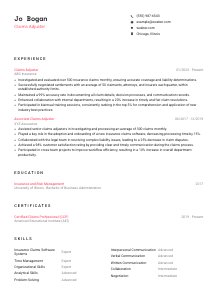

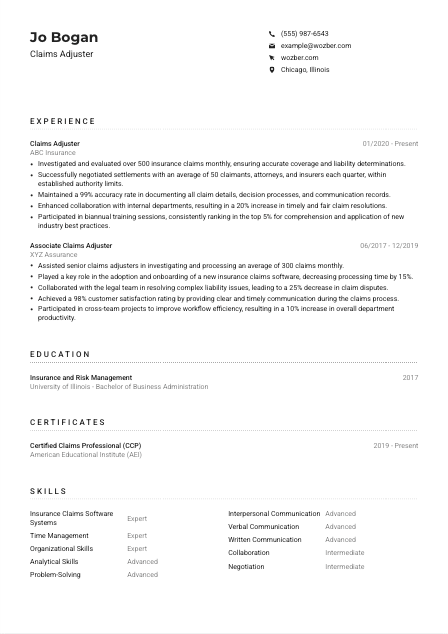

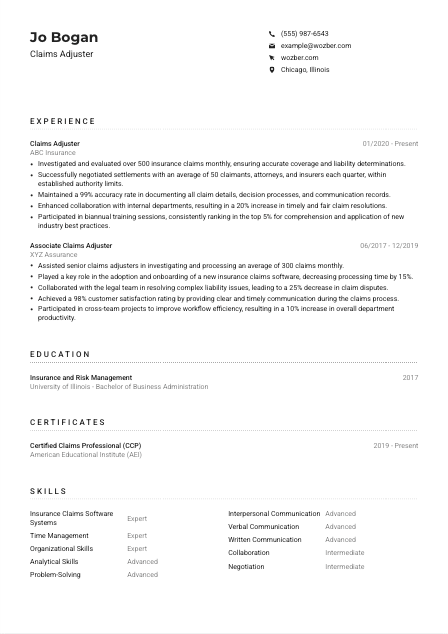

Claims Adjuster Resume Example

Reviewing damages, but your resume doesn't settle well? Dive into this Claims Adjuster resume example, tailored with Wozber free resume builder. See how you can detail your appraising expertise to meet the policy of any job, ensuring your career trajectory is as smooth as a fair settlement!

How to write a Claims Adjuster resume?

Hello, aspiring Claims Adjuster! Navigating through the process of crafting a resume that stands out can be as intricate as determining the liability in complex insurance claims. But worry not; you're about to embark on a journey that will transform your resume into a document as compelling as a well-negotiated settlement.

Utilizing the power of Wozber's free resume builder, you're on your way to creating an ATS-compliant resume that resonates with the essence of your desired Claims Adjuster role. Let's dive in, shall we?

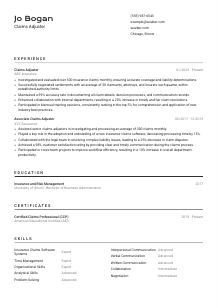

Personal Details

The Personal Information section is more than a mere collection of your contact details. It's the gateway to your professional persona. Here, you're setting the foundation with details aligned perfectly with the Claims Adjuster role.

1. Highlight Your Name and Title

Your name is your professional identity. Ensure it's clearly visible, using a legible font and a slightly larger size. Below it, align yourself with the job by listing 'Claims Adjuster' as your professional title. This synchronization with the job description sends a subliminal message to the hiring manager that you're a perfect fit.

2. Add Contact Information Strategically

Your phone number and a professional email address (ideally firstname.lastname@email.com) are essentials. Double-check for correctness. A small typo could be the only thing standing between you and your next job interview.

3. Location Matters

Including "Chicago, Illinois" proactively addresses one of the job's key criteria, showing you're already in the right place. This detail can give you an edge, especially when the hiring manager is looking to fill the position without the complications of relocation.

4. Link to Your Professional World

If you have a LinkedIn profile or a professional portfolio online, inserting a link to it can provide further insight into your career. Make sure that any linked content is an echo of your resume's professionalism and is kept updated.

5. Keep It Relevant and Professional

Avoid including details that aren't specifically asked for or directly relevant to the Claims Adjuster role. Your aim is to present yourself as the ideal candidate, not to provide personal trivia.

Takeaway

Your personal section is the entrée, laying the groundwork for the main course to come. Make every word count, keeping it professional, relevant, and aligned with your target role. Remember, first impressions last – let this be a memorable one.

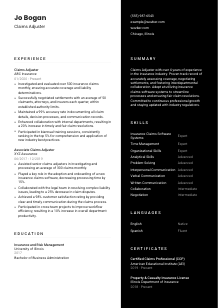

Experience

The Experience section is your opportunity to illustrate your journey as a Claims Adjuster. Here, you'll not just list where you've worked, but also clearly demonstrate how each role has prepared you for this moment.

- Investigated and evaluated over 500 insurance claims monthly, ensuring accurate coverage and liability determinations.

- Successfully negotiated settlements with an average of 50 claimants, attorneys, and insurers each quarter, within established authority limits.

- Maintained a 99% accuracy rate in documenting all claim details, decision processes, and communication records.

- Enhanced collaboration with internal departments, resulting in a 20% increase in timely and fair claim resolutions.

- Participated in biannual training sessions, consistently ranking in the top 5% for comprehension and application of new industry best practices.

- Assisted senior claims adjusters in investigating and processing an average of 300 claims monthly.

- Played a key role in the adoption and onboarding of a new insurance claims software, decreasing processing time by 15%.

- Collaborated with the legal team in resolving complex liability issues, leading to a 25% decrease in claim disputes.

- Achieved a 98% customer satisfaction rating by providing clear and timely communication during the claims process.

- Participated in cross‑team projects to improve workflow efficiency, resulting in a 10% increase in overall department productivity.

1. Analyze the Job Description

Take a magnifying glass to the job description, just as you would when investigating a claim. Highlight keywords and responsibilities such as 'investigate and evaluate insurance claims' and 'negotiate settlements'. These will be your guideposts for tailoring your experience.

2. Present Your Roles Impressively

Structure your experience in reverse chronological order, beginning with your most recent job. For each entry, include your title, the company's name, and your tenure. This structure keeps your resume logical and easy to follow.

3. Quantify and Qualify Your Achievements

Numbers speak louder than words. When detailing your roles, incorporate data wherever you can, such as 'Investigated and evaluated over 500 insurance claims monthly'. It adds weight and credibility to your claims (pun intended!).

4. Focus on What Matters

Align your achievements and duties with the responsibilities and requirements detailed in the job description. If you've streamlined a process, solved complex claim disputes, or handled specific types of claims mentioned, highlight these instances.

5. Continuous Professional Development

Mention any insurance industry-specific training or seminars you've participated in to show your commitment to staying current with best practices. This underscores your dedication to your profession and willingness to grow.

Takeaway

Your experience is not just a list of past jobs; it's a story of your journey and growth in the insurance claims world. Highlight your relevant achievements, skills, and continuous learning to make your resume compelling. Let them see the Claims Adjuster they've been searching for – you.

Education

While the thrill of the job often lies in the fieldwork for a Claims Adjuster, your educational background is what sets the foundation. Let's ensure this section of your resume stands as a testament to your preparedness for the role.

1. Align With Job Requirements

The job description mentions a 'Bachelor's degree in related field', marking it as a non-negotiable. If your degree aligns, such as a Bachelor of Business Administration in Insurance and Risk Management, make sure it's front and center.

2. Keep It Clear

Structure your education section for easy readability: degree, field, institution, and graduation date. This allows hiring managers to quickly verify your credentials against their requirements.

3. Highlight Relevant Coursework

If your degree closely aligns with the Claims Adjuster role, mentioning specific courses can reinforce the relevance of your educational background, especially if your professional experience is limited.

4. The Extra Mile

Should you have any academic achievements like honors, or membership in relevant professional organizations, include these. They add depth to your profile and show a commitment to your field beyond just coursework.

5. Ongoing Learning

Insurance laws and technologies evolve; so should you. If you've taken any recent courses or certifications, even online, that enhance your claims adjusting skill set, include them here. It shows initiative and a proactive approach to your career.

Takeaway

With education, you're not just listing where you've studied. You're highlighting your foundation for success in the Claims Adjuster role. Tailor it with an eye to the future, showing you're built on a solid educational foundation, yet always reaching forward.

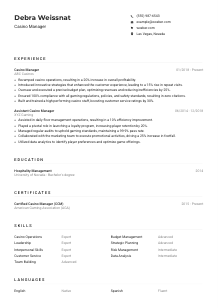

Certificates

In the detail-oriented world of claims adjusting, certifications can significantly bolster your standing as a top candidate. They're proof of your dedication and expertise. Let's distinguish which certificates make you stand out.

1. Pinpoint Relevant Certifications

While the job description might not explicitly demand specific certifications, including relevant ones like 'Certified Claims Professional (CCP)' or a 'Property & Casualty Insurance License' immediately sets you apart and speaks to your specialized knowledge.

2. Choose Quality Over Quantity

List certifications that directly relate to the Claims Adjuster role, favoring those that strengthen your candidacy. This targeted approach ensures that every line of your resume adds value.

3. Dates Matter

Include the acquisition or renewal dates for each certification to show that your expertise is current. This detail is particularly important in fields like insurance, where regulations and best practices are continually evolving.

4. Keep Up-to-Date

Always be on the lookout for new certifications or renewals that can bolster your skill set. This not only enhances your resume but demonstrates a commitment to your professional growth and adaptability in the ever-changing world of claims adjusting.

Takeaway

Certifications are more than just accolades; they're a testament to your dedication and expertise in the nuanced world of claims adjusting. Curate and update this section to reflect your ongoing commitment to professional excellence.

Skills

Skills are the tools in your professional toolbox. The right mix of hard and soft skills can paint you as the ideal Claims Adjuster candidate. Here's how to tailor this section to speak volumes about your capability.

1. Extract from the Job Description

Identify both the explicit and implicit skills required for the Claims Adjuster position from the job description. Skills like 'Proficiency with insurance claims software systems' and 'Strong analytical and problem-solving skills' are non-negotiables.

2. Match and Showcase

Align your skills with those requested in the job description. This tailored approach ensures that your resume resonates with what the hiring manager is seeking. Use the terms they use (where truthful), like 'Insurance Claims Software Systems: Expert'.

3. Keep It Focused

Resist the urge to list every skill you've ever acquired. Instead, prioritize the ones most relevant to a Claims Adjuster's responsibilities. This focus keeps your resume sharp and directed towards your desired role.

Takeaway

Each skill you list is a building block in the structure of your professional identity. Shape this section with care, ensuring it mirrors the skills sought for a Claims Adjuster. Let your resume showcase the expertly balanced toolkit you bring to the table.

Languages

While the core of a Claims Adjuster's role might not hinge on multilingualism, the ability to communicate in multiple languages can be a distinct advantage, especially in a diverse, global city like Chicago. Let's navigate how to include languages effectively.

1. Prioritize Job Requirements

Since the job description emphasizes the ability to 'read and write in English effectively', your proficiency in English should be noted as 'Native'. This immediately clarifies your ability to meet one of the fundamental requirements.

2. Highlight Additional Languages

If you're also fluent in other languages, list them. This additional skill sets you apart and demonstrates your ability to communicate with a broader range of clients or colleagues.

3. Be Honest About Your Level

Accurately portray your language proficiencies using terms like 'Native', 'Fluent', or 'Basic'. Overestimating your ability sets both you and your employer up for potential misunderstandings.

4. Reflect on the Role

For roles with a potential for international clients or in multicultural hubs like Chicago, highlighting your language skills can give you an edge. Claim that advantage if it's yours to claim.

5. Continuously Improve

Language skills can always be honed. Even if you're starting with 'Basic' proficiency, showing a commitment to improvement is a positive trait that employers value.

Takeaway

Your ability to communicate in different languages is a powerful tool, opening doors to nuanced customer interactions and enhanced service delivery. Showcase your linguistic skills as part of the diverse portfolio you bring to the Claims Adjusting role.

Summary

Your summary is the bow that ties your resume package together, offering a snapshot of your professional journey and aspirations. Here's how to distill your experiences and skills into an irresistible introduction.

1. Reflect on the Role

Begin by thinking deeply about what the role of a Claims Adjuster entails and how your experiences align with those requirements. This understanding will inform the tone and content of your summary.

2. Start with a Bang

Open with a strong statement that encapsulates your profession and standing. For instance, 'Claims Adjuster with over 4 years of experience in the insurance industry' immediately signals your relevance for the role.

3. Showcase Key Achievements

Select a handful of achievements that demonstrate your capability and dedication, such as 'Successfully negotiated settlements with an average of 50 claimants, attorneys, and insurers each quarter'. These specifics give weight to your claims.

4. Keep It Precise

Your summary should be concise, aiming for 3-5 lines. It's a teaser, inviting the hiring manager to dive deeper into the compelling narrative of your resume.

Takeaway

The summary is your chance to make a strong first impression, encapsulating why you're the ideal candidate for the Claims Adjuster position. It sets the tone for the rest of your resume, so make every word count.

Embarking on Your Claims Adjuster Career Path

Equipped with these tailored insights and the powerful features of Wozber's free resume builder, including ATS-friendly resume templates and an ATS resume scanner, you're ready to craft an ATS-compliant resume that not only meets the requirements but surpasses them. Your resume is more than a document—it's the key to unlocking your future in the dynamic world of claims adjustment. Go ahead, let your professionalism shine through every section of your meticulously crafted resume.

The claims adjusting world awaits your expertise and passion. Your journey begins now.

- Bachelor's degree in related field or equivalent work experience.

- Minimum of 3 years of experience in claims adjusting or similar role.

- Proficiency with insurance claims software systems.

- Strong analytical and problem-solving skills.

- Excellent interpersonal and communication skills, both written and verbal.

- Must be able to read and write in English effectively.

- Must be located in Chicago, Illinois.

- Investigate and evaluate insurance claims to determine coverage and liability.

- Negotiate settlements with claimants, attorneys, and insurers within established authority limits.

- Ensure accurate documentation of all claim details, decision processes, and communication records.

- Collaborate with internal departments, such as underwriting and legal, to ensure timely and fair claim resolutions.

- Regularly participate in training sessions and stay updated with industry best practices and regulations.