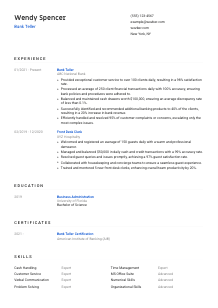

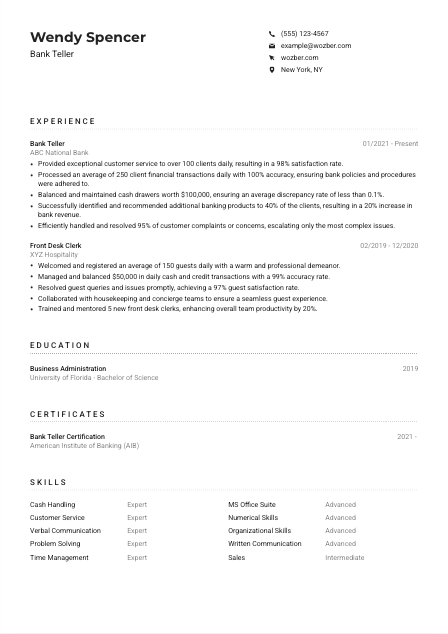

Bank Teller Resume Example

Counting bills, but your resume balance is off? Delve into this Bank Teller resume example, sharpened with Wozber free resume builder. Discover how you can align your customer service and cash-handling skills with job criteria, making your career vault as prosperous as the bank you serve!

How to write a Bank Teller resume?

Diving into the world of finance as a Bank Teller, you stand at the forefront of customer service and financial transactions. It's a role that demands precision, trustworthiness, and a knack for numbers. But before you can land that dream Bank Teller job, your resume needs to speak volumes, perfectly aligning with your potential employer's needs. Fear not!

With the help of Wozber free resume builder, this guide is meticulously designed to journey through crafting an ATS-compliant resume that mirrors the job description of a Bank Teller. Let's navigate through, ensuring every detail of your resume is a testament to your capabilities and readiness for the bank floor.

Personal Details

Navigating the financial world starts with a personal introduction that sets the stage for your professional narrative. Perfecting your contact information and aligning it with the job requirements is not just a formality; it's your first step to securing that Bank Teller position. Here, every detail counts. Let's ensure your resume begins with a strong foundation.

1. Showcase Your Name Proudly

Your name is not just a label; it's a brand that represents you. Ensure it's in a clear, professional font, making it slightly more prominent than the rest of your resume's text. This is where your personal brand begins to shine.

2. Highlight Your Desired Role

Directly below your name, proudly state your desired job title - in this case, "Bank Teller." This alignment with the job description immediately shows your intention and focus, making it clear to the hiring manager what role you're after.

3. Include Only Relevant Contact Information

Your phone number and a professional email address should be front and center. Remember, firstname.lastname@email.com reflects a level of professionalism that's expected in the banking sector. A simple oversight like a typo can be the difference between an interview invitation and a missed opportunity.

4. Mention Your Location

Given that the job description specifies New York, NY, including this in your contact details immediately reassures the employer of your availability and saves time for both parties. This detail is crucial for local positions with no relocation options.

5. Link to Your Professional Online Profile

If you have a LinkedIn profile, now's the time to include it. Just ensure it's polished and reflects the same professionalism as your resume. In the digital age, a well-maintained online profile can be as telling as the resume itself.

Takeaway

Just like a firm handshake, the Personal Details section of your resume sets the tone for what's to follow. It might seem minor, but getting this right sets you up for success. Double-check for accuracy, maintain professionalism, and ensure alignment with the Bank Teller role you're aiming for. Moving forward with confidence, let's make sure your resume's introduction speaks volumes.

Experience

In banking, detail is everything. The Experience section of your resume is your opportunity to showcase how your previous roles have prepared you for the responsibilities of a Bank Teller. From customer service to cash handling, let each bullet point articulate your qualifications and readiness for the role, with a clear focus on how your past experiences align with the job at hand.

- Provided exceptional customer service to over 100 clients daily, resulting in a 98% satisfaction rate.

- Processed an average of 250 client financial transactions daily with 100% accuracy, ensuring bank policies and procedures were adhered to.

- Balanced and maintained cash drawers worth $100,000, ensuring an average discrepancy rate of less than 0.1%.

- Successfully identified and recommended additional banking products to 40% of the clients, resulting in a 20% increase in bank revenue.

- Efficiently handled and resolved 95% of customer complaints or concerns, escalating only the most complex issues.

- Welcomed and registered an average of 150 guests daily with a warm and professional demeanor.

- Managed and balanced $50,000 in daily cash and credit transactions with a 99% accuracy rate.

- Resolved guest queries and issues promptly, achieving a 97% guest satisfaction rate.

- Collaborated with housekeeping and concierge teams to ensure a seamless guest experience.

- Trained and mentored 5 new front desk clerks, enhancing overall team productivity by 20%.

1. Match Your Experience to Job Requirements

Begin by dissecting the job description, pinpointing the responsibilities and experiences it prioritizes. For instance, if 'processing client financial transactions' is listed, detail how you've excelled in this area in past roles. This direct correlation shows you're not just experienced, but specifically prepared for the tasks at hand.

2. Outline Your Professional Journey

Using a reverse-chronological format, present your experience, starting with your most recent role. Be sure to include your job title, the company name, and the dates of your employment, laying out a clear timeline of your professional growth.

3. Highlight Your Achievements With Numbers

Quantify your successes whenever possible. Did your recommendations lead to an increase in bank revenue? By how much? Did you manage a large volume of transactions daily? Numbers provide a tangible measure of your capabilities and impact.

4. Focus on Relevance and Precision

Keep your content focused on the responsibilities and achievements most relevant to a Bank Teller position. While being an office ping-pong champ is impressive, it doesn't hold weight in this context. Tailor your accomplishments to mirror the key duties of a Bank Teller.

5. Leverage Action-Oriented Language

Use dynamic verbs that convey action and achievement. Phrases like 'Processed over 250 client transactions daily with 100% accuracy' or 'Identified and recommended banking products, resulting in a 20% increase in revenue' are impactful, illustrating your proactive approach and positive outcomes.

Takeaway

Your experience section is the proof of your professional journey, underlining your readiness for the Bank Teller role. Tailored to mirror the job description, it's here that you demonstrate not just your qualifications, but your potential for future success in the banking industry. Make every word count, highlight your accomplishments, and show how you're not just fit for the role, but a valuable addition to the team.

Education

While the Educational Requirements for a Bank Teller might initially seem straightforward, this section can significantly bolster your candidacy when crafted thoughtfully. It's more than just listing degrees; it's about drawing a clear line from your academic achievements to your potential as a Bank Teller. Let's delve into how to present your education in a way that highlights its relevance and value.

1. Clarify Your Educational Background

The job description calls for a high school diploma or equivalent, but if you have further education, such as a Bachelor's in Business Administration, make sure to highlight this. It not only meets the basic requirement but also adds depth to your credentials.

2. Structure for Clarity and Impact

Keep your education section well-organized and easy to skim. List your degree, the institution where you earned it, and your graduation year. This clarity helps hiring managers quickly verify your educational qualifications.

3. Link Your Degree to the Bank Teller Role

If your degree aligns closely with the responsibilities of a Bank Teller—such as a degree in Business Administration—make that connection explicit. Mention any coursework or projects directly relevant to banking, customer service, or finance to underscore your preparedness.

4. Mention Relevant Extracurriculars or Honors

If you've been part of clubs, activities, or received honors that showcase skills important for a Bank Teller (like leadership, teamwork, or financial planning), include these. They provide a fuller picture of your capabilities and interests.

5. Continuously Seek Knowledge

In a rapidly evolving field like banking, ongoing learning is key. If you've taken additional courses or workshops related to banking, finance, or customer service after your formal education, list them here. It shows your initiative and commitment to professional growth.

Takeaway

Your education section is a beacon of your readiness and suitability for the Bank Teller role. It's not just about fulfilling a requirement but demonstrating a foundation of knowledge that prepares you for the responsibilities of the job. By clearly aligning your education with the role's demands, you solidify your position as a well-rounded and capable candidate, ready to transition seamlessly into the banking world.

Certificates

Certificates are your opportunity to shine, proving your dedication to continuous learning and professional development. In the context of a Bank Teller resume, certifications can set you apart, showcasing specific expertise and commitment to excellence in the banking industry. Let's dive into which certs to highlight and how.

1. Identify Certificates Aligned with Job Demands

Although the job description might not explicitly require certifications, including relevant ones, like a 'Bank Teller Certification' from the American Institute of Banking (AIB), can significantly strengthen your resume. It shows you're not just meeting the basics; you're exceeding them.

2. Prioritize Pertinence Over Quantity

Rather than listing every certificate you've earned, prioritize those that are most relevant to the Bank Teller job. Quality trumps quantity here, ensuring hiring managers see the most pertinent information first.

3. Provide Details and Context

For each certificate, include the issuing organization and the date you received it, especially for recent achievements. This provides context and demonstrates your ongoing commitment to your professional development.

4. Stay Current

The banking sector evolves continuously, making it imperative to keep your knowledge and skills up to date. Regularly renewing your certifications and pursuing new ones related to your field shows a proactive approach to your career development.

Takeaway

Your certificates are a testament to your commitment to excellence and continuous improvement in your profession. By carefully selecting and presenting certifications that underscore your suitability and readiness for the Bank Teller role, you leave a lasting impression on hiring managers. Stay ahead of the curve, and let your certifications open more doors for you in the banking industry.

Skills

The Skills section of your resume is essentially a highlight reel of your professional arsenal. For a Bank Teller, this means emphasizing a combination of hard skills like cash handling and soft skills such as customer service. Let's refine this section to reflect the unique blend of competencies that make you the ideal candidate for the job.

1. Extract Skills from the Job Description

Begin by identifying key skills listed in the job description, such as 'strong numerical and organizational skills' and 'proficiency with MS Office Suite.' Matching these with your own skills is crucial to pass ATS scans and to draw the hiring manager's attention.

2. Balance Hard and Soft Skills

A successful Bank Teller possesses a blend of hard (technical) and soft (interpersonal) skills. Alongside technical proficiencies, highlight your customer service expertise and ability to handle and resolve complaints—skills that are invaluable in maintaining customer satisfaction.

3. Prioritize and Organize

Instead of listing every skill you possess, focus on those most relevant to a Bank Teller role. Prioritize skills that address the job requirements directly, and organize them in a way that's easy for hiring managers to skim through.

Takeaway

Your skills section is a concise yet powerful testament to your readiness for the Bank Teller position. By aligning this section with the job description and presenting a balanced mix of hard and soft skills, you not only showcase your qualifications but also your understanding of what the role entails. Highlight your skillset with confidence, knowing that each one you list is a step closer to securing that Bank Teller role.

Languages

In an ever-globalizing world, your ability to communicate in multiple languages can be a significant asset, especially in diverse urban centers like New York. While the job description specifies strong proficiency in English, possessing additional language skills can enhance your appeal as a Bank Teller. Let's navigate how to effectively present your linguistic capabilities.

1. Identify Language Requirements

Start by affirming the primary language requirement for the role—'Strong proficiency in English needed.' Your proficiency level in English should be clearly stated to meet the job's essential requirements.

2. Highlight Additional Languages

If you speak languages beyond the primary requirement, list them as well. Being bilingual or multilingual, especially in a city like New York, can be a distinct advantage, allowing you to connect with a wider range of customers.

3. Be Honest About Your Level of Proficiency

For each language listed, accurately represent your proficiency level. Whether you're 'Fluent' or at an 'Intermediate' level, clarity here helps set realistic expectations and demonstrates honesty in your application.

4. Consider the Bank's Clientele

If the bank serves a diverse population, speaking a second language could be especially beneficial. Assess the needs of the bank's clientele and highlight your language skills as a means to better serve them and enhance the customer experience.

5. Value Every Language You Speak

Every language you know opens new avenues for communication and connection. While not every language may seem directly relevant, each one adds to your versatility and capability as a Bank Teller, enriching the customer experience and setting you apart from other candidates.

Takeaway

Your linguistic skills are more than mere lines on a resume; they're a testament to your ability to engage and serve a diverse clientele. By thoughtfully showcasing your proficiency in multiple languages, you not only meet the essential requirements but also present yourself as a valuable asset ready to tackle the vibrant and varied landscape of New York's banking sector. Let your multilingual talents shine, further solidifying your candidacy for the Bank Teller position.

Summary

Your summary is the prologue to your professional story. This concise section is your moment to engage the hiring manager, offering a sneak peek into your qualifications and drawing them into the narrative of your resume. As a Bank Teller applicant, your summary needs to be compelling, reflective of the role's demands, and a testament to your readiness to excel.

1. Reflect on Your Professional Essence

Begin by internalizing the essence of the job description. Understand the role of a Bank Teller deeply—its challenges and its rewards. This insight will be the guiding force in drafting a summary that resonates.

2. Start with a Strong Introduction

Kick off your summary with a statement that captures your profession and level of experience, e.g., 'Bank Teller with over 3 years of hands-on experience.' This sets the stage, informing the hiring manager of your background and the perspective you bring.

3. Highlight Key Skills and Achievements

Directly address key aspects of the job description by listing relevant skills and notable achievements from your career. Be selective, focusing on experiences that directly align with the Bank Teller role's demands. This showcases not just your qualifications, but your potential for impact in the position.

4. Craft a Concise and Compelling Narrative

While your summary should be brief, it must also be compelling. Aim for 3-5 lines that encapsulate your professional identity, underscore your suitability for the Bank Teller role, and pique the hiring manager's interest. This is your elevator pitch; make every word count.

Takeaway

Crafted with intention, your summary is the handshake before the conversation. It's an opportunity to assert your fit for the Bank Teller role confidently and to outline the value you'd bring to the bank. Let it be a window into your professional story, compelling the hiring manager to delve deeper into your journey. With a sharp, tailored summary, you invite engagement and set the tone for the rest of your resume.

Embarking on Your Bank Teller Journey

Congratulations on meticulously crafting each section of your Bank Teller resume. With Wozber's free resume builder, ATS-friendly resume templates, and ATS optimization techniques at your disposal, you're not just ready; you're positioned for success. Your resume is now a strategic alignment of your skills, experience, and ambitions with the demands of the Bank Teller role. Embrace this journey, refine your resume with confidence, and step into the world of banking with the assurance that you have everything it takes to excel.

The next chapter of your professional story is just beginning. Forge ahead with the knowledge that your resume is your strongest ally.

- High school diploma or equivalent required.

- Minimum of 1 year of cash handling or customer service experience, preferably in a banking environment.

- Strong numerical and organizational skills with an acute eye for detail.

- Excellent verbal and written communication abilities.

- Proficiency with MS Office Suite, specifically Word and Excel.

- Strong proficiency in English needed.

- Must be located in New York, NY.

- Provide exceptional customer service by promptly and courteously serving banking clients.

- Process client financial transactions while maintaining accuracy and adhering to bank policies and procedures.

- Balance cash drawers and maintain adequate currency and coin supplies.

- Identify and offer additional banking products or services to customers based on needs and preferences.

- Handle and resolve customer complaints or concerns;

- escalate complex issues as necessary.