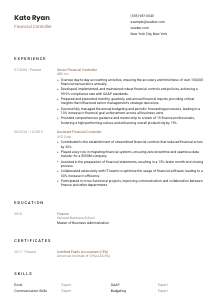

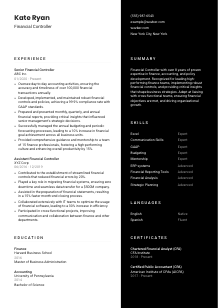

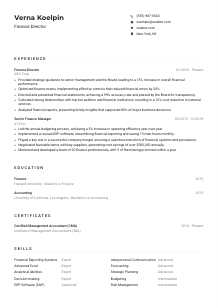

Financial Controller Resume Example

Balancing ledgers, but your resume doesn't add up? Crunch numbers with this Financial Controller resume example, calculated using Wozber free resume builder. See how effortlessly you can present your fiscal finesse to match job specifications, so your career accounts for both growth and dividends!

How to write a Financial Controller Resume?

Hello, aspiring Financial Controller! In the fast-paced and competitive finance industry, setting yourself apart isn't just a goal—it's a necessity. Your resume is more than a piece of paper; it's a billboard advertising your expertise and accomplishments. With Wozber's free resume builder, this guide will navigate you through the art of crafting a resume that resonates perfectly with the Financial Controller role you're eyeing. Let's transform your professional narrative into a winning ticket to your next big opportunity!

Personal Details

The Personal Details section is your virtual handshake. In the world of finance, precision and professionalism are non-negotiable. Here, we'll refine your introduction to ensure it aligns perfectly with the expectations for a Financial Controller, setting the stage for a memorable first impression.

1. Your Name, Your Brand

Your name isn't just an identifier; it's the title of your professional story. Use a font that's clean and authoritative, making your name slightly larger to catch the eye. In the finance world, clarity and prominence reflect confidence—a trait every senior role demands.

2. Match the Job Title

Immediately below your name, include the position you're vying for. Aligning with the role, "Financial Controller", positions you as a tailored candidate right off the bat. It signals to hiring managers that your resume isn't a one-size-fits-all but a focused application.

3. Essential Contact Information

- Phone Number: Accuracy is key. A typo here could mean a missed opportunity. Make sure it's the number where you are most available.

- Professional Email Address: First impressions start here. Opt for an email that is clear and professional, typically in the firstname.lastname format, steering clear of whimsical or outdated handles.

4. Location Matters

"Must be located in New York City, New York" is a clear directive from the job listing. By specifying New York City as your location, you directly fulfill a significant requirement, reassuring the employer of your suitability in terms of logistics.

5. A Touch of Modern

Including a LinkedIn profile or a personal website can provide a more comprehensive picture of your professional persona. Ensure it's polished and mirrors the achievements and skills listed on your resume. In today's digital age, a strong online presence can be a decisive factor.

Takeaway

Think of the Personal Details section as the prelude to your professional concerto. It's where you set the tone and make a promise of the value you bring. Precision, alignment, and a dash of modernity here pave the way for a standout introduction. Welcome them into your professional journey with open arms; after all, this is just the beginning.

Experience

In the realm of finance, your experience is your currency. This section is your opportunity to detail your journey of growth, achievements, and the impact you've made. Let's tailor your experience to reflect the precision, strategic insight, and leadership expected from a Financial Controller.

- Oversee day‑to‑day accounting activities, ensuring the accuracy and timeliness of over 100,000 financial transactions annually.

- Developed, implemented, and maintained robust financial controls and policies, achieving a 99.9% compliance rate with GAAP standards.

- Prepared and presented monthly, quarterly, and annual financial reports, providing critical insights that influenced senior management's strategic decisions.

- Successfully managed the annual budgeting and periodic forecasting processes, leading to a 10% increase in financial goal achievement across all business units.

- Provided comprehensive guidance and mentorship to a team of 15 finance professionals, fostering a high‑performing culture and enhancing overall productivity by 15%.

- Contributed to the establishment of streamlined financial controls that reduced financial errors by 20%.

- Played a key role in migrating financial systems, ensuring zero downtime and seamless data transfer for a $500M company.

- Assisted in the preparation of financial statements, resulting in a 15% faster month‑end closing process.

- Collaborated extensively with IT teams to optimize the usage of financial software, leading to a 30% increase in efficiency.

- Participated in cross‑functional projects, improving communication and collaboration between finance and other departments.

1. Dissect Job Requirements

Start with a forensic analysis of the job listing. Each requirement speaks to specific skills and experiences valued by the employer. For instance, the demand for "progressive finance and accounting experience" signals the need for candidates who've shown growth and expanded competencies over time.

2. Chronology is Key

List your career trajectory starting with your most recent position, emphasizing roles and responsibilities that resonate with the Financial Controller role. Not only does this show your career progression, but it also highlights how each phase has uniquely prepared you for this moment.

3. Impact Through Accomplishments

"Prepared and presented monthly, quarterly, and annual financial reports" is an accomplishment that directly matches a responsibility listed in the job description. Quantify your achievements, using metrics to illustrate your contributions and the value you've added to previous organizations.

4. Quantification Speaks Volumes

Numbers bring your impact to life. Whenever you can, quantify your accomplishments. Managed a team of 15? Increased efficiency by 30%? These details act as proof of your ability to handle responsibility and drive results.

5. Relevance Is Your Compass

Tailor every point to reflect your fitness for the Financial Controller role. Remember, this isn't just a record of your job history; it's a strategic narrative demonstrating that you are not just suitable for the role—you are the best choice.

Takeaway

Your experience section is where you validate your claim to the Financial Controller throne. With each bullet point, you're building a case for why the company shouldn't just hire a Financial Controller, but why they should hire you. It's your story of growth, impact, and readiness for the responsibility that lies ahead. Let it shine!

Education

For a Financial Controller, your educational background doesn't just demonstrate knowledge; it's the bedrock of your credibility. In this section, we'll shape your educational achievements to showcase not just your qualifications, but your dedication to the finance profession.

1. Match Key Requirements

Firstly, ensure your degrees align with the job's educational mandates. A "Bachelor's degree in Finance, Accounting, or a related field" is a non-negotiable baseline. If you've gone above and beyond—perhaps with a Master's—make sure it's prominently featured.

2. Structure for Clarity

Present your degrees in a clean, easily digestible format: field of study, degree, institution, and graduation date. In the finance sector, clarity and order are not just appreciated; they're expected.

3. Tailor Your Degree Details

If your degree closely aligns with or exceeds the role's requirements, make sure it's highlighted respectfully. For the Financial Controller role, emphasizing a Master of Business Administration in Finance showcases not only your educational attainment but also your dedication to the field.

4. Relevant Courses and Achievements

While it's important not to clutter this section, highlighting coursework relevant to high-level financial management or achievements like honors can add depth to your profile, especially if they directly relate to responsibilities you'll shoulder as a Financial Controller.

5. Continuous Learning

In the ever-evolving finance field, ongoing education is key. If applicable, noting that you've kept abreast of the latest developments through certifications or additional courses will underline your commitment to staying at the forefront of industry knowledge.

Takeaway

Well-conceived and neatly presented, your education section is a testament to your foundation in the finance field. It underlines your preparedness, not just academically, but in terms of continuous growth and learning. Let it reflect your unwavering commitment to excellence and your readiness to command the role of Financial Controller.

Certificates

In the realm of finance, certifications like CPA or CFA are not just accolades—they're your armor. They prove your expertise and dedication to your craft. Here, we'll align your certifications with the job's demands, ensuring they showcase your specialized skills and knowledge.

1. Align With Job Demands

The job listing specifically calls for "Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA) designation." If you possess these, they deserve a place of honor on your resume. They directly correlate to the stated requirements, signaling your qualification and commitment to the field.

2. Highlight Relevant Certifications

Focus on certifications closely tied to the Financial Controller role. Extraneous certificates, while impressive, may dilute the impact of those most relevant. Lead with the strongest, most directly applicable credentials.

3. Dates Matter

Validity matters in the world of certifications. Include acquisition or renewal dates to show current knowledge and engagement with professional standards in the finance industry.

4. Stay Current

The finance industry is dynamic, with regulations and best practices constantly evolving. Demonstrating a commitment to ongoing education and recertification reflects your adaptability and dedication to excellence.

Takeaway

Your certifications are a powerful section of your resume, showcasing your specialized expertise and ongoing commitment to your profession. Highlight them wisely, ensuring they shine brightly as proof of your qualifications and readiness for the Financial Controller role. Let your credentials speak volumes of your dedication to professional growth.

Skills

For a Financial Controller, your skills section is a succinct showcase of your professional aptitudes. This isn't just a list; it's a strategic compilation of your strengths, carefully selected to resonate with the specifics of the role you're targeting. Let's ensure your skills make a compelling case for why you're the ideal candidate.

1. Extract Job-Related Skills

Dive into the job description and highlight skills that are directly requested or implied. For the Financial Controller role, proficiency in "financial software, including Excel, ERP systems, and financial reporting tools," alongside "strong interpersonal and communication skills," are paramount. Make sure they're prominently featured on your resume.

2. Prioritize Impact

Focus on skills that have the most significant impact on the role. In finance, expertise in Excel, budgeting, and strategic planning aren't just tools; they're essential to your success and the company's financial health.

3. Organize and Optimize

List your skills in a logical order—starting with those most critical for the Financial Controller position. Use clear, concise terms and, where possible, align this with the language used in the job listing. This not only aids in readability but also in ATS optimization, ensuring your resume speaks "the same language" as the employer's systems.

Takeaway

The Skills section is your professional highlight reel. Craft it with intention, ensuring each skill listed aligns with the demands of the Financial Controller role. This is your moment to show the hiring manager not just your qualifications, but your strategic fit for the role. Let your skills paint a picture of a future where you are already contributing to their success.

Languages

In the globalized arena of finance, language skills can differentiate you from the pack. Whether the role explicitly requires multilingualism or not, showcasing your linguistic abilities can signify cultural agility and a broader perspective—attributes of immense value.

1. Reflect Job Necessities

For the Financial Controller position, professional fluency in English is explicitly required. Highlight your proficiency level at the top, affirming your capability to communicate efficiently in the primary business language.

2. Emphasize Key Languages

If the role interacts with international markets or teams, additional languages can be a considerable asset. Place these languages strategically in your resume to catch the eye of hiring managers looking for versatile and globally minded candidates.

3. Honest Proficiency Representation

Be truthful about your language capabilities. Misrepresenting your fluency can lead to awkward situations and undermine your credibility. Use standardized levels like "native," "fluent," "intermediate," or "basic" to describe your proficiency.

4. Additional Languages as Assets

Even if not directly related to the role's requirements, other languages may demonstrate your adaptability and readiness to engage in today's globalized business environment. It showcases you as a candidate with a broader worldview.

5. Role's Scope and Your Languages

Consider the geographical and cultural scope of the role. If it involves managing or interacting with finances across borders, your language skills could significantly enhance your appeal to potential employers.

Takeaway

Languages can open doors to new opportunities, offering a unique advantage in the competitive field of finance. Your language skills are a testament to your adaptability and global perspective—traits that are increasingly valuable in today's interlinked economic landscape. Let them serve as a bridge to opportunities beyond borders, making you a truly global financial player.

Summary

The Summary is your chance to captivate the hiring manager's attention. It's a concise, powerful statement that encapsulates your professional persona, aligning your experience, skills, and aspirations with the Financial Controller role. Let's craft a summary that's both compelling and reflective of your career highlights.

1. Digest the Essence

Before writing, absorb the core requirements and objectives of the Financial Controller position. Understand what drives success in this role—be it strategic insight, leadership in financial management, or a collaborative spirit.

2. Open with Confidence

Start with a strong, confident introduction. "Financial Controller with over 8 years of proven expertise" immediately sets the stage, presenting you as a seasoned professional ready to take on the challenges of the role.

3. Align with Key Requirements

Highlight your alignment with the job's core demands, integrating specific skills and achievements that mirror those listed in the job description. This tailored approach signals a perfect fit, showcasing your readiness to excel in the role.

4. Conciseness is Key

Your summary should be a succinct pitch, not a comprehensive autobiography. Aim for 3-5 impactful lines that encapsulate your qualifications, experience, and how you can contribute to the company's success as a Financial Controller.

Takeaway

Crafted with care, your summary section is the opening act that draws the hiring manager into your story. It's your opportunity to make a strong, immediate connection, positioning you as a leading candidate for the Financial Controller role. Reflect on your career's highlights and present them confidently—you're not just ready for the next step; you're poised to make a significant impact.

Embarking on Your Financial Controller Journey

Congratulations! You're now equipped with insider knowledge on tailoring your resume to the Financial Controller role. With Wozber's free resume builder, ATS-compliant resume templates, and ATS optimization tools, you have everything you need to create a resume that not only meets the job requirements but stands out from the competition. Your resume is the key to unlocking doors to new opportunities; craft it with precision, present it with confidence, and prepare for your next big breakthrough.

The finance world awaits your expertise. Go make your mark!

- Bachelor's degree in Finance, Accounting, or a related field.

- Minimum of 7 years of progressive finance and accounting experience, with at least 3 years in a similar role (preferably in a public company).

- Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA) designation.

- Proficiency with financial software, including Excel, ERP systems, and financial reporting tools.

- Strong interpersonal and communication skills, with the ability to liaise and collaborate with cross-functional teams.

- Ability to communicate professionally in English is required.

- Must be located in New York City, New York.

- Oversee day-to-day accounting activities, ensuring the accuracy and timeliness of financial transactions.

- Develop, implement, and maintain financial controls and policies, in adherence to GAAP and company standards.

- Prepare monthly, quarterly, and annual financial reports, providing insights and analysis to senior management.

- Manage the annual budgeting and periodic forecasting processes, working closely with business units to achieve financial objectives.

- Provide guidance and mentorship to the finance team, promoting professional growth and a high-performing culture.