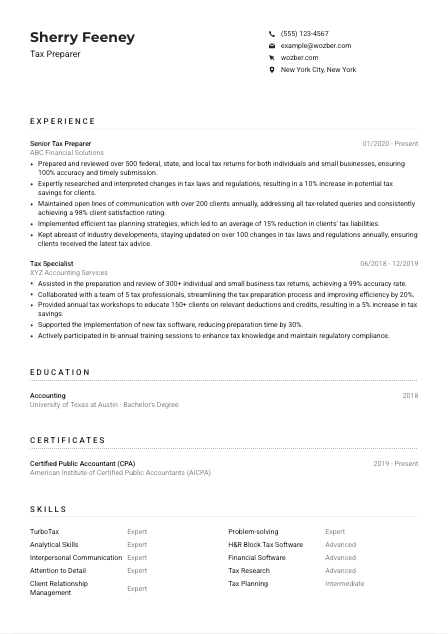

Tax Preparer Resume Example

Calculating exemptions, but your resume doesn't quite tally? Explore this Tax Preparer resume example, devised with Wozber free resume builder. Grasp how to structure your financial expertise to align with job prerequisites, ensuring your career sums up to be as rewarding as those well-balanced accounts!

How to write a Tax Preparer resume?

Hey there, aspiring Tax Preparer! If you've ever felt like navigating through the dense forest of job applications is akin to solving a complex tax problem, you're in the right place. The goal here is to transform your resume from just another piece of paper into a powerful tool that captures the essence of your professional prowess – particularly for that Tax Preparer role you've been eyeing.

With the help of Wozber's free resume builder, this guide is tailor-made to ensure your resume not only meets the expectations but exceeds them, paving your way to your dream job. Let's plunge into creating a resume that not only ticks all the boxes but also showcases your unique value as a Tax Preparer.

Personal Details

First impressions count, especially when it comes to your resume. Your Personal Details section is the welcoming handshake, the first note of your professional symphony. It's time to make it resonate with the tone of a proficient Tax Preparer.

1. Your Name, Your Brand

Think of your name as the title of your professional story. Ensure it's in a clear, bold typeface – it's not just a name; it's the headline of your professional narrative.

2. Job Title Precision

Right below your name, echo the job title you're aiming for – in this case, "Tax Preparer". This tactic aligns your resume to the job at a glance, acting as an immediate signal to the hiring manager that you're in the right arena.

3. Contact Basics

List your phone number and professional email - consider firstname.lastname@email.com for simplicity and professionalism. This is the direct line to further conversations, so clarity and correctness are key.

4. Geo-Alignment

"Must be located in New York City, New York." This requirement is like a lock, and your resume needs to be the key. Mentioning your New York City location acts as a perfect fit, reassuring the employer of your availability and suitability.

5. Digital Footprint

Including a LinkedIn profile or personal website? Make sure it mirrors the professionalism of your resume and provides additional, valuable insights into your professional world. Keep it relevant and clean.

Takeaway

This introductory handshake is your chance to start the conversation on the right foot. By aligning your personal details to match the tone and requirements of the Tax Preparer position, you're setting a professional and attentive tone for the rest of your resume. Let these details be a reflection of your precision and readiness.

Experience

The Experience section of your resume isn't just a list of places you've worked; it's a vivid story of your journey and impact as a Tax Preparer. Here's how to make it underscore your suitability for the role you're pursuing.

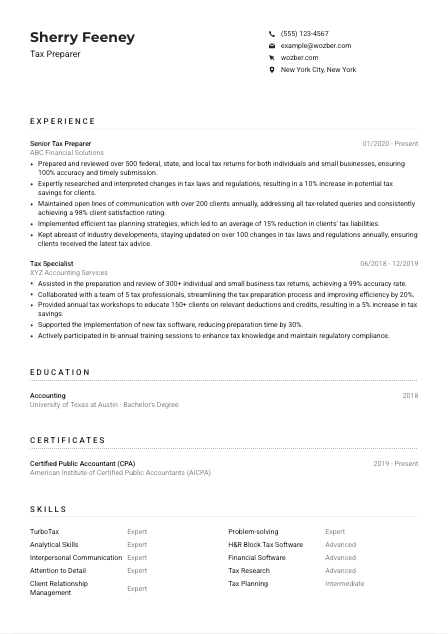

- Prepared and reviewed over 500 federal, state, and local tax returns for both individuals and small businesses, ensuring 100% accuracy and timely submission.

- Expertly researched and interpreted changes in tax laws and regulations, resulting in a 10% increase in potential tax savings for clients.

- Maintained open lines of communication with over 200 clients annually, addressing all tax‑related queries and consistently achieving a 98% client satisfaction rating.

- Implemented efficient tax planning strategies, which led to an average of 15% reduction in clients' tax liabilities.

- Kept abreast of industry developments, staying updated on over 100 changes in tax laws and regulations annually, ensuring clients received the latest tax advice.

- Assisted in the preparation and review of 300+ individual and small business tax returns, achieving a 99% accuracy rate.

- Collaborated with a team of 5 tax professionals, streamlining the tax preparation process and improving efficiency by 20%.

- Provided annual tax workshops to educate 150+ clients on relevant deductions and credits, resulting in a 5% increase in tax savings.

- Supported the implementation of new tax software, reducing preparation time by 30%.

- Actively participated in bi‑annual training sessions to enhance tax knowledge and maintain regulatory compliance.

1. Job Requirements Lens

Begin with a laser focus on the job description. Every bullet point of experience should be a mirror reflecting the responsibilities and accomplishments found in the job posting. For instance, "Prepared and reviewed over 500 federal, state, and local tax returns", directly maps to the job requirement.

2. A Chronology of Success

Structure this section starting with your most recent role, descending back through your career. Each entry should clearly list your job title, place of employment, and the dates of your tenure there. This organized approach speaks to your systematic nature, a key trait for a Tax Preparer.

3. Accomplishments That Matter

Every task and triumph listed should resonate with the core responsibilities of a Tax Preparer. Did you help clients save money? Enhance filing accuracy? These are the stories that need to be told, with each bullet point underscoring your capabilities and achievements.

4. The Power of Numbers

Quantifying your contributions provides a clear, compelling snapshot of your impact. For instance, stating that you "resulted in a 10% increase in potential tax savings for clients" offers tangible evidence of your effectiveness and attention to detail.

5. Relevance is Key

Stick closely to experiences that speak directly to the tasks and expectations of a Tax Preparer. While diverse experience is valuable, this section should highlight your most relevant professional accomplishments that align with the requirements outlined in the job posting.

Takeaway

Your experience section is the pillar of your resume, substantiating your proficiency and suitability for the Tax Preparer role. By strategically organizing and presenting your professional journey, you spotlight your readiness and enthusiasm for making significant contributions in this position. Allow your experience to be the proof of your prowess.

Education

In the realm of Tax Preparation, your educational background is not just a requirement; it's the bedrock of your knowledge and skills. Let's ensure this section shines with as much precision and relevance as the rest of your resume.

1. Address Educational Prerequisites

Directly aligning with the job's educational requirements, your degree in "Accounting, Finance, or a related field" sets the stage. This immediate matching confirms to the hiring managers that your educational background is in perfect harmony with the job's needs.

2. Clarity and Structure

Maintain simplicity and clearness in presenting your education. List your degree, the institution where you earned it, and your graduation year. This straightforward presentation respects the hiring manager's time and offers them the information they need at a glance.

3. Degree Detailing

Given the specific requirement of the Tax Preparer role, mentioning your Bachelor's Degree in Accounting, for example, directly connects your educational qualifications with the job's prerequisites.

4. Course Highlights

Though not always necessary, mentioning relevant courses can be particularly effective for recent graduates or those new to Tax Preparation. This detail showcases your focus and preparation for tackling the responsibilities of the role.

5. Educational Accolades

If your academic journey includes honors, relevant extracurricular activities, or notable projects, briefly highlighting these can underscore your commitment and capability. Remember, though, to balance this information's relevance with the role's seniority and focus.

Takeaway

Your education section is an affirmation of your preparedness and fit for the Tax Preparer role. By meticulously aligning it with the job requirements, you reassure the hiring managers of your solid foundation and readiness to excel. Let your educational background be not just a list, but a persuasive argument of your suitability.

Certificates

For a Tax Preparer, certifications can significantly bolster your resume by offering concrete evidence of specialized expertise and ongoing professional development. Let's navigate how to present these credentials to maximize their impact.

1. Understanding Job Needs

Always start by aligning your certifications with the job requirements. While the provided job description doesn't specify required certifications, possessing a CPA (Certified Public Accountant) certification, as mentioned in our example, undeniably strengthens your application.

2. Selective Listing

Quality trumps quantity. Highlight certifications that showcase your commitment to the field and your proactive stance on professional growth, particularly those esteemed in the Tax Preparation sector.

3. Dates Matter

When your certification has an expiry or was recently obtained, adding dates adds to its relevance. It shows you're up-to-date in your field, a crucial factor in the fast-evolving financial realm.

4. Remain Proactive

The professional landscape is ever-changing, and so should be your learning journey. Regular updates to your certifications list reflect your dedication to staying at the forefront of your industry.

Takeaway

In the world of Tax Preparation, certifications can be a decisive factor in setting you apart from the competition. By showcasing relevant, current certifications, you underscore your expertise and dedication to your profession. Let these credentials illuminate your path to the Tax Preparer role, affirming your readiness to excel.

Skills

Your skills section is where your resume says, 'I've got exactly what you need.' For a Tax Preparer, this means listing those hard and soft skills that directly meet the job's demands. Let's breakdown how to curate this pivotal section.

1. Decoding the Job Specs

Start by extracting both the stated and implied skills from the job description. For instance, proficiency in tax software like TurboTax and H&R Block Tax Software is explicitly mentioned, making these skills crucial to highlight.

2. Tailored Skills Listing

Match the job description skills with your own, categorizing them into 'hard' and 'soft' skills. For a Tax Preparer, analytical skills, attention to detail, and proficiency in tax software are vital to your success and appeal.

3. Concise and Focused

Resist the urge to list every skill under the sun. Prioritize those that align with the job description, ensuring every skill mentioned reinforces your qualification for the Tax Preparer role.

Takeaway

Your skills section is not just a list; it's a strategic selection of your professional toolkit, tailored to meet the specific needs of the Tax Preparer role. By carefully curating this section, you signal to hiring managers that you are not merely a match but an ideal candidate poised to contribute significantly. Showcase your skills with confidence, knowing they are precisely what the role requires.

Languages

In today's global economy, your linguistic skills can set you apart. For a Tax Preparer, while the primary requirement may be proficiency in English, additional language skills can enhance your resume's appeal, demonstrating versatility and a broader communication skill set.

1. Align with Job Requirements

The job description specifies "Must have good English communication skills." Your resume should clearly state your proficiency in English, marking it as 'Native' or 'Fluent' to meet this essential requirement.

2. Showcase Additional Languages

After meeting the primary language requirement, listing other languages you're proficient in showcases additional value. This might not be directly requested but demonstrates your readiness for diverse client interactions.

3. Honest Proficiency Levels

Be truthful about your language proficiency levels. Misrepresentation can lead to challenges down the line, so whether your level is 'Basic,' 'Intermediate,' 'Fluent,' or 'Native,' honesty is always the best policy.

4. Language and Role Scope

Consider the scope of your desired role. If the Tax Preparer position implies potential for international clients, highlighting your multilingual capabilities could significantly bolster your application.

5. Languages as Bridges

View your language skills as bridges – connections to potential clients and an expression of your capability to navigate diverse situations. Each language you speak opens up new avenues of communication and understanding.

Takeaway

Your linguistic capabilities can be a strong accompaniment to your professional qualifications. Whether directly relevant to the Tax Preparer role or not, they illuminate your ability to engage with a diverse range of clients and scenarios. Let your resume reflect your linguistic richness, a testament to your versatility and global readiness.

Summary

The summary section is like the cover letter of your resume – a potent, concise portrayal of your professional essence. For a Tax Preparer, it's your chance to highlight how your skills, experiences, and education align perfectly with the role's requirements.

1. Digest the Job Essence

Begin with a clear understanding of what the Tax Preparer role entails and what the employer is seeking. This perspective will guide the crafting of a summary that speaks directly to the needs and aspirations of the position.

2. The Opening Salvo

Open with a statement that encapsulates your profession and experience level, immediately establishing your candidacy as relevant and potent. For example, "Tax Preparer with over 4 years of experience..." sets a strong, relevant tone.

3. Highlight Unique Selling Points

In a few lines, convey your most significant accomplishments, skills, and traits that are directly pertinent to the Tax Preparer role. This includes your prowess in tax software, research skills, and history of improving client tax savings.

4. Brevity is the Soul of Wit

Your summary should be a snapshot, not a deep dive. Keep it concise, aiming for 3-5 impactful lines that invite the hiring manager to delve into the details of your resume.

Takeaway

Think of your summary as the hook that captivates the hiring manager's attention. A well-crafted introduction sets you apart, positioning you as a prime candidate for the Tax Preparer role. This is your moment to shine brightly, reflecting your core competencies and readiness for the role. Let your summary be the bridge that connects your past achievements with future possibilities.

Launching Your Tax Preparer Journey

Congratulations on fine-tuning your resume into a masterpiece that not only presents your qualifications but tells the story of your professional journey tailored for the Tax Preparer role. Using Wozber's free resume builder, ATS-friendly resume templates, and ATS resume scanner, you've crafted a document ready to navigate through ATS filters with ease. As you step forward to submit your application, remember that your resume is now a beacon, illuminating your path towards your next professional milestone. The journey towards securing your dream role is filled with possibilities.

Equip yourself with confidence and let your resume be your advocate. Your next chapter as a Tax Preparer awaits. Embrace it.

- Bachelor's degree in Accounting, Finance, or a related field.

- Minimum of 2 years of experience in tax preparation or related financial field.

- Proficiency in tax software such as TurboTax or H&R Block Tax Software.

- Strong numerical and analytical skills with attention to detail.

- Excellent interpersonal and communication skills, both written and verbal.

- Must have good English communication skills.

- Must be located in New York City, New York.

- Prepare and review federal, state, and local tax returns for individuals and small businesses.

- Research and interpret tax laws and regulations to ensure accurate filing and compliance.

- Communicate and work closely with clients to gather necessary information and address tax-related questions or concerns.

- Handle tax planning, estimations, and quarterly filings for businesses.

- Stay updated on changes in tax laws and regulations to provide the most up-to-date advice and services to clients.