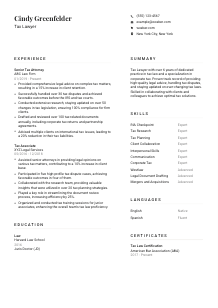

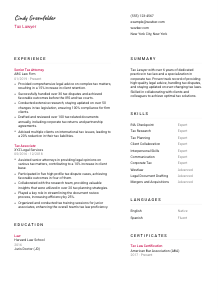

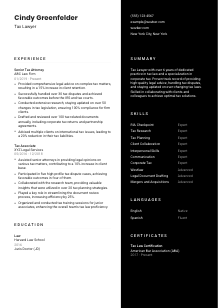

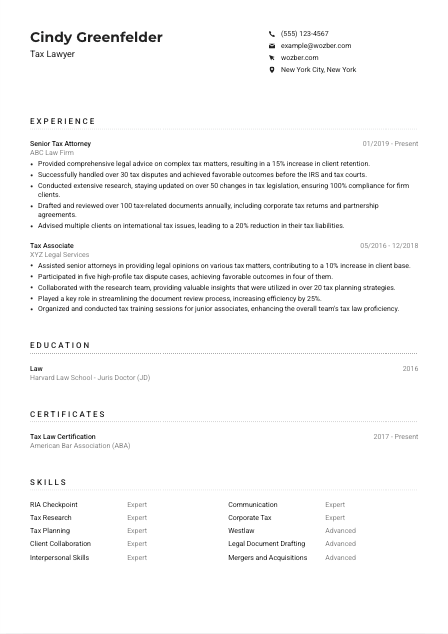

Tax Lawyer Resume Example

Defending clients against IRS, but your resume owes you an explanation? Tackle the complexities of tax law, as evident in this Tax Lawyer resume example, crafted with Wozber free resume builder. Learn how to elegantly present your legal acumen to meet job criteria, making sure your career avoids any audit!

How to write a Tax Lawyer resume?

Hello, aspiring Tax Lawyer! The path to securing your dream job in tax law starts here. You're about to embark on a strategic journey, transforming your resume into a powerful tool that stands out in a competitive field. With the right guidance and the help of Wozber, a free resume builder, you'll learn how to align your resume perfectly with the specific demands of your desired tax lawyer role.

It's time to give your legal career the spotlight it deserves. Get ready to hone your resume with precision!

Personal Details

Your success as a Tax Lawyer hinges on your ability to present yourself effectively. Your Personal Details section is the cornerstone of your resume, introducing you to potential employers. Let's delve into crafting this section with the finesse it demands, ensuring every detail underscores your suitability for a Tax Lawyer position.

1. Illuminate Your Name

Your name is more than a label; it's the headline of your professional narrative. Ensure it's distinctive and easy to remember. Opt for a font that's professional and a size slightly larger than the rest of your resume. This is where your brand begins.

2. Job Title Specificity

Right below your name, state your desired job title: "Tax Lawyer." This tactic instantly clarifies your professional direction and aligns your resume with the job description, making it easier for the hiring manager to recognize your target role.

3. Essential Contact Details

Include your phone number and a professional email address (think firstname.lastname@email.com). Double-check for accuracy. In today's digital age, even a minor typo can mean a missed opportunity.

4. Local Advantage

Given the job's requirement for a candidate located in "New York City, New York," make sure to highlight your local address or willingness to relocate. This aligns with one of the key prerequisites and signals to the employer your readiness for the role.

5. Online Presence

If applicable, adding a LinkedIn or professional website link can bolster your application. Make sure any linked content is polished and mirrors your resume's professionalism, offering a deeper insight into your qualifications and achievements.

Takeaway

Crafting your Personal Details with care sets a professional tone for your resume and ensures you capture the attention of hiring managers right off the bat. Each element should contribute to a snapshot of a highly qualified Tax Lawyer, ready to take on the challenges of the role. Let this section be the handshake that leads to further conversation.

Experience

Your journey as a Tax Lawyer is recounted in the accomplishments and milestones you've achieved. Here, you have a golden opportunity to showcase how your past positions and achievements set you up for success in your desired role.

- Provided comprehensive legal advice on complex tax matters, resulting in a 15% increase in client retention.

- Successfully handled over 30 tax disputes and achieved favorable outcomes before the IRS and tax courts.

- Conducted extensive research, staying updated on over 50 changes in tax legislation, ensuring 100% compliance for firm clients.

- Drafted and reviewed over 100 tax‑related documents annually, including corporate tax returns and partnership agreements.

- Advised multiple clients on international tax issues, leading to a 20% reduction in their tax liabilities.

- Assisted senior attorneys in providing legal opinions on various tax matters, contributing to a 10% increase in client base.

- Participated in five high‑profile tax dispute cases, achieving favorable outcomes in four of them.

- Collaborated with the research team, providing valuable insights that were utilized in over 20 tax planning strategies.

- Played a key role in streamlining the document review process, increasing efficiency by 25%.

- Organized and conducted tax training sessions for junior associates, enhancing the overall team's tax law proficiency.

1. Dissect the Job Description

Start by dissecting the job description, focusing on needed experience like "advising on complex tax matters" and "handling tax disputes." These are your keywords and skills that your experience should echo.

2. The Role Hierarchy

Organize your experience in reverse chronological order, beginning with your most recent position. Clearly list each role's title, the firm's name, and your tenure there. This format highlights your growth and the expanding scope of your responsibilities.

3. Mimic the Job's Language

Translate your tasks and achievements into terms that mirror the job description. For example, if you've "Reviewed and drafted tax-related documents," align it with the requirement to "Review and draft tax-related documents such as corporate tax returns and partnership agreements." This kind of parallelism demonstrates your direct relevance.

4. Numbers Speak Louder

Quantifying your achievements makes them more tangible. "Successfully handled over 30 tax disputes" or "Advised multiple clients leading to a 20% reduction in their tax liabilities" provides a clearer picture of your impact.

5. Relevance is Key

Ensure every bullet point shines a light on skills and experiences directly relevant to a Tax Lawyer's role. Extraneous details dilute your message; keep your narrative focused and potent.

Takeaway

A well-crafted Experience section is your proof of competence, showing how you've navigated the complexities of tax law with finesse. By closely aligning your resume with the job requisites, you confirm your capability and readiness for this new challenge. Let your experiences advocate for your expertise.

Education

For a Tax Lawyer, the Education section is not merely a formality; it's the bedrock of your technical competence. It's where you highlight your academic journey, ensuring it speaks to your readiness for the role at hand.

1. Academia Meets Job Criteria

Start with a laser focus on the primary academic requirement: a "JD from an accredited law school." Mirror this exact phrasing where applicable, establishing an instant qualification for the role.

2. Structure Matters

Present this information cleanly and directly, listing your degree, the field of study, institution name, and graduation date. This familiar format allows hiring managers to quickly assess your educational background.

3. Degree Specifications

In adhering to the job's demands, if your degree is especially relevant or prestigious, such as a JD from Harvard Law School, don't shy away from making this clear. Prestige can carry weight in legal circles.

4. Course Relevance

If you've taken specialized courses related to tax law, consider listing these. Especially if you're at the beginning of your career, pertinent coursework can demonstrate foundational knowledge in areas crucial to the Tax Lawyer role.

5. Supplementary Achievements

Should you have academic honors, relevant extracurricular involvements, or published work that aligns with tax law, briefly mention these. However, gauge their significance based on the level of the position to which you're applying.

Takeaway

In translating your academic journey into a compelling narrative, you lay the groundwork for your expertise and dedication. As you progress in your career, the significance of each accomplishment may vary, but your educational foundation remains a testament to your qualifications. Let it strongly support your expertise in tax law.

Certificates

In the rapidly evolving world of tax law, continuing education is key. Certificates are a tangible reflection of your commitment to stay ahead of changes and deepen your expertise.

1. Sync with Requirements

Review the job description and highlight key certifications like "Possession of Tax Law Certification." Including these verbatim on your resume draws an instant connection between your qualifications and what the employer seeks.

2. Prioritize Pertinence

Focus on listing certifications directly relevant to the role of a Tax Lawyer. If you hold a "Tax Law Certification" from the American Bar Association, this takes precedence, directly fulfilling a specified job criteria.

3. Date Your Achievements

For certificates with validity periods, keep them up-to-date and note any expiration dates. This demonstrates your ongoing commitment to maintaining and enhancing your professional credentials.

4. Perpetual Growth

The legal landscape, especially tax law, is continually shifting. Actively pursuing certifications not only keeps you competitive but also signals to potential employers your dedication to excellence and continuous improvement.

Takeaway

Your certifications are more than accolades; they're proof of your endless pursuit of knowledge and specialization. In a field as dynamic as tax law, staying updated is crucial. Let your certifications highlight your dedication to being at the forefront of tax law expertise.

Skills

In the realm of tax law, your skillset is your most potent weapon. Crafting a Skills section that captures your comprehensive expertise can significantly elevate your resume.

1. Extract the Essentials

Begin by synthesizing the job description into core skills - "tax research", "RIA Checkpoint proficiency", and "client collaboration." These keywords are your guideposts.

2. Tailor and Prioritize

Position the skills that directly match the job's requirements at the forefront. Consider ranking "RIA Checkpoint" and "Westlaw" knowledge as 'Expert' if these are your strengths, directly mirroring the necessities of the role.

3. A Curated Display

Resist the temptation to list every skill you possess. A concise, targeted list where each skill resonates with the job description will make a more compelling case for your candidacy.

Takeaway

Each listed skill should serve as a testament to your capabilities and experience as a Tax Lawyer. Your skills are not just proficiencies; they narrate your suitability and potential. Choose wisely, ensuring your professional toolkit is both impressive and pertinent.

Languages

In a globalized world, the ability to communicate across cultures is invaluable. The Languages section is your chance to showcase this facet of your professional persona.

1. Job Requirements Revisited

If the job description explicitly mentions "Must possess effective English communication abilities," this becomes your linguistic foundation. State your fluency level clearly to align with this vital requirement.

2. Primary Language First

Lead with the primary language required for the role, noting your proficiency level (e.g., 'Native' for English). This direct approach leaves no room for ambiguity regarding your communication skills.

3. Additional Linguistic Skills

Beyond the primary language, listing other languages you're proficient in can underscore your versatility and ability to engage with diverse client bases, a considerable asset in cross-border tax law matters.

4. Honesty in Proficiency

Accuracy in self-assessment is crucial. Use standardized terms like 'Fluent' or 'Basic' to describe your skills, ensuring expectations are properly set from the outset.

5. Considering the Role's Scope

For roles with an international dimension or those requiring interactions with diverse clientele, your multilingual capabilities can significantly enhance your appeal as a candidate, offering a competitive edge.

Takeaway

Your ability to navigate diverse linguistic landscapes speaks volumes about your adaptability and global perspective. In tax law, where the nuances of communication can significantly impact outcomes, your linguistic prowess is a distinctive advantage. Embrace it fully.

Summary

Your resume's Summary is the opening act, setting the stage for all that follows. It's where you distill your professional essence into a compelling narrative that captures the essence of your candidacy for a Tax Lawyer position.

1. Core Essence

Begin by reflecting on the essence of the job description. A Tax Lawyer needs a robust understanding of complex legal matters and excellent communication skills. Your summary should radiate these qualities.

2. The Power Introduction

Start strong with an introductory sentence that encapsulates your expertise and experience. "Tax Lawyer with over 6 years of dedicated practice in tax law and a specialization in corporate tax" immediately conveys depth and specialization.

3. Echo the Job's Demands

Select accomplishments or skills that mirror the job's core requirements. Highlighting your proven track record in providing high-quality legal advice or handling tax disputes underscores your direct relevance to the role.

4. Brevity and Impact

Keep your summary succinct yet powerful. Aim for 3-5 lines that convey your unique value proposition. This is your chance to make a memorable impression, so every word must count towards presenting you as the ideal Tax Lawyer.

Takeaway

A meticulously crafted summary acts as your professional handshake. It's your opportunity to assert your qualifications and passion right off the bat. By aligning your summary with the job requirements, you're not just another candidate; you're the Tax Lawyer they've been searching for. Set the tone for your resume with confidence and clarity.

Embarking on Your Tax Lawyer Journey

Congratulations! You now have a blueprint for crafting a Tax Lawyer resume that resonates with distinction. Armed with insights from Wozber, your resume is primed to showcase your expertise, align with job specifications, and captivate hiring managers. Remember, your resume is the narrative of your professional journey. Fine-tune it with care, infuse it with your unique professional story, and let it pave your way to the next exciting chapter in your career.

Your meticulously crafted resume is the key to unlocking new vistas in your tax law career. Wield it with confidence, and step forward into your future with assurance. The world of tax law awaits your expertise.

- JD from an accredited law school and active membership in the bar association.

- Minimum of 5 years of experience in tax law, preferably with a focus on corporate tax or international tax.

- Proficient in tax research tools, including Westlaw and RIA Checkpoint.

- Strong interpersonal and communication skills to effectively collaborate with clients and colleagues.

- Possession of Tax Law Certification or similar industry-recognized credential.

- Must possess effective English communication abilities.

- Must be located in New York City, New York.

- Provide legal advice on complex tax matters, including mergers and acquisitions, reorganizations, and tax planning.

- Handle tax disputes and represent clients before the IRS, tax courts, and other regulatory bodies.

- Conduct research and stay updated on changes in tax legislation to ensure compliance and maximize tax benefits for clients.

- Review and draft tax-related documents, such as corporate tax returns, partnership agreements, and tax opinions.

- Advise clients on international tax issues, including transfer pricing, foreign tax credits, and repatriation planning.