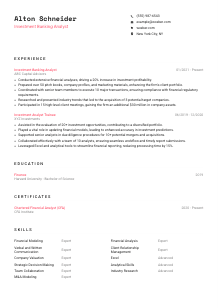

Investment Banking Analyst Resume Example

Juggling numbers, but your resume isn't adding up? Explore this Investment Banking Analyst resume example, formulated with Wozber free resume builder. See how adeptly you can integrate your financial finesse to meet job specs, ensuring your career portfolio yields the highest returns!

How to write an Investment Banking Analyst Resume?

Aspiring to carve a niche in the dynamic world of investment banking? Your resume is the golden ticket to getting noticed. With the fierce competition out there, it's critical your resume not only meets but exceeds expectations. This guide, powered by Wozber's free resume builder, is your personal blueprint to crafting an Investment Banking Analyst resume that's not just ATS-compliant but compelling enough to make hiring managers eager to meet you. Let the transformation begin!

Personal Details

First impressions count, and in the world of resumes, your personal details section is the frontline. It's more than a formality—it's your introduction. For an Investment Banking Analyst, every detail matters. Let's tailor this to perfection.

1. Your Name: The Brand

Think of your name as the headline of your professional story. Use a clean, professional font that stands out but remains easy on the eyes. Considering investment banking's formal nature, tradition wins over trendiness here.

2. Job Title Precision

Directly beneath your name, affirm your career identity with the job title, "Investment Banking Analyst." This alignment with the position signals to the ATS and the hiring manager that you're not just a contender; you're a perfect fit.

3. Contact Info: Keep it Professional

List only your most professional contact details. A well-structured email like firstname.lastname@email.com and a current phone number are mandatory. Meticulousness here shows you're serious about your professional persona.

4. Geo-Tagging: Location Matters

"Must be located in New York City, NY." Since the job insists on a NYC-based candidate, highlighting your NYC address upfront matches one of the key prerequisites, giving you geographic credibility.

5. Online Presence: Polished and Professional

In today's digital age, including a LinkedIn URL is almost expected, especially for a role as network-driven as Investment Banking Analyst. Ensure your profile is updated and reflects your resume's story, reinforcing your professional narrative.

Takeaway

Your personal details section sets the stage. Make it count by being precise and aligned with the Investment Banking Analyst role. This isn't just about providing contact information; it's about starting your professional story on the right note.

Experience

As an Investment Banking Analyst, your experience section is where you shine. It's about proving your prowess, quantifying your accomplishments, and aligning every detail with the role's demands. Let's align your resume to reflect your expertise in financial analysis and client management.

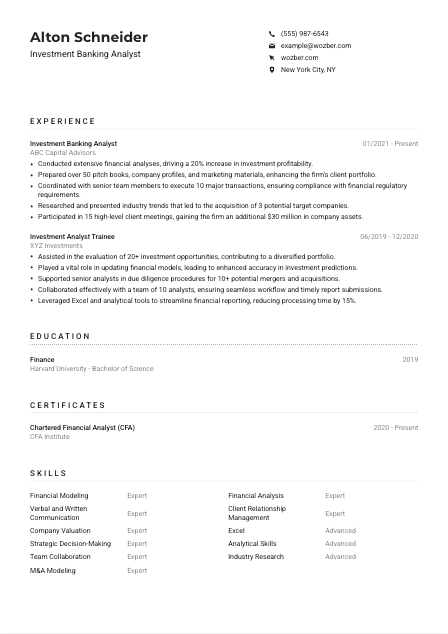

- Conducted extensive financial analyses, driving a 20% increase in investment profitability.

- Prepared over 50 pitch books, company profiles, and marketing materials, enhancing the firm's client portfolio.

- Coordinated with senior team members to execute 10 major transactions, ensuring compliance with financial regulatory requirements.

- Researched and presented industry trends that led to the acquisition of 3 potential target companies.

- Participated in 15 high‑level client meetings, gaining the firm an additional $30 million in company assets.

- Assisted in the evaluation of 20+ investment opportunities, contributing to a diversified portfolio.

- Played a vital role in updating financial models, leading to enhanced accuracy in investment predictions.

- Supported senior analysts in due diligence procedures for 10+ potential mergers and acquisitions.

- Collaborated effectively with a team of 10 analysts, ensuring seamless workflow and timely report submissions.

- Leveraged Excel and analytical tools to streamline financial reporting, reducing processing time by 15%.

1. Mapping the Terrain

First, decode the job description. For instance, "Conducted extensive financial analyses, driving a 20% increase in investment profitability," directly addresses the job's call for strong quantitative and analytical skills.

2. Your Professional Saga

Structure your work history starting with your most recent role. List your title, company name, and tenure. Make it easy for the ATS and hiring managers to follow your career progression at a glance.

3. Achievements: The Proof

Each bullet point should be a showcase of how you've impacted your previous roles. For example, "Prepared over 50 pitch books, enhancing the firm's client portfolio," speaks volumes of your capacity to deliver results and your knowledge in creating compelling marketing documents.

4. The Power of Numbers

Quantifying your achievements adds weight to your claims. Whether it's the percentage growth you catalyzed or the number of transactions you facilitated, numbers provide a tangible measure of your impact.

5. Relevance is Key

Ensure each experience listed speaks directly to the Investment Banking Analyst role. Irrelevant roles can distract from your core value proposition. Focus on what makes you unbeatable for this position.

Takeaway

Your experience section is not just a timeline; it's a narrative of your professional journey tailored to the Investment Banking Analyst role. It's about connecting your past successes to your future potential. Ensure it speaks directly to the job at hand, with evidence of your qualifications and acumen.

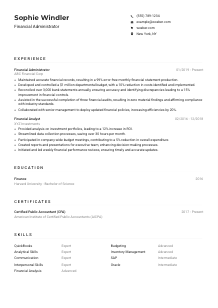

Education

The educational background for an Investment Banking Analyst lays the foundation of their technical knowledge. This section, while seemingly straightforward, can significantly bolster your profile if aligned correctly with the job requirements.

1. Degree Specified

"Bachelor's degree in Finance, Economics, or a related field"—the job description is clear. Ensure you list your degree accurately, mirroring the job's language. This direct alignment helps surpass ATS filters.

2. Keep It Clean

Format this section for clarity and easy reading. Your degree, field of study, institution, and graduation year should be listed in a clean, straightforward manner. Skip the fluff; let the facts speak for themselves.

3. Degree Alignment

Your degree tells a story of your commitment to the field. For instance, a "Bachelor of Science in Finance" directly correlates with the essential educational background for an Investment Banking Analyst, spotlighting your relevance.

4. Coursework & Extras

Highlighting relevant coursework, honors, or activities can add depth to your educational background, especially for newer professionals. If you led a significant finance-related project or were part of a relevant club, mention it.

5. Certifications & Continuing Education

In the fast-evolving finance sector, ongoing education is key. Mention any additional certifications, like CFA or FRM, here to show your dedication to staying at the forefront of your field.

Takeaway

Your educational section should reflect your journey and commitment to the field of investment banking. It's more than a list of qualifications; it's proof of your foundational knowledge and continuous growth. Tailor it to showcase your readiness and alignment with the role's requirements.

Certificates

In the world of investment banking, certain certifications can set you apart. Showing your initiative for further professional development through relevant certifications can significantly elevate your resume.

1. Key Requirements First

Point out certifications the job description mentions, such as CFA or FRM. Having these certifications not only aligns you with the job requirements but also demonstrates your commitment to your professional growth.

2. Choose Wisely

Prioritize your certifications based on what's most relevant to the role. More than just a list, this section is an indicator of your areas of expertise and dedication.

3. Dates Matter

Including the date of certification, especially if it's recent, adds to your profile's current relevance. It shows that you're up-to-date with the latest in financial modeling, risk management, and ethical practices.

4. Continuous Learning

Investment banking is an ever-evolving field. Highlighting your ongoing education, whether through formal certifications or professional workshops, shows that you're proactive about keeping your skills sharp.

Takeaway

Certificates in your resume are more than accolades; they're testament to your dedication and expertise in your field. Choose and present them in a way that accentuates your fit for the Investment Banking Analyst role.

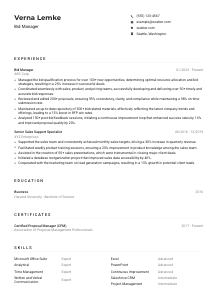

Skills

The skills section of your resume is where you get to show off what makes you a fantastic candidate for an Investment Banking Analyst position. Think of it as a quick-reference catalog of your professional toolkit.

1. Match with Job Description

Extract key skills directly from the job description, like "strong quantitative and analytical skills" and "proficiency in Excel." Matching these skills with your own demonstrates your eligibility for the role.

2. Hard and Soft Skills

Combine both technical skills (like financial modeling) and interpersonal ones (such as client relationship management). This mix shows you're not only competent in crunching numbers but also adept at navigating client and team interactions.

3. Organized and Focused

Keep this section streamlined and easy to scan. Listing your skills in a logical order, starting with those most relevant to investment banking, makes it easy for hiring managers (and ATSs) to see your fit for the role.

Takeaway

Consider your skills section the signature of your professional brand. It should quickly communicate your most marketable skills, tailored specifically to the Investment Banking Analyst role. Let it reflect the unique blend of expertise you bring to the table.

Languages

In the global arena of investment banking, language skills can differentiate you. They hint at your ability to navigate multicultural environments—a valuable asset for firms engaged in international transactions.

1. Job Requirements Check

Start by identifying any language preferences specified in the job description. In this case, "strong skills in both verbal and written English are essential." Listing English as native or fluent meets this fundamental requirement.

2. Prioritize Important Languages

If you're proficient in another language that's a key business language or relevant to the bank's market, make sure to list it. For example, fluency in Mandarin could be a major plus if the bank deals with the Chinese market.

3. Additional Languages

Even languages not directly mentioned in the job description can be valuable. They show cultural fluency and adaptability—traits prized in the interconnected world of finance.

4. Proficiency Levels

Be honest and precise about your language proficiency levels. From 'Native' to 'Basic,' your self-assessment should give an accurate picture of your ability to communicate in different languages.

5. The Role's Global Nature

For roles with an international dimension, showcasing your multilingual skills can underscore your readiness to engage with global markets and diverse teams. If your role involves liaising with international clients, emphasize your linguistic skills.

Takeaway

Your language skills are not just personal achievements; they're professional tools that can open doors in the international finance world. Present them as assets that enhance your value as an Investment Banking Analyst.

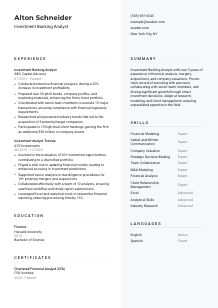

Summary

The summary is where you distill your professional persona into a few compelling lines—a narrative hook that grabs attention. For an Investment Banking Analyst, it's about striking a balance between technical proficiency and strategic acumen.

1. Decode the Job's Core

Begin by internalizing the essence of the role. Understanding what sets an Investment Banking Analyst apart—your analytical prowess, strategic thinking, and client-centric mindset—is key to crafting a powerful summary.

2. Lead with Strength

Start with a strong statement that encapsulates your professional identity. For instance, "Investment Banking Analyst with over 3 years of experience in financial analysis, mergers, acquisitions, and company valuations," instantly presents you as a seasoned professional.

3. Showcase Your Fit

Highlight your alignment with the role's requirements. Mention your hands-on experience in financial modeling, client presentations, and your ability to work seamlessly within cross-functional teams, showcasing your comprehensive skill set.

4. Conciseness is Your Friend

This is your elevator pitch; make every word count. Aim for a summary that's punchy yet informative, encapsulating your unique value proposition in the investment banking landscape.

Takeaway

Crafting a captivating summary is art and strategy combined. It's your first chance to make an impression, so align it closely with the Investment Banking Analyst role. Let it reflect your expertise, your achievements, and your professional journey's distinction.

Launching Your Investment Banking Analyst Journey

You're now equipped with the nuances of tailoring an investment banking analyst resume that not only passes ATS scrutiny but also vividly tells your professional story. Remember, using Wozber's free resume builder, you can effortlessly craft an ATS-compliant resume, employ ATS-friendly resume templates, and ensure ATS optimization with an ATS resume scanner. Allow your resume to open doors to new opportunities. Your next great adventure as an Investment Banking Analyst awaits. Go ahead, make your mark!

- Bachelor's degree in Finance, Economics, or a related field.

- A minimum of 1-2 years of relevant experience in investment banking, financial services, or a related industry.

- Strong quantitative and analytical skills, with proficiency in Excel and financial modeling.

- Excellent verbal and written communication skills for effective collaboration with team members and clients.

- Familiarity with commonly used certifications such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM).

- Strong skills in both verbal and written English are essential.

- Must be located in New York City, NY.

- Conduct extensive financial analysis, including company valuation, merger and acquisition (M&A) modeling, and due diligence.

- Prepare pitch books, company profiles, and other marketing documents for potential client presentations.

- Coordinate with senior team members and cross-functional teams, such as legal and compliance, to execute transactions.

- Research industry trends, potential target companies, and competitive landscapes for strategic decision-making.

- Participate in client meetings, roadshows, and conferences, representing the firm with utmost professionalism and expertise.