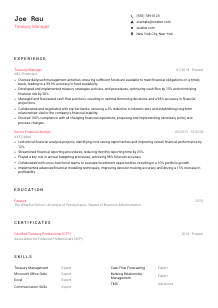

Treasury Manager Resume Example

Diving into finances, but your resume feels like hidden treasure? Uncover this Treasury Manager resume example, crafted with Wozber free resume builder. Discover how you can present your fiscal leadership to align with job expectations, making your career prospects as rich and rewarding as your balance sheet!

How to write a Treasury Manager Resume?

Hello, aspiring Treasury Manager! If you're set on conquering the financial helm of an organization, your resume needs to be as strategic and well-regulated as your approach to cash flow management. Merging finance with strategy, your resume is your portfolio, showcasing your fiscal finesse and leadership acumen.

Here's a deep dive into sculpting a resume that resonates with the pulse of Treasury Management, employing the cutting-edge tools of Wozber's free resume builder, ATS-friendly resume templates, and seminal ATS resume scanner. Let's chart the course to a resume that not only speaks your professional language but also passes with flying colors through the selective lens of an ATS.

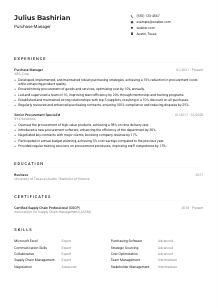

Personal Details

First impressions count, especially in the competitive sphere of Treasury Management. Crafting your Personal Details section is akin to presenting your business card at an exclusive finance gala; it must be impeccable, professional, and aligned with your target role.

1. Name as Your Brand

Your name heralds your resume, so ensure it's prominently displayed in a clean, professional font. Think of it as the brand logo of 'You Inc.', inviting the hiring manager to invest their time in reading further.

2. Job Title Alignment

Mimic the exact job title you're pursuing – in this case, 'Treasury Manager.' Placing this title below your name acts like a beacon, signaling your career aspirations and aligning your resume with the job at hand.

3. Essential Contact Information

Your phone number and email address are your direct lines. Ensure your email conveys professionalism; a variation of your name is the gold standard. Remember, this is financial territory, so accuracy in these details mirrors your meticulous nature.

4. Geographical Consideration

Including 'New York City, New York' as your location demonstrates logistical alignment with the job's requirements. It subtly assures the hiring team of your readiness and minimizes logistical hesitancies.

5. Leverage Digital Footprint

In today's interconnected world, a LinkedIn profile is your digital portfolio. Linking it (when applicable) can provide a deeper insight into your professional landscape, expanding on the succinct story your resume tells.

Takeaway

As the gateway to your financial narrative, your Personal Details section must be polished and professional. It's the first handshake with potential employers, setting the stage for the detailed prowess awaiting in the subsequent sections of your resume. Remember, every detail counts in showcasing your readiness to step into the Treasury Manager role.

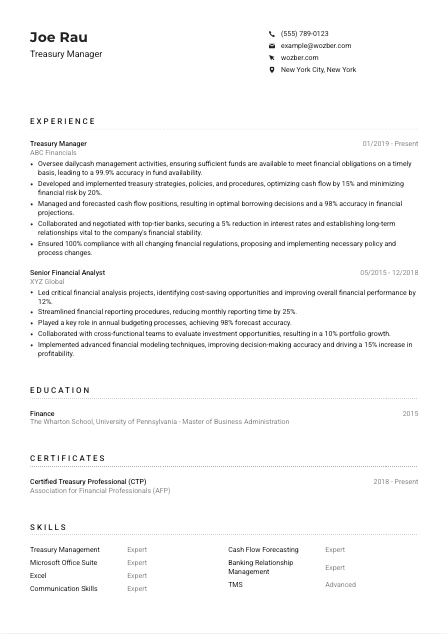

Experience

The Experience section is where you crystallize your professional journey, showcasing your evolution and highlighting your aptitude for the Treasury Manager role. It's your chance to demonstrate your strategic impact and operational proficiency in treasury functions.

- Oversee dailycash management activities, ensuring sufficient funds are available to meet financial obligations on a timely basis, leading to a 99.9% accuracy in fund availability.

- Developed and implemented treasury strategies, policies, and procedures, optimizing cash flow by 15% and minimizing financial risk by 20%.

- Managed and forecasted cash flow positions, resulting in optimal borrowing decisions and a 98% accuracy in financial projections.

- Collaborated and negotiated with top‑tier banks, securing a 5% reduction in interest rates and establishing long‑term relationships vital to the company's financial stability.

- Ensured 100% compliance with all changing financial regulations, proposing and implementing necessary policy and process changes.

- Led critical financial analysis projects, identifying cost‑saving opportunities and improving overall financial performance by 12%.

- Streamlined financial reporting procedures, reducing monthly reporting time by 25%.

- Played a key role in annual budgeting processes, achieving 98% forecast accuracy.

- Collaborated with cross‑functional teams to evaluate investment opportunities, resulting in a 10% portfolio growth.

- Implemented advanced financial modeling techniques, improving decision‑making accuracy and driving a 15% increase in profitability.

1. Dissecting the Job Spec

Start by absorbing every requirement laid out in the job description. Pay close attention to phrases like 'oversee daily cash management activities' or 'develop treasury strategies,' as these will be your keywords to mirror in your resume.

2. Role & Organization Structure

List each position in reverse chronological order. Ensure roles directly related to Treasury Management are given prominence, drawing a clear line between past positions and the targeted Treasury Manager role.

3. Tailoring Accomplishments

For each role, craft bullet points that resonate with the job description. Quantify achievements like "Optimized cash flow by 15%" or "Secured a 5% reduction in interest rates." This not only shows you're capable but also speaks the language of results.

4. The Power of Quantification

Quantifiable accomplishments are your best arguments. They translate your professional story into the universal language of numbers, allowing hiring managers to gauge your potential impact at a glance.

5. Pertinence over Prevalence

Filter through your experiences, focusing solely on those that sculpt your narrative towards the Treasury Manager role. Extraneous information might dilute your resume's effectiveness, so keep your content targeted.

Takeaway

Consider the Experience section as the core of your resume. It's where you furnish proof of your competencies and signal to hiring managers your readiness and capability for the Treasury Manager role. By strategically aligning your experiences with the job requirements, you paint a compelling picture of your financial acumen.

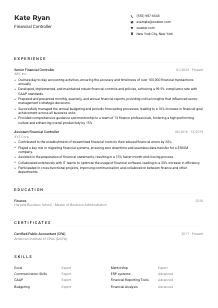

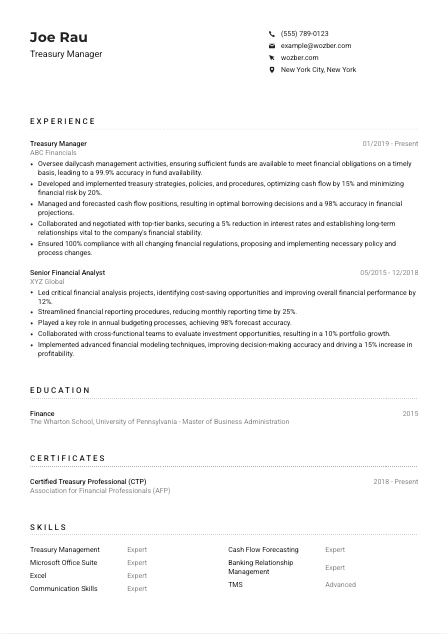

Education

In the realm of Treasury Management, your educational background lays the cornerstone of your expertise. While seemingly straightforward, this section allows you to underline your foundational knowledge and analytical capabilities.

1. Zeroing in on Key Requirements

Anchor your education details around the job's requirements. For instance, specifying your "Bachelor's degree in Finance, Accounting, or a related field," directly addresses one of the primary criteria for the Treasury Manager role.

2. The Structure of Clarity

Maintain simplicity and clarity. List your degrees, institutions, and graduation years in an organized manner. This straightforward approach ensures the hiring manager can quickly verify your educational qualifications.

3. Degree Specificity

Align your degree titles closely with the job description. A "Master of Business Administration in Finance" directly echoes the depth of knowledge and specialization preferred for a Treasury Manager.

4. Coursework & Achievements

Highlight specific courses or achievements that bolster your candidacy. Though our example Treasury Manager's broader degrees cover the necessities, mentioning relevant coursework could further showcase specialization.

5. Beyond Academia

If applicable, showcase extracurricular achievements that reflect your leadership or financial acumen. Remember, senior roles appreciate depth of experience, both in and out of the classroom.

Takeaway

Your Education section is more than a list of degrees; it's a testament to your analytical and foundational prowess in finance and management. Ensure it mirrors the role's requirements, carrying your resume further in the trajectory towards securing the Treasury Manager position.

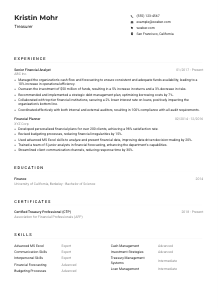

Certificates

In the finance domain, certifications are a badge of your commitment to excellence and continuous learning. Let's navigate integrating them into your resume, amplifying your proficiency and distinguishing you from the competition.

1. Sifting Through Requirements

Identify certifications explicitly mentioned in the job description, such as the "Certified Treasury Professional (CTP)" preference. This holds a spotlight to your dedication and specialized knowledge in treasury management.

2. Prioritizing Certifications

Select certifications that underline your fit for the Treasury Manager role. Highlighting your CTP status immediately aligns with the employer's preferences, demonstrating your preparedness and competitive edge.

3. Dates Matter

Including the dates of your certifications, especially when recent, reflects your active participation in professional development, keeping abreast of the latest in financial management and strategic operations.

4. Continuous Evolution

The finance industry is ever-evolving. Commit to ongoing education and certification to stay ahead, underscoring your dedication to excellence and leadership in treasury management.

Takeaway

Treat certifications as laurels of your professional growth and passion for the field of Treasury Management. They not only validate your expertise but also position you as a candidate who values advancement and is attuned to the dynamic nature of finance.

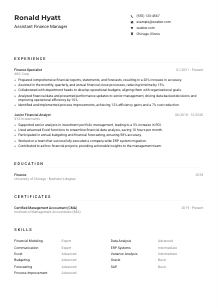

Skills

The Skills section is your professional toolbox, where you showcase your technical prowess and soft skills. For a Treasury Manager, balancing financial acumen with interpersonal finesse is pivotal. Let's delve into tailoring this section to reflect your multifaceted skill set.

1. Decoding the Job Description

Gather both hard and soft skills from the job description. Phrases like "strong proficiency in treasury management systems (TMS)" and "excellent analytical skills" pinpoint exactly what the hiring manager is looking for.

2. Curating a Matched List

Ensure your listed skills mirror those requested in the job description. For instance, stating your expertise in "Cash Flow Forecasting" and "Banking Relationship Management" directly aligns with the job's demands.

3. The Art of Organization

Structure your skills in a readable, compelling format, focusing on those most pertinent to the Treasury Manager role. This is not the section for a kitchen-sink approach; it's about showcasing your most relevant professional tools.

Takeaway

Curate your Skills section as an emblematic representation of your professional capabilities, particularly tailored to the Treasury Manager domain. This is your chance to highlight your proficiency in both the technical and interpersonal arenas critical to fiscal management and leadership.

Languages

In a globalized business landscape, linguistic skills can provide a considerable edge. While the primary requirement for a Treasury Manager might be proficiency in English, additional languages signal your ability to navigate international waters confidently.

1. Aligning with Job Specifications

Start by ensuring your resume accentuates required languages. Given "English proficiency is vital," explicitly showcasing your fluency meets an essential criterion straight off the bat.

2. Showcasing Additional Languages

Listing other languages demonstrates global awareness and adaptability – highly desirable traits in the diverse field of finance. Be honest about your proficiency level to ensure authenticity and transparency.

3. Conveying Proficiency Levels

Use clear labels to describe your fluency: native, fluent, intermediate, or basic. This gives hiring managers an immediate understanding of your communication capabilities in diverse environments.

4. Understanding the Role's Scope

If the Treasury Manager role encompasses international dealings, emphasizing your multilingual skills could distinguish your application. It portrays you as a bridge in multicultural financial landscapes.

5. Embracing Global Connectivity

In the interconnected realm of finance, every language you speak fluently adds to your professional allure. It's a manifestation of your readiness to operate on a global stage, transcending borders and cultural barriers.

Takeaway

Use your linguistic skills to underscore your global perspective and versatility. Every language proficiency you list is a testament to your capacity for empathy, adaptability, and connectivity in an ever-globalizing world of finance.

Summary

The Summary is your resume's handshake, the narrative arc that invites hiring managers into your professional story. For a Treasury Manager, it's about distilling your journey into a compelling executive summary that broadcasts your strategic vision and financial acumen.

1. Grasping the Job Essence

Decipher the job requirements to ensure your summary encapsulates your alignment with the role's needs. This is where your professional persona meets the job's demands, creating a resonant introduction.

2. An Engaging Introduction

Start with a strong opening line that positions you as a seasoned Treasury Manager, setting the stage for the narrative of your professional journey and how it aligns with the path ahead.

3. Echoing Key Requirements

Highlight your skills and accomplishments, particularly those matching the job description. Phrases like "Optimizing cash flow" or "Ensuring compliance with changing financial regulations" speak volumes of your suitability.

4. Brevity and Precision

Keep your summary succinct but powerful. Aim for a punchy, persuasive paragraph that leaves hiring managers intrigued and wanting to learn more about your financial stewardship journey.

Takeaway

Think of your Summary as the opening chapter of your professional story. It sets the tone, highlights your thematic strengths, and lays the groundwork for the detailed achievements to come. A well-crafted Summary can captivate your audience from the get-go, positioning you as the Treasury Manager of choice.

Embarking on Your Treasury Manager Voyage

Congratulations on navigating the intricacies of crafting a resume tailored for the Treasury Manager role. With these insights, you have the tools to build a resume that doesn't just pass the ATS screening but leaves a lasting impression on hiring managers. Use Wozber's free resume builder, including the ATS-friendly resume templates and ATS resume scanner, to ensure your resume is a beacon of your professional prowess.

Your journey to a fulfilling Treasury Manager role is well on its way – your strategic narrative, refined skills, and financial acumen are about to open new chapters of career success. Step forward with confidence, the spotlight awaits!

- Bachelor's degree in Finance, Accounting, or a related field.

- Minimum of 5 years' experience in treasury operations or financial analysis, with at least 2 years in a managerial role.

- Professional certification such as Certified Treasury Professional (CTP) is preferred.

- Strong proficiency in treasury management systems (TMS) and Microsoft Office Suite, particularly Excel.

- Excellent analytical, interpersonal, and communication skills.

- English proficiency is vital for this role.

- Must be located in or willing to relocate to New York City, New York.

- Oversee daily cash management activities, ensuring sufficient funds are available to meet financial obligations.

- Develop and implement treasury strategies, policies, and procedures to optimize cash flow and minimize financial risk.

- Manage and forecast cash flow positions, associated borrowing needs, and ensure necessary funding decisions are made timely and efficiently.

- Collaborate with internal and external stakeholders, including banks, to negotiate and maintain relationships, as well as secure banking and credit facilities.

- Stay updated with changing financial regulations, ensuring compliance and proposing necessary changes in policies or processes.