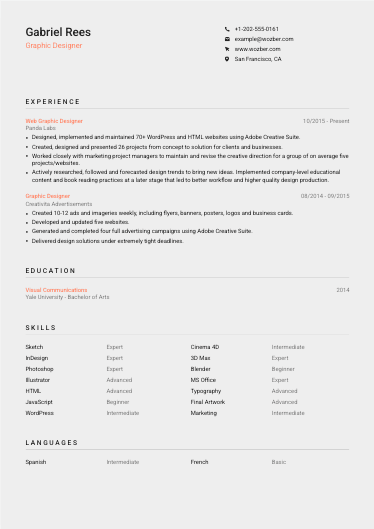

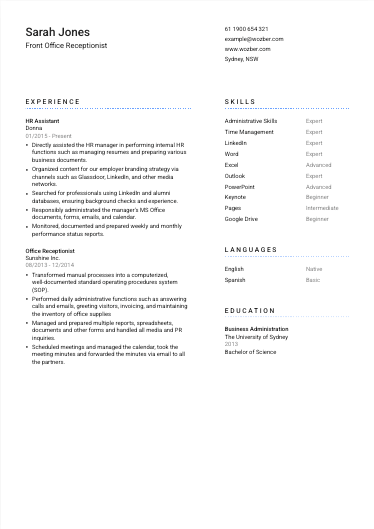

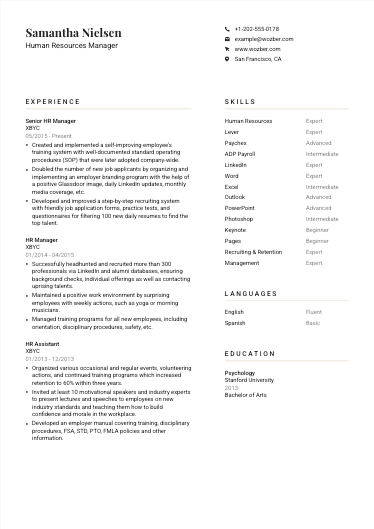

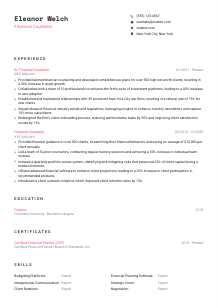

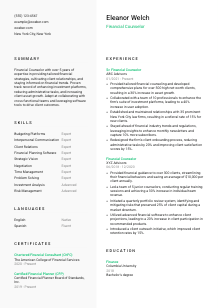

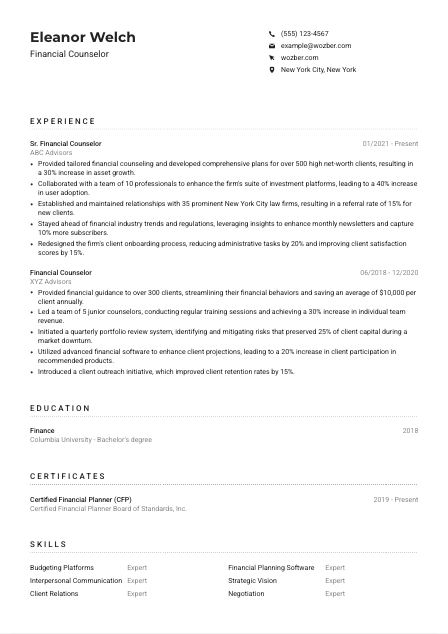

Financial Counselor Resume Example

Guiding finances, but your resume feels bankrupt? Delve into this Financial Counselor resume example, shaped with Wozber free resume builder. Discover how to present your fiscal acumen to align with job expectations, nudging your career investment steadily towards prosperity!

How to write a Financial Counselor resume?

Hello, aspiring Financial Counselor! If you're on the edge of stepping into the financial counseling world or aiming to ascend further within it, your resume needs to be as polished and precise as a well-managed investment portfolio. With the financial sector's competitiveness, creating a standout resume isn't just about listing your experiences; it's about strategically showcasing them. Using Wozber's free resume builder, this guide will walk you through tailoring your resume to nail that Financial Counselor position with cutting-edge tips, including ATS optimization tactics.

Ready to unfold the blueprint that will set your resume apart? Let's dive in and champion your financial acumen!

Personal Details

The 'Personal Details' section is your resume's welcoming handshake. It needs to not only convey the basic info but do so in a way that aligns perfectly with a Financial Counselor role's requirements. Here's how to make this section work hard for you.

1. Reflect Your Professional Identity

Start boldly—with your name. However, don't stop there. Use this as an opportunity to immediately connect with your desired job title. By positioning "Financial Counselor" prominently under your name, you're aligning your identity with your aspiration, making for a strategic introduction in the eyes of hiring managers.

2. The Key to Communication

Provide your phone number and a professional email. Imagine these as open lines for your next big opportunity. A format like firstname.lastname@email.com speaks volumes of your professionalism. Don't forget, in financial counseling, attention to detail is paramount, including ensuring there are no typos in your contact info!

3. Location, Location, Location

Being in the right place can be just as crucial as having the right skills. For a Financial Counselor role in New York City, this means explicitly stating New York City, New York in your resume. It's a small detail that can significantly impact your job application, ensuring you fit the geographical requirements without a hitch.

4. A Professional Profile That Talks

Including a LinkedIn profile or personal website demonstrates you're engaged with the professional world beyond the basics. For a financial counselor, this could also mean showcasing your commitment to staying informed about financial trends or participating in industry discussions.

5. Streamlining Personal Info

Remember, less can be more. Stick to the essentials that speak to your professional persona. For a Financial Counselor position, you'll want to leave out personal details like age or hobbies. Focus instead on what's most relevant to financial counseling roles, sharpening the professional focus of your resume.

Takeaway

Your 'Personal Details' section is the gateway to your professional story. Start strong, clear, and aligned with the Financial Counselor position you're aiming for. With these steps, you're not just sharing your contact info; you're setting a professional tone that resonates with potential employers. Precision here sets the stage for the detailed excellence to come.

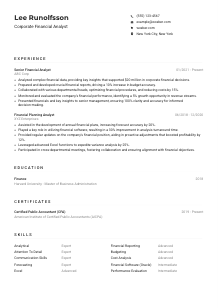

Experience

The 'Experience' section is where you get to shine a spotlight on your achievements and how they align with what's needed for a Financial Counselor position. Here's how to highlight your professional journey in a way that speaks directly to hiring managers.

- Provided tailored financial counseling and developed comprehensive plans for over 500 high net‑worth clients, resulting in a 30% increase in asset growth.

- Collaborated with a team of 10 professionals to enhance the firm's suite of investment platforms, leading to a 40% increase in user adoption.

- Established and maintained relationships with 35 prominent New York City law firms, resulting in a referral rate of 15% for new clients.

- Stayed ahead of financial industry trends and regulations, leveraging insights to enhance monthly newsletters and capture 10% more subscribers.

- Redesigned the firm's client onboarding process, reducing administrative tasks by 20% and improving client satisfaction scores by 15%.

- Provided financial guidance to over 300 clients, streamlining their financial behaviors and saving an average of $10,000 per client annually.

- Led a team of 5 junior counselors, conducting regular training sessions and achieving a 30% increase in individual team revenue.

- Initiated a quarterly portfolio review system, identifying and mitigating risks that preserved 25% of client capital during a market downturn.

- Utilized advanced financial software to enhance client projections, leading to a 20% increase in client participation in recommended products.

- Introduced a client outreach initiative, which improved client retention rates by 15%.

1. Dissecting the Job Description

Start by thoroughly understanding the job description. For a Financial Counselor, this entails highlighting your direct experience in financial counseling or planning. Notice keywords like "personalized financial counseling sessions" and "develop and present financial plans", and ensure these are mirrored in your experience descriptions.

2. Presenting Your Professional Saga

List your experience in reverse chronological order, emphasizing roles that pertain to financial counseling. For instance, if you previously worked as a 'Sr. Financial Counselor', that needs to take precedence, showcasing the depth of your experience in the field.

3. Tailoring Your Achievement Tales

In detailing your past roles, focus on accomplishments that resonate with a Financial Counselor's duties. Phrases like "Developed comprehensive plans for high net-worth clients," or "Enhanced investment platforms" directly mirror the responsibilities outlined in the job description, making a compelling argument for your fit.

4. Numbers Talk

Quantify your successes whenever possible. If you contributed to a 30% increase in asset growth or facilitated a 40% increase in software adoption, those numbers provide tangible evidence of your impact and prowess. In financial counseling, your ability to drive results can distinguish you from the competition.

5. Relevance Reigns Supreme

Curate your experience to fit the Financial Counselor mold precisely. Extraneous roles or achievements, no matter how impressive, can distract from your fit for this specific role. Make every word count toward painting you as the ideal candidate for financial counseling.

Takeaway

Your 'Experience' section is the powerhouse of your resume, a testament to your ability to fulfill the Financial Counselor role. By strategically aligning your professional journey with the job's requirements, you're not merely listing past roles; you're narrating your readiness and fervor for the position ahead.

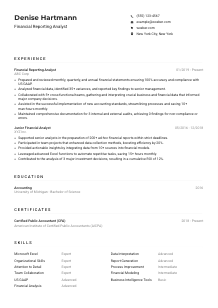

Education

In the world of financial counseling, your educational background can significantly bolster your credibility. Crafting this section with attention can help you highlight the academic qualifications that directly support your Financial Counselor aspirations.

1. Match the Degree Requirement

First off, ensure your highest degree matches the job requirements. For a Financial Counselor position requiring a "Bachelor's degree in Finance, Accounting, Business, or a related field", explicitly listing your "Bachelor's degree in Finance" from a renowned institution like Columbia University showcases you not only meet but appreciate the value of specialized education.

2. Structuring with Clarity

Keep the education section straightforward - degree, field, institution, and graduation date. This tidiness assures the hiring manager can quickly confirm your educational credentials without getting lost in unnecessary details.

3. Tailoring to Your Specialty

Highlighting specific degrees or coursework that aligns with financial counseling can make your resume stand out. By precisely matching the degree mentioned in the job description, you squarely hit the target of what the employer is searching for.

4. Courses and Certificates

While your broader degree title might carry the primary weight, don't hesitate to list relevant courses or additional certificates (like "Certified Financial Planner (CFP)" or "Chartered Financial Consultant (ChFC)") that reinforce your expertise and dedication to continual learning in finance.

5. Extra Academic Achievements

Don't shy away from listing honors, recognitions, or extracurricular activities that further bolster your qualifications as a Financial Counselor. Whether it's a finance club presidency or an award in a finance competition, these achievements contribute depth to your financial acumen.

Takeaway

The 'Education' section is more than just a formality; it's the foundation on which your professional competencies are built. By effectively tailoring this section to the Financial Counselor role, you're not just displaying your qualifications; you're demonstrating a rock-solid foundation in finance, ready to be built upon in your next role.

Certificates

In the finance sector, continuous professional development is not just encouraged; it's often expected. Here's how to make your certifications shine, proving you're a lifelong learner who's always looking to sharpen your financial counseling acumen.

1. Highlight Key Certifications

Lead with the certifications that directly correlate with the Financial Counselor role. For instance, if "Certified Financial Planner (CFP)" or "Chartered Financial Consultant (ChFC)" is preferred, as mentioned in the job description, prominently featuring these certifications positions you a cut above those without.

2. Quality Over Quantity

Focus on listing certifications that add real value to your Financial Counselor aspirations. It's about showcasing certifications that scream relevance to financial planning and counseling, rather than cluttering this section with every certificate you've ever earned.

3. Date Delineation

For certifications, clarity with dates can make a difference. Indicating the acquisition (or renewal) dates of your certifications, like "2019 - Present" for CFP, shows an ongoing commitment to maintaining your credentials. This sends a clear message about your dedication to staying at the forefront of your field.

4. Ongoing Education

In the finance world, staying updated isn't just about credentials; it's about remaining on the cutting edge of financial strategies and technologies. Highlighting your commitment to continuous learning and professional growth through up-to-date certifications can make you stand out in a sea of candidates.

Takeaway

Your certifications speak volumes about your dedication to professional growth and mastery in financial counseling. By carefully selecting and presenting certifications that underscore your readiness for the Financial Counselor role, you underscore your commitment to excellence and continual improvement in the finance domain.

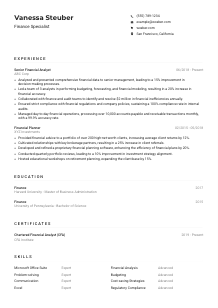

Skills

The 'Skills' section of your resume is your moment to succinctly showcase the breadth of your financial counseling toolkit. In a field where precision and expertise are non-negotiable, highlighting the right skills can set you apart.

1. Decoding the Job Post

Begin with a meticulous review of the job description, identifying both stated and implied skills needed for a Financial Counselor. Skills like 'Strong proficiency with financial software and tools' and 'Excellent interpersonal and communication skills' should be prominently displayed in your skills section.

2. Aligning with Job Needs

Choose skills that perfectly align with the job requirements. For instance, listing 'Budgeting Platforms' and 'Financial Planning Software' as Expert showcases your technical prowess, while 'Interpersonal Communication' and 'Client Relations' highlight the soft skills essential for personal client interactions in financial counseling.

3. Clarity and Conciseness

In the financial world, clarity is key. List your skills in a clean, organized manner, focusing on those most relevant to a Financial Counselor position. The aim is to immediately convey to the hiring manager that you possess the exact skill set they're searching for.

Takeaway

The 'Skills' section is your showcase, a clear demonstration of your readiness for the Financial Counselor role. By aligning your skills with the job's requirements, you're not only speaking the language of the hiring manager but also proving that you bring the needed toolkit to the table. Don't underestimate the power of this concise yet potent section in making your case.

Languages

In a city like New York, the ability to communicate in multiple languages can be a significant asset, especially in a client-facing role like Financial Counseling. Here's how to effectively showcase your linguistic prowess.

1. Assessing Language Needs

Start by evaluating the job description for any explicit language requirements or preferences. While the job posting for a Financial Counselor might not specify language needs, being multilingual in a diverse city can be a unique advantage.

2. Prioritizing Relevant Languages

Emphasize any languages that may benefit your role as a Financial Counselor, particularly in a multicultural metropolis like New York. Highlighting your fluency in languages beyond English, such as Spanish, demonstrates your capability to serve a broader range of clients.

3. Showcasing Language Diversity

Even if additional languages aren't directly requested, showcasing your multilingual abilities can set you apart. It showcases not only your communication skills but also your adaptability and cultural sensitivity—key traits in personalized financial counseling.

4. Honest Proficiency Levels

Be truthful about your language proficiency levels—'Native', 'Fluent', 'Intermediate', or 'Basic'. This honesty ensures expectations are set correctly and can help avoid any misunderstanding in your capability to communicate with clients or colleagues in those languages.

5. Scope of Role Consideration

Finally, understand the global or local scope of the Financial Counselor position. For roles with an international perspective or diverse client base, your multilingual skills can prominently bolster your resume, presenting you as a valuable asset for financial counseling within a global or diverse landscape.

Takeaway

Your languages section illuminates your interpersonal capabilities and cultural adaptability, attributes that are incredibly valuable in financial counseling. Showcase your linguistic skills as bridges to better client relationships, and as tools that enhance your professional versatility in the finance sector.

Summary

The 'Summary' section tops your resume, setting the stage for everything that follows. It's your chance to encapsulate your qualifications, experiences, and personal drive in a powerful, concise narrative. Here's how to make it count.

1. Job Essence Understanding

Before anything, absorb the essence of the Financial Counselor role. This understanding will guide how you present yourself in the summary. The goal is to reflect a professional squarely within the realm of financial counseling, ready to excel.

2. A Strong Opening

Begin with a punchy introduction that frames you within your chosen profession. For instance, stating 'Financial Counselor with over 5 years of expertise' immediately situates you in the field, offering a snapshot of your experience at a glance.

3. Highlighting Matched Skills and Achievements

Directly address how your skills and achievements align with the job description. By weaving in phrases like 'tailored financial strategies, cultivating client relationships, and staying informed on financial trends,' you echo central duties from the job description, positioning yourself as a perfect fit.

4. Perfect Pitch

Keep your summary tight and potent. This is not the place for the minutiae of every achievement but rather for the distilled essence of your professional narrative. A well-crafted summary invites the hiring manager to dive deeper into your resume, eager to learn how you will bring value to the role.

Takeaway

Your summary is your handshake, your first impression, and your elevator pitch all rolled into one. By precisely tailing it to the Financial Counselor position with a deft touch, you position yourself as the standout candidate. This section sets the tone; make it count with clarity, conciseness, and direct alignment with your targeted role.

Embarking on Your Financial Counselor Journey

Congratulations on navigating the nuances of crafting a resume tailored for the Financial Counselor position. With a resume primed for ATS compliance, using Wozber's free resume builder and ATS resume scanner, you're positioned to make a compelling impact. Let your resume be the key that unlocks new doors in your financial counseling career. It's time to step forward with confidence, equipped with an ATS-compliant resume that not only meets the mark but sets a new standard.

Here's to the bright future ahead, filled with success and fulfillment in your chosen path. Embrace the journey and let your skills and passion lead the way!

- Bachelor's degree in Finance, Accounting, Business, or a related field.

- Minimum of 2 years of experience in financial counseling, financial planning, or a closely related field.

- Strong proficiency with financial software and tools, including budgeting and investment platforms.

- Excellent interpersonal and communication skills to effectively counsel and educate clients on their financial options.

- Professional certification such as Certified Financial Planner (CFP) or Chartered Financial Consultant (ChFC) is preferred.

- Must have a high level of English proficiency.

- Must be located in New York City, New York.

- Provide personalized financial counseling sessions to clients, assessing their financial situation and recommending appropriate strategies and products.

- Develop and present financial plans to clients that align with their specific goals and risk tolerance.

- Stay up-to-date with industry trends, regulations, and market conditions to provide the most accurate and relevant financial advice.

- Collaborate with other professionals, such as accountants or attorneys, to provide comprehensive financial services to clients.

- Maintain detailed records of client interactions and follow-up activities to ensure consistent service and support.