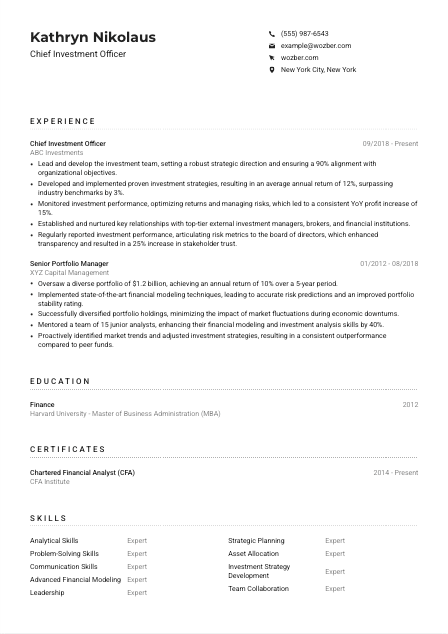

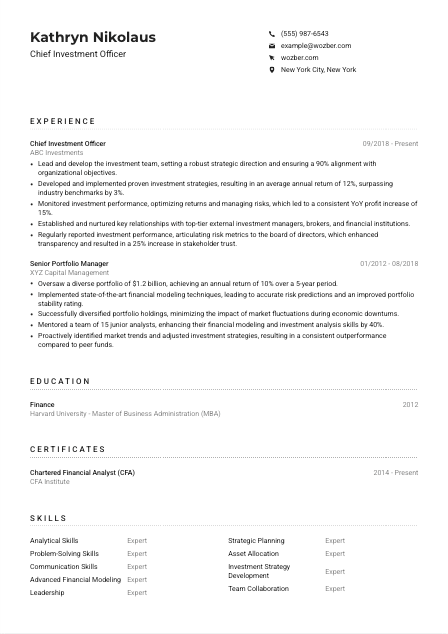

Chief Investment Officer Resume Example

Orchestrating financial strategies, but feeling your resume isn't striking the right investment mix? Dive into this Chief Investment Officer resume example, structured with Wozber free resume builder. Grasp how harmoniously you can tune your investment prowess to blend with job criteria, and take your career portfolio to new and prosperous heights!

How to write a Chief Investment Officer Resume?

Venturing into the strategic world of finance as a Chief Investment Officer is no small feat. Your resume isn't just a document; it's a key that can unlock the doors to executive boardrooms. With Wozber's free resume builder, this guide is tailored to help you mold your resume into a masterpiece that resonates with the exactitude of your profession. Let's embark on a transformative journey to refine your resume, ensuring it's not just a match but a standout in the discerning eyes of financial giants.

Ready to turn the page? Let's dive deep into crafting a resume that speaks volumes of your financial acumen and strategic prowess.

Personal Details

Even the small details matter, especially when it comes to your personal introduction on your resume. It's the initial handshake with your potential employer, setting the tone for everything that follows. Here's how to meticulously align this section for the Chief Investment Officer position, ensuring every detail is polished to perfection.

1. Naming Your Brand

Your name is essentially your brand in the professional world. Use a clear, professional font and consider making it a tad larger than the rest of your resume text. Remember, first impressions are vital, and in the realm of finance, precision and clarity speak volumes.

2. Title Precision

Directly below your name, align yourself with the role by specifying "Chief Investment Officer". This immediately signals to the ATS and the hiring manager that your resume is meticulously crafted for the position, mirroring the focused approach required in high-level investment management.

3. Communicate with Clarity

In the contact information, ensure your phone number is typo-free. Your professional email should follow the firstname.lastname@email.com format. This isn't just about providing a way to get in touch; it's about demonstrating your professionalism and attention to detail.

4. Location Matters

"New York City, New York" isn't just text on your resume; it's a strategic match to the job's geographical requirements. Highlighting this ensures you tick another box of the job specification seamlessly, underscoring your readiness and eligibility based on locality.

5. A Professional Footprint

If you have a LinkedIn profile or a professional blog pertinent to investment management, including it can provide depth. Make sure these profiles are updated and reflective of your professional journey. They serve as an extended view into your capabilities and are particularly valuable in the finance domain.

Takeaway

Like the opening moves in a game of chess, your personal details set the stage for what's to come. Ensure this section is lean, professional, and immediately aligns with the Chief Investment Officer position. It's your first opportunity to demonstrate your alignment with the role's requirements – make every detail count!

Experience

In the role of a Chief Investment Officer, your experience section is where you showcase your strategic prowess and financial acumen. It's about more than just where you've worked; it's a chance to show how you've shaped financial landscapes and led teams to success. Here's how to align your experience with the precision the role demands.

- Lead and develop the investment team, setting a robust strategic direction and ensuring a 90% alignment with organizational objectives.

- Developed and implemented proven investment strategies, resulting in an average annual return of 12%, surpassing industry benchmarks by 3%.

- Monitored investment performance, optimizing returns and managing risks, which led to a consistent YoY profit increase of 15%.

- Established and nurtured key relationships with top‑tier external investment managers, brokers, and financial institutions.

- Regularly reported investment performance, articulating risk metrics to the board of directors, which enhanced transparency and resulted in a 25% increase in stakeholder trust.

- Oversaw a diverse portfolio of $1.2 billion, achieving an annual return of 10% over a 5‑year period.

- Implemented state‑of‑the‑art financial modeling techniques, leading to accurate risk predictions and an improved portfolio stability rating.

- Successfully diversified portfolio holdings, minimizing the impact of market fluctuations during economic downturns.

- Mentored a team of 15 junior analysts, enhancing their financial modeling and investment analysis skills by 40%.

- Proactively identified market trends and adjusted investment strategies, resulting in a consistent outperformance compared to peer funds.

1. Dissecting the Requirements

Dive deep into the job description, highlighting keywords and phrases. For a Chief Investment Officer, phrases like "lead and develop the investment team", "develop and implement investment strategies", and "monitor investment performance" are critical anchors for your resume.

2. A Chronology of Leadership

Structure your experience to lead with your most recent and relevant roles. Each role should clearly outline your position, the company name, and your tenure. This isn't just about listing where you've been; it's about weaving a narrative of leadership and strategic success.

3. Strategic Achievements

Highlight accomplishments that reflect the job requirements. Use statements like "Led the development and implementation of investment strategies, resulting in a X% annual return" to quantitatively demonstrate your impact. This specificity is invaluable in illustrating your capability to not just fit, but excel in the role.

4. Quantify Your Financial Acumen

Whenever possible, numbers should back your achievements. Statements like "Optimized returns and managed risks, leading to a consistent YoY profit increase of 15%" showcase a tangible track record of success, which is gold in the eyes of potential employers in the finance sector.

5. Relevant Riches

Stick to the gold - your most relevant experiences. While overseeing a billion-dollar portfolio is impressive, mentioning unrelated achievements can dilute your narrative. Focus on experiences that underscore your investment strategy and leadership prowess.

Takeaway

Think of your experience section as your personal stock market, with each achievement another dividend. Tailor your narrative to show clear, quantifiable instances where you have made strategic impacts. Your resume should resonate with the depth of your experience and the breadth of your capabilities. Shine a spotlight on your strategic achievements, and watch as it attracts the interest it deserves.

Education

While your professional experience speaks to your practical abilities, your educational background lays the groundwork for your understanding of finance and economics. For a Chief Investment Officer, highlighting your education is not about listing degrees; it's about underscoring the foundation of your strategic insight.

1. Prioritize Key Qualifications

Pinpoint exactly what the job listing specifies. The mandate for a "Bachelor's degree in Finance, Economics, or related field; Master's degree in Business Administration (MBA) preferred" should dictate how you list your qualifications, showcasing your academic alignment with the role's requirements.

2. Straight to the Point

Your educational section should be clear and to the point: Degree, field of study, institution, and graduation year. For a Chief Investment Officer, positioning your MBA at the forefront demonstrates not just academic achievement, but a commitment to the pinnacle of financial education.

3. Tailor to the Role

If you hold the preferred MBA or a closely related qualification, make it a highlight. For instance, an MBA with a focus on Finance from a prestigious university speaks volumes of your preparedness for high-stake decision-making and strategic planning inherent in the Chief Investment Officer role.

4. Coursework Counts

Where relevant, highlight specific courses that have direct bearing on your ability to excel as a Chief Investment Officer. Advanced financial modeling, risk management, or global economic analysis courses are not just educational footnotes; they are pillars supporting your capability narrative.

5. The Extra Mile

For roles as strategic and pivotal as a Chief Investment Officer, including honors, relevant extracurriculars, or significant projects can add depth. These details speak to your dedication to your field beyond the classroom.

Takeaway

Remember, every line of your resume, including the education section, contributes to the overall picture of you as the ideal Chief Investment Officer candidate. Make sure it reflects not only your qualifications but also your readiness to take on the strategic challenges of the role. Your education is the bedrock of your strategic vision - showcase it with pride.

Certificates

In the fast-evolving field of investment and finance, continuous learning is not just beneficial; it's a career lifeline. Certifications can significantly bolster your appeal as a Chief Investment Officer by showcasing your dedication to staying at the forefront of your field.

1. Relevance is Key

Start by identifying which certifications are most relevant to the Chief Investment Officer role. While the job description may not list specific certifications, including ones like Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) demonstrates a commitment to excellence in investment strategy and financial planning.

2. Quality Over Quantity

It's better to list a few highly relevant certifications than a long list of only tangentially related ones. Each certification should underscore your expertise and readiness for the responsibilities of a Chief Investment Officer.

3. Timing Matters

Be mindful of the dates of your certifications. Recent certifications indicate you're up-to-date with the latest in financial strategies and market analysis techniques, showcasing your initiative to keep your skills sharp in a rapidly changing field.

4. Ongoing Development

The financial world never stands still, and neither should your certifications. Regularly updating your credentials and seeking out new learning opportunities demonstrates a dynamic commitment to your professional growth, a key trait for any successful Chief Investment Officer.

Takeaway

In a world where financial landscapes can shift overnight, your certifications serve as solid proof of your expertise and dedication to excellence. Leverage them as tools not just of qualification, but as indicators of your ongoing commitment to navigating the complexities of investment and financial strategy with skill and foresight.

Skills

In the world of high-stakes investment, your skills section isn't just a list; it's a reflection of the strategic arsenal at your disposal. For a Chief Investment Officer, this is where you get to shine a spotlight on the specific skills that make you the perfect candidate for the role.

1. Decipher the Blueprint

Start by dissecting the job description for both explicit and implicit skills required. Skills like "advanced financial modeling," "strategic planning," and "global economic analysis" are not just buzzwords; they are the benchmarks of your suitability for the role.

2. Match and Highlight

Ensure every skill you list resonates with the Chief Investment Officer's responsibilities. This is about quality, not quantity. Focus on those skills that directly correlate with the job's demands, illustrating your readiness to tackle the role's challenges head-on.

3. Clarity and Precision

Resist the temptation to list every skill you possess. Instead, pick the most relevant ones that will catch a hiring manager's eye. Your skills section should be a laser-focused selection of your capabilities, each one reinforcing your candidacy for the Chief Investment Officer position.

Takeaway

Approach your skills section as a curated display of your professional toolkit. It's an opportunity to affirm to the hiring manager that you're not just a good fit; you're the best fit. Highlight your proficiency with pride, and remember, in the realm of investment management, precision and forward-thinking are key. Let your skills underscore your readiness to navigate the complexities of global finance.

Languages

The ability to engage effectively across diverse cultures and markets is invaluable, especially for a Chief Investment Officer with a global outlook. Here's how to position your linguistic capabilities as an integral part of your international strategic approach.

1. Align with Requirements

Not all roles explicitly demand multilingual abilities, but for a Chief Investment Officer, the capacity to communicate beyond borders is a covert asset. Beginning with the essential - English for this role - list languages in order of relevance and proficiency.

2. Prioritize

Highlight your mastery of English at the top, given its stated importance for the role. Then, follow with any additional languages. This stratification not just fulfills the stated requirement but also showcases an asset for potential global interactions.

3. Showcase Your Proficiency

For each language, be clear about your level of proficiency using terms like "Native," "Fluent," or "Intermediate". This clarity speaks to your ability to engage with stakeholders, teams, and markets on various levels.

4. Understand the Strategic Advantage

In a role that may involve cross-border strategies and global economic analysis, your language skills are not merely about communication; they're a strategic asset. They enable you to navigate international markets with confidence, offering a significant edge in the global financial arena.

5. Versatility and Insight

While fluency in multiple languages might not be a prerequisite, it underscores your versatility and breadth of perspective. It reflects a capability to engage and collaborate on multiple fronts, an essential trait for a Chief Investment Officer aiming to make a global impact.

Takeaway

Your linguistic skills are more than just a personal attribute; they represent a bridge to the global financial community. They signify your readiness to engage, understand, and strategize on an international scale. In the dynamic world of investment, such versatility is a coveted asset. Flaunt your linguistic prowess, and position yourself as a global financial strategist ready to take on the world.

Summary

Your resume summary is where you get to distill your professional essence into a few powerful sentences. For a Chief Investment Officer, this is the space where you weave together your expertise, accomplishments, and strategic vision, making an immediate impactful impression.

1. The Essence of Strategy

Begin by internalizing the job requirements. A summary that captures your essence as a Chief Investment Officer must resonate with strategic vision and leadership, reflecting a deep understanding of the financial landscape.

2. Open Strong

Introduce yourself as a seasoned professional in the realm of investment management, echoing the position you're targeting. A powerful opening sets the tone for the compelling narrative that follows.

3. Key Achievements and Skills

Highlight your strategic contributions and the leadership qualities you've honed over your career. Make a note of how your initiatives have translated into success, like "developing investment strategies that yielded an above-average annual return" or "optimizing financial performance through meticulous risk management."

4. Conciseness is Key

An effective summary is poignant and to the point. Aim for a tight, engaging overview that grabs attention and makes the hiring manager eager to dive deeper into your resume. Remember, this is your elevator pitch - make every word count!

Takeaway

Your summary is the prologue to your professional story. Make it count by crafting a narrative that's not just compelling but perfectly aligned with the Chief Investment Officer role you aspire to. It's your first chance to communicate your strategic vision and leadership capabilities. Use this opportunity to make an indelible mark on the hiring manager's mind.

Launching Your Chief Investment Officer Journey

You're now equipped with the insights and strategies needed to craft a Chief Investment Officer resume that stands out. With Wozber's free resume builder, ATS-compliant resume templates, and ATS resume scanner, you have all the tools at your fingertips to ensure your resume is not just seen but remembered. Your journey towards becoming a Chief Investment Officer is about to take a significant leap forward. Embrace this opportunity, showcase your strategic genius, and step into the role you were destined for.

The financial world awaits your leadership and vision. Go forth, make your mark, and redefine what's possible in the realm of investment management.

- Bachelor's degree in Finance, Economics, or a related field;

- Master's degree in Business Administration (MBA) preferred.

- Minimum of 10 years of experience in investment management, with a strong background in portfolio management and asset allocation.

- Proven track record of driving investment strategies to deliver optimal returns, mitigate risks, and achieve long-term financial goals.

- Strong analytical, quantitative, and problem-solving skills with advanced proficiency in financial modeling and data analysis tools.

- Exceptional leadership and communication skills, with the ability to collaborate effectively with diverse teams and stakeholders.

- English language skills are mandatory for this position.

- Location requirement: Must be based in New York City, New York.

- Lead and develop the investment team by setting strategic direction, assigning priorities, and ensuring alignment with organizational objectives.

- Develop and implement investment strategies based on thorough analysis of global, regional, and local economic trends, as well as risk parameters.

- Monitor investment performance, regularly review existing portfolios, and recommend adjustments to optimize returns and manage risks.

- Build and maintain key relationships with external investment managers, brokers, and financial institutions.

- Report investment performance, risk metrics, and analysis to senior management and the board of directors regularly.