impression.

Embarking on Your Journey

Congratulations on equipping yourself with the knowledge to craft a standout, ATS-compliant resume for the Tax Manager position. By engaging with each section thoughtfully and strategically, you're not just preparing a document; you're laying the groundwork for your next professional achievement. Using Wozber's free resume builder, including its ATS-friendly resume template and ATS resume scanner, transforms this complex task into a streamlined process, ensuring your resume not only meets but exceeds the expectations. Your career in tax management awaits – it's time to take that step forward with confidence.

- Bachelor's degree in Accounting, Finance, or a related field.

- Advanced degree or CPA certification preferred.

- Minimum of 6 years' experience in tax compliance and/or tax consulting with a public accounting firm or corporate tax department.

- Proficiency in tax software such as CCH, ProSystem fx, or similar platforms.

- In-depth knowledge of federal, state, and international tax laws and regulations.

- Exceptional interpersonal, communication, and leadership skills.

- Must be able to communicate effectively in English.

- Must be located in or willing to relocate to Chicago, Illinois.

- Manage and oversee the preparation and filing of federal, state, and local tax returns ensuring accuracy and compliance.

- Develop and implement tax planning strategies to minimize the company's tax liabilities.

- Stay updated with the latest tax legislation changes and their impact on the organization.

- Collaborate with cross-functional teams and senior management to provide tax advice on business decisions and transactions.

- Supervise and mentor tax team members, fostering a collaborative and growth-oriented work environment.