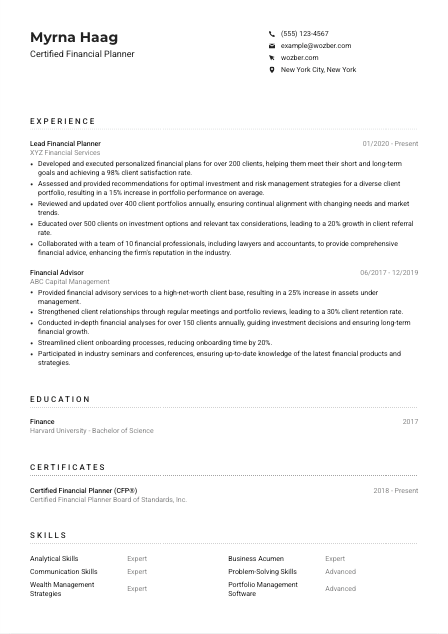

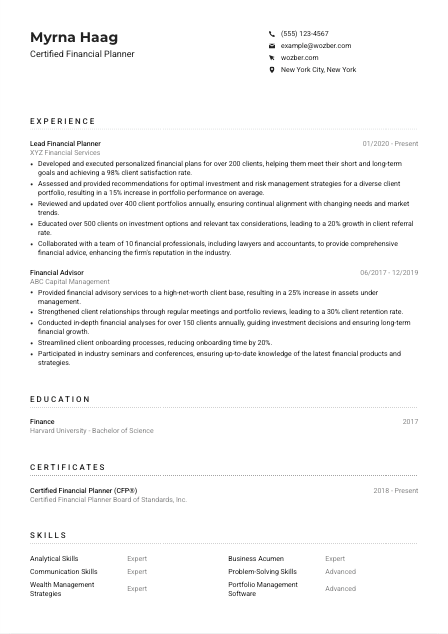

Certified Financial Planner Resume Example

Crafting portfolios, but your resume doesn't show the dividends? Sift through this Certified Financial Planner resume example, mapped out with Wozber free resume builder. Discover how to articulate your financial wisdom and planning prowess to fit job blueprints, making your career path as rewarding as those investment returns!

How to write a Certified Financial Planner Resume?

Welcome, aspiring Certified Financial Planner! In the realm of finance, where precision meets strategy, your resume stands as your personal asset. We're diving deep into crafting a resume not just as a document, but as a reflection of your expertise, tailored to soar through Applicant Tracking Systems and impress hiring managers. With the Wozber free resume builder at your side, we'll navigate the nuances of constructing a Certified Financial Planner resume that speaks volumes.

Ready to align your career aspirations with your dream role? Let's embark on this financial journey together.

Personal Details

The initial handshake of your resume, the Personal Details section, sets the tone for your professional narrative. Make it compelling, precise, and perfectly aligned with the Certified Financial Planner job requirements.

1. Name as Your Brand

Think of your name as the logo of your personal brand. Use a clear, legible font and size it just a notch above the rest for immediate visibility. After all, your name is what you want them to remember.

2. Job Title Alignment

Placing the job title "Certified Financial Planner" right under your name instantly signals to the hiring manager that you're not just applying; you're answering their call. This direct match reinforces your application's relevance from the get-go.

3. Essential Contact Info

Ensure your phone number is correct - this might seem obvious, but a simple typo can derail your application. Use a professional email format like firstname.lastname@email.com to maintain a polished profile. This attention to detail underlines your meticulous nature, a cherished trait in the financial planning domain.

4. Location Matters

"New York City, New York" isn't just an address; it's a strategic alignment with the job requirement. Demonstrating that you're local or willing to relocate without hassle considerably amps up your resume's appeal.

5. Digital Presence

Consider adding a LinkedIn profile or personal portfolio link, especially if they showcase your financial expertise and professional connections. An up-to-date digital presence can significantly augment your resume's narrative.

Takeaway

Your Personal Details section is the curtain-raiser to your professional story. Craft it with precision and strategic alignment to the Certified Financial Planner role. It's more than basic info; it's the beginning of your professional narrative. Keep it neat, accurate, and aligned.

Experience

The Experience section is where you shine a spotlight on your achievements. Let's tailor this section to demonstrate your prowess as a Certified Financial Planner, showcasing experience that echoes the job requirements.

- Developed and executed personalized financial plans for over 200 clients, helping them meet their short and long‑term goals and achieving a 98% client satisfaction rate.

- Assessed and provided recommendations for optimal investment and risk management strategies for a diverse client portfolio, resulting in a 15% increase in portfolio performance on average.

- Reviewed and updated over 400 client portfolios annually, ensuring continual alignment with changing needs and market trends.

- Educated over 500 clients on investment options and relevant tax considerations, leading to a 20% growth in client referral rate.

- Collaborated with a team of 10 financial professionals, including lawyers and accountants, to provide comprehensive financial advice, enhancing the firm's reputation in the industry.

- Provided financial advisory services to a high‑net‑worth client base, resulting in a 25% increase in assets under management.

- Strengthened client relationships through regular meetings and portfolio reviews, leading to a 30% client retention rate.

- Conducted in‑depth financial analyses for over 150 clients annually, guiding investment decisions and ensuring long‑term financial growth.

- Streamlined client onboarding processes, reducing onboarding time by 20%.

- Participated in industry seminars and conferences, ensuring up‑to‑date knowledge of the latest financial products and strategies.

1. Dismantle Job Requirements

Start with dissecting the job description. Each responsibility and requirement holds a clue to what the hiring manager values. Your goal is to mirror these in your resume, making it impossible to overlook your fit for the role.

2. Experience Structure

List your roles chronologically, with your most recent position at the forefront. This structure not only highlights your career progression but also makes it easy for the hiring manager to trace your growing expertise in financial planning.

3. Tailored Accomplishments

It's not just about what you did; it's about how well you did it. Detail your achievements in a way that mirrors the job posting - "developed personalized financial plans for over 200 clients" instantly shows you're a perfect match. Quantify your success where possible to add credibility.

4. Relevance Is Key

Ensure that every bullet point under your experiences directly relates to the job of a Certified Financial Planner. This focus demonstrates your dedication to the field and underscores your suitability for the role.

5. The Power of Numbers

Quantifying your accomplishments adds weight to your claims. For instance, stating "resulting in a 15% increase in portfolio performance" quantifies your impact in a way that's hard to ignore. Numbers provide tangible evidence of your contributions.

Takeaway

Crafting an experience section that resonates with the Certified Financial Planner role is your opportunity to stand out. Tailor each point, quantify your achievements, and make your financial planning expertise unmistakable. Showcase not just where you've been, but how you've excelled.

Education

Your education section is more than a list; it's a testament to your foundational knowledge in finance. Let's sculpt this part of your resume to resonate deeply with the principal requirements of a Certified Financial Planner.

1. Highlight Key Requirements

The job specifies a "Bachelor's degree in Finance, Business, or a related field." Make sure this requirement doesn't just get ticked off; let it shine by placing it prominently within your education section.

2. Structure and Simplicity

Keep the education section straightforward yet impactful. List your degree, field of study, and the institution's name, followed by your graduation date. This clarity ensures the hiring manager can quickly verify your educational qualifications.

3. Degree Specificity

For roles like the Certified Financial Planner, showcasing your specific degree title, like "Bachelor of Science in Finance," directly parallels the job requirements. This immediate alignment speaks volumes.

4. Relevant Coursework

In some cases, highlighting pertinent courses can play to your advantage, especially if they directly relate to financial planning or the investment strategies the job entails. Although not necessary for everyone, this can be particularly beneficial for recent graduates.

5. Academic Achievements

If your academic journey includes honors, awards, or specific projects that demonstrate your financial acumen and dedication, include these. Such details can bolster your application, proving you're not just a fit, but a standout candidate.

Takeaway

Let your education section be a beacon of your commitment and suitability for the Certified Financial Planner role. Highlight the essential degree, align it with job requirements, and infuse it with details that showcase your excellence and dedication to your craft.

Certificates

In the meticulous world of financial planning, certifications like the CFP® mark you as a committed professional. Let's navigate how to showcase these credentials to reflect your ongoing dedication and expertise.

1. Pinpoint the Essentials

The Certified Financial Planner (CFP) designation is not just a credential; it's a crucial requirement for this role. Highlighting this certification in your resume directly addresses one of the primary requisites of the job posting.

2. Quality over Quantity

While you might hold various certifications, prioritize those most relevant to the CFP role. This focus ensures the hiring manager immediately sees the match between their needs and your qualifications.

3. Validity and Recency

For certifications, especially those like the CFP which have ongoing education requirements, include the date of acquisition or renewal. This not only demonstrates your current expertise but also your commitment to staying updated in your field.

4. Continuous Learning

The financial landscape is ever-evolving. Show that your knowledge keeps pace by regularly updating your certifications and pursuing new learning opportunities. This proactiveness is highly valued in the financial planning field.

Takeaway

Your certifications are a testament to your professional dedication and expertise. Highlight relevant credentials like the CFP designation prominently, showcasing your commitment to excellence and continuous learning in the realm of financial planning.

Skills

In the detailed-oriented field of financial planning, your skills section is a concise showcase of your professional toolkit. Let's align this part of your resume specifically to the skills needed for a Certified Financial Planner.

1. Extract Key Skills

Begin by sifting through the job description to identify both explicitly mentioned and implicitly required skills. Your role is to match your skills with these requirements, creating a direct link to what the employer is seeking.

2. Prioritize Relevance

Focus on listing skills that directly align with the Certified Financial Planner role. This might include "Wealth Management Strategies," "Risk Assessment," and "Investment Analysis." Prioritizing these indicates you possess the exact toolkit the job demands.

3. Organized Presentation

Avoid overwhelming the hiring manager with an exhaustive list. An organized, prioritized display of skills allows for immediate recognition of your fit for the role and demonstrates your ability to communicate complex information effectively.

Takeaway

Your skills section is a potent aspect of your resume, offering a snapshot of your professional capabilities. Carefully select and present skills that resonate with the Certified Financial Planner role, showcasing your preparedness and exceptional fit for the position.

Languages

In a global profession like financial planning, multilingual abilities can be a significant asset. Let's explore how to align your language skills with the Certified Financial Planner role, emphasizing communication prowess as a key strength.

1. Job Specification Check

The job posting explicitly requires "Strong English fluency." This is non-negotiable. Ensure English is listed at the top of your languages section to match this requirement directly. This clears any doubts about your communication skills in the primary business language.

2. Showcase Additional Languages

Even if not mentioned in the job description, other language skills, like Spanish fluency, can augment your resume. These abilities signal an advantage in dealing with a diverse clientele or working in multinational environments.

3. Precision in Proficiency

Clearly stating your proficiency level in each language adds credibility. Whether you're "Native" or "Fluent," this specificity allows employers to gauge your ability to engage and communicate effectively.

4. Understanding the Role's Scope

For roles that might involve regional or international client interaction, your multilingual skills become even more relevant. A Certified Financial Planner who can cross language barriers has a distinct edge in personalizing financial advice and expanding market reach.

5. Value of Connectivity

Your language skills are more than a technical capability; they represent your ability to connect with clients across cultures. In the intricate world of financial planning, this connectivity can be the difference between a good planner and a great one.

Takeaway

Your ability to speak multiple languages can significantly broaden your professional and personal horizons. Flaunt this skill with pride, especially for a Certified Financial Planner role where communication is key. Each language you speak opens new avenues and opportunities in the global market.

Summary

Your summary is the inviting entryway into your professional world, offering a snapshot of your journey and aspirations as a Certified Financial Planner. Crafting a summary that captures the essence of your professional identity is crucial.

1. Comprehend the Job's Heart

A thorough understanding of the job requirements is your foundation. Reflect these in your summary, showcasing not only your compatibility but also your unique offerings that set you apart as a Certified Financial Planner.

2. A Striking Introduction

Begin with a powerful introduction, stating your professional title and years of experience. For example, "Certified Financial Planner with over 7 years of experience" establishes your authority in the field right off the bat.

3. Highlight Key Competencies

Mention skills and achievements that correlate with the job's responsibilities. Phrases like "developing tailored financial plans" and "enhancing portfolio performance" directly address the job description, reinforcing your fit for the role.

4. Brevity and Impact

Keep your summary succinct yet impactful, focusing on key points that will catch the hiring manager's attention. Aim for 3-5 compelling lines that make them eager to dive into the rest of your resume.

Takeaway

Your summary is more than an introduction; it's a powerful statement of your professional caliber and ambition. Tailor it to the Certified Financial Planner role, making it impossible for hiring managers to pass by. Let it showcase your achievements, skills, and the unique value you bring.

Launching Your Certified Financial Planner Journey

Congratulations on completing this comprehensive guide! Equipped with these insights, you're well-prepared to craft a Certified Financial Planner resume that not only matches the job requirements but exudes your unique professional essence. With Wozber's free resume builder, ATS-friendly resume template, and ATS resume scanner at your disposal, you're set to create a resume that not only passes through the ATS but also captures the hearts of hiring managers.

Dive into Wozber today, and let it be the launchpad for your financial planning career ascendancy. Your narrative is compelling; it's time for the world to see it.

- Bachelor's degree in Finance, Business, or a related field.

- Certified Financial Planner (CFP) designation.

- Minimum of 4 years of experience in financial planning or wealth management.

- Strong analytical and problem-solving skills.

- Exceptional interpersonal and communication skills.

- Strong English fluency is essential for this role.

- Must be located in or willing to relocate to New York City, New York.

- Develop personalized financial plans to help clients meet their short and long-term goals.

- Assess clients' current financial situations and recommend appropriate investment and risk management strategies.

- Regularly review and update clients' portfolios to ensure alignment with their changing needs.

- Educate clients on investment options, potential risks, and relevant tax considerations.

- Collaborate with other financial professionals, such as lawyers and accountants, to provide comprehensive advice to clients.