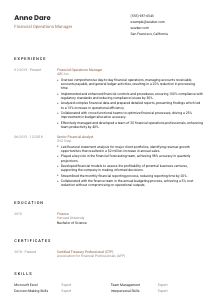

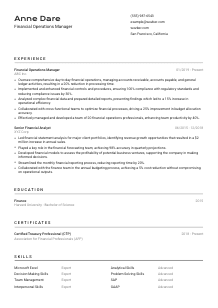

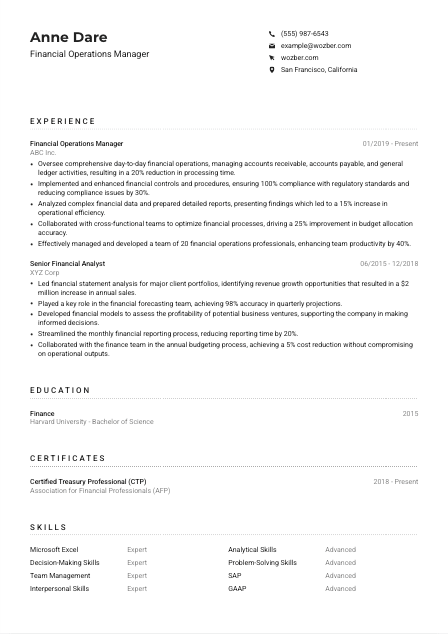

Financial Operations Manager Resume Example

Masterminding financial flows, but your resume seems a bit cash-strapped? Delve into this Financial Operations Manager resume example, structured using Wozber free resume builder. Learn how to showcase your monetary acumen and operational prowess in tune with job guidelines, charting a career path that's always in the black!

How to write a Financial Operations Manager Resume?

Embarking on the journey to nab that Financial Operations Manager role isn't just about crunching numbers or managing budgets; it's about painting a vivid picture of your financial finesse and strategic acumen, all on a single sheet of paper - your resume. Using Wozber, a free resume builder, this guide will walk you through the art of crafting a resume that doesn't just pass the ATS (Applicant Tracking System) test but resonates with hiring managers. It's time to fine-tune your professional story into a targeted, engaging narrative that opens doors to your next big opportunity.

Personal Details

The 'Personal Details' section is your resume's curtain raiser. While simple, this section sets the tone and introduces you as the accomplished Financial Operations Manager that you are. How can you ensure this introduction speaks volumes about your professionalism? Here's how to fine-tune this section, making every line count.

1. Brand Yourself Boldly

Your name is the marquee of your professional show, so let it shine! Use a font that's clean and professional, allowing your name to take center stage. This isn't just about typography; it's about branding yourself as the Financial Operations Manager ready to take on the challenges in San Francisco.

2. Role Resonance

Immediacy is key. Including the job title "Financial Operations Manager" right below your name ties you directly to the role you're pursuing. It sends a clear message to the hiring manager: You're not just any candidate; you're THE candidate for this position.

3. Essential Contact Hooks

Your contact information isn't just about where, it's about how. How will the prospective employer reach out? Ensure your phone number is correct and your email address professional; think firstname.lastname@email.com. This detail, while small, is a critical bridge connecting you to your future employer.

4. Geographical Greenlight

Mentioning "San Francisco, California" as your location directly aligns with the job's specifications, signaling to the hiring manager that you're either a local candidate or ready to relocate. It's one less hurdle in the recruitment process.

5. Digital Presence

Consider adding a LinkedIn profile or a personal website link if it showcases your professional achievements or portfolio. Not only does this offer a deeper insight into your career, but it also shows your comfort with embracing the digital world, a must-have skill in today's landscape.

Takeaway

Keep the handshake firm and the introduction clear. Presenting your personal details with precision and intent is your first step to ensuring your resume speaks directly to the hiring manager as a Financial Operations Manager. Let every detail count towards making that fantastic first impression.

Experience

The 'Experience' section is where you showcase not just where you've been, but how you've shone. As a Financial Operations Manager, you've dealt with the numbers, led teams, and optimized processes. How do you make sure this experience pops off the page in the eyes of a hiring manager? Let's dive into making your career history a compelling narrative.

- Oversee comprehensive day‑to‑day financial operations, managing accounts receivable, accounts payable, and general ledger activities, resulting in a 20% reduction in processing time.

- Implemented and enhanced financial controls and procedures, ensuring 100% compliance with regulatory standards and reducing compliance issues by 30%.

- Analyzed complex financial data and prepared detailed reports, presenting findings which led to a 15% increase in operational efficiency.

- Collaborated with cross‑functional teams to optimize financial processes, driving a 25% improvement in budget allocation accuracy.

- Effectively managed and developed a team of 20 financial operations professionals, enhancing team productivity by 40%.

- Led financial statement analysis for major client portfolios, identifying revenue growth opportunities that resulted in a $2 million increase in annual sales.

- Played a key role in the financial forecasting team, achieving 98% accuracy in quarterly projections.

- Developed financial models to assess the profitability of potential business ventures, supporting the company in making informed decisions.

- Streamlined the monthly financial reporting process, reducing reporting time by 20%.

- Collaborated with the finance team in the annual budgeting process, achieving a 5% cost reduction without compromising on operational outputs.

1. Syncing with Job Requirements

Begin with the end in mind. Refer back to the job description highlights: overseeing financial operations, ensuring regulatory compliance, analyzing financial data. Your task is to mirror these responsibilities in your accomplishments, proving you're not just a fit but the perfect puzzle piece.

2. Roles and Companies Structure

Chronology matters. List your positions starting with the most recent. Each entry should clearly outline your job title, the company's name, and your tenure there. This structure not only showcases your career trajectory but highlights your growth and adaptation in various financial environments.

3. Amplifying Achievements

Showcase achievements that align with the key responsibilities of a Financial Operations Manager. Did you implement a procedure that reduced compliance issues by 30%? That's gold. Make your accomplishments specific, quantifiable, and directly related to the core functions of the job you're applying for.

4. Numbers Talk

Quantify your impact wherever possible. Whether it's increasing operational efficiency by 15% or managing a team that boosted productivity by 40%, numbers provide a tangible metric for your contributions. They're the proof in the pudding, offering a quantifiable snapshot of your capability.

5. Relevance Is Key

While it might be tempting to list every role you've ever had, focus. Zero in on experiences that speak to your prowess as a Financial Operations Manager. This isn't just about trimming fat; it's about sculpting your career narrative to fit the role you're aiming for like a glove.

Takeaway

Your experience is your story. Tell it in a way that resonates, that proves you're not just ready for the role of Financial Operations Manager but that you're poised to excel in it. Use the job description as your guide and your achievements as the road map. The goal? To leave the hiring manager with no doubt that you're the ideal candidate.

Education

In the realm of Financial Operations Management, your educational background lays the foundation of your expertise. It's not just about the degrees you've earned but about highlighting how your educational journey has prepared you for this specific role. Let's refine your 'Education' section to reflect a base built on knowledge and foresight.

1. Degree Specificity

The job calls for a Bachelor's degree in Finance, Accounting, or a related field. If your degree aligns perfectly, make it prominent. This isn't just meeting a requirement; it's showcasing your preparedness from the ground up for the intricacies of financial operations management.

2. Structure and Clarity

Keep this section straightforward but detailed. List your most relevant degree first, followed by the institution and graduation date. This clarity not only helps the hiring manager gauge your qualifications quickly but also reflects your ability to prioritize and organize information clearly, a must-have trait for any Financial Operations Manager.

3. Tailoring Your Degree

If your degree is directly relevant to the position, like a "Bachelor of Science in Finance," it's not just a bullet point; it's a beacon. It signals to the hiring manager that your foundation in the field is solid, and your insights and capabilities are built on pertinent knowledge.

4. Relevant Courses and Achievements

Though your degree speaks volumes, don't hesitate to highlight standout courses or achievements that underscore your suitability for the role. Received accolades or led a noteworthy project in Corporate Finance or Accounting? These details add depth to your educational narrative, showcasing a commitment to excellence in your field.

5. Continuous Education

The financial world is ever-evolving, and so should your knowledge. If you've pursued further certifications or courses beyond your degree that enhance your expertise as a Financial Operations Manager, list them. This portrays you as a lifelong learner, dedicated to staying at the forefront of financial management best practices.

Takeaway

Your education isn't just a list of degrees; it's the bedrock of your expertise as a Financial Operations Manager. By tailoring this section to reflect both the requirements of the role and your own continuous journey of learning, you demonstrate not just your readiness but your zeal for the profession. Let your education section be a testament to your dedication and depth of knowledge.

Certificates

In the fast-paced world of finance, staying ahead means continuously honing your skills. Certificates are your badges of honor, evidence of your commitment to professional growth. But when it comes to your resume, it's not about displaying every badge you've earned. Let's curate your 'Certificates' section to make sure it showcases the ones most relevant to a Financial Operations Manager.

1. Targeted Selection

The job description mentions a preference for the "Certified Treasury Professional (CTP)" or "Certified Management Accountant (CMA)" designation. If you hold these certificates, place them front and center. This direct alignment with the job's preferences speaks louder than a long list of unrelated certifications.

2. Quality over Quantity

While it might be tempting to list every certification you've earned, focus on those most pertinent to the role of Financial Operations Manager. This selective approach doesn't just tailor your resume to the job at hand; it also highlights your strategic mindset in recognizing what's truly relevant for success in the position.

3. Date and Details

Sometimes, the freshness of your certification matters. Listing the acquisition or expiration dates of your certifications can provide context regarding how up-to-date your skills and knowledge are. This transparency demonstrates your commitment to staying relevant in a field that values precision and current awareness.

4. Continuous Learning

The financial world doesn't stand still, and neither should your credentials. Actively pursuing new certifications and recertifications not only keeps your skills sharp but also signals to potential employers your dedication to professional excellence and continuous improvement in the realm of financial operations.

Takeaway

Your certifications are a mirror reflecting your specialized knowledge and dedication to your profession. By tactically choosing which certifications to highlight, you're not just listing qualifications; you're underscoring your commitment to excellence and continuous growth in the field of financial operations. Let your certificates do more than occupy space; let them narrate your journey of professional development.

Skills

In the role of a Financial Operations Manager, your skill set is the toolbox that enables you to navigate the complexities of financial landscapes, lead teams with precision, and drive operational excellence. How do you convey this dynamic toolkit on your resume? It's all in how you present your skills. Let's maximize the impact of your 'Skills' section to set you apart.

1. Dissect Job Requirements

Thoroughly examine the job description to distinguish between the hard and soft skills sought. For instance, "strong proficiency in financial software and Microsoft Excel" and "excellent analytical and problem-solving skills" are your cues. These aren't just keywords; they're the lynchpins of your skills section.

2. Direct Alignment

Once you've identified the key skills from the job description, match them with your own capabilities. This goes beyond just listing skills; it's about narrating your proficiency in a way that resonates with the needs of the role. Your goal is to mirror the job requirements so closely that the hiring manager sees an instant fit.

3. Clarity and Cohesion

Resist the temptation to overcrowd your skills section with every skill under the sun. Prioritize clarity and relevance, focusing on the skills that case you as the go-to candidate for this Financial Operations Manager role. Each skill listed should be a brick in the pathway leading the hiring manager to see you as the ideal candidate.

Takeaway

Skillfully presenting your professional toolkit isn't just about ticking boxes; it's about weaving a narrative that highlights your proficiency, relevance, and readiness to excel as a Financial Operations Manager. Think of your skills section as a curated exhibition, each skill a piece of the puzzle that completes the picture of your professional identity.

Languages

In the diverse, interconnected business world, linguistic abilities can set you apart, offering a nuanced understanding of global operations and cultural sensitivities. While the primary requirement for a Financial Operations Manager might be a "good command over the English language," showcasing additional linguistic skills can underscore your versatility and readiness for broader responsibilities.

1. Language Prioritization

Start by listing English proficiency to align with the job's clear requirement. This immediate alignment not only meets a basic necessity but also sets a solid foundation for your linguistic capabilities.

2. Additional Languages

If you possess proficiency in additional languages, systematically list them next. This isn't about showcasing how many languages you know; it's about highlighting an ability to communicate and operate in a multilingual, multicultural environment, a plus in any role.

3. Precise Proficiency Levels

Clarity is key when describing your language proficiency. Terms like "native," "fluent," "intermediate," and "basic" provide a quick snapshot of your linguistic range, allowing the hiring manager to ascertain your communication strengths at a glance.

4. Tailoring to the Role

Consider the role's scope and the company's global presence. If the position involves international operations or communications, highlighting your multi-language skills could be particularly appealing, offering insight into your potential for navigating international financial landscapes.

5. Authentic Representation

Honesty in representing your language proficiency is paramount. Overstating your abilities can lead to uncomfortable situations, while underselling them might lose you a competitive edge. Strike a balance, presenting your linguistic skills with accuracy and confidence.

Takeaway

Your linguistic skills are more than just personal achievements; they're professional tools that enhance your capacity to operate in a globalized business arena. By thoughtfully curating this section, you're not just ticking a box for competency in English; you're showcasing your readiness to engage with a diverse, multifaceted world as a Financial Operations Manager.

Summary

Your summary is more than an introduction; it's your headline. It conveys your essence as a Financial Operations Manager within a few compelling lines. Here lies your opportunity to distill your experience, skills, and unique professional value into a potent narrative that captures the hiring manager's attention. Let's craft a summary that does justice to your career journey.

1. Essence of the Role

Start by absorbing the core responsibilities and attributes the job demands. Your summary should reflect a deep understanding of what it takes to be a successful Financial Operations Manager, mirroring the job's requirements and your alignment with them.

2. Crafting Your Introduction

Begin with a crisp, clear statement that encapsulates who you are professionally. "Financial Operations Manager with over 9 years of experience" sets the stage. It's direct and positions you immediately in the realm of experienced professionals.

3. Highlighting Your Match

Draw on key elements from the job description, weaving in your achievements and capabilities. If the role emphasizes regulatory compliance, mention your track record of ensuring 100% adherence. This section is where you customize, directly linking your past successes to future contributions.

4. Conciseness and Clarity

While your career might span a vast array of experiences and successes, the summary demands brevity. Aim for a succinct, impactful paragraph that invites the hiring manager to delve deeper into your resume, eager to uncover the full story of your professional journey.

Takeaway

The summary isn't just an opening remark; it's your professional anthem. It encapsulates the essence of your career and your readiness to elevate the role of Financial Operations Manager. A well-crafted summary not only intrigues but assures the hiring manager of your fit and potential impact, setting the stage for everything that follows in your resume.

Launching Your Financial Operations Manager Journey

With these insights and guidance, you're now equipped to craft a resume that truly stands out. Through targeted narratives, strategic showcasing of skills and achievements, and a fine-tuned presentation, your journey to becoming a Financial Operations Manager is clearer. Remember, your resume is more than a document; it's a testament to your dedication, skill, and potential. Use Wozber, a free resume builder, to bring these elements together into an ATS-compliant resume that opens doors.

Your career in financial operations management is on the cusp of an exciting chapter. Dive in, refine your story, and let it be the key to your next professional adventure.

- Bachelor's degree in Finance, Accounting, or a related field.

- Minimum of 5 years of experience in financial operations or a related field.

- Strong proficiency in financial software and Microsoft Excel.

- Excellent analytical, problem-solving, and decision-making skills.

- Certified Treasury Professional (CTP) or Certified Management Accountant (CMA) designation preferred.

- Must possess good command over English language.

- Must be located in or willing to relocate to San Francisco, California.

- Oversee day-to-day financial operations, including accounts receivable, accounts payable, and general ledger activities.

- Implement and maintain financial controls and procedures to ensure compliance with regulatory standards.

- Analyze financial data, prepare financial reports, and present findings to senior management.

- Collaborate with cross-functional teams to optimize operational efficiencies and drive process improvements.

- Manage, develop, and train a team of financial operations professionals.