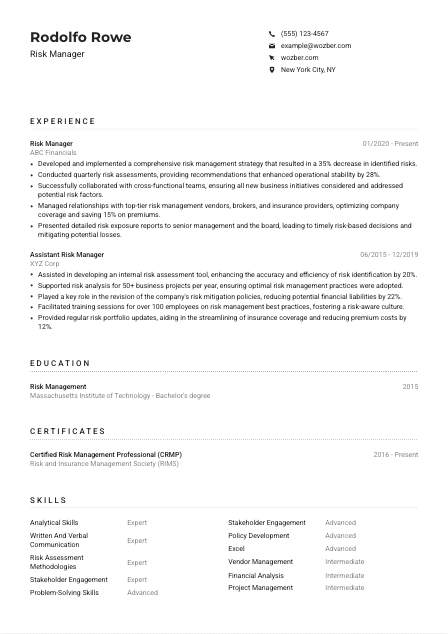

Risk Manager Resume Example

Navigating through risky terrains, but your resume feels uncertain? Check out this Risk Manager resume example, fortified with Wozber free resume builder. Learn how to spotlight your risk-mitigating prowess to sync with job expectations, ensuring your career path remains as secure as ever!

How to write a Risk Manager Resume?

Stepping into the domain of Risk Management requires not just quantifying uncertainties but managing them with precision, foresight, and strategy. Your resume is the first step in showcasing your capability in navigating through uncertain terrains with confidence and skill. With the Wozber free resume builder, you're equipped to craft a resume that resonates with the core of risk management, tailored meticulously to the nuances of a Risk Manager's role. Let this guide be your compass in aligning your professional narrative with your career aspirations, sculpted with the best ATS-friendly resume template, and sharpened with ATS optimization techniques.

Personal Details

The Personal Details section is more than just your contact information; it's the forefront of your personal brand. A Risk Manager's brand should communicate precision, reliability, and strategic insight, starting from the very first line of your resume. Here's how to fine-tune this section to align perfectly with a Risk Manager position.

1. Brand Yourself with Your Name

Your name isn't just a label; it's the title of your professional story. Make it memorable by using a clear, authoritative font. Let your name set the tone for the expertise and confidence you're about to unfold in your resume.

2. Align with the Risk Management Domain

Directly below your name, position yourself as a 'Risk Manager' - this is crucial. It immediately informs the hiring manager of your domain and correlates your expertise with the job you're pursuing. Remember, in risk management, clarity and precision are key.

3. Opt for Concise and Professional Contact Information

- Phone Number: Ensure your number is up-to-date. A simple typo could mean a missed opportunity.

- Professional Email Address: Your email should echo professionalism. A format that follows firstname.lastname@email.com is optimal.

4. Showcase Desired Locale

"Must be located in New York City, NY." According to the job requirements, location matters. Highlighting 'New York City, NY' in your contact details reinforces your eligibility and readiness for the position without the need for clarification or relocation.

5. Link to Your Professional World

Including your LinkedIn profile or a professional portfolio is a modern resume must. It provides a broader landscape for your professional narrative. For a Risk Manager, an up-to-date LinkedIn profile can offer a deeper insight into your professional ethos, recommendations, and connections in the industry.

Takeaway

Your Personal Details section isn't just the beginning of your resume; it's the start of your dialogue with potential employers. Craft it with the same precision and analytical insight characteristic of a Risk Manager. This section sets you up as a strong, well-prepared candidate, ready to make impactful moves.

Experience

A Risk Manager's experience section is not just a recount of past roles but a showcase of strategic achievements and learnt insights. Let's delve into reimagining your experience with a focus on risk management.

- Developed and implemented a comprehensive risk management strategy that resulted in a 35% decrease in identified risks.

- Conducted quarterly risk assessments, providing recommendations that enhanced operational stability by 28%.

- Successfully collaborated with cross‑functional teams, ensuring all new business initiatives considered and addressed potential risk factors.

- Managed relationships with top‑tier risk management vendors, brokers, and insurance providers, optimizing company coverage and saving 15% on premiums.

- Presented detailed risk exposure reports to senior management and the board, leading to timely risk‑based decisions and mitigating potential losses.

- Assisted in developing an internal risk assessment tool, enhancing the accuracy and efficiency of risk identification by 20%.

- Supported risk analysis for 50+ business projects per year, ensuring optimal risk management practices were adopted.

- Played a key role in the revision of the company's risk mitigation policies, reducing potential financial liabilities by 22%.

- Facilitated training sessions for over 100 employees on risk management best practices, fostering a risk‑aware culture.

- Provided regular risk portfolio updates, aiding in the streamlining of insurance coverage and reducing premium costs by 12%.

1. Decode the Job Summary

Start by weaving through the job requirements, note down vital keywords like 'risk assessments', 'mitigating identified risks', and 'collaborating with internal teams'. These are not just tasks; they're the heartbeats of your role.

2. Structure Your Story

List your positions in reverse chronological order, starting from the most recent. For each, mention your title, 'Risk Manager' or 'Assistant Risk Manager', the company, and the date range of your employment. This organization provides clear, navigable insights into your journey.

3. Tailor Achievement-Focused Bullet Points

Craft bullet points that resonate with the job description. Use impactful statements like 'Developed and implemented a comprehensive risk management strategy, reducing identified risks by 35%'. Quantify your achievements to provide a tangible sense of your contributions and capabilities.

4. Quantify Your Impact

In risk management, the numbers tell the story. Whether it's reducing risk exposure or saving on premiums, highlight the quantifiable impact of your actions. This underscores your ability to deliver results through strategic insights and actions.

5. Prioritize Relevance

Keep your experience relevant to the role you're applying for. Focus on achievements that directly address the job requirements, such as risk assessments, policies development, and stakeholder presentations. Irrelevant details can cloud your true value proposition.

Takeaway

Think of your Experience section as your strategic advantage. It's where you showcase your expertise in risk management, not just through the roles you've held but through the strategic actions you've taken and the tangible results you've achieved. Here, specificity and relevance are your best tactics.

Education

In risk management, your educational background lays down the theoretical foundation for your practical achievements. Let's ensure your Education section showcases this foundation in alignment with your ambitions.

1. Highlight the Cornerstone

"Bachelor's degree in Business, Finance, Risk Management, or a related field." Identifying this as the cornerstone of your educational qualifications is essential. It directly aligns with the job requirement and sets the stage for your specialized skill set.

2. Present Your Credentials Clearly

Articulate your education in a structured and easy-to-follow format. List your degree, the field of study, the institution's name, and your graduation date. This clarity is invaluable in risk management, portraying your educational trajectory with precision.

3. Match Your Degree with Job Requirements

If your degree perfectly matches one of those listed in the job requirements, highlight it prominently. In this case, a "Bachelor's degree in Risk Management" perfectly aligns with the specialized nature of the role you're targeting.

4. Mention Relevant Coursework

For roles in risk management, mentioning key coursework can further underscore your specialized knowledge. While the broader degree might be sufficient for seasoned professionals, recent graduates can benefit from specifying relevant subjects or projects tackled during their studies.

5. Consider Other Notable Achievements

If you've graduated with honors or participated in relevant extracurricular activities, consider noting these achievements. They can speak volumes about your commitment and potential for growth, attributes highly valued in the risk management field.

Takeaway

Your Education section is a testament to your foundational knowledge and dedication in the field of risk management. Ensure it resonates with the prospective employer's expectations, showcasing not just academic achievements but a deep-rooted understanding and commitment to your profession.

Certificates

In the evolving landscape of risk management, certifications are not just accolades but reflections of ongoing dedication and specialization. Let's navigate through enhancing your resume with the power of relevant certifications.

1. Identify Key Certifications

From the job description, pinpoint certifications that are directly mentioned or implied as advantageous. A "Certified Risk Management Professional (CRMP)" is not just a title; it's a testament to your expertise and commitment to the field.

2. Select Certifications That Speak Volumes

Prioritize listing certifications that closely align with the role's demands. These are your badges of honor, showcasing your specialized knowledge and skills in risk management. They directly correlate your qualifications with the job's requirements.

3. Date Your Achievements

Where applicable, including the date of certification can provide insights into the currency of your expertise. In rapidly evolving fields, staying updated is key. This shows potential employers your commitment to continuous learning and staying ahead in your domain.

4. Embrace Continuous Learning

The field of risk management is dynamic, requiring professionals to continually update their knowledge and skills. Showcasing recent certifications or ongoing education efforts can significantly bolster your resume, reflecting a proactive approach to professional growth.

Takeaway

Certifications are the pillars that strengthen your professional narrative, especially in specialized fields like risk management. They not only corroborate your expertise but also your dedication to staying at the forefront of your domain. Let them shine as beacons of your professional commitment.

Skills

The Skills section is your opportunity to display the tools and techniques at your disposal for managing risk effectively. Let's ensure this section directly reflects the competencies required for a Risk Management role.

1. Extract Crucial Skills

Analyze the job description meticulously. Skills like "Strong analytical and problem-solving skills" and "proficiency in risk assessment methodologies" are not just requirements; they're the essence of your role as a Risk Manager.

2. Reflect Your Matching Skills

Identify and list skills that showcase your capability to meet and exceed the job requirements. Remember, this section is a mirror reflecting your fit for the role – make sure it's polished and precise.

3. Precision Over Quantity

Resist the urge to list every skill you possess. Focus instead on those that align closely with the job description. This selective approach not only makes your resume more targeted but also easier for hiring managers to recognize your primary strengths.

Takeaway

Your Skills section is a distilled essence of your professional capabilities. Think of it as your strategic toolset, each skill carefully selected to resonate with the demands of a Risk Manager role. This is where you affirm, through clear alignment, that you are not just qualified but exceptionally suited for the position.

Languages

In a field that requires clear and precise communication, showcasing your language skills can be a significant asset. Here's how to articulate your linguistic abilities for a Risk Manager role.

1. Acknowledge the Must-Haves

"English language proficiency is a must." Your ability to communicate effectively in English is not just a requirement; it's fundamental to your success in the role. List this clearly and prominently to align with the job's demands.

2. List Your Linguistic Abilities

Position English at the top, followed by any additional languages you are proficient in. In a globally connected world, additional languages can enhance your value, showcasing adaptability and a broader communicative reach.

3. Be Transparent About Your Level

Use clear descriptors like 'Native', 'Fluent', 'Intermediate', or 'Basic' to detail your proficiency. Accurate representation of your language skills can set realistic expectations and showcase your honesty.

4. Tailor to the Role's Scope

If the role involves international dealings or communicating across different cultures, emphasizing your multilingual skills can significantly boost your appeal. It showcases your readiness to navigate diverse environments seamlessly.

5. Understand the Value of Diversity

Your linguistic skills represent more than just the ability to communicate; they reflect an understanding and respect for cultural nuances. Highlighting these skills can significantly position you as a globally-minded professional, an asset in any organization.

Takeaway

Your ability to communicate in multiple languages is a testament to your adaptability and global awareness. Especially in risk management, where clear and precise communication is paramount, your linguistic skills can open doors to new perspectives and opportunities. Let them reflect your depth as a professional, ready to bridge divides and connect worlds.

Summary

The Summary section is your moment to shine, to encapsulate your professional identity in a few powerful statements. For a Risk Manager, it's about striking a balance between showcasing your achievements and illustrating your strategic vision.

1. Comprehend the Role

Start by fully understanding the essence of the position you're applying for. A Risk Manager isn't just about managing risks; it's about foreseeing challenges, devising strategies, and communicating solutions.

2. Initiate with Impact

Begin your summary with a statement that reflects your professional stance and experience level, such as: "Risk Manager with over 6 years of experience in corporate risk management." This sets the tone for your narrative.

3. Highlight Your Unique Contributions

Incorporate your key achievements and skills that directly align with the job's requirements. Showcase how you've developed strategies, identified potential risks, and facilitated cross-functional collaboration, making your impact tangible.

4. Aim for Conciseness

Your summary should be a teaser, not a tell-all. With 3-5 well-crafted lines, you can create a compelling narrative that intrigues and invites the reader to dive deeper into your resume. Balance is key; provide just enough to pique interest.

Takeaway

Your summary is more than an introduction; it's your headline. It sets the stage for your professional narrative, encapsulating your expertise, achievements, and strategic vision as a Risk Manager. Craft it with precision, making every word count, and watch as it opens doors to your next big opportunity.

Launching Your Risk Manager Journey

Congratulations on meticulously honing your resume! With these tailored insights and strategic alignments, you're ready to step confidently into the landscape of risk management. Remember, your resume is not just a document; it's a reflection of your professional journey, crafted with precision and strategic foresight. As you move forward, let the Wozber free resume builder be your ally in ensuring your resume isn't just ATS-compliant but compellingly narrates your professional story.

The world of risk management awaits your unique blend of insight, strategy, and leadership. Forge ahead with confidence and make your mark!

- Bachelor's degree in Business, Finance, Risk Management, or a related field.

- Minimum of 5 years of experience in risk management, preferably in a corporate or financial institution setting.

- Strong analytical and problem-solving skills, with proficiency in risk assessment methodologies.

- Excellent written and verbal communication skills, including the ability to present complex information to senior management and stakeholders.

- Certified Risk Management Professional (CRMP) or comparable risk management certifications.

- English language proficiency is a must.

- Must be located in New York City, NY.

- Develop and implement the organization's risk management strategy, policies, and procedures.

- Conduct regular risk assessments and provide recommendations for mitigating identified risks.

- Collaborate with internal teams to ensure risk is considered and addressed in new business initiatives and projects.

- Manage relationships with external risk management vendors, brokers, and insurance providers.

- Report regularly to senior management and the board of directors regarding risk exposure, mitigation efforts, and risk-based decisions.