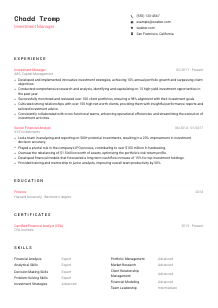

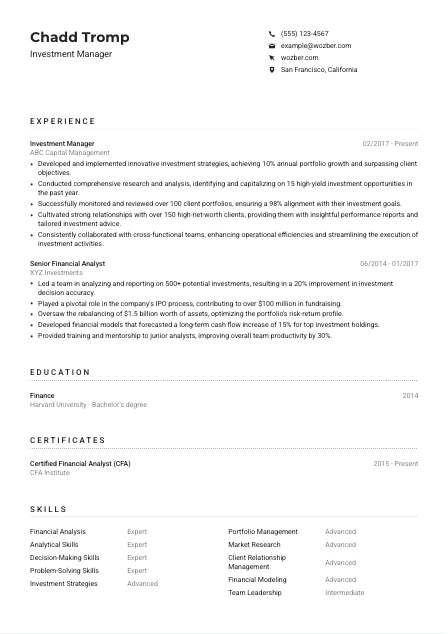

Investment Manager Resume Example

Juggling stocks, but your resume doesn't seem as lucrative? Delve into this Investment Manager resume example, crafted using Wozber free resume builder. See how effortlessly you can align your asset management acumen with job specifications, positioning your career portfolio for a growth trajectory!

How to write an Investment Manager Resume?

Navigating the world of Investment Management can often feel like strategizing for the most critical portfolio. Each choice carries weight, mirroring the meticulous thought process behind every investment decision. In this high-stakes arena, your resume not only represents your professional identity but also embodies your strategic acumen and foresight.

Utilizing Wozber's free resume builder, this guide is expertly crafted to navigate through the intricacies of constructing an ATS-compliant resume distinctly tailored for the Investment Manager role. Let's embark on this empowering journey together, transforming your resume into a potent testament of your prowess.

Personal Details

Your Personal Details section is much more than just a professional formality; it's the cornerstone of your personal brand. To resonate with the criteria for an Investment Manager position, precision in curating this section is key. Below, we'll dive deeper into how to align your introduction flawlessly with the expectations inherent to your field.

1. Enunciate Your Name with Pride

Your name is your marque; make sure it claims its rightful prominence. Employ a font that's not just clear and legible but one that commands attention, subtly asserting your presence in the competitive landscape of finance.

2. Echo the Role

Mirror the precision of a well-balanced portfolio by aligning your title - "Investment Manager" directly beneath your name, signaling immediate relevance to the hiring team.

3. Essential Contact Facets

In the realm of communication, clarity is king. Ensure your phone number is accurate - a single mistype can mean a missed opportunity. Adopt a professional email format (firstname.lastname@email.com), keeping the channel of potential dialogues open and clear.

4. Locality Magic

The job calls for a San Francisco, California location. By listing "San Francisco, California" prominently, you're not just ticking a box; you're emphasizing logistical compatibility and your readiness to engage in investment ventures within the heart of the finance hub.

5. Digital Presence

In today's digital age, a polished LinkedIn profile or a professional website can serve as a dynamic extension of your resume. Include URLs that recruiters can visit for a deeper dive into your professional narrative - ensure these platforms reflect the same level of professionalism and are in harmony with your resume.

Takeaway

Consider the Personal Details section as your personal spotlight. It's your chance to assert your professional identity succinctly, aligning seamlessly with the expectations for the Investment Manager role. Remember, every element from your name's typography to your location serves a purpose, setting the tone for the narrative that unfolds. Showcase your meticulous attention to detail right from the start.

Experience

The Experience section of your resume is where you get to showcase your strategic prowess and your ability to navigate the complex waters of investment management successfully. It's your opportunity to align your professional journey with the specific requirements of the role you're aspiring to. Let's delve into how you can craft this section to reflect not just your expertise but also your unique contributions to the field.

- Developed and implemented innovative investment strategies, achieving 10% annual portfolio growth and surpassing client objectives.

- Conducted comprehensive research and analysis, identifying and capitalizing on 15 high‑yield investment opportunities in the past year.

- Successfully monitored and reviewed over 100 client portfolios, ensuring a 98% alignment with their investment goals.

- Cultivated strong relationships with over 150 high‑net‑worth clients, providing them with insightful performance reports and tailored investment advice.

- Consistently collaborated with cross‑functional teams, enhancing operational efficiencies and streamlining the execution of investment activities.

- Led a team in analyzing and reporting on 500+ potential investments, resulting in a 20% improvement in investment decision accuracy.

- Played a pivotal role in the company's IPO process, contributing to over $100 million in fundraising.

- Oversaw the rebalancing of $1.5 billion worth of assets, optimizing the portfolio's risk‑return profile.

- Developed financial models that forecasted a long‑term cash flow increase of 15% for top investment holdings.

- Provided training and mentorship to junior analysts, improving overall team productivity by 30%.

1. Job Requirements Analysis

Dive deep into each requirement listed in the job description. For an Investment Manager, this means highlighting your proficiency in developing and implementing investment strategies, conducting market research, and portfolio management. These are your guideposts.

2. Structured Presentation

Present your roles sequentially, showcasing your evolution in the field. Start with your most recent position, clearly outlining your designation, the firm's name, and your tenure there. This chronological narrative offers a clear trajectory of your growth and professional development.

3. Impactful Achievements

Each role should include quantifiable accomplishments that mirror the job requirements. For instance, "Developed and implemented innovative investment strategies, achieving 10% annual portfolio growth." These statements serve as testaments to your ability to exceed objectives and contribute to organizational success.

4. Numbers Speak

Quantify your impact wherever possible. Saying "identified and capitalized on 15 high-yield investment opportunities in the past year" offers tangible proof of your analytical prowess and your knack for uncovering value.

5. Relevance is Key

Tailor your experience to the role. Extracurricular achievements are commendable but stay focused on experiences that directly align with the responsibilities and requirements of an Investment Manager. Let every bullet point reinforce your suitability for the role.

Takeaway

Crafting your Experience section is akin to presenting a compelling portfolio to potential investors. Each element should be chosen and presented with the intent to showcase the best aspects of your professional journey. Remember, this section is your proof of performance; make it impactful, relevant, and quantifiable. Position yourself as the candidate who not only meets but exceeds expectations.

Education

The world of Investment Management places a high premium on educational achievements, seeing them as the bedrock upon which practical skills and analytical acumen are built. The Education section, while seemingly straightforward, is your chance to underscore the academic credentials that prepare you for the complexities of this role. Let's explore how to polish this section to reflect the caliber of expertise the role demands.

1. Key Degree Identification

Firstly, align your degree with the job's requirements by listing your "Bachelor's degree in Finance, Business, Economics, or related field." This directly matches the job description and sets a strong academic foundation for your candidacy.

2. Clarity and Conciseness

Structure this section for easy reading. List your degree, the field of study, the institution, and your graduation year. Keep it straightforward, allowing the hiring manager to quickly ascertain your academic qualifications.

3. Degree Specification

If your degree directly aligns with the job (e.g., Finance for an Investment Manager), make that clear. Additionally, if your academic focus included relevant coursework or specialized tracks, mentioning these can add depth to your qualifications.

4. Educational Highlights

Though not always necessary, including significant academic achievements, honors, or extracurricular involvements related to finance or investment can complement your profile, especially if they're prestigious or highly relevant.

5. Broader Academic Achievements

For roles demanding continuous learning, such as Investment Management, showcasing additional certifications or ongoing education in relevant areas (like the CFA certification) can significantly bolster your profile, demonstrating a dedication to staying at the forefront of industry trends and standards.

Takeaway

The Education section is more than a testament to your academic endeavors; it's a mirror reflecting your preparedness for the rigorous analytical and strategic demands of the Investment Manager role. Tailor this section to highlight the solid foundation upon which your professional qualifications are built, demonstrating both your commitment to the field and your readiness to contribute to it at the highest level.

Certificates

In the competitive arena of Investment Management, certifications like the Certified Financial Analyst (CFA) designation not only attest to your expertise but also distinguish you as a committed professional. This section is where you spotlight these credentials, further aligning your profile with the targeted role's expectations. Let's delve into crafting a certificates section that elevates your standing.

1. Certificates Selection

Start by listing your most impactful certifications, foremost among them being your "Certified Financial Analyst (CFA)" designation for the Investment Manager role. This aligns directly with the job description, signaling your specialized knowledge and dedication.

2. Highlighting Relevance

Prioritize certificates that resonate most with the role you're applying for. Quality trumps quantity here; a well-chosen certification that demonstrates depth in investment management theory and practice will carry more weight than a litany of unrelated credentials.

3. Date Transparency

For certifications with a validity period or those that are particularly recent, noting the acquisition date or lifespan of the certification can provide context regarding your current competencies and commitment to professional development.

4. Continuous Learning

The field of Investment Management thrives on constant evolution. Highlighting recent or ongoing certifications can demonstrate your proactive stance on growth and adaptability – key traits in this dynamic sector.

Takeaway

In the fast-paced world of Investment Management, certifications are not just accolades; they're affirmations of your expertise and commitment to excellence. When tailored to the role, they can significantly elevate your profile, providing tangible proof of your readiness to navigate the complexities of the field. Let your certifications shine as badges of honor, underscoring your dedication to both personal and professional growth.

Skills

The Skill section is your opportunity to succinctly present your professional toolkit. Within the context of Investment Management, this means spotlighting the hard and soft skills that align with the demands and expectations of the job. Let's explore how to effectively curate this section to underscore your prowess and strategic insight.

1. Skills Deciphering

Initiate by identifying the skills explicitly and implicitly conveyed in the job description, such as "Financial Analysis," "Portfolio Management," and "Market Research." These become the core around which you build your skills list.

2. Direct Skill Alignment

Your skills list should directly reflect those mentioned in the job requirements. This clear alignment demonstrates to the hiring manager your capability to fulfill the role's demands with precision and confidence.

3. Organizational Clarity

Avoid cluttering this section with every conceivable skill. Instead, focus on those most pertinent to an Investment Manager. This strategic selection not only highlights your relevancy but also showcases your discerning judgment – a key asset in investment decision-making.

Takeaway

The Skills section lays bare your professional arsenal, inviting the hiring manager to gauge your fit for the role. Approach this with strategic selectivity, ensuring each listed skill resonates with the core competencies of an Investment Manager. Demonstrating both range and depth here can significantly fortify your candidacy, positioning you as a comprehensive and compelling choice for the role.

Languages

In the globalized realm of Investment Management, linguistic fluency can bridge markets and cultures, expanding the scope of your professional impact. Whether explicitly stated in the job description or not, your proficiency in multiple languages can be a significant asset. Let's break down how to effectively showcase your linguistic capabilities.

1. Adhering to Job Prerequisites

Begin by referencing any language requirements or preferences stated in the job description. For this Investment Manager position, proficient English speaking skills are a must. Your fluency level in English should be prominently showcased.

2. Prioritizing Essential Languages

Lead with the languages most relevant to the job, ensuring your proficiency levels are clearly marked. If the role has a global or regional focus, highlighting additional languages you're fluent in can underscore your readiness for cross-border investment initiatives.

3. Broad Linguistic Range

Beyond the requirements, listing other languages you are conversant in can offer a glimpse into your versatility, potentially opening doors in markets or with clients where those languages are dominant.

4. Honest Proficiency Appraisal

Be accurate in assessing your linguistic proficiency, utilizing terms like "Native," "Fluent," "Intermediate," and "Basic." This honesty ensures expectations are set correctly, safeguarding your professional integrity.

5. Understanding Regional Impact

Evaluate the role's scope and the geographical regions it encompasses. In positions with a broad market purview or diverse client base, proficiency in multiple languages can be a definitive edge, marking you as an invaluable asset to the team.

Takeaway

Your language skills are more than just a line on your resume; they are keys to unlocking global opportunities and deepening client relationships. In the field of Investment Management, where cross-border collaborations and market diversity are commonplace, your linguistic abilities can significantly enhance your professional appeal. Flaunt your proficiency with confidence, and view each language as a potent tool in your investment arsenal.

Summary

The summary section serves as your professional eulogy, condensing your career highlights, skills, and unique selling points into a potent narrative. For an Investment Manager, this is where you crystallize your expertise in developing strategic investment solutions and managing high-value portfolios. Let's guide you through crafting a summary that captivates and convinces.

1. Essence Comprehension

Immerse yourself in understanding the core of the Investment Manager role, aligning your professional ethos with the strategic and analytical demands of the job.

2. Compelling Introduction

Commence with a dynamic opener that encapsulates your career in Investment Management. This might include the years of experience, areas of specialization, and any defining attributes that mark your professional journey.

3. Addressing Core Competencies

Weave into your summary the pivotal skills and achievements that align with the job description. Highlighting accomplishments like "achieving 10% annual portfolio growth" or "identifying 15 high-yield investment opportunities" directly showcases your impact and relevance.

4. Brevity and Impact

While crafting your summary, remember to be concise yet impactful. Aim for a succinct, compelling narrative that beckons the reader to delve deeper into your resume, priming them to uncover the wealth of experience and insight you bring to the table.

Takeaway

The summary is your opening gambit, a strategic pitch that defines your professional narrative at a glance. It should radiate confidence, competence, and the unique value proposition you offer as an Investment Manager. Crafting it with precision and passion sets the tone for the detailed exposition that follows, inviting the hiring manager on a journey through your professional landscape. Make it resonate, make it memorable, and most importantly, make it you.

Embracing Your Role as an Investment Manager

Congratulations on navigating through the nuances of curating a robust, ATS-compliant resume tailored for the Investment Manager position. With each section thoughtfully crafted, your resume now stands as a testament to your strategic acumen, analytical prowess, and unwavering commitment to the field of investment management. Allow Wozber's free resume builder, ATS-friendly resume templates, and the ATS resume scanner to be your steadfast allies in this journey.

Your professional narrative is compelling, your readiness palpable; the market of opportunities awaits. Forge ahead with confidence, and let your resume open doors to a future replete with success and fulfillment.

- Bachelor's degree in finance, business, economics or related field.

- Minimum of 5 years' experience in investment management or a related field.

- Strong proficiency in financial and investment software and tools.

- Excellent analytical, decision-making, and problem-solving skills.

- Active Certified Financial Analyst (CFA) designation.

- The role requires proficient English speaking skills.

- Must be located in San Francisco, California.

- Develop and implement investment strategies to achieve client objectives and optimize portfolio performance.

- Conduct thorough research and analysis on potential investment opportunities, tracking market trends, and assessing risk factors.

- Regularly monitor and review client portfolios, making adjustments as necessary to ensure alignment with investment goals.

- Build and maintain relationships with clients, providing regular reports on investment performance and advising on potential adjustments.

- Collaborate with cross-functional teams, including legal, operations, and sales, to ensure the smooth execution of investment activities.