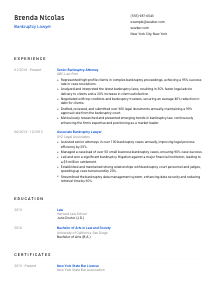

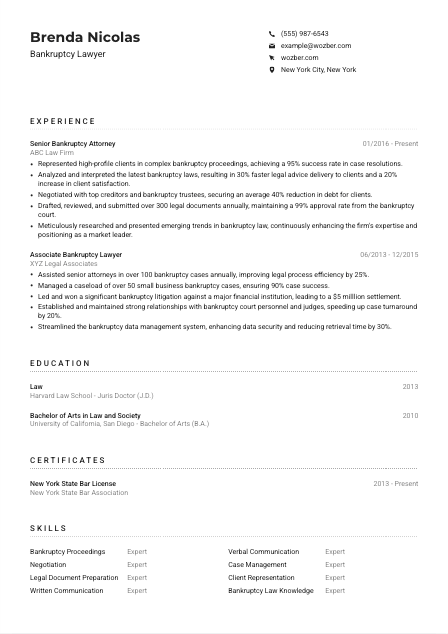

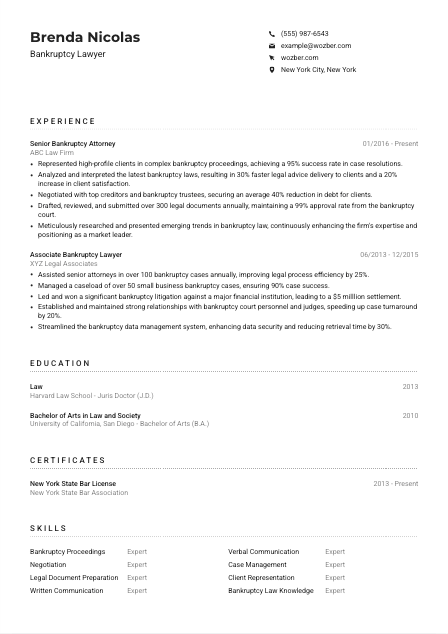

Bankruptcy Lawyer Resume Example

Navigating distressed finances, but your resume feels chaptered out? Dive into this Bankruptcy Lawyer resume example, streamlined with Wozber free resume builder. See how adeptly you can showcase your legal acumen to match job requirements, ensuring your career always stands on solid financial ground!

How to write a Bankruptcy Lawyer resume?

Hello, aspiring Bankruptcy Lawyer! Standing out in the selective legal job market is a challenge, but one that you can conquer with a meticulously crafted resume. Your resume is not just a document; it's a narrative, a carefully assembled collection of your professional experiences and achievements that showcase your expertise in the nuanced field of bankruptcy law. Leveraging Wozber free resume builder, this guide will steer you through creating a resume that resonates with hiring managers, optimized for both human eyes and Applicant Tracking Systems (ATS).

Ready to turn the page towards your next career chapter as a Bankruptcy Lawyer? Let's dive in!

Personal Details

The Personal Details section is your resume's opening statement, setting the stage for your candidacy. Specificity and alignment with the job description are crucial here. Here's how to craft a Personal Details section that introduces you as the Bankruptcy Lawyer a firm in New York City is searching for.

1. Begin with Your Name

Your name is the marquee of your professional brand. Ensure it stands clear and proud atop your resume, using a font that's professional yet distinct. First impressions matter immensely in the legal field.

2. Position Title with Precision

Directly below your name, position the job title you're aiming for, which in this case is "Bankruptcy Lawyer." It's a strategic move that straightaway tells the hiring manager that your career is aligned with the role, optimizing your resume for ATS by matching the job description.

3. Essential Contact Info

In the competitive realm of bankruptcy law, every detail counts. Provide your phone number and a professional email—that's simple like firstname.lastname@email.com. Triple-check for correctness because missed contacts mean missed opportunities.

4. Declare Your Turf

"Must be located in New York City, New York," the job states. Confirm your match by highlighting your New York City residence upfront. It reassures the employer of your logistical fit and dispels any concerns about relocation delays.

5. Online Presence Matters

If applicable, include a link to a professional profile or personal site that showcases your achievements or publications in bankruptcy law. This can be an excellent tool for providing deeper insight into your legal prowess beyond the confines of a resume.

Takeaway

The Personal Details section is more than a formality. It's a chance to instantly align with the role's logistics and requirements while establishing your professional identity. Take the time to get this section right; it's the first step in ensuring your resume speaks directly to your capabilities and fitness for the Bankruptcy Lawyer position.

Experience

The Experience section is the backbone of your resume. Here, you'll paint a picture of your legal career, emphasizing successes in bankruptcy law. Let's break down how to make your experience resonate with the demands of a New York City Bankruptcy Lawyer role.

- Represented high‑profile clients in complex bankruptcy proceedings, achieving a 95% success rate in case resolutions.

- Analyzed and interpreted the latest bankruptcy laws, resulting in 30% faster legal advice delivery to clients and a 20% increase in client satisfaction.

- Negotiated with top creditors and bankruptcy trustees, securing an average 40% reduction in debt for clients.

- Drafted, reviewed, and submitted over 300 legal documents annually, maintaining a 99% approval rate from the bankruptcy court.

- Meticulously researched and presented emerging trends in bankruptcy law, continuously enhancing the firm's expertise and positioning as a market leader.

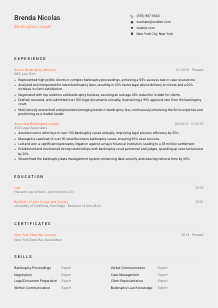

- Assisted senior attorneys in over 100 bankruptcy cases annually, improving legal process efficiency by 25%.

- Managed a caseload of over 50 small business bankruptcy cases, ensuring 90% case success.

- Led and won a significant bankruptcy litigation against a major financial institution, leading to a $5 milllion settlement.

- Established and maintained strong relationships with bankruptcy court personnel and judges, speeding up case turnaround by 20%.

- Streamlined the bankruptcy data management system, enhancing data security and reducing retrieval time by 30%.

1. Dissect the Job Description

Start by carefully reading the job description. Note the specific responsibilities — representing clients in chapter 7, 11, and 13 cases, analyzing and interpreting bankruptcy laws, etc. These will guide the experiences you choose to highlight.

2. Chronological Clarity

List your roles in reverse chronological order, focusing on those that showcase your involvement in creditor and debtor representation. Ensuring clarity and organization here helps the hiring manager and the ATS to quickly grasp your career trajectory.

3. Highlight Achievements

For each position, draft bullet points that demonstrate your contributions. Phrases like "Represented high-profile clients in complex bankruptcy proceedings" align well with the job responsibility of client representation in various bankruptcy cases.

4. Numbers Speak Volumes

Quantify your achievements whenever possible. Mentioning a "95% success rate in case resolutions" or "negotiating a 40% debt reduction for clients" provides tangible proof of your competence and achievements.

5. Relevance is Key

Prioritize experiences that directly tie to bankruptcy law. This role isn't just any legal position—it's specialized. That time you reduced a client's debt by 40% is far more relevant than generic legal duties.

Takeaway

The Experience section is where you showcase your relevance and exceptional fit for the Bankruptcy Lawyer role. Remember, it's not just about what you've done; it's about conveying your accomplishments in a way that aligns with the targeted role. Each bullet point should serve as a testament to your expertise and success within the bankruptcy law niche.

Education

Your academic background lays the foundation of your legal expertise. For a Bankruptcy Lawyer, particular qualifications are non-negotiable. Let's tailor the Education section to exemplify your readiness for this specialized role.

1. Confirm Educational Requisites

The job clearly specifies a Juris Doctor (J.D.) degree from an accredited law school. This is non-negotiable, thus it should be prominently listed, along with your graduation year and the institution's prestige.

2. Conciseness and Clarity

Keep this section to-the-point. Mention your degree, the granting institution, and your year of graduation. This clarity ensures quick verification through an ATS and by busy hiring managers.

3. Bridge the Degree and Role

Listing your J.D. aligns with the role's requirements, but also consider mentioning relevant coursework or experiences during your law school tenure that directly pertain to bankruptcy law to further align with the job's requisites.

4. Relevant Courses and Activities

If newer to the field or looking to bolster this section, list pivotal courses, moot court competitions, or internships focused on bankruptcy law. These add depth, showing a long-standing focus on this specialization.

5. Licenses and Specializations

"Admission to the state bar and in good standing" is crucial. While typically covered under Certificates, highlighting your license to practice law in New York in this section can further underscore your qualifications.

Takeaway

The Education section is not just a list. It's a strategic element that conveys your foundational readiness for the Bankruptcy Lawyer role. By carefully curating this section, you illustrate your commitment and alignment with the field's rigorous standards. Make each entry a pillar that supports your candidacy.

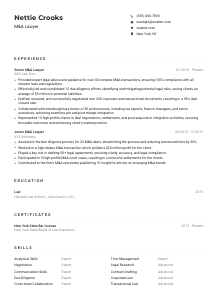

Certificates

In the legal profession, continuous education and certifications can distinguish you from the competition. While the job description for the Bankruptcy Lawyer may not specify required certificates, showcasing relevant achievements can make you more appealing.

1. Frame Your Certifications

Though not explicitly required, relevant certifications like the "Certified Specialist in Bankruptcy Law" underscore your dedication and specialization. This not only adds credibility but also illustrates a commitment to your legal discipline.

2. Selective and Strategic

Quality trumps quantity. List certifications that enhance your appeal for the Bankruptcy Lawyer role. This selective approach ensures that the hiring manager sees your most relevant qualifications first.

3. Freshness Factor

Including the date of acquisition shows recency and relevance, especially in a rapidly evolving field. A recent certification implies up-to-date knowledge, an asset in the dynamic landscape of bankruptcy law.

4. Continuous Advancement

The law does not stand still, nor should your certifications. Stay abreast of new opportunities to advance your expertise in bankruptcy law. This ongoing professional development signals your commitment to excellence and adaptation.

Takeaway

Incorporating strategically chosen certifications can significantly bolster your profile. They're tangible proof of your expertise, commitment, and continuous learning—the trifecta that can set you apart in the competitive field of bankruptcy law. Highlight them with pride and precision.

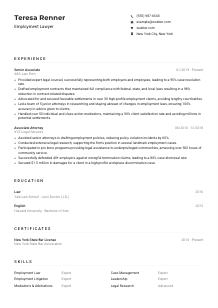

Skills

The Skills section is where you succinctly list your professional toolbox. For the Bankruptcy Lawyer position, blending legal acumen with interpersonal adeptness is key. Learn to present your skills in a way that mirrors the job's macro and micro demands.

1. Extract from the Job Description

Carefully parse the job listing for both stated and implied skills. Phrases like "analytical, research, and negotiation skills" and "excellent written and verbal communication abilities" are your cues.

2. Match and Present

Cross-reference your abilities with those sought in the role. For a Bankruptcy Lawyer, prioritizing skills such as "Bankruptcy Proceedings", "Legal Document Preparation", and "Negotiation" directly ties to the job's requirements.

3. Less is More

Resist the urge to list every skill. Focus on those most pertinent to a Bankruptcy Lawyer, ensuring each skill explicitly aligns with the responsibilities and skills highlighted in the job description.

Takeaway

Your skills section is an immediate showcase of your legal toolbox. Curate it to reflect the specialized skills that make you the ideal candidate for the Bankruptcy Lawyer role. Remember, each skill listed is a pledge of the value you bring. Choose wisely, aiming for precision and relevance.

Languages

In a city as diverse as New York, the ability to communicate across languages is a coveted asset. While the Bankruptcy Lawyer role specifies "Strong English language communication abilities necessary," let's navigate how to effectively present your linguistic prowess.

1. Highlight the Essential

Given the job's emphasis on English proficiency, list it at the top rated as "Native." This aligns perfectly with the requirement, showing no room for communication barriers in your operations.

2. The Advantage of Multilinguism

After fulfilling the primary language requirement, introducing other languages you're fluent in, like Spanish, can broaden your appeal, especially in New York's multicultural setting.

3. Honesty in Proficiency

Clearly demarcate your level of proficiency using terms like "Native", "Fluent", "Intermediate", or "Basic". Precise representation of your linguistic skills ensures clear expectations.

4. Other Languages as Assets

Even if not directly required, additional languages can make you more versatile and relatable to a wider client base. This can be particularly valuable in personal and sensitive cases like bankruptcy.

5. Understand the Role's Scope

While the focus is on English for this position, don't underestimate the value of additional languages in enhancing client communication and empathy in challenging cases.

Takeaway

While English proficiency is non-negotiable for the Bankruptcy Lawyer role, showcasing additional languages can underscore your versatility and capacity for empathy in a diverse city like New York. View each language as a bridge to better understanding and connecting with clients from various backgrounds.

Summary

Crafting a compelling Summary section is your opportunity to encapsulate your value proposition as a Bankruptcy Lawyer. This is where you captivate and convince the hiring manager that they're looking at the resume of their ideal candidate.

1. Digest the Core of the Role

Absorb the essence of the job description. Understanding the role's core allows you to start your Summary with a powerful statement of professional identity aligned with the expectations for a Bankruptcy Lawyer in New York City.

2. Set the Stage

Introduce yourself with a statement that encapsulates your legal expertise, acknowledging your years of experience and areas of specialization. Something like, "Bankruptcy Lawyer with over 8 years of experience specializing in both creditor and debtor representation," directly asserts your fit.

3. Pinpoint Your Unique Value

What makes you the right fit for this position? Is it your "impeccable win record", your "extensive knowledge of bankruptcy laws", or your "proven track record in negotiating complex financial transactions"? Identify your unique strengths and weave them into this narrative.

4. Brevity is Your Ally

Keep it concise. Aim for a summary that packs a punch in just a few lines, drawing the hiring manager in and leaving them eager to learn more about you through the details in your resume.

Takeaway

The Summary section is your chance to shine in a few, impactful sentences. Make each word count, and tailor your pitch to reflect the qualities sought in the Bankruptcy Lawyer role. This is your introductory hand-shake - firm, confident, and promising.

Launching Your Bankruptcy Lawyer Journey

You've just been equipped with the insights to craft a resume that not only meets but exceeds the expectations for a Bankruptcy Lawyer role in New York City. Leveraging the free resume builder at Wozber, you now have the resources at your fingertips to create an ATS-compliant resume, using an ATS-friendly resume template, and ensuring ATS optimization with our advanced ATS resume scanner. Remember, your resume is the narrative of your professional journey. Fine-tune it with care, infuse it with your unique legal insights, and let it pave your way to your next rewarding chapter in bankruptcy law.

The courtroom awaits your expertise. Champion your career with confidence!

- Juris Doctor (J.D.) degree from an accredited law school.

- Admission to the state bar and in good standing with the State Bar Association.

- Minimum of 5 years of experience practicing bankruptcy law, preferably with both creditor and debtor representation.

- Strong analytical, research, and negotiation skills.

- Excellent written and verbal communication abilities to collaborate with both clients and stakeholders.

- Strong English language communication abilities necessary.

- Must be located in New York City, New York.

- Represent clients in bankruptcy proceedings, including chapter 7, chapter 11, and chapter 13 cases.

- Analyze and interpret bankruptcy laws, regulations, and court decisions to provide legal advice to individuals or companies regarding the legal aspects of bankruptcy proceedings.

- Negotiate with creditors, other attorneys, and bankruptcy trustees to reach the best possible outcomes for clients.

- Prepare and review legal documents related to bankruptcy filings, such as petitions, schedules, and plans.

- Stay updated on changes in bankruptcy laws and stay attuned to emerging trends and best practices in the field.